Decoding RBI’s Monetary Policy and its Impact: October 2024

October 16, 2024

8 minutes read

Introduction

The “Mother” of all lending organizations, the World Bank, initially forecasted a “sluggish” prognosis for 2024.

It supported its forecasts with worldwide unsettling elements like the conflict in the Middle East and Ukraine, the COVID-19 pandemic’s ongoing repercussions, and the most sensitive inflation rate of all. World economists were spooked when the World Bank said that the world economy was about to see its “weakest half-decade performance in 30 years.”

Another worrying issue was news of established economies like the UK, Japan, and Germany going into recession. All central banks worldwide, including our Reserve Bank of India, got on their front foot, trying their best to build strategies to safeguard their economies.

So, if we try to comprehend the link between the recession news and our monetary policy, it has a straightforward connection: consumers’ low spending during a recession causes a slow fall in output, which in turn leads to layoffs and ultimately a reduction in their ability to invest. It has an impact on practically every industry that operates inside an ecosystem.

Any ruling government can deal with such circumstances in several ways, one such way is through its monetary policy.

What is a Monetary Policy?

Monetary policy and its interpretations even today have many guises. But the most lucid job description of the Monetary Policy is:

In our country, the Reserve Bank of India (“RBI”) is vested with the power to bring about any change in the Monetary Policy. There is a Committee, which goes by the name Monetary Policy Committee (“MPC”), that meets bimonthly to closely observe the domestic demand-supply situation and make allied and apt economic decisions by changing or not changing the terms of our Monetary Policy.

Key Highlights Related to the Monetary Policy:

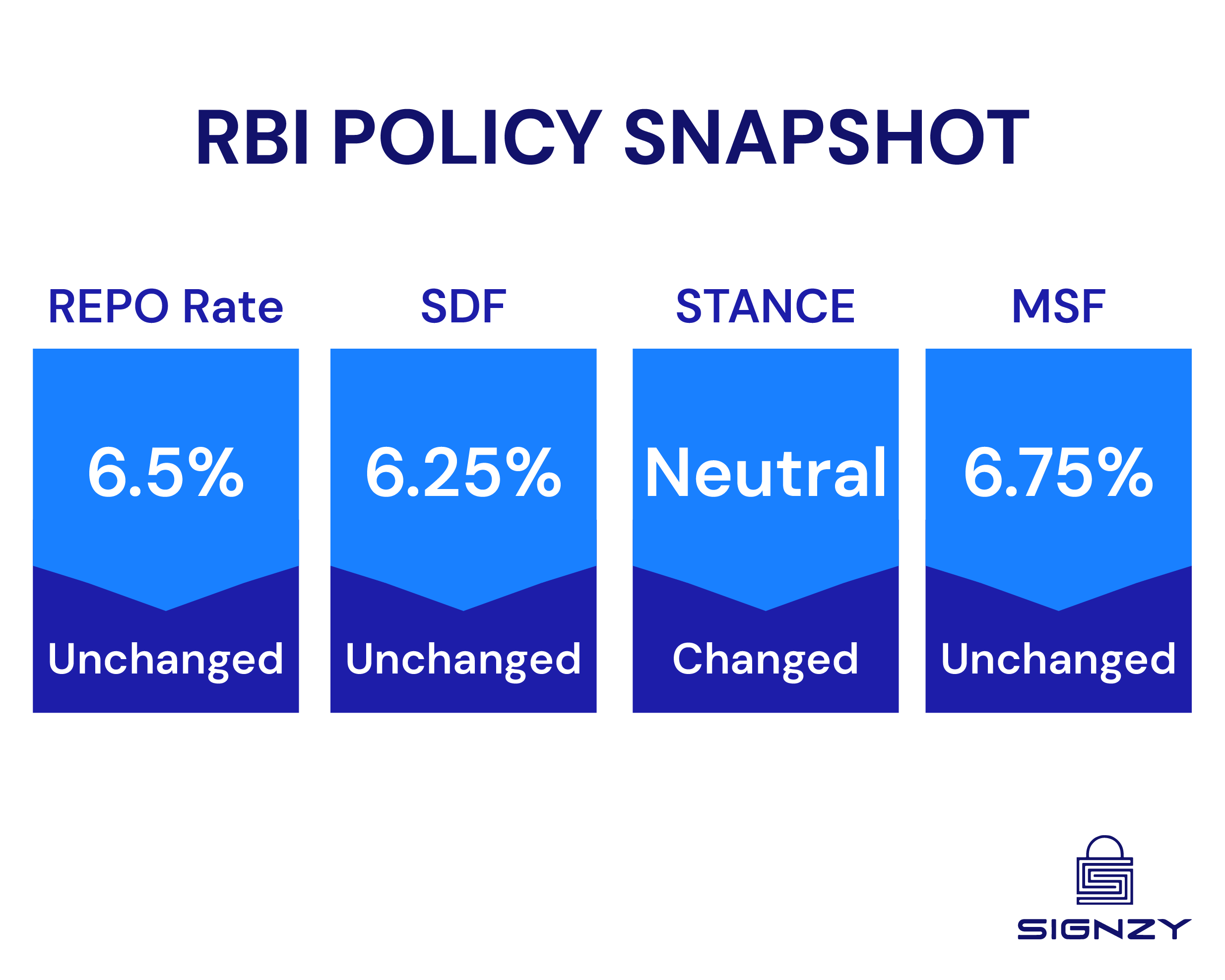

This month also the MPC met and here are a few grave matters they decided upon:

1. Key repo rate remains unchanged at 6.5%

Earlier this month, looking at the current global economic scenarios and with the endeavor to control the volatility, the US Federal Reserve resorted to a 50 basis point cut. Many advanced economies also followed in the footsteps of the USA. An air of anticipation was clouding around and more eyes were on India waiting for its decision on the repo rate.

Basically, the repo rate is the rate of interest at which the RBI lends money to banks. The loans that these banks offer and the fixed deposits that they accept are directly and inevitably impacted by any change in this rate.

To everyone’s relief and a little astonishment, Shaktikanta Das, the Governor of RBI, declared that the MPC with a majority of 5:1, has decided on keeping the key repo rate unchanged at 6.5%. This was the 10th consecutive meeting where the MPC opted to keep the key repo rate stagnant at 6.5%.

The effect of the announcement was visibly seen in the Indian stock market the following day.

The global financial ecosystem is exceedingly volatile. Furthermore, even though India is doing considerably better, borrowing costs for us are still rather high. This directly affects all businesses, whether they are sole proprietorships, start-ups, or large enterprises. The moment there is an increase in the borrowing cost, it slashes down the profits and savings.

So, there is no doubt that the borrowers were the happiest, as there was no foreseeable change in the interest rate of their respective loans.

2. SDF and MSF Rates:

Banks were also delighted and here is why.

The MPC decided upon keeping the Standing Deposit Facility (“SDF”) at 6.25% and the Marginal Standing Facility (“MSF”) and bank rates at 6.75%.

For more clarity, all commercial banks can borrow from the RBI under the MSF, which is an emergency overnight liquidity instrument. In contrast, SDF is a more recent mechanism that was unveiled in April 2022 and allows banks to park their excess liquid cash with the RBI without any collateral or security in exchange for interest.

So, again, a matter of relief for our lending agents.

3. Stance of the Monetary Policy changed to ‘Neutral’

Rapid decision-making will be essential if we want India to stay up with the constantly changing global landscape. The decision of the RBI to change the stance of monetary policy to ‘neutral’ from ‘withdrawal of accommodation’ was indeed commendable.

The alteration to the neutral stance will provide enough room for the MPC to make adjustments to the monetary policy as and when needed.

The Report clearly stated that the decisions about the repo rate, MSF, SDF and neutral stance are all taken keeping in mind the dual objectives:

1.achieving the medium-term target for consumer price index (CPI) inflation of 4% within a band of +/- 2 %;

2.Continued support for economic growth.

Other impactful insights by the Governor:

Current situation of the agriculture, consumer, and infrastructure industries:

India is an agrarian nation, as it supports the livelihood of 42.3% of Indians, and contributes close to 18.2% to our GDP. Monsoons every year are the sole factor setting the tone of our output and consumption from these industries.

This year we must be really grateful for Lord Indra’s blessings.

Normal monsoons were a huge relief for the agricultural and allied industries. Despite this, the RBI’s report stated that food prices might see an upturn for a while, but a positive downside will be visible towards the fourth quarter of FY 2024-25. The reversal will be possible owing to better Kharif arrivals and rising prospects of a good rabi season.

Additionally, a sufficient buffer supply of cereals is kept at the reservoirs to ensure food security in the country. This is encouraging because it will contribute to the food price deflation in the upcoming quarter.

The consumer industry is all smiles as well. The consumer-centric industry has gained confidence due to a notable increase in consumer spending for the upcoming holiday season.

Infrastructure is the backbone of any economy and our infrastructure industry is the talk of the town. Massive development projects have attracted the attention of elite international players, bringing in good investments even from abroad.

Looking within, despite a dip in profitability, the healthy balance sheets of the commercial banks, corporate houses, and the public sectors are a sign that the stupendous momentum of the infrastructure industry in India is here to stay.

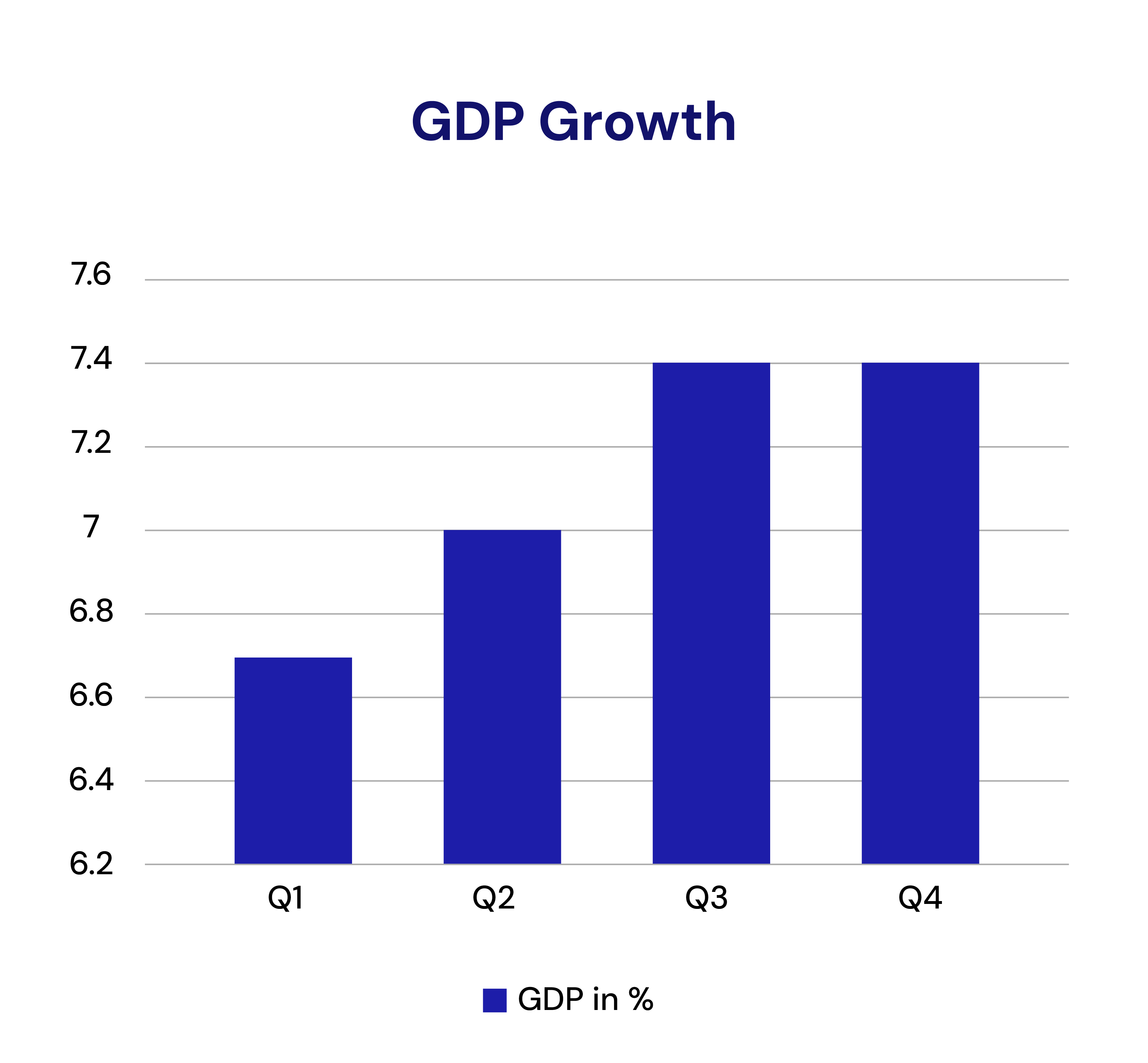

Das then came to the end game and spoke about our GDP. Private consumption and investment activities have remained stable, leading to a real GDP growth of 6.7% in the first quarter of FY 2024-25. Considering both macro and microeconomic variables, the GDP growth forecasts for FY 2024–2025 are as follows:

Both domestic and foreign investors and agencies are pleased with these figures.

Climate Risk Information System:

However, it is impossible to overlook the worries brought on by the rise in metal prices worldwide, the increased tensions between Asian nations, the financial market’s extreme volatility, unpredictably bad weather, and other things.

As part of his announcement, Das discussed climate change and noted that it has a big impact on all ecosystems, including the financial environment.

As a first step in this direction, he declared that RBI will create a ‘Reserve Bank Climate Risk Information System (RB-CRIS)’. It is believed that this system will act as a repository for all climate-related data.

Das harped on this matter further by stating: “It is crucial for regulated entities to undertake climate risk assessments for ensuring the stability of their balance sheets and that of the financial system. Such an assessment requires, among other things, high-quality data relating to local climate scenarios, climate forecasts, and emissions.”

Aam Admi and Monetary Policy:

Lastly, our Governor did have the final touch for the Aam Admi. The per transaction limit for UPI123PAY, a platform available for feature phone users, was doubled to Rs. 10,000. Even the UPILite wallet limit is increased to Rs. 5,000 and the per-transaction limit from ₹500 to ₹1,000.

These measures will boost low-value digital transactions undertaken by Aam Admi through their feature phones.

Conclusion:

Our world is moving through a wave of rapid and extreme changes where on one side AI is becoming an inseparable part of our home and work lives and on the other side climate change is forcing us to rethink our set ways—all these and many other factors shall decide the way forward for our Monetary Policy.

Until the next meeting of our MPS, let us enjoy the stagnant repo rate of 6.5% and all the benefits it brings, shall we?

For more insights, read at:

1. https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=58850

2.https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=58851

About Signzy

At Signzy, we’re solving for lasting first impressions and seamless new beginnings 🙂

Our powerful tools and APIs deliver seamless digital onboarding, identity verification, and monitoring solutions.

With just a few clicks, you can integrate with any workflow using simple widgets—perfect for streamlining KYC, KYB, AML, fraud checks, bank account verification, and age verification for your business.