The Era Of Digitization-Fintech Strategy of Digital Onboarding And What’s In Store For The Future

February 20, 2021

9 minutes read

Introduction

The world fintech market share across 48 unicorn fintech companies is north of $187 billion. This amounts to more than 1% of the global financial industry. A sensible question that comes to mind is, how are they doing this?

Fintech startups are considered underdogs in the financial ecosystem especially when compared to financial behemoths that are already present. Nonetheless, they are growing at a tremendous pace posing a challenge to these traditional giants. This is evident from the pace at which they acquire new customers. Some take less than 4 minutes to complete the entire end-to-end customer acquisition flow and in most cases right from the customer’s smartphone with almost no human interaction.

The reason for their excellent presence is due to multiple factors. The fact that they have defined a specific customer base to explore helps them identify their market. Their diligent proximity with advancing technology helps them create innovative and cheaper solutions. But mere statements for how they are doing it isn’t enough. We need a thorough understanding of the mechanics and strategy. Let’s have a closer look at how fintech startups approach digitization

How the Fintechs Have Fared in the Past Decade

The era before the dot-com bubble was the time of startup boom with over $30 billion in venture capitalist investments in the US. But once the bubble burst, investments for startups, especially fintech startups declined. By the early 2000s, the total investments were barely meeting the $5 billion mark.

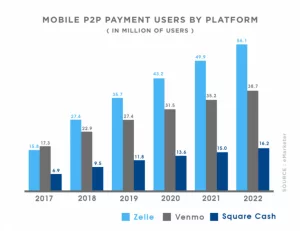

The situation has been on a drastic change since the beginning of the past decade. Investments have grown tremendously, coming back on top to over $22 billion in the US alone. A good example is Venmo (launched in 2009) whose valuation rose from $150 million in 2013 to $38 billion in 2020. The company had proven that they had fresh ideas and excellent execution strategies for investors. The fact that they had grown from 10 million users to 40 million users was one of the primary reasons for this. This attracted the backing they required, boosting the venture.

Braintree, a division of PayPal acquired the company for $26.2 million in 2012. This was no epiphany for the fintech giant, but the result of years of close observation. Not only was the startup gaining customers, most of them remained active. Currently, with more than 26 million active users, Venmo is set to grow faster and better.

Venmo is merely one example of this potential opportunity. 2018 was particularly a crucial year as 18,000 startups received more than $254 billion globally. The majority of these were from the US. The global fintech market was worth $127.66 billion in the same year with an expected growth rate of 25% to $309.98 billion by 2022. All this was due to how sedulous catering of their customers.

What Are The Fintech Startups Doing Right To Grow?

Fintech startups are not bound by traditional methods. They have the freedom to think outside the box for they know not where the boundaries of convention confine them. They can understand the most fundamental concept in running a business. Gaining a customer is harder than retaining one.

Retaining your customers will help you forage all the low-hanging fruits. One of the vital aspects of any financial venture is to create retainable, loyal customers while improving the ease of onboarding new ones. Thus, it is easy to conclude that onboarding customers are the key to a company’s growth. But, whether fintech startups have done so is a question to be pondered upon. They have amalgamated technology into their onboarding process by making it completely digital. In an industry where 71% of consumers end their relationship with a company because of poor customer service, it is essential to provide the best service you can from the get-go.

Most Fintech Startups focus on certain areas of improvement when it comes to customer onboarding and service. Some of these areas are:

Selective Niche

The Startups define their customers. Mostly focusing on Gen X and Millennials, they cater to a younger customer base. This is beneficial in the long term as most of the current younger generations can be converted into long-term loyal customers with considerable financial assets in the future. For example, Most of Venmo’s customer base is aged lower than 34 years. 7.4 million P2P payment service users are between the ages of 18 and 34. 4.1 million of them are between 25 and 34 years. Since they are focusing on the younger generations, only 1.4 million consumers are above the age of 35 and below 44.

Digitization and Consumer Experience

The traditional methods of onboarding are tedious for newer customers. Fintech Startups acknowledge this by making the process easier. The first step is to provide digital onboarding options. Not only does this reduce the time required for the process, but it also enhances the overall user experience. Expenses too are reduced for the companies due to reduced exploitation of resources for storage and manpower.

The best technology usable will meet contemporary expectations in customer service. Banks with no websites or no online presence are yet to come out of the dark ages. By 2020 more than 67% of consumers have used a fintech platform. This was 33% more than in 2017. This number will soon reach absolute saturation. Giants in the insurance sector are wise in predicting this. More than 63% of CEOs in the sector believe technology like IoT(Internet of Things) will impact the whole financial sector.

60% of the consumers opt for transactions with financial institutions with a single online platform. This number is set to increase as a 2020 survey pointed out that 96% of the global population is aware of one or more fintech companies

Mobile Onboarding

The human palms are more powerful than ever with the advancements in mobile technology. Any financial task is performed on a smartphone with a mobile app by customers. This is made possible by the institutions welcoming and adopting this technology. Payment services companies promote this to a greater extent increasing mobility for the customers. Tipalti.com predicts mobile transactions to grow 121% by 2022. This will constitute 88% of all bank transactions. Fintechs are targeting this latent market.

The Road Not Taken- What the Fintech Startups can do going forward

The financial landscape is expected to change in the coming decades. 2021 has more than 90% of users making at least one payment using a smartphone. By 2022 78% of Millennials in the US will become digital banking users with credit cards, debit cards, and e-wallets surpassing cash at all points of sales. Fintech Startups see all this as an unavoidable opportunity.

Fintech startups’ methods of digitization and mobile onboarding have become inevitable for customer experience enhancement. They save time, energy, and in most cases, even money. Unfortunately, the traditional banks are struggling to adopt what the fintech startups have already embraced. Meanwhile, the startups are looking ahead in decades. They are understanding new technology that can be used for better customer service.

Some of these are:

Blockchain Technology

Neo-Banks are considering better methods for data storage and security. Blockchain technology is an excellent option for this. Blockchain is a DLT(Distributed Ledger Technology) that permits data to be stored globally on multiple servers. A form of cryptocurrency is used by two entities(people or companies) as payment. The agreement forms the ‘block’ in the chain. This type of financial technology revolutionizes central banks and financial markets.

More than 24% of the world population is familiar with this technology. This is because Blockchain and Regtech(Regulatory Technology) are leading in terms of growth in the fintech industry. Blockchain technology is set to reach $20 billion by 2024. This includes P2P digital lending which was at $43.16 billion in 2018. It is expected to reach more than $567 billion in 2026 with a CAGR greater than 26%

Artificial Intelligence

AI is already prevalent in the current fintech ecosystem. It is used for automation and related processes. It can vary from simple automation to complex Machine Learning(ML). AI and ML in the financial sector are used to perform tasks that are traditionally done by a human worker. Such repetitive tasks being automated will aid the company both financially and in aspects of time.

But fintech startups are looking at the next stage of AI implementation. Banking-related chatbot interactions are expected to go to 3150% by the year 2023 from 2019. This will enhance the experience the customer has while onboarding and interacting with the institution. Along with this $2 trillion will be managed by ‘Robo-Advisors’ by the same year.

AI will also enhance labor productivity by a maximum of 40%. The projected expectations of 2035 estimate profitability of 39% for all industries, let alone banking. Even customers are expected to prefer Machine interaction over human interactions in the coming future. Startups analyze these data and evolve their modes to suit the future customer base.

Conclusion

The financial niche has been altered by the booming fintech startups. Among traditional banks and organizations, nearly 82% intend to collaborate with fintech companies in the next decade. If they do not, they might lose the total customer base by the end. With nearly 90% of banks fearing their consumers to be lost to up-and-coming startups, they are willing to adapt.

Consumers demand a seamless digital experience while onboarding and transacting. Smart traditional banks see the solution and upgrade their methods. If that is not possible they collaborate in partnerships or contracts with fintech startups and other technology companies. Most of this helps in onboarding younger customers. This converts many B2C models to a more B2B model. They then gain access to a bigger client pool.

Established financial institutions need to focus on onboarding more customers, for their existing consumer base will soon be exhausted. Thus, while retaining their customers they must focus on expanding their presence in the future. For this Help of fintech startups can be used. This will be the swiftest and smartest step traditional financial institutions can take for the better.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.