In 2021, total digital transactions conducted exceeded 40 billion with an accumulated estimate of over a quadrillion INR across the country. RBI had been brainstorming for a long time to optimize these transactions while creating a more efficient system for payments and keeping track. Account Aggregators(AA) are the latest initiative to resolve this.

What Is Account Aggregators Initiative?

Account Aggregators are RBI’s newest reformation in the payment processes. It allows the collection of user data that can be shared among multiple financial institutions with approval consent every step of the way. This permits institutions to create a better understanding of customers and provide their services, accordingly.

In addition, 8 major banks are joining RBI’s pep for reform. These include State Bank of India, HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra Bank, IDFC First Bank, IndusInd Bank, and Federal Bank. The new system with the aid of these many primary players helps the free flow of data between financial information providers(FIPs) and banks. It will especially help loans for MSMEs and other small scale businesses.

Account Aggregators relay user information between financial information providers and financial information users(FIU) during transactions. User consent is mandatory for each step in the process. This is mostly effective for loans and lending, but other payment processes can also utilize it.

What are the Benefits of Account Aggregators?

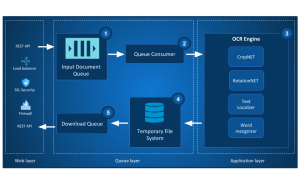

Account Aggregators create a systematic approach to financial data management among institutions. It is a precise solution for scattered data across financial entities and enables the transfer of consented data without view or processing by the aggregator itself. Users can search and find information

In terms of economic impact, observers are comparing Account Aggregators to UPI. Expectations are that Account Aggregators will bring unprecedented benefits in making payments and lending easier, just like how unexpectedly UPI transformed the economy.

With Account Aggregators, many SMEs can operate without physical branches transforming credit penetration. The ease of access Account Aggregators creates during loan applications, will encourage entrepreneurs and businesses to execute their ideas faster. Since the entire system is overseen by government bodies, chances of fraud and malpractices are nearly nullified.

Data Privacy

One of the major concerns surrounding Account Aggregators is how private the data is. Before the official release, speculations were in the air. RBI was diligent to emphasize how secure the user data will be. Data privacy and user consent are keystones for any transaction and formulate the fundamentals of the framework.

Presently, RBI allows only regulated entities to access the Account Aggregator ecosystem. On top of this, user consent is mandatory along every pitstop in the process. It is important to note that account aggregators themselves are unable to view or access data as they are designed only to relay information between FIPs and FIUs.

What It Means And How Can Signzy Help You

RBI acknowledges the pace at which the information era economy is transforming. Just like UPI, Account Aggregators are a step in the right direction. This will fasten and ease payment services and the lending industry. It is clear that what the nation aims for is a completely digitized economic infrastructure.

Digitizing your services is not simply about digitizing your services. In the cutthroat competition, it is simply not enough to meet the minimum standards. You need to craft a user-friendly, fast-paced, secure system. We at Signzy can help you create the perfect solutions for all your onboarding and KYC related needs.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.