Customers are increasingly demanding better digital banking experiences to match the integrated experiences they receive in other industries. Financial institutions continuously find themselves under pressure to deliver a mobile-first, customer-centric digital experience to customers throughout their journey starting right from account opening. Artificial Intelligence has the potential to drive digital transformation in banking and redefine the way financial institutions interact with customers during the digital customer onboarding process.

The onboarding system is generally the first experience a customer has with any banking institution and that in itself sets the tone of the ongoing experience the bank can deliver. The client onboarding process is also critical by the fact that it gathers Know Your Customer Data for continuing maintenance and management of the account.

AI in banking has become a priority, and bankers have identified two areas worthy of digital transformation in banking – KYC and digital onboarding.

How Can Banks Offer a Seamless Onboarding Experience?

There are four critical areas in which banks can focus to revolutionize the onboarding experience they offer:

-

Digitize processes, indeed

Often financial institutions fail to understand that digital is more than online and mobile. Their customers demand sophisticated interfaces, but banks continue to work through manual and paper-based workflows. This way, bankers are rendered unable to answer customer queries about process status and task completed. Enabling a single point of truth of each customer and eliminating manual, disconnected processes will empower bankers to quickly onboard customers and collect and manage their information seamlessly. AI in banking will also increase the quality of data and help minimize errors.

-

Allow customers to bank anytime, anywhere

Digital transformation in banking will help customers to carry out functions 24×7, from anywhere using their preferred device or channel. In turn, financial institutions will be able to market products across multiple channels, improving sales and customer retention. By introducing an Omni channel experience through responsive web design, banks will be able to offer frictionless user experiences allowing customers to undertake the digital onboarding process on one platform and finish it on a different one.

-

Collect data once

Customers often face frustration when they have to provide the same information over and over again for different banking tasks. Digital transformation in banking can change that. Banks have started experimenting with end-to-end interfaces that allow customer details to be entered once and reflect everywhere else. This cuts down a lot of hassle for both customers and banking officials. In conjunction with AI in banking, institutions are also considering the applications of blockchain to consolidate data across a financial organization.

-

Personalize experiences

Predictive analytics can be leveraged to learn more about customer behavior- where customers spend their time, where they abandon sessions, and so on. With this data, banking institutions can personalize experiences for customers and expedite the digital onboarding process.

Banking organizations are ripe with data ingested by intelligent capture only waiting to introduce processing intelligence.

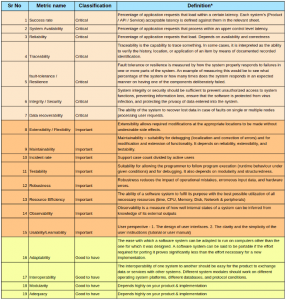

Digitize the Onboarding System & Opt for Online ID Verification

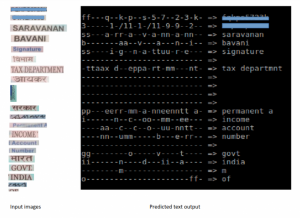

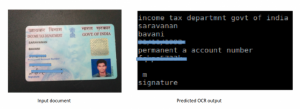

AI is helping banks set up a seamless digital onboarding experience. Consider this: when a customer opens a new bank account or applies for a loan, they have to provide a number of documents and ids to their banks such as employment proof, identity proof, and proof of address.

Additionally, the bank staff needs to physically scan each document to verify specific clauses, values, and statements in their process. Then, bankers need to verify particular intentions or assumptions with the customer before deciding each customer’s creditworthiness for a loan or a product.

These manual activities are tiresome and can very well induce error anywhere in the end-to-end process.

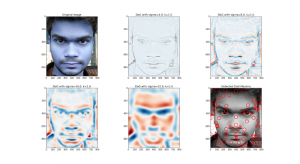

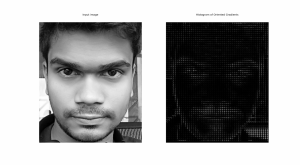

With intelligent capture and online id verification, this can be done with a few clicks on a smartphone. Thus, saving bankers and customers a lot of time and effort.

Since customer satisfaction is a crucial differentiator for banking institutions today, automating and digitizing onboarding process can prove to be a game-changing strategy. In other words, the client onboarding process can determine customer experience, loyalty, referrals, sales, and profitability.

Hence, Digital transformation in banking will help financial institutions adapt to changing regulations quickly. With manual paperwork, turning a few regulations every month can seem a daunting task, while digital processes make the process easier.

How Signzy is Innovating in the Banking Space

Trusted by ICICI Bank, SBI, Birla Sun Life Mutual Fund, Edelweiss, MasterCard, PayU, HDFC Bank, and many other financial institutions, Signzy is a classic example of a tech-enabled solution disrupting the banking space.

Through Blockchain and AI solutions in banking and financial services, Signzy is reducing human interaction with customers at various levels, saving it only for the critical decision making aspects of banking.

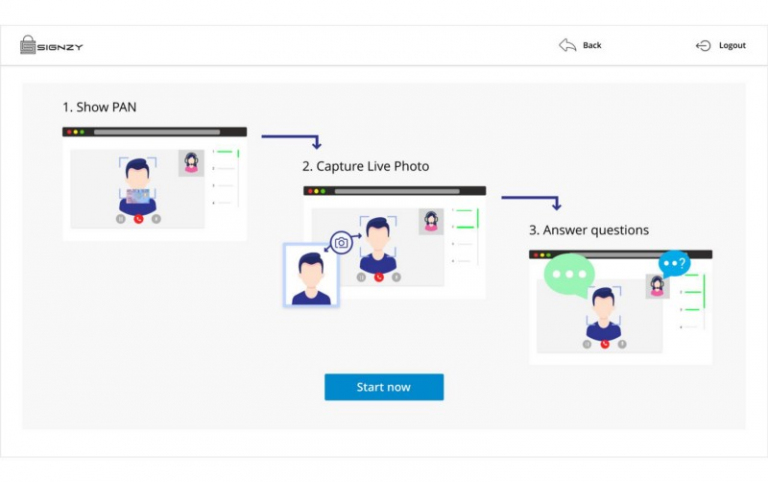

Here are a few features Signzy offers across its product line:

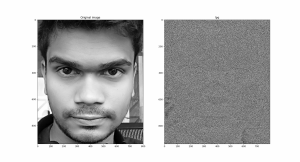

- Digital real-time KYC

- Digital signature for KYC

- Biometric signatures

- Algorithmic Risk Intelligence to provide a satisfactory background check

- Digital contracts

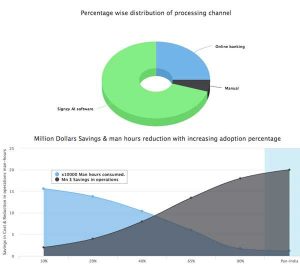

Signzy can help financial institutions decrease operational expenditure by 75 percent.

Case in Point: How Signzy led digital transformation in banking for its client

The existing process consisted of the following steps:

- The customer manually fills in the application form.

- The bank sales associate collects the forms and KYC documents without verifying.

- The branch manager screens all documents to make sure everything is in place.

- The central ops do a risk check on the documents collected.

If the documents have anything amiss, they go back a phase and the process restarts.

Here are the challenges the baking firm faced because of their manual processes:

- Errors in filling out forms.

- No real-time verification of the information submitted by the customer.

- Missing documents or details.

- Time-consuming process.

- Manual documentation that’s hard to maintain.

The solution to this firm’s woes was a digitized platform to disrupt their inefficient process such as Signzy.

The benefits Signzy realized for this institution:

- As customers filled out digital forms and submitted to bank associate, the information could be checked in real-time.

- The verification process was automated as a result.

- The auto-populating of form quickens the process.

- Reduction in human typing errors by data extraction.

- Company verification from government records.

- The user experience was transformed into a smoother one.

- The bank ops could now focus on key risk cases and undertake high-value tasks

- Since the bank saw a dramatic reduction in their operational costs, their revenues surged.

Signzy can bring out massive measurable benefits for their customers through digital transformation in banking.

Signzy realized the following metrics for its client:

- 80% cost reduction in customer onboarding process.

- Reduction in the TAT from 3 days to 30 minutes- a huge time saving and a differentiator in customer experience.

- Three times more efficient sales.

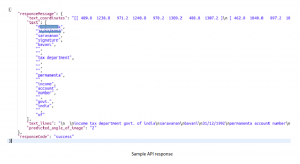

As of the end of 2018, Signzy supports 51 customer accounts and answers half-a-million API calls each month. Signzy digitally transforms businesses focused on financial services.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Ankit Ratan, CEO-Signzy