- All UAE free zone authorities maintain their own business verification databases, making cross-verification more streamlined than in many other markets.

- The UAE Central Bank allows banks to issue digitally stamped verification letters, eliminating the need for physical branch visits.

- Digital verification platforms in UAE can validate accounts across all local and international banks operating in the country within minutes.

Forget about banks for a second.

Imagine you’re about to buy a used car from someone. They say it’s in perfect shape, low mileage, one previous owner. Sounds ideal, right?

But anyone who’s done this before knows you don’t just take their word for it.

You look up the car’s history, you run the VIN, and you get it checked out by a mechanic if you can. Not because you’re expecting anything to be wrong—just because you’re smart about covering your bases.

Verifying a business bank account in the UAE is like doing that background check on the car.

Like that car purchase, it’s not about doubting someone’s word. You’re just doing the practical steps to make sure what you’re dealing with is exactly what you think it is. And once you’ve ticked those boxes, you can feel confident you’re on solid ground.

Have 6 minutes? Here’s every step you need to take, from basic document checks to smart digital tools that help you verify bank account ownership with confidence.

Why Verify Bank Accounts in UAE?

The UAE’s position as a global business center brings together companies from different markets, payment systems, and business cultures. This creates an environment where careful verification becomes valuable—not from distrust, but from a practical need to ensure smooth business operations.

Every business faces moments when verifying bank account details becomes particularly valuable:

- During expansion phases when working with multiple new partners

- When setting up payment systems across different emirates

- For businesses managing international transactions

- When handling significant one-time payments

While not mandated by UAE’s regulations, this verification step helps businesses build stronger, more reliable financial relationships.

How Bank Account Verification Works

Bank account verification in the UAE makes perfect business sense – much like double-checking the address before sending an important package. It’s particularly valuable in UAE free zones, where businesses often deal with partners from various regulatory backgrounds.

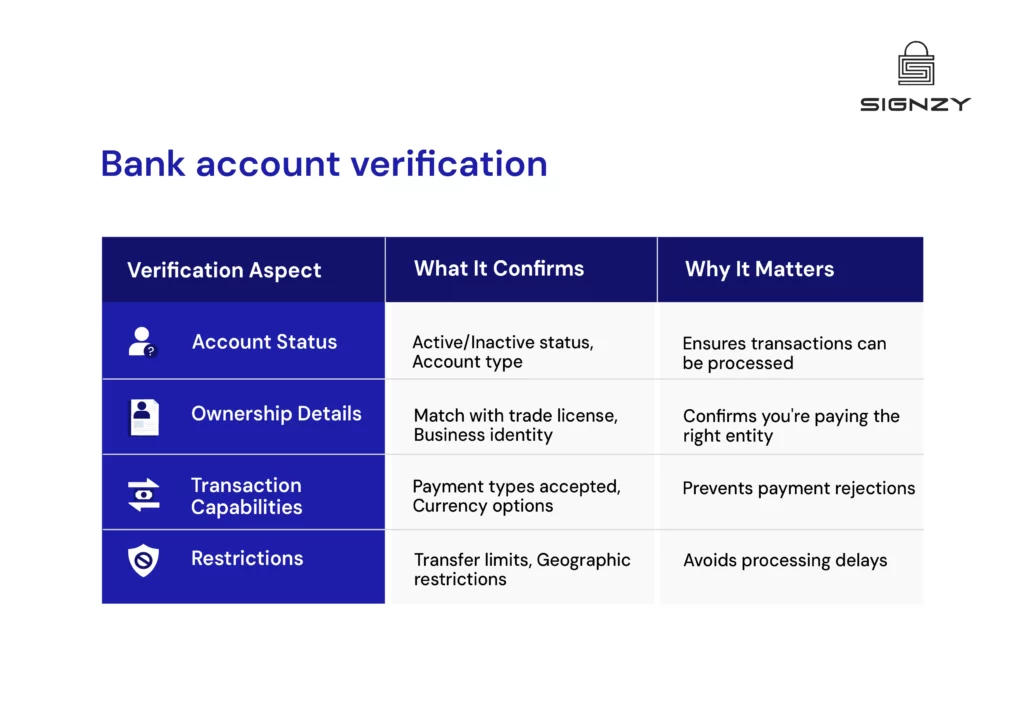

What bank account verification actually covers:

For international transfers and recurring payments, these checks, while simple, help avoid common issues like payment rejections or processing delays that can affect business operations.

Ways to Verify Bank Accounts in UAE

Verifying bank accounts in the UAE doesn’t need to feel overwhelming. Each method has its own way of working, and understanding these mechanics helps choose what works best for specific business needs.

While the choice of verification method depends on factors like urgency and relationship type, each approach offers unique advantages. Here’s how each method works in practice:

1. Micro-Deposit Verification

Think of micro-deposits as a handshake between two bank accounts. The process starts with sending a tiny amount – usually just a dirham or two – to the account being verified. The real verification happens when the account holder confirms receiving this amount or shares the specific reference code attached to the transfer.

Here’s a example scenario of verifying your supplier’s account:

- You send AED 1 to the supplier’s account

- The transfer includes a unique reference code: “VER12345”

- Your supplier receives the amount

- They email you: the exact amount received (AED 1) and the reference code “VER12345”

- You confirm these details match your records

- Verification complete

This verification gives you certainty on what matters most: the account is operational and under the control of your business partner.

Such nature makes micro-deposits particularly useful when setting up new business relationships or automated payment systems.

2. Checking Official Documents

A bank letter or statement does more than show account details – it creates a verifiable link between the account and its owner. Here’s how it works: The bank issues an official document that states not just the account number, but also confirms the account holder’s identity and account status. These documents carry security features like watermarks, stamps, and official signatures that make them trustworthy.

Modern UAE banks have added convenience to this process. Most now offer these verification documents through their online banking portals. Account holders can download digitally stamped letters instantly, while maintaining the same level of authenticity as physical documents. These digital versions often include unique reference numbers that anyone can verify through the bank’s official channels.

3. Business Document Cross-Verification

This method connects banking details with official business identities. It works by creating a clear map between what the bank knows about an account and what official business registries show about the company. The process taps into UAE’s comprehensive business registration systems, where every registered company has verifiable credentials.

The bank account ownership verification happens by matching key details across different documents. Here’s a checklist you can use:

✔️ Verify company name matches exactly across bank account and trade license

✔️ Check business registration number is active and valid

✔️ Confirm operating address matches bank records

✔️ Ensure authorized signatories on bank account match company documents

✔️ Validate free zone license details align with bank information

✔️ Cross-check business activity codes with account type

This method proves particularly valuable in the UAE’s free zones, where businesses often maintain specific registration requirements.

4. Digital Verification Tools

Digital verification has simplified how UAE businesses confirm bank account details. These modern solutions connect with banking systems to provide quick, reliable verification results. When account details are entered into a verification platform, it checks multiple data points simultaneously – confirming if the account exists, is active, and matches the provided business information.

The process works through secure connections between verification platforms and banking databases. Rather than manually checking documents or waiting for test transactions, these systems can instantly validate account information. For businesses managing multiple payments or regular vendor setups, this means fewer delays and more confidence in their transactions. Every verification gets logged automatically, maintaining a clear record of checks performed.

Digital solutions can also do bank account ownership validation across multiple countries, making them particularly valuable for UAE businesses dealing with international partners.

Streamlining Bank Account Verification Operations

For businesses looking to automate their verification process while maintaining compliance, Signzy offers bank account verification solutions that can significantly lower verification costs and prevent frauds.

Our system can help prevent fraud while ensuring smooth user onboarding – particularly valuable for businesses handling high volumes of transactions or expanding their operations globally from the UAE.

Experience digital verification firsthand – book a no-obligation demo call to see how Signzy’s solutions align with your business verification needs.

FAQs

- Is bank account verification mandatory in the UAE?

No, it’s not mandatory but highly recommended as a business best practice. It helps prevent payment issues and builds secure financial relationships, especially in free zone operations.

- How long does the verification process usually take?

It varies by method. Digital verification is instant, micro-deposits take 1-2 business days, while document verification typically takes 2-3 business days depending on the bank.

- Can I verify international bank accounts from the UAE?

Yes, you can verify international accounts, though the process might take longer. Digital verification platforms are particularly useful for cross-border verification needs.

- What documents are typically needed for verification?

Common requirements include bank letters, trade licenses, and business registration documents. For UAE free zone companies, additional zone-specific documentation may be required.