Money Laundering refers to the process by which financial transactions are conducted in a way that obscures the link between the funds and the origin. Did you know that money laundering makes up 2-5% of the global GDP, i.e. about 2 trillion? Despite all the measures, compliances, and checks, the increasing rate of financial crimes is proving to be a major roadblock for banks and other financial institutions, thus exposing the loopholes in the traditional financial ecosystem. Being in the business world, you need to be extra careful of these inadequacies so as to avoid any risks. And that’s why, Anti-money Laundering (AML) is the need of the hour for the identification of the customers, tracking, and preventing such crimes.

AML is the set of laws or regulations made to prevent financial crimes and produce incomes through illegal activities. In today’s digital era, with the evolving complexity and volume of financial transactions, the current state of AML is unable to keep pace with it and track laundering activities happening around the financial ecosystem.

Use of Blockchain

The decentralized system of blockchain technology has proved to be a boon for effectively running cryptocurrencies and covering numerous use cases across businesses and industries. Blockchain acts as an extremely secure platform to record and store data and information related to AML & KYC compliance. Blockchain-enabled platforms streamline AML/KYC processes on a decentralized ledger. Know Your Customer or KYC plays a significant role in AML as it assesses your business risks and complies with AML laws.

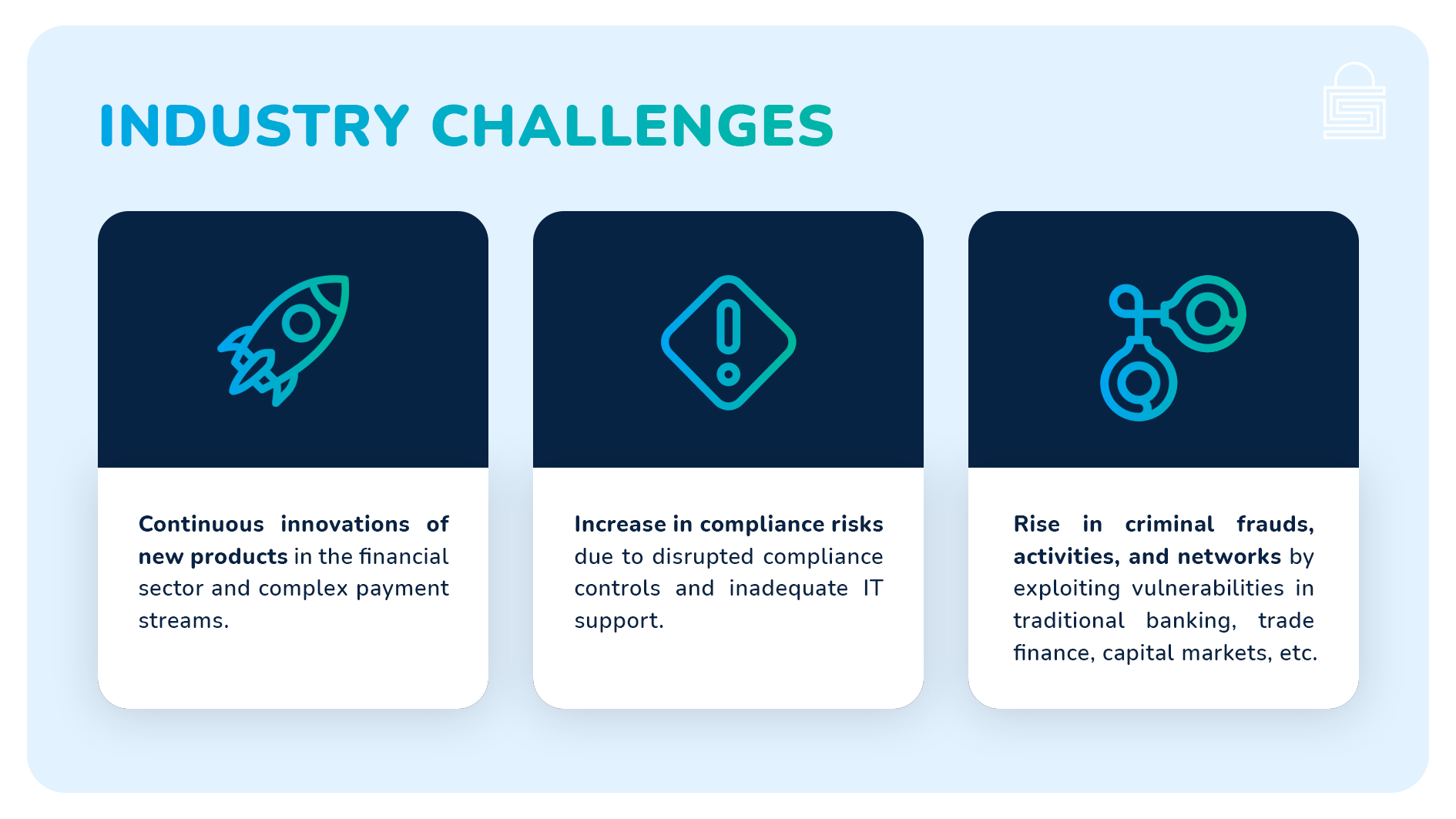

Industry Challenges

Like every other market sector, even the anti-financial crime departments at most organizations lacked effective monitoring systems and risk-based frameworks during the pandemic era. Major challenges obstructing the AML compliance are as follows:

Facts and Figures on Crimes that Happened in this Industry

Cases of money laundering are not new for any industry. Despite that, more than 57% of the Virtual Asset Service Providers (VASPs) approved by the Financial Action Task Force (FATF) still have weak, porous anti-money laundering measures. This basically means that their KYC processes and AML software are not at par with the security standards. In the year 2017, the global anti-money laundering software market stood at a whopping $879.0 million and now, it is projected to reach $2,717.0 million by 2025.

Impact of Blockchain on AML

Initially, a customer would be required to create a block that will consist of all of this data and information. These details are then encrypted and the customer will be provided with a digital passkey to see the data. This public blockchain ledger can further supervise, validate, and record every transaction’s complete history, wherein the readers and crypto miners get immediate notifications of transactions as they occur. In case, if one of the transactions gets unverified, it gets blocked immediately, thus preventing any further loss. Blockchain thereby doesn’t just monitor the entry and exit points of such transactions but also provides overall system analysis and reporting mechanism.

Case Study

In the year 2018, Netherlands‘ largest bank ING Group was fined $900 million for failing to spot money laundering. ING had violated laws in preventing money laundering and financing terrorism for years by not vetting the owners of client accounts and not tracking and analyzing the unusual transactions carried out through them. This came after January 2018 saw Citibank being fined $70 million for the shortcomings in its anti-money laundering policies. The reason behind this penalty was non-compliance with OCC’s 2012 order, due to which the bank failed to complete corrective actions to address AML compliance issues as required.

How does Signzy Position Itself as a Tech Thought Leader and How Have We Adopted a Change to Make the System?

You can make use of reliable blockchain platforms to mitigate the risks caused due to shortcomings in AML regulations and delayed KYC due diligence. Procedures like AML and KYC can be effectively managed through the digital onboarding by Signzy. With customizable APIs and digital tools, Signzy assists you to conduct safe and compliant AML, KYC, and other requirements.

Don’t wait for the mishap to happen. Connect with Signzy today, and ensure secured financial transactions.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.