- In a 2023 evaluation, the UAE achieved notable FATF ratings: Compliant for 15 and Largely Compliant for 24 of the 40 Recommendations.

- The requirements to verify individuals and corporate customers in the UAE are totally different, demanding comprehensive knowledge.

- Violations of KYC and AML regulations face strict enforcement measures, with penalties ranging from financial fines to imprisonment.

Collecting KYC documents in the UAE isn’t exactly anyone’s idea of a good time. Yet here you are, tasked with making sure your business gets it right.

And with financial penalties that can make your CFO break out in a cold sweat, the stakes couldn’t be higher. So, if you came here looking for a straight-shooting guide to KYC document collection in the UAE, perfect – you got exactly that.

Let’s start right away.

UAE KYC Document Requirements for Individual Customers

Running a UAE business means you’ll be collecting KYC documents from individual customers pretty regularly. And while it might seem straightforward, there’s more to it than just grabbing a copy of someone’s Emirates ID.

| Document Required | Purpose |

| Emirates ID (Latest version) | Serves as primary identity verification and confirms UAE residency status |

| Valid Passport | Verifies nationality, provides secondary identification, and required for non-residents |

| UAE Visa Page | Confirms legal residency status and duration of stay |

| Proof of Address (< 3 months old) | Establishes current residential location and validates contact details |

| FATCA/CRS Self-Certification | Determines tax residency status and ensures international compliance |

| Source of Funds Declaration | Creates transparency about income sources and helps assess risk levels |

| Recent Photograph | Enables visual verification and maintains updated records |

| Specimen Signature | Provides a baseline for future transaction verification |

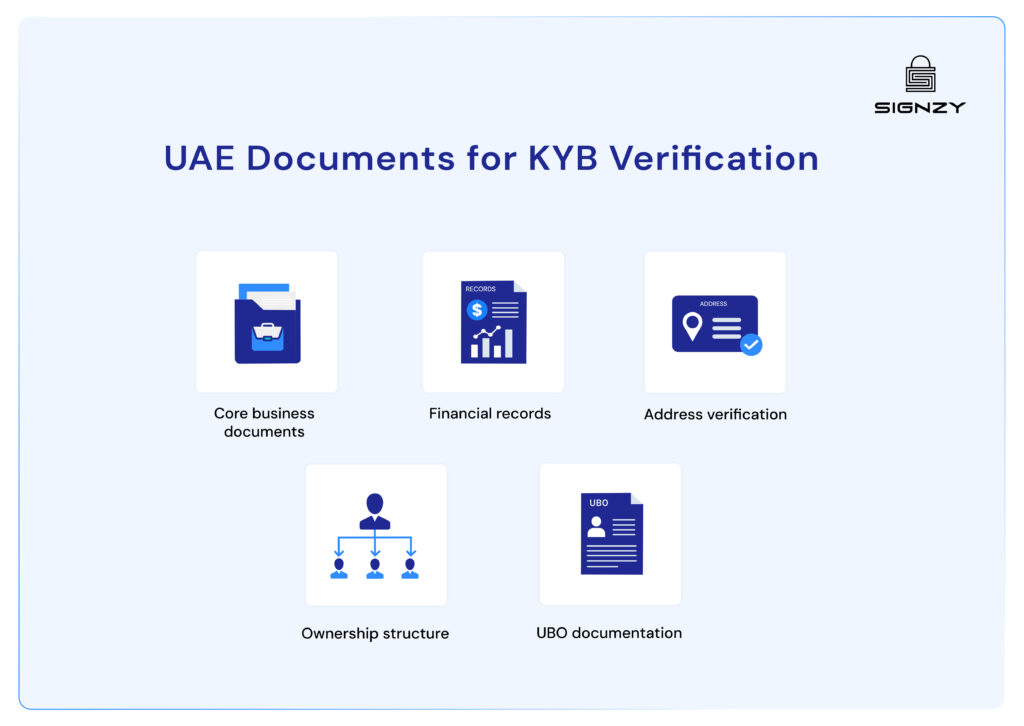

UAE KYC Document Requirements for Businesses and Corporate Customers

Corporate KYC is like peeling an onion – there are multiple layers to verify, and yes, sometimes it might make you want to cry.

| Document Required | Purpose |

| Trade License | Confirms legal registration and permitted business activities |

| Certificate of Incorporation | Verifies company formation and registration details |

| Memorandum & Articles of Association | Outlines company structure and operational framework |

| Board Resolution | Authorizes specific individuals to act on the company’s behalf |

| Shareholder Registry | Maps ownership structure and identifies major stakeholders |

| UBO Declaration | Identifies ultimate beneficial owners with >25% ownership |

| Director Details & IDs | Verifies the identity of all board members and decision-makers |

| POA Holder Documents | Validates authority of designated representatives |

| Business Bank Statements (3 months) | Demonstrates financial activity and transaction patterns |

| Entity FATCA/CRS Forms | Confirms tax residency status and reporting obligations |

Now, these were requirements for any normal corporation and businesses. But if your customer base includes non-financial businesses and professions, you need to collect some additional documents.

Designated Non-Financial Businesses and Professions (DNFBPs) UAE KYC Document Requirements

If you are dealing with – Real estate agents, law firms, accounting practices, precious metal dealers and such businesses in UAE – you’d need to collect some additional documents than normal businesses and individuals.

Everyone’s KYC requirements are unique because their risks are different. Not complete, but here’s the list you can refer to along with collecting some sector-specific documents.

| Document Required | Purpose |

| Professional License | Validates authority to operate in a regulated sector |

| Registration Certificate with Supervisory Authority | Confirms compliance with sector-specific regulations |

| Beneficial Ownership Declaration | Maps control structure beyond 25% ownership |

| Partner/Owner Identity Documents | Verifies key stakeholders’ backgrounds |

| Business Activity Profile | Establishes the nature and scope of operations |

| Compliance Officer Appointment | Shows commitment to regulatory requirements |

| Risk Assessment Documentation | Demonstrates understanding of sector-specific risks |

| AML Policy & Procedures | Proves the existence of internal controls |

| Staff Training Records | Confirms ongoing compliance awareness |

| Transaction Monitoring Framework | Shows capability to identify suspicious activities |

While verifying DNFBPs in UAE, you’re often dealing with professionals who know the rules but might be resistant to extensive documentation. Be ready to make it clear that proper KYC protects their practice as much as it protects you.

UAE KYC Document Requirements for Trusts and Non-Profit Organizations

Trusts and NPOs require extra scrutiny – not because they’re inherently risky, but because their structures can be complicated and their activities often cross borders.

Trust and NPO verification in UAE is like a detailed family portrait – you need to capture every relationship, every flow of funds, and every decision-maker in the picture.

| Document Required | Purpose |

| Trust Deed/NPO Constitution | Establishes legal framework and operational scope |

| Founder/Settlor Documentation | Identifies the source of assets and founding purpose |

| Trustee Appointment Documents | Verifies authority of asset managers |

| Beneficiary Information | Maps out who ultimately benefits from the structure |

| Council Member Details | Confirms the identity of governing body members |

| Source of Donations (NPOs) | Tracks the origin of funds and ensures legitimacy |

| Annual Financial Reports | Shows pattern of activities and fund distribution |

| Regulatory Approvals | Validates compliance with UAE charity regulations |

| Guardian Details (if applicable) | Identifies oversight personnel |

| Project Implementation Reports (NPOs) | Documents how funds are being used |

The layered nature of these organizations can make it tricky.

A trust might have beneficiaries who are themselves other trusts. An NPO might receive donations through complex channels. Your job is to untangle these threads without getting caught in them.

You can create a visual mapping tool for these structures. Sometimes seeing the relationships drawn out makes verification easier and helps spot potential risks you might miss in text-only documentation.

Verifying the collected UAE documents

Having a stack of KYC documents doesn’t mean you’re actually meeting compliance requirements. The real challenge kicks in when you need to verify each document’s authenticity, cross-reference details across multiple sources, and maintain ongoing monitoring. All while keeping your customer onboarding smooth and swift.

In a region where regulatory scrutiny is intensifying and penalties for non-compliance can be severe, the margin for error is basically zero.

Even worse, high-quality forgeries are just a few clicks away nowadays – traditional eyeball-and-approve methods just don’t cut it anymore.

That’s where Signzy steps in, offering targeted solutions for UAE businesses. Our KYC Verification API handles everything from Emirates ID validation to corporate document verification, while our Identity Verification Suite ensures comprehensive individual authentication.

For corporate clients, our UBO and Criminal Screening APIs add that extra layer of security your compliance team needs. Because at the end of the day, verification shouldn’t be your bottleneck – it should be your strength.