- The new “PAN data vault system” under PAN 2.0 requires all organizations like banks and insurance companies to store PAN information in a secure, standardized way.

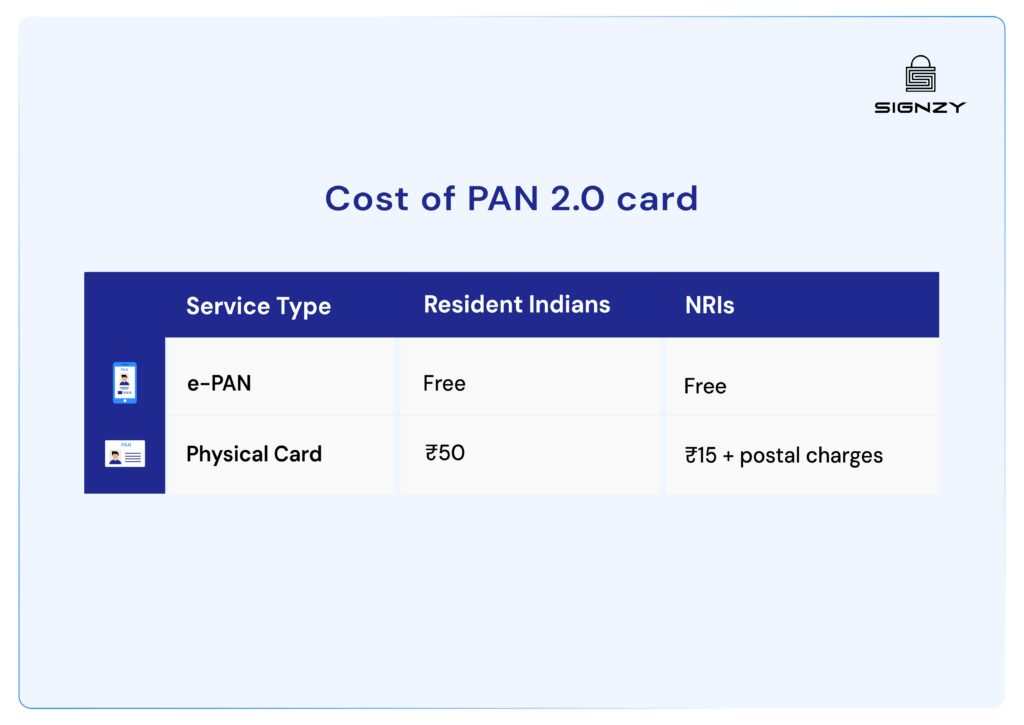

- Under the new system, digital PAN (e-PAN) will be issued at no cost, while those wanting a physical card will need to pay Rs 50 if delivered within India.

- The Income Tax Act imposes a Rs 10,000 fine under Section 272B if taxpayers fail to follow PAN rules or provide incorrect PAN information.

Let me guess – you’ve seen ‘PAN 2.0 Project’ floating around your feeds or news, probably sandwiched between market updates and tech innovations.

The next thing you did was Google it…and now we are here.

So, out of respect for your time, we are directly getting to the point – covering everything you need to know about the Indian Government’s new PAN 2.0 project.

Whatever doubts you now may have – what is PAN 2.0? Why do we need a new PAN? How to get a new PAN? Will my old PAN become invalid? What are new regulations around it? – all will be answered by the final paragraph.

If you have the next 9 minutes – here are the answers to 10 most common questions you may have about PAN 2.0 project – all sourced from official government resources.

1. What is PAN 2.0?

PAN 2.0 is the Income Tax Department’s new ₹1,435 crore digital upgrade that consolidates all PAN services into a single unified portal, making tax identification simpler and more secure for everyone in India.

2. How is PAN 2.0 different from traditional PAN?

Remember those times when handling PAN-related tasks meant jumping between different websites and portals? That’s about to change. PAN 2.0 Project brings together three separate systems (e-Filing Portal, UTIITSL Portal, and Protean e-Gov Portal) – everything will now be available in one place.

The project was introduced in the November 25, 2024, Cabinet Briefing by Union Minister Ashwini Vaishnaw.

“A new form of common business identification for India is needed, for which PAN 2.0 has been approved today. It will be completely paperless, completely online, and there will be a strong focus on the grievance redressal system – how to quickly solve any difficulties faced by any users.” The Union Minister said.

PAN 2.0 Project – Quick Benefits

- The PAN 2.0 project introduces smart features like encrypted QR codes that contain secure identification details, making verification as simple as scanning a code.

- The system brings in something called a “single source of truth,” ensuring that whether you are checking your customer’s PAN with a bank or a government office, you’ll be seeing the same, accurate information.

- PAN 2.0 will act like a digital secretary, handling verification tasks that once required manual checking. Real-time validation capabilities mean faster service delivery – especially important for financial institutions processing numerous applications daily.

- For regular cardholders, this means no more waiting in queues for updates or corrections. Need to change an address or update contact details? The system handles these changes digitally, often in real time.

- The enhanced QR code system adds an extra layer of security, making identity theft significantly harder.

3. What is the Common Business Identifier in PAN 2.0 project?

The Common Business Identifier (CBI) in PAN 2.0 project combines PAN, TAN, and TIN into a single identification number for businesses. As clarified by Union Minister Ashwini Vaishnaw, this integration responds to industry demands for a unified business identifier across government platforms.

Think of it as turning your PAN into a master key. Instead of carrying different keys (identification numbers) for different locks (government departments), businesses will use one key that works everywhere.

For instance, a business that currently uses separate numbers for tax deduction (TAN), tax collection (TIN), and permanent account (PAN) will soon manage everything through one identifier. This consolidation simplifies compliance, reduces paperwork, and creates a more efficient system for business-government interactions.

4. How will PAN 2.0 affect businesses and taxpayers?

For years, India’s bureaucratic innovation followed a predictable pattern: take a paper-based system, digitize it, call it e-something, and hope for the best. However, the PAN 2.0 project signals something different.

It’s bringing major changes to business operations through streamlined identity verification, unified data systems, and automated compliance, which can impact business in endless ways.

- Single Portal Access: All PAN and TAN-related services – from applications to corrections – will move to one centralized Income Tax Department portal. This replaces the current scattered system of using separate websites for different services.

- Real-time Validation Services: Organizations gain access to immediate online PAN validation. This particularly impacts banks, financial institutions, and businesses handling large volumes of customer onboarding.

- Data Vault Requirements: Financial institutions and businesses must now store PAN data in a mandatory secure vault system. This new regulation applies to banks, insurance companies, and any organization that collects PAN information.

- Simplified Verification Process: The enhanced QR code system transforms how businesses verify identities. Instead of manual document checks, a simple scan provides instant access to encrypted identification details.

- TAN/TIN Integration: Tax Deduction Account Number (TAN) services merge into the same system. For businesses handling TDS, this means managing tax deduction responsibilities through the same portal as PAN services.

- Inter-departmental Communication: The system enables better information sharing between different government departments. This reduces redundant document submissions for businesses dealing with multiple agencies.

5. Is my old PAN card still valid?

Yes, existing PAN cards remain completely valid under the new PAN update. The government’s official press release has made this crystal clear in their official communications: there’s no mandatory requirement to upgrade existing cards.

Still, those with older PAN cards (especially ones without QR codes) might want to consider an upgrade. Why? The new cards come with enhanced security features that make identity verification faster at banks and financial institutions. But there’s no rush – the choice to upgrade stays entirely with the cardholder.

6. What is the cost of PAN 2.0 card?

A new physical PAN 2.0 card costs ₹50 for domestic delivery and ₹15 + postal charges for international delivery. The good news? The e-PAN version, which carries the same legal validity as the physical card, comes at absolutely no cost. It’s delivered directly to your registered email address, typically within 24 hours of application approval. Plus, all online corrections and updates to your PAN details come free of cost under the new system.

7. How to apply for PAN 2.0?

So, while you will find tons of step-by-step answers showing up as you search “how to apply for PAN 2.0”, the real answer is there’s no official process yet. Most of the answers present on the internet currently will just help you download e-PAN, which is not new, and not PAN 2.0 either; rather, it’s only a PDF version of your physical PAN. You can always come back here, and we will update this part as soon as any official process to apply for PAN 2.0 (or e-PAN 2.0) rolls out.

8. How to download e-PAN 2.0?

Again, as stated in the last section, there’s no formal process to get PAN 2.0 yet. You can download the ePAN, though (not e-PAN 2.0). The process is: head to the NSDL portal, log in with secure credentials, navigate to the ‘Download e-PAN’ section, verify identity through OTP, and download the document.

Store your e-PAN on both cloud storage and local devices. Being digital doesn’t make it any less official – the e-PAN carries the same validity as a physical card for most purposes.

9. PAN 2.0 Documents Required List

Like PAN, you mainly need to provide one identity proof like an Aadhaar card or passport and one address proof like a utility bill or bank statement. Here’s a complete list of essential documents needed for PAN 2.0:

- Identity proof (any one): Aadhaar Card (preferred), passport, Voter ID card, driving license.

- Address proof (any one): Utility bills (not older than 3 months), bank statement/passbook, rental agreement, Property documents.

10. How can businesses verify PAN cards now?

While PAN 2.0 project promises future enhancements, businesses currently need robust solutions for PAN verification. The transition period requires reliable systems that can handle both existing PAN cards and the upcoming PAN 2.0 format, ensuring continuous operations without disruption to customer service.

While the PAN 2.0 project rollout continues, businesses and financial institutions need to maintain efficient verification processes for the millions of PAN cards in circulation. Signzy supports this critical need through its Digital Onboarding Solutions and PAN Verification API, helping organizations streamline their verification processes while the new system takes shape.