The onboarding process for Asset Management Companies (AMCs) is among the most complex of all client-facing activities. Reams of documentation are exchanged between a client and the investment management firm. It is then distributed throughout the organization. Most of this requires approvals, signatures, and validations.

Digital onboarding requires finalizing legal agreements, Know Your Customer (KYC) and Anti Money Laundering (AML) activities. It also involves opening client accounts on multiple systems and transitioning incoming assets. Each of these activities engages multiple groups throughout the organization. Examples include client service, legal, compliance, and operations. Without well-defined and coordinated procedures, this could lead to errors. Ex: misplaced information, breakdowns in communication, and duplicated efforts are likely. The right-hand needs to know what the left hand is doing in order to properly manage all the hand-offs and moving parts.

Benefits of improving onboarding:-

- Ability to generate fees sooner.

- Increased potential to cross-sell, additional products, and services.

- More referrals from clients due to a positive experience.

- Reduced client turnover.

- More efficient resource allocation.

- Better views into process status.

- Fewer mishandled communications and handoffs between the team.

- Measurable efficiency through metrics.

- Faster addition of new products and services.

Why Digital KYC? The Need For Digitization Of KYC In Mutual Funds

- At present, investing in a mutual fund requires a second round of KYC. This is also true even for customers who have completed KYC in their bank accounts. The procedure involves the submission of identification and address proofs along with photographs. The distributor or adviser must physically meet the customer to conduct ‘in-person verification’ for him/her. This requirement greatly hampers the growth of mutual funds online.

- It also affects access to mutual fund investments for those in remote areas. In 2019, the Nilekani committee proposed that there should be a simple KYC procedure for opening a mutual fund account funded from a KYC-verified bank account. However, inflows into such a folio and redemptions to it must be restricted to this account.

This leads to the digitization of KYC. Among the many advantages of getting paperless KYC done, the following benefits are most important:

- Personal Details are Secure: All information is stored and transmitted on the website with a special configuration. Whether it is your Account Information, Demographic Data, Biometric Data, etc. The KRA, Fund House, or AMC’s Portal is maintained with the highest level of Security. It reduces illegal activities of money laundering, loan scams, identity theft, and fraud.

- You are the Boss: The option to invest will always be yours. The digital KYC mechanism is completely dependent on your decision. Not only that, you have the choice of providing access to your details to whomsoever you want. In some cases, if you change your mind. You may not want to invest in Mutual Funds. Whereas, if you opt for offline KYC. It is possible that your self-attested documents end up with unauthorized parties. This risk gets reduced to a large extent by taking the online KYC mode.

- Instant Process: No Human element is involved that means no Red Tape is involved. The efficiency in the digital process ensures no delays. Comparatively, the offline process would take at least a few days.

- Transparency: Incidents of the KYC documents in illegal and illegitimate persons occurred commonly. Opting for Online KYC, you can avoid such an event. The websites store the data in encrypted servers. It makes the possibility of a breach highly unlikely. Besides, the trespasser or the source of the breach can be traced in online transactions. They can be brought to legal authority with proof.

- No Hidden Costs: Some Mutual Funds agents may charge extra amount as KYC Registration fees. And investors need to pay to avoid the hassle of taking time off from work and visiting the Government Agency in person. With eKYC, you do not need to pay in addition to the investment amount.

- Compliance: Your data gets validated using the latest technologies. This increases the overall security of the system. It also ensures that the digitally transferred document is legally valid.

The Road To Digitization Of KYC

As per regulatory developments from January 1, 2011, KYC is mandatory for investors wanting to transact in Mutual Funds. This is regardless of the transaction amount. It implies that you will not be able to process any fresh MF purchases post January 1, 2011. This is true except when you are MF KYC compliant as per CDSL Ventures Limited (CVL) norms.

This implies that you can always ask your broker to provide you forms for submission to your KYC. Since there are no charges for mutual funds they may not be useful. As such, it is better you also understand you can get your KYC done. Follow these steps:

1. Get the Form

The KYC application form can be availed from the investor service centers for the particular Fund, CAMS or at any specified ‘Points of Service’ (POS) of CDSL Ventures Ltd. You can also download it from your broker, advisor or AMC.

2. Documents

The following lists the set of documents which are required for submission with the KYC application form:

1. A recent passport size photograph

2. PAN card copy

3. Address proof (Recent bank statement will work but if you have to get your bank statement in the email you need to visit your bank branch to get an original one.)

The document submission can be done at the CAMS Online office in your city. Ensure you carry the originals along with a photocopy of the documents because at times they might need to verify with the originals.

3. Verification

Once the KYC application form and supporting documents are verified, the investors will receive a letter authenticating their KYC compliance. They normally give you the letter in a few hours to a max of 24 hours for this identity verification api .

You can verify your KYC status online. You should verify on the day of form submission that your status is processing. Once it is done, your status should change to VERIFIED.

Actually KYC need not be done at your broker’s end. But some online systems do not accept the order. This can happen if they don’t have the data in their own system and so it is better to get that done as well.

KRA and K-IPV In KYC Collection

SEBI had initiated the usage of uniform KYC by all SEBI registered intermediaries (RIs). This was done to bring uniformity in the KYC requirements for the securities markets. In this regard, SEBI had issued the SEBI KYC Registration Agency (KRA), Regulations, 2011.

KRA is the authority for the centralization of all KYC records and details in the securities market. The client who wishes to open an account with a broker shall submit the KYC details. They can be submitted through the KYC Registration form with supporting documents. The Intermediary is responsible for conducting the initial KYC. The RI should also upload the details to the KRA system. The KYC details are accessible to all SEBI RIs for the same client. So once the client has undergone KYC with an RI, it is not necessary to repeat the same process again with other RIs.

It is compulsory for each client to be registered with any one of the various KRA registered intermediaries. This should be done before availing the benefits of any intermediary. Such benefits include Stock Broker, Mutual Fund Companies, Depository Participant, Portfolio Management Services (PMS) etc.

In-Person Verification (IPV) is part of the process of doing KRA-KYC registration of clients. KRA compliant clients are not required to undergo this process.

Importance Of IPV

The Prevention of Money Laundering Act, 2002 (PMLA), came into effect from 1 July 2005. The Act enforces that no one could use investment tools to hide their illegal wealth. Soon after, SEBI mandated that all intermediaries should adopt the KYC policy. It was also necessary to plan and install certain policies. The policies should follow vis-a-vis the guidelines on anti-money laundering measures.

Since 1 January 2011, KYC compliance has been made mandatory for all investors. This is irrespective of the amount invested and includes the following transactions:

a. New / Additional Purchases

b. Switching Transactions

c. First-time Registrations for SIP/ STP/ Flex STP/ FlexIndex/ DTP

d. Any SIP/STP/trigger-related products which were introduced after the enactment of the act

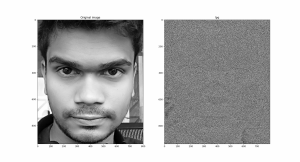

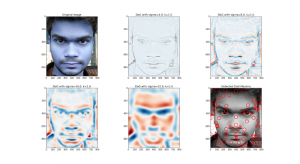

e-KYC (Know Your Customer) is a value-added feature that is offered by many financial institutions. E-kyc is useful for making the application process convenient. Investors can access it and upload the necessary documents. It can be done from the comfort of their home or office. As previously discussed, this is applicable to only SEBI-approved KRAs. For ex: CVL and CAMS can complete the e-KYC process. This means that Digital KYC can be used for IPV as well.

EKYC — The Miracle Turned Myth

To remove the repetitive submission of documents, SEBI launched the concept of common KYC in 2011. With this move, the first intermediary processes the KYC-related information and sends them to the KYC Registration Agency (KRA). Once your account is created, any other intermediary can make use of the same details in the future for new accounts.

Why eKYC?

The concept of common KYC smoothened things for retail investors, However, it was still a time-consuming process (8–10 days). It also included the problem of in-person verification. This also increased the cost of servicing small investors while preventing immediate on-boarding of new customers.

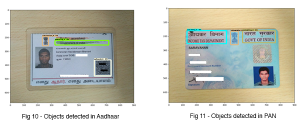

SEBI launched eKYC in order to make the procedure more investor-friendly. It enabled customers to verify their identity and upload documents digitally. To get started, you only needed to quote your Aadhaar number, PAN number, e-mail id, and mobile number. Once you type in the details, you will receive a one-time password (OTP) in your Aadhaar-registered mobile number. After entering the OTP, the eKYC process would be completed and you could start investing in mutual funds within minutes.

While Aadhaar based eKYC had been introduced as a means for onboarding, there were a lot of discrepancies. This was especially after the Supreme court judgement on the use of Aadhaar based eKYC. It was later reintroduced. This had left a state of confusion and many AMCs continued traditional methods of KYC collection for onboarding. Physical KYCs are more time-consuming. The distributor has to submit the documents to KYC Registration Agencies or KRAs. The KRA nodal agencies have to manually fill in the data in their systems from the applications. If the handwriting is illegible, capturing the KYC data could lead to errors. This would delay the process further.

The SEBI Way Of Digital KYC

In a recent move on April 24, 2020, the Securities & Exchange Board Of India (SEBI) has issued the latest guidelines on the digitization of the KYC process. Some of the highlights are mentioned below:

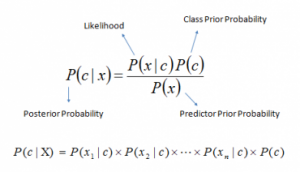

1. Know Your Customer (KYC) and Customer Due Diligence (CDD) policies form a part of KYC. They are the foundations of an effective Anti-Money Laundering process. The KYC process requires every SEBI registered intermediary (also known as ‘RI’) to collect and verify the Proof of Identity (PoI) and Proof of Address (PoA) from the investor.

2. The provisions as laid down under the Prevention of Money-Laundering Act, 2002, Prevention of Money-Laundering (Maintenance of Records) Rules, 2005, SEBI Master Circular on Anti Money Laundering (AML) dated October 15, 2019 and relevant KYC / AML circulars issued from time to time shall continue to remain applicable. Further, the SEBI registered intermediary will continue to ensure to obtain the express consent of the investor. This should be done before undertaking online KYC.

3. SEBI, from time to time has issued various circulars to simplify the process of KYC by investors / RIs. Constant technology evolution has led to multiple innovative platforms being created. These allow investors to complete the KYC process online. SEBI held discussions with various market participants and based on their feedback, technology like Aadhar-based e-Sign service which can facilitate online KYC will now be used. This is done with a view to allow ease of doing business in the securities market.

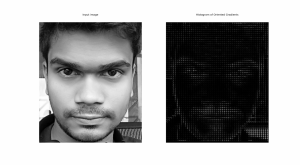

4. New regulations allow Investor’s KYC to be completed through an online / App-based KYC. There is also provision for in-person verification through video, online submission of Officially Valid Document (OVD) / other documents under eSign. It allows the introduction of VideoKYC, which was also allowed by RBI for the banking sector earlier this year. (Click here< to read more about RBI Guidelines for VideoKYC)

5. SEBI registered intermediary may implement their own Application (App) for undertaking online KYC of investors. The App shall facilitate taking photographs, scanning, acceptance of OVD through Digilocker, video capturing in a live environment, usage of the App only by authorized persons of the RI.

6. The guidelines also allow RIs to undertake the VIPV(Video In-Person Verification) of an individual investor through their App. This is done to ease investor onboarding.

Digital KYC For The New Era

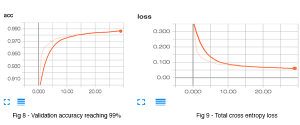

Signzy has developed an AI-based electronic KYC solution called RealKYC. It consists of a host of microservices that provide the following benefits to AMCs

- Reduction of TAT: During investor onboarding, the traditional method of KYC collection involves the submission of a lot of documents and processing that is done by several departments and their officers. This can be a time-consuming process but with VideoKYC, the entire process is automated and can be done in a matter of minutes in real-time.

- Lower Operational Costs: The onboarding process for a new investor can require several checkpoints that are cost-effective. There is significant manpower involved as well which also raises the cost of onboarding. All these factors can be automated with RealKYC, thereby reducing operational expenses.

- Remote Onboarding: With RealKYC, there is no need for investors/entities to pay multiple visits to the physical branch for the processing of KYC. They can simply visit the website and submit all their documents as well as get the verification done, online.

Signzy’s VideoKYC solution offers a simple, secure KYC collection process that is 100% compliant with the latest SEBI Guidelines. The benefits include:

- Compatibility With Most User Devices: This solution has matured over dialects, browsers and low-internet scenarios. This means that most users can undergo VideoKYC without any technical pain points.

- Improved BackOps; Our Patented AI reduces 90% Backops effort, making onboarding of investors a smooth process.

Conclusion

KYC or Know Your Customer is a compulsory requirement for those wishing to invest in Mutual Funds. It is mandatorily needed by the Market Regulator SEBI (Securities and Exchange Board of India). This identification process needs to be undertaken only once. KYC was introduced to avoid fraudulent activities. eKYC for Mutual Fund was launched for the ease of investors.Digitization of KYC merely changes the mode of KYC collection and not the process.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.