A TransUnion Analysis found that digital frauds grew by 23.8% in the first four months of 2021 compared to the previous four months. At 60%, the financial services industry recorded the largest increase in online frauds.

To enable faster customer onboarding and an enhanced experience, Fintech providers and financial service companies are switching to digital identity technology. Also known as “Digital ID,” digital identification (or identity) is emerging as the new mode of identifying consumers lacking any legal form of ID documents.

Through this article, we shall look at the use of digital identity in the Fintech sector – and how to overcome its challenges.

Digital Identity in Fintech

By using a digital ID, Fintech companies can unlock a huge market potential and offer a range of innovative financial services to their consumers, including financial inclusion of the “unbanked.” A Digital ID can streamline user authentication and improve the overall customer experience.

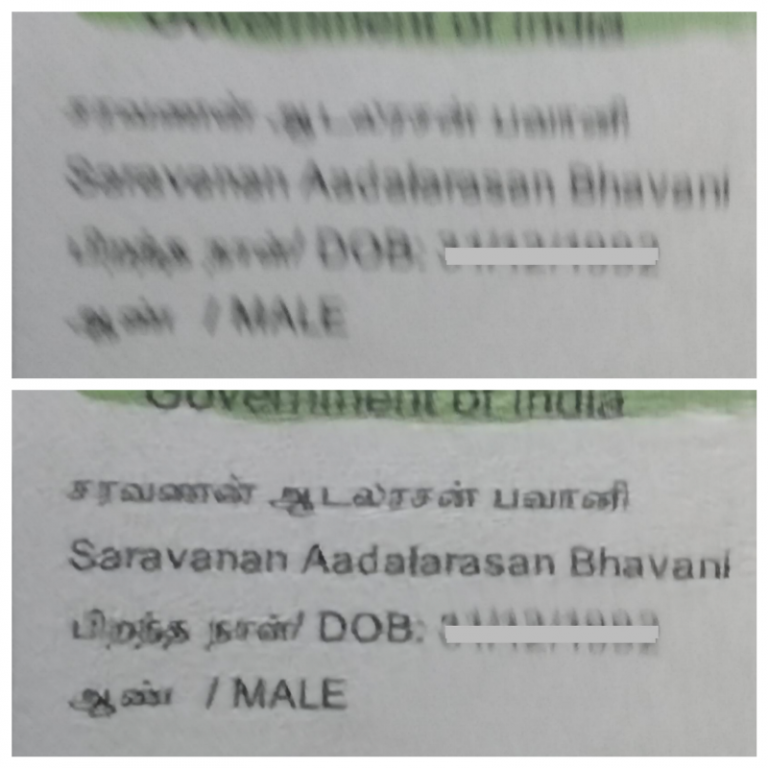

Globally, governments and government agencies are putting together the infrastructure required for digital identity systems. For example, the Indian government has implemented the Aadhar-based eKYC registration process – which has reduced the cost of KYC registration from $5 to $0.70 for each customer.

How does this technology help in reducing identity thefts and cyber risks in the financial service sector?

- Enabled by digital IDs, financial institutions can perform identity verification through the individual’s photo or video capture.

- Digital IDs can also secure online transactions that are easier to manage instead of users having multiple online accounts that cyber attackers can target.

Why is Digital Identity Important in Fintech?

Here is what makes digital identity important to the Fintech sector:

- It helps in improving operational efficiency and eliminates “human error” from manual verification processes through building accurate customer profiles.

- Increasing financial revenue by offering innovative products or services to previously unavailable consumers due to verification constraints.

- Providing a superior user experience by removing any barriers to online transactions and securing user attributes.

Further, digital IDs can reduce the cost of customer service – by eliminating calling customers requesting for resetting their “forgotten” account passwords. At the same time, a digital identity can improve risk management by streamlining the eKYC process and safeguarding customer data from security breaches.

Digital Identity – Validation Workflow

How does digital identity work? A video-enabled digital identification process can help in identifying and validating individuals in the following ways:

- Matching the person (on video) with the face on the ID document (example, PAN or Aadhar card).

- A highly intuitive user interface for the best video interaction.

- Use of video-based forensics for detecting any fake identity or spoofs.

- High-end encryption for video transmission and communication.

- Real-time capture of geolocation and IP address.

Digital Identity – Challenges

As stated by Phillip Malcolm of Refinitiv, banks and financial service providers must be able to “provide products and services (with increased scalability) that need to be technologically advanced.” Any large-scale disruption in anti-money laundering practices can result in irreversible damage – and large investments into digital identity technologies and infrastructures.

Additionally, with billions of dollars being transferred through online payments and eCommerce transactions, financial service companies will be regulated for compliance and penalized for any failures.

What is Signizy’s Role?

At Signzy, we believe that efficient digital identity solutions can go a long way in validating banking consumers and improving their banking experience. Designed for high-grade banking, Signzy’s VideoKYC solution is being used to onboard new banking customers according to financial regulations.

Through its partnership with the UAE-based Seed Group, Signzy is set to expand its footprint among banks and financial institutions based in the Middle East. With its global presence, Signzy has been instrumental in the digital transformation of leading banks and improving their global market share. This includes complete automation of their back-office operations and empowering their security infrastructure – among other capabilities.

Want to know how we can help? It is time to get in touch with us.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.