Regulations & Revenue- How Digital KYC For CASA Can Be A Relief For US Banks

January 30, 2021

9 minutes read

Introduction

KYC (Know Your Customer) has become a crucial part of the financial framework in America. Banks in the US are required to have a proper understanding of the identity of their customers. This requirement with advancing technology creates challenges for the banks in conducting KYC. The cumbersome methods of traditional KYC are becoming outdated. It is time for Digital KYC.

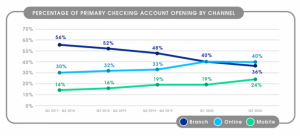

The solution to these problems is similar to solutions to most problems in banking. Digitizing the entire process with technology does the trick. Unfortunately, most banks overlook this and stick with more clumsy routes from tradition. More than 64% of account opening applications in 2020 Q3 were either online or through a mobile device. This was a huge jump from the previous year’s 53% during Q2-Q4. The evidence is clear on how customers are changing their preferences.

One area in banking that can benefit from digitization is CASA (Checking/Current Account Savings Account). It’s a very beneficial option for the bank as the revenue from CASA and checking accounts is high. This is because of the low interests that they offer while providing other attractive options for the customer. Unfortunately, the regulations are strict in this area and conducting effective KYC is a tedious process.

Digital KYC is useful for CASA customers and banks. With efficient implementation it will save time and effort for both parties, rendering less attrition and more benefits. A detailed look at how the machinations will reveal a better picture.

Role of CASA In The US Banking Sector

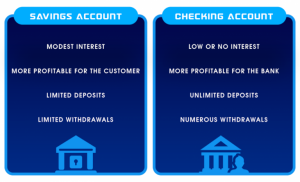

Before understanding CASA we must know the exact difference between savings and checking/current accounts:

- A savings account is a deposit account that bears interest at a bank or any financial institution. Even though they provide modest rates of interest, they are often set against growing inflation. Nonetheless, they are safe and reliable with good liquidity. They are not very profitable for the financial institutions as they would have to provide interest to the customer.

- A current account/checking account on the other hand has no or low-interest rates. They have safety and liquidity too. But what makes them stand out is their option for unlimited deposits and numerous withdrawals. They are also called demand accounts or transactional accounts. They are far more profitable for the banks since they can hold the money while paying no or low interests.

CASA combines the features of both these accounts. This will have an appealing effect on the customers to keep the money in the bank. This is beneficial for the bank as they pay no or low returns on the checking/current account while maintaining decent interest on the savings portion. It doesn’t have a specific maturity date. Thus, it is valid as long as the account holder needs it to be open. Banks always prefer customers to have a CASA or checking account than a savings account.

Even though CASA is usually a combined type of account, the term is often used to refer to both Checking and Savings Accounts together. In most parts of the world, they are used separately, but West and Southeast Asia predominantly have CASA along with the other types of accounts. Such bank accounts are located in markets with saturation and cutthroat competition. The US banking sector is headed towards such a scenario.

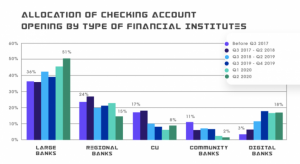

During the COVID-19 pandemic, the USA has seen a fall in new checking accounts in regional and community banks. The major reason was the unease of the physical process of account opening. It is noteworthy that digital banks and Large banks (like JP Morgan Chase and Bank of America) who had digital KYC and onboarding options accounted for nearly 55% of all accounts in 2019 and increased it to 69% by Q2 2020

Source- CORNERSTONE ADVISORS

What Happens When Banks Don’t Know Their CASA Customers?

Even though KYC helps build better relations with the customer and smoothens transactions in the long run, it’s primary objective is to prevent fraud. Several frauds may lead to money laundering and even terrorist funding. In Q1 2020 alone saw a 104% rise in financial fraud reports compared to Q1 2019. This amounted to more than 430% increase from Q1 2015.

This is where KYC comes into play. An established data on the credibility of the customer helps banks determine the risk involved in dealings with each individual. Government bodies like FinCEN(Financial Crimes Enforcement Network) and international entities like FATF play a role in ensuring AML/CFT(Anti-Money Laundering/Combating the Financing of Terrorism). But financial institutions have their responsibilities.

The Federal Government has taken certain steps to ensure this. In 2016, a rule which mandates financial institutions to verify the identities of customers was established. This was especially for legal entity clients and their beneficial owners including corporations, partnerships, LLCs and others.

Banks and financial other institutions are advised to secure from the customer:

- The customer’s full name

- Residential address

- SSN(Social Security Number)

- Date of birth.

CASA is a lucrative option for the banks. They are sometimes given lenient customer onboarding directives. This might lead to inefficient KYC procedures. Unfortunately, money laundering and other illegal activities are mostly done through checking accounts. CASA will also be subject to this as it has similar accessibility. Thus KYC for CASA is of the utmost necessity.

Digital KYC Is The Next Step…Here’s Why!

Another major factor that comes into play is the digitization of bank functions. Customers prefer remote and digital KYC and onboarding procedures to physical and traditional ones. Some of the important reasons for this are:

- Ease of access as they can do it from their homes

- The time required is extremely low relative to traditional methods

- Health concerns amidst the COVID-19 scenario

In 2020 most of the US citizens preferred to access their old and new accounts through an online portal. Some of them went as far as to change their primary accounts from a traditional bank to a bank that provides uber digital access.

The biggest surge was from mobile users who found it much easier to access their bank accounts from anywhere in the world at any time they wanted to. They were literally carrying the snippet of a bank in their pockets.

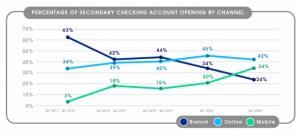

From the data on fraud alone, it makes it necessary for banks to switch to digital KYC for onboarding process, combine this with the fall of new secondary checking account opening from 63% in 2017 to 24% in 2020 at traditional banks, digital KYC becomes essential

Source- CORNERSTONE ADVISORS

Source- CORNERSTONE ADVISORS

Source- CORNERSTONE ADVISORS

Digital KYC For CASA Operations Comes With A Plethora Of Benefits

Digital KYC is an idea that even governments are entertaining. With proper regulatory guidelines, they will be stringent and secure. It is the most efficient way to conduct KYC for CASA. As a matter of fact, it would be the most efficient method to conduct KYC for any aspect of the banking sector. The reasons for these include:

- As the numbers of in-person account openings have fallen it is clear that customers prefer other modes.

- As the entire populace has access to smartphones, it is only sensible to provide them with the option to create a CASA account from their mobile devices, if they wish to

- Long Queues and formal delays will be avoided due to the virtual onboarding process

- TAT can be reduced to a matter of hours or even minutes.

- Health concerns amidst the pandemic are nullified as no human contact is nil.

- Once implemented the procedure will be cheaper than traditional KYC.

- If regulatory guidelines for Digital KYC are strictly followed, fraud risk can be reduced to a minimum.

- With efficient and experienced third parties’ oversight, the platform can be user experience-driven.

- Overall customer experience and satisfaction is met.

Even without any push for digitization customers are preferring all their banking processes online. KYC usually is a one time process, if enough activation enthusiasm can be generated from the customers, permanent customers can be ensured by the institutions.

Conclusion

The facts are in front of us. The citizens of the world’s largest economy prefer to go digital due to the convenience, security and safety it brings. Digital KYC for CASA in US banks is gaining importance and is becoming the need of the hour in the banking industry. It’s becoming inevitable. Perhaps, in a decade or more the entire industry would go online rendering any physical interventions either useless or extremely unavoidable.

CASA is a symbiotic option for both the customers and the financial institutions. Welcoming more customers into using it would benefit all. It is the responsibility of Such institutions to ensure that customers are attracted and easily integrated into their user-base. Digital KYC is the next step for all entities in the banking sector. Without further adieu, that is where they should head their wheels at.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.