Evolution of ENACH

The journey of ENACH (Electronic National Automated Clearing House) is a testament to the evolving landscape of digital financial transactions in India. As we increasingly transition to a cashless society, the need for efficient, automated, and secure payment systems becomes paramount.

The centralized payment/transaction processing system was launched on 30th June 2019. The launch was done by the National Payments Corporation of India (NPCI). National Automated Clearing House (NACH) has been constructed for banks, corporates, financial institutions and the Government. It enables you to easily manage recurring payments across multiple banks. It assists you to manage payments of utility bills, SIPs, premiums, donations, Credit Card bills etc.

NACH was set up to serve as a faster and efficient platform for clearance.

NPCI — The Driving Force Behind ENACH

The NPCI was formed by the Reserve Bank of India (RBI) in collaboration with the Indian Banks Association and ten promoter banks. The ten promoter banks are SBI, ICICI, HDFC, PNB, Citi, HSBC, Canara Bank, Bank of India, Union Bank of India and Bank of Baroda. NACH is NPCI’s product offering. Its objective is to replace the existing ECS systems across the country.

With the implementation of the NACH system, NPCI intends to provide a single set of rules for businesses. It also allows for .open standards and best industry practices for electronic transactions. These are common across all the participants, Service Providers and Users, etc. NACH system also supports Financial Inclusion measures initiated by Government, Government Agencies and Banks by providing support to Aadhaar based transactions.

The NACH system enables the member banks to design their own products. It also addresses the specific needs of the banks & corporates. These include a refined Mandate Management System (MMS) and an online Dispute Management System (DMS). The last one is coupled with strong information exchange and customized MIS capabilities.

The NACH system provides a robust, secure and scalable platform to the participants. It has both transaction and file-based transaction processing capabilities. It has best in class security features, cost efficiency & payment performance. All these are coupled with a multi-level data validation facility. It is accessible to and from all participants across the country.

Know Your NACH — Its Evolution & How It Helps

NACH was a system introduced by the NPCI, for interbank, high volume, electronic transfers. These were periodic in nature.

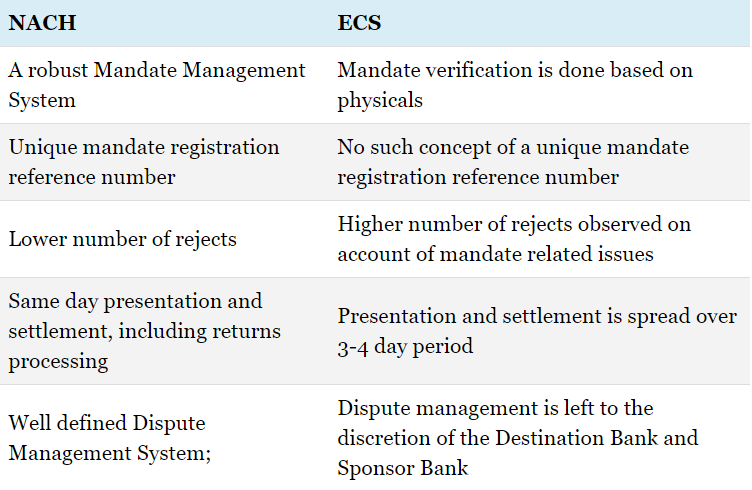

NACH Over ECS — What Was The Need

NACH creates a better option for facilitating clearing services. It is more efficient than the existing Electronic Clearing Service (ECS) system.

NACH is a centralized, web-based clearing service that facilitates services for banks, financial institutions, the government and corporates. It consolidates all regional ECS systems into one national payment system. This helps by removing any geographical barriers in banking.

The most evident difference between NACH and ECS is the method by which the system makes a transaction. Electronic Clearing System (ECS) is a time-consuming method for electronic transactions. Whereas NACH is an online-based transaction system working on the basis of Core Banking Solutions.

Validation is another issue that was majorly faced by the ECS system. This is another reason for giving way to the formation of the NACH system. The NACH is a superior system that is trusted by a major portion of the population.

Here are 5 major differences why NACH is a better choice over ECS

The NPCI introduced NACH as an improvement over the existing Electronic Clearing System (ECS) and consolidated multiple ECS systems running all over the country. The NACH system is used for bulk towards the distribution of subsidies, dividends, interest, salary, pension, etc. and also for bulk transactions towards the collection of payments for telephone, electricity, water, loans, investments in mutual funds, insurance premium, etc.

Benefits of NACH:

E-NACH facilitates everyone who deals in bulk and high volume payments every month or so. From the customers to the banks to the organizations — everyone will be equally benefited through the NACH system.

For consumers

- An automated process of transfer for easier and simpler handling of payments.

- A faster process that can be settled in a single day.

- The auto-debit feature allows customers the freedom to not remember the payment dates. This applies for EMI, bills, taxes and other recurring payments that one has to pay at regular intervals.

For organizations

- The online process is fast and independent of cheques and clearing.

- Requires less time do and send payment like dividends, salaries, bonuses and so on.

- Make the payment of grants and subsidies easier and quicker for the beneficiaries.

- Easy settlement of customer bills providing better satisfaction for the customers.

For banks

- Quicker approval of payments helps in creating better customer relations. It also helps maintain corporate clients satisfied with quick services.

- Less paperwork like cheques reduces the complexity and time required.

- The online transaction makes it simpler and easier for every party to conduct business easily.

- Reduces chances of fraud and theft.

Classification of NACH

The 3 major types of NACH are:

- E-NACH

- E-NACH through eSign

- Physical mandates

E-NACH

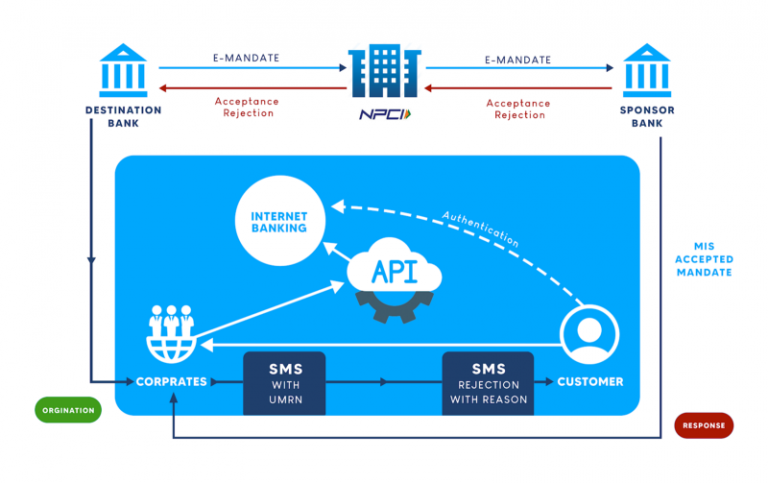

NACH Debit ‘e-mandate’ is a process that enables registration of mandates through the Merchant website, thereby making the whole process of mandate registration online. E-mandates through its digital form of creation of mandates via merchant/aggregator websites are authenticated directly by the end customers.

E-NACH through eSign

In this variation, the merchant, aggregator or bank can get a digital mandate authenticated using Aadhaar credentials verified using UIDAI data. The digital mandate contains the eSign of the customer which will be passed on by the Sponsor bank to the Destination bank. The Destination bank can then verify the eSign and accept/reject digital mandates.

Physical mandates

In this case, the customer can submit the physical mandate to their bank branch. The bank after verification of the customer signature and other details provided on the mandate will upload the data mandate through NACH system on the sponsor bank. The mandate image is optional in this case.

NACH Mandate — How It helps Businesses

NACH helps in the online transactions of money across businesses and customers. It also facilitates loan acquisition and repayment. This makes it a widely utilized system in the modern economy. Small businesses, government agencies, corporate agencies, banks, and other financial institutions use NACH to for effective credit flow. NACH also reduces the time taken for such transactions. It is safe and provides tracking of the transactions. This can be done using the reference number produced for every transaction which happens through NACH.

There are 2 main mandates under the NACH that overlook the transaction flow from a client’s account to the collection agency. In such cases, the lender of the loan can collect the EMIs automatically. This is by sending a NACH mandate to the customer’s bank.

NACH Credit

NACH credit is a part of the NACH mandate. Under this section, a business authorized under the RBI guidelines can make huge payments. These are made directly to the bank accounts of multiple beneficiaries. It is an electronic payment service for bulk payment options. It is applicable for large organizations and corporate companies.

The mandate is helpful in the payment of salaries, dividends, implementation of the mandate. You have to specify the following information in the NACH mandate along with your signature. The sample NACH Form is given below.

Features of NACH Credit

- The system can facilitate 10 million transactions in a single day.

- Provides safety for uploading documents through web access for approval.

- In case of a dispute, it provides an online dispute management system for redressal.

- Multiple file processing is allowed in a single settlement request using the NACH.

- Corporate organizations can have Direct Corporate Access.

- Direct Corporate Access to NACH allows corporate organizations to check the status of their transactions effectively.

- ACK/NACK helps in tracking all your transactions.

- Operational every day of the week apart from Sundays and days when RTGS does not operate.

NACH Debit

Financial institutions and banks use the NACH Debit to collect payments in large volumes from multiple people without any interference. In case of a loan, the lender uses this system to collect EMIs automatically from your bank account once the customer submits the NACH mandate form. It makes it simple and easier to pay recurring payments like EMIs, bills, taxes automatically and simply. For the organizations, it makes the collection easier and trackable using a single settlement.

Features of NACH Debit

- Easy collection of recurring payments from bulk customers directly from their bank account safely.

- Online dispute management system allowing safety and security for high-value transactions.

- It makes it easier for the agencies and organizations to collect payments on behalf of the customers using a safe system that generates a unique reference number for tracking.

- It makes it easier for the customers to pay their dues on time without having to remember the date for paying EMI, bills or taxes.

E-Nach Debit Mandate — The Base For EMI

The NACH is used for regular payments. You are not required to issue cheque or transfer funds every time. Instead, you have to issue a one-time mandate for the regular NACH payments.

The NACH mandate form is similar to the normal cheque. But it asks for more information for effective and foolproof implementation of the mandate. You have to specify the following information in the NACH mandate along with your signature. The sample NACH Form is given below.

- Bank account number

- Bank name

- IFSC or MICR

- Payment Debit type — Fixed or Maximum

- Frequency

- Debit type

- Maximum Amount

- Period From, to or until cancelled.

- Signature with name

Debit Type and Period

In the form, you have to select the ‘ Debit Type’. You must decide the ‘Debit type’ carefully. If you are paying the same amount repeatedly, you should use the ‘Fixed Amount’ Debit Type. It ensures that the debit from your account would remain the same in the future.

While you should use the Maximum amount for the Bill payments as billed amount changes. In this case, you set an assumptive maximum amount. The biller would not be able to withdraw more than the specified limit. Fix this amount after the due consideration. The very low limit would create hassles instead of convenience.

Period For Mandate

You have to also decide the beginning and end date of the NACH mandate. The tenure should be fixed for EMI payments. But you can keep it ‘Until canceled’ in the case of Bill payments. If you choose a shorter period, you have to again give the mandate.

E-Mandate of NACH

Normally, people give a mandate for the NACH through the physical slip. But now you can give the E-Mandate as well. This is done through net banking or debit card.

The institutions which give e-Mandate facility, ask for all the information online and takes your consent through net banking. Besides net banking, you can also use a debit card to give the E-mandate. Earlier, Aadhhaar authentication was also used for the Mandate but, the NPCI has stopped it.

You can use the E-mandate, only if the institution has made an arrangement with the bank.

How NACH Debit improves Customer Experience

NACH Credit uses ‘Push’ payment methods which denote payments through credit cards, debit cards, digital wallets and UPI. It is generally required that the customer authorizes each and every payment. As a result, customers often delay, forget or fail to pay, or they just cancel. RBI has relaxed the requirement for second-factor authentication on card-not-present transactions. This allows recurring payments on cards — but customers must have a card. They must also be comfortable with using it. Further, customers must have authorized the instruction via the card network’s security system.

NACH Debit is a ‘pull’ payment method. It requires the customer to only authorize an initial mandate for you to pull money from their account. This is that they don’t need to worry about authorizing future transactions. On the other hand, collectors don’t need to worry about chasing up customers for future payments.

Cards can expire or get canceled, in such case the payment will fail. NACH Debit mandates expire when you want them to. They can’t be lost or stolen. This makes them much more reliable for recurring payments.

Payment gateways levy uncapped percentage fees of up to 3% for card, wallet and UPI payments. NACH Debit charges much less.

Most Indians do not possess credit cards. NACH Debit requires the customer to have a bank account and no credit card is required.

Digital wallet payments require the customer to load the wallet first. This needs the customer’s authorization each time, generating more friction

EMI-based E-NACH Use Cases

Below we explore some popular areas where recurring payments like EMI’s are easily supported by E-NACH:

eNACH via Debit card or Net banking

With the Supreme Court’s verdict on the use of Aadhaar, most private sector companies could not utilize Aadhaar APIs for user verification. NPCI, after the judgement, deactivated eSign based eNACH product. This led merchants to revert back to paper-based NACH or ECS systems for recurring payments. This was especially in the case of loans and EMIs.

Debit card/Net banking authorized eNACH is meant to be a replacement to the eSign based eNACH. It has a simpler flow and zeroes to minimal human intervention. APIs from NPCI allows a merchant to get the mandate signed using a debit card or Netbanking credentials. They can then send the same directly to NPCI.

NPCI then uses and shares this information with the sponsor bank and destination banks. It then sets up the eNACH payment just within 2 days.

Insurance: If you are subscribing for an insurance plan for your family through an e-Mandate, you can schedule all your premium payments through a simple online process at the start of the insurance period, instead of manually keeping track and making individual premium payments. This applies to all sectors of the insurance industry and is particularly beneficial as regular payments are made throughout the year by the claim owner.

Electronic Appliances; E-Nach also helps when you purchase electronic appliances or consumer goods in the form of EMI-based payments. Today, EMI’s are applicable for devices like mobile phones and tablets as well. If you have bought a few electronic appliances on EMI for 2 years, you can schedule fixed payments through the online process.

Vehicle Loans/EMI’s: If you have purchased your vehicle by taking a loan from a bank or through a financier, then the E-NACH form is provided to you by the banker/financer. If you have picked up a loan for a vehicle, the payment for the loan can be completely automated in this way.

Utility Bills: Most utility bills are paid on a periodic basis. These include Phone bills, electricity bills and others. For example, postpaid bills can be scheduled to be paid automatically. This is by using standing instructions with a credit card.

But, the same thing can’t be done with other utilities. For example, electricity and water bills. This is due to the dynamic nature of bills that are generated on a usage basis every month. As soon as a new bill is generated, you are manually required to pay the amount in full before the due date. Failure to do so risks penalization or no service. With E-NACH, you can schedule recurring payments for the same, hassle-free.

IoT based Smart Services: With recurring payments opening up for debit cards and internet banking via eNACH mandates, India can finally start seeing the IoT industry capitalizing and building products that would mirror IoT innovation in the western hemisphere.

In the future, recurring IoT services like home-security monitoring, smart homes and more would not need you to create your personal infrastructure. In fact, Google and Amazon are already making moves. by introducing their products like the Nest Hub, or Amazon Echo, which are the first step in creating Indian smart homes. Another potential application for E-NACH.

Why Do Customers Choose ENACH?

- Fundamentally designed for business use (like corporates, banks, and government bodies), NACH provides higher mandate limits up to Rs 1 Cr. for customers.

- E-NACH mandate creation takes up to 2–10 days as opposed to ECS which used to take 30 days or more.

- E-NACH eliminates physical movement of mandates, resulting in very low TAT (<2 days)

- 24*7 capability for mandate registration through corporate web/mobile applications

Conclusion

Recurring Payments powered with eNACH are unlocking a new economy in India. With Debit cards and internet banking being allowed for the first-time to make recurring payments in India. various Industries in India could look forward to building a unique experience for their customers. EMI-based payments are beneficial for both businesses and customers with regards to areas like predictable cash flow, predictable growth, better customer experience and affordable services.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Reach us at: www.signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.