Trusted by industry leaders

Why Choose Signzy's Account Aggregator API?

Comprehensive Data Coverage

Comprehensive Data Coverage

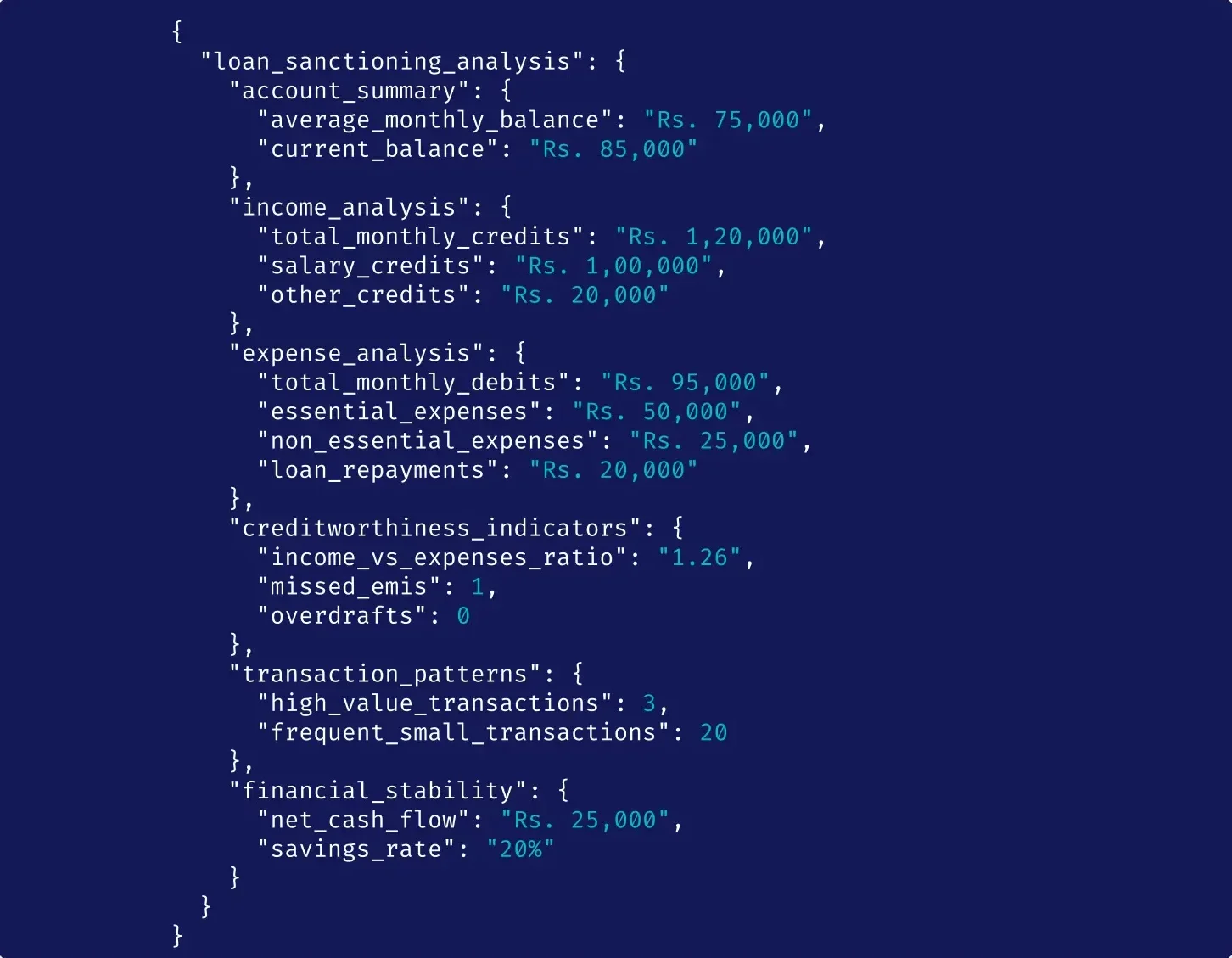

Calculate total income, analyze stability, categorize sources, and assess debt-to-income ratio to understand financial health and predictability.

Personal Details

Includes essential personal details such as mobile number, date of birth, and PAN.

Financial Overview

This provides a quick snapshot of the customer’s financial standing, such as account balances, savings and investment details such as monthly savings, SIPs, insurance premiums etc.

Transaction Insights

This offere a detailed record of the customer’s financial activity, like bank statements, GSTR 1, 3B filing data and purchase history.

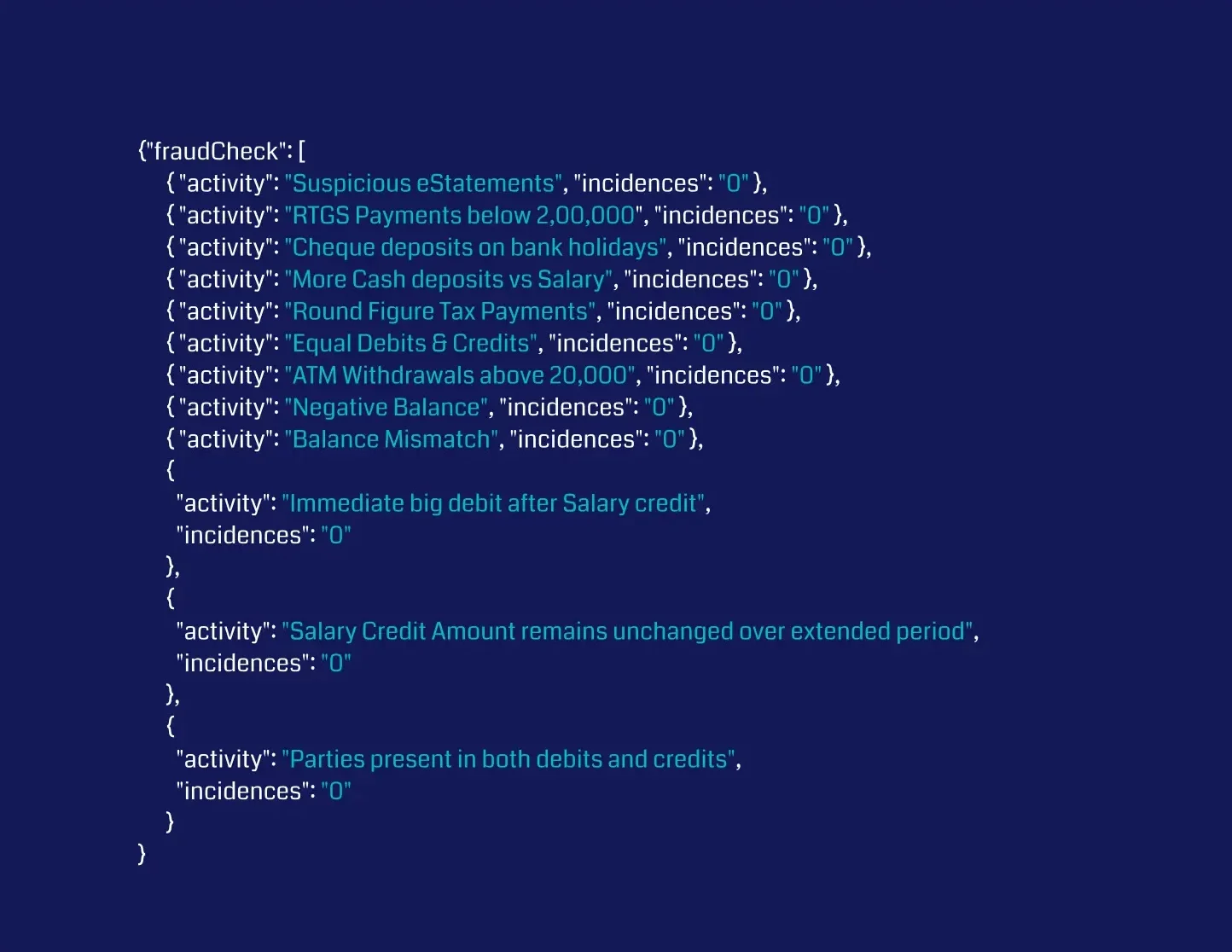

Unlock Valuable Insights

Unlock Valuable Insights

Harness the power of Signzy’s analytical tools to gain valuable business intelligence. Leverage features such as GST Analytics, Bank Statement Analytics, and customizable rule sets to extract meaningful data and drive informed decisions.

Authenticated and Reliable

Authenticated and Reliable

Data is verified and retrieved directly from your customers banking, investment and insurance partners.

Approved by the RBI

The Account Aggregator API is recommended by the RBI to enable smooth and secure sharing of information between parties.

You can read more about RBIs Account Aggregator Initiative hereSystem ready data

Data received is already converted into a system readable format to enable a streamlined process.

Streamline Onboarding and Verification

Streamline Onboarding and Verification

No need for manual document collection and verification, Signzy AA API streamlines onboarding procedures, reducing turnaround times and enhancing the overall customer experience.

Secure and Compliant

Secure and Compliant

Our AA API strictly adheres to regulatory mandates and stringent data security standards. With certifications from the Reserve Bank of India and adherence to industry best practices, we prioritize the protection of your sensitive information, fostering trust and legitimacy in every transaction.

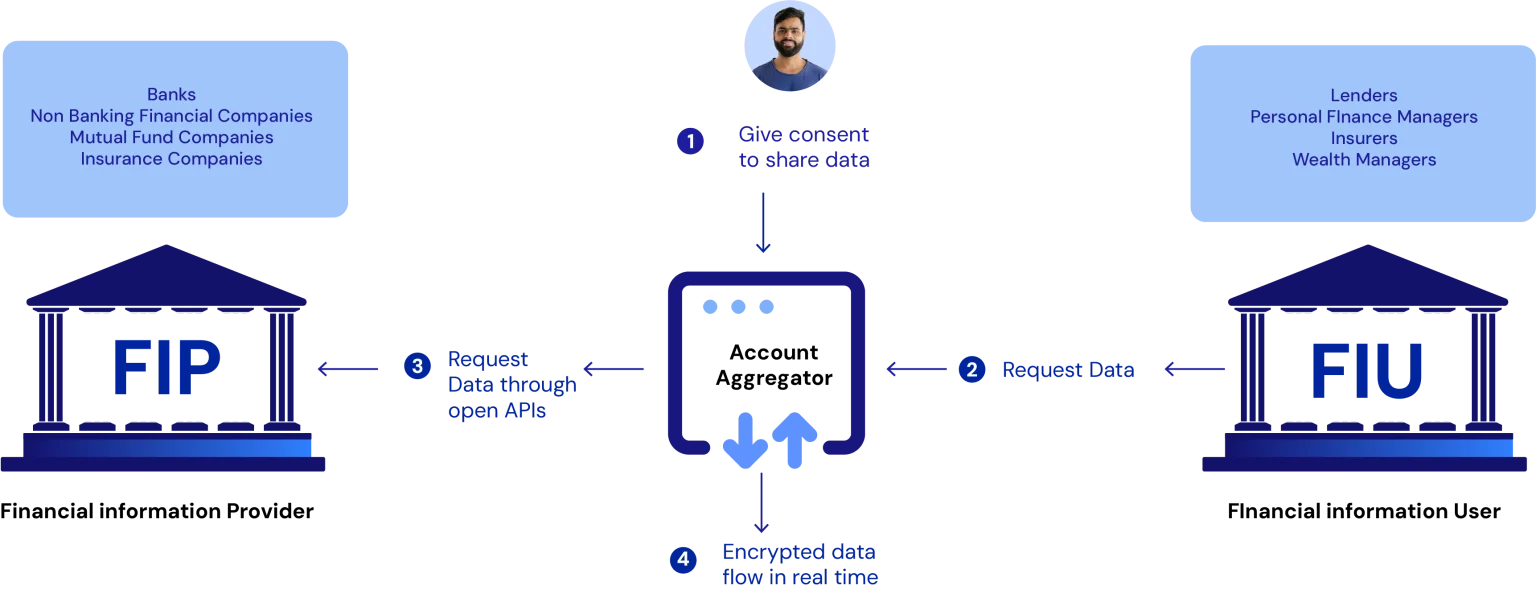

How does it work

User Consent

In the context of the Account Aggregator (AA) API, user consent plays a pivotal role in the secure sharing of financial data within the AA ecosystem. This consent empowers users with control over the sharing of their financial data from one entity in the network to another, ensuring that the privacy and security of the account information are maintained.

Data Request

The financial information user will be asked to initiate a data request through the API, specifying the type of financial data required and the purpose of the request.

Data Retrieval

The AA API will be required to communicate with the user’s financial data sources, such as banks or insurance companies, to retrieve the requested data in a secure and standardized format.

Data Encryption and Transmission

Once retrieved, the financial data will be encrypted to ensure security and privacy during transmission. It will then be securely transmitted to the requesting third-party entity via the AA API.

Data Utilization

The third-party entity will be able to receive the encrypted financial data through the AA API and utilize it for the specified purpose, such as credit assessment, risk analysis, or personalized financial services, while adhering to regulatory guidelines and user consent preferences.

Just as your mobile payment service like PhonePe, GooglePay, Paytm require a PIN to make payments from your bank account like HDFC, ICICI, Axis directly to your cab driver or restaurant’s bank account, Account Aggregator API fetches data directly from your customer’s bank/ insurance company.

Multiple Use Cases

Signzy’s Account Aggregator API is helping organisations from domains like personal loans, corporate lending, insurance etc to cross the bridge the gap from pen and paper systems to machine enabled processes for a quicker TAT, comprehensive decision making and increased security from application stage fraud.

Loan Sanctioning

Investor Onboarding

Financial & Analysis Reports

Experience rapid deployment and full functionality integration within just 1 week!

Receive comprehensive support for seamless onboarding ensuring smooth integration with your existing systems without disruption

FAQ's

What is an Account Aggregator?

Account Aggregators are RBI licensed entities that facilitate secure data sharing with companies under India’s new data privacy framework. Upon receiving a data request, they ensure compliance with regulatory guidelines by seeking explicit consent from the customer before securely sharing approved data with the requesting company.

What is an FIU and FIP?

An FIP, or Financial Information Provider, encompasses entities such as banks or insurance companies that possess financial data related to their customers and products.

On the other hand, an FIU, or Financial Information User, refers to an entity that requests data from an FIP, typically for purposes such as customer verification or facilitating financial product services.

How does customer consent for AA API work?

When an app or website seeks financial data from a customer, the customer can manage the request through an Account Aggregator (AA) app or website they’re registered with. The request details typically include the type of data, reason for the request, frequency of access, duration of storage, and more.

Customers review these details and can either approve or reject the request using a simple PIN-based authentication method. Additionally, customers have the option to revoke consent for data sharing, providing them with full control over their information.

This process not only empowers users but also fosters trust between financial apps/websites and their customers.

Does the AA have access to customer data?

No. The API and AA can only obtain data the FIPs provide. They do not retain or access any data, even with the customer’s consent.

Does the AA keep customer data after approval?

No. AA acts only as a transferring vessel for the data. All data obtained from FIPs are transferred to FIUs without retaining any information, even with consent.

Can AA access all customer data after approval? How safe is it?

No. Only data to which the customer has given consent can be accessed. The API transfers this data from the FIP to FIU. The process is fortified, and no external party can access the data. Even the AA does not access this data. All this is done while ensuring the best customer experience during the customer onboarding process.