The Indian insurance sector is on the cusp of a transformative journey, with automation taking center stage. As the country’s financial landscape modernizes, insurers are turning to advanced technologies to streamline processes, enhance customer experiences, and reduce operational costs. Drawing inspiration from global practices, particularly from developed markets, the adoption of automation promises to revolutionize the way insurance is marketed, sold, and serviced in India, ushering in an era of efficiency and innovation.

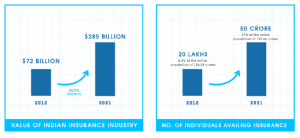

In 2012, the Indian Insurance Industry was estimated to be US$72 billion in value. Within 9 years, in 2021 it soared to more than US$285 billion. The growth was nearly an increase of 300%. The credit to this rise lies in increased awareness among the people and better measures from the government.

In 2012, the US life and health insurance sector of the insurance industry alone accounted for US$645 billion in size. By 2021 this rose to nearly US$1.2 trillion. How they accomplished this feat is appreciable. There are things to understand and emulate from it. The biggest democracy in the world can learn how the biggest economy in the world handles its insurance industry.

This article delves into the current situation in the Indian Insurance Industry and how the US model of adopting technology through automation is a good guideline. The learnings can be used for not just handling the industry processes, but also accelerating the growth of the whole sector.

Traditional Methods And Automation In The Insurance Sector

While the financial value of the Indian Insurance Industry rose, so did the number of individuals availing insurance. From a mere 20 lakhs in 2012(0.2% of the entire population of 126.58 crores) to an exponential 50 crore(37% of the entire population of 136.64%) by 2021. There is no doubt that there is gain for the whole country. But the major takeaway from this for an insurer is the number of uninsured citizens. 86 crore is certainly not a small number.

The question here is why does such a huge portion of society not have insurance? In most western countries, a state-run medical system ensures the security of the health of its citizens. Thus, the need for medical insurance is minimal. Unfortunately, India can not afford to provide such a facility due to the massive size of the population. This results in individuals taking insurance policies for their life and health.

The citizens of India are not well aware of the need and benefits of insurance. Even the ones who are, find it difficult to access the versatile options insurers provide. Most documentations are not online and require hard copies. Most processing requires in-person interaction. Mediators and agents are sometimes unable to match the applicant to the right policy that will help them. And most of these important decisions are either left to the agent or the customers just pick the first policy that matches their current needs.

Overall the customers are not given much power in accessing or deciding what suits them best. Even if they find a good option, they are doubtful if it is the right option for them due to lack of clarity. Some may even drop the whole idea hoping nothing bad happens. Such a potential market is unused because their experience is not optimized.

How Has The US Insurance Sector Benefitted Using Automation

The US insurance sector is faring better than the Indian counterpart. This is despite the Indian Insurance Sector being superior with a growth rate of 12%-15% and the US falling behind with a 5% growth.

Having said that, health insurance claims fraud in India can be as high as 35% of the claims costs. This is less than 10% in the US. More than 75% of US citizens are covered under some sort of health insurance scheme. The strict regulatory initiatives from the government helps this. But the pivotal role is played by the measures the insurance companies take in protecting their customers.

Insurers protect their clients through increased security and safety while maintaining ease of access for them. The best way to do this is through applications of technology like Automation and versatile APIs. Automating the insurance industry includes implementing it from the get-go of applications to the rounds of claims approvals. Some of the ways in which automation helps the Insurance industry is given below:

- Improved Data Management and Customer Service– Automation eases data management. This includes information transfer, new applications, claims status, etc. freeing employee times for more critical tasks. Along with this, as most transactions are online, the customer doesn’t go through the troubles traditional methods demand.

- Online Documentation– Since automation uses softcopies of all documents, no physical effort or space is required for storing them. It is easier for the client to obtain and use these documents accordingly.

- Better Compliance- Insurance companies can easily comply with existing and new regulations and compliance advice. The easy automation and online processing make it easy for the changes.

- Enhanced Fraud Detection- Automation tracks all transactions and processing and call out any red flags associated with forgery or fraud. It can be more efficient and accurate at this than what a human element would have been able to do.

- Reduced Processing Time- As most steps in traditional methods are avoided, automation reduces the total time required for application, data management, and even claims processes.

- Increased Credibility- Customers find automated processes as no middle man can interfere with the pricing or the claims processing. Insurance companies find it reliable as no malpractice is missed and proper verification is done without unnecessary human interference

- Better Claims Processing– discrepancies and disputes relating to claims are greatly minimized as a basic standard is set with compliance with regulatory guidelines. The claims processing is also faster than before as many unnecessary steps in traditional methods such as submitting forms manually.

Where Is India Headed And What Can Be Learned From The US?

India is on a journey towards automation. This is not just in the insurance sector but the financial industry as a whole. As more and more banks and financial institutions are transforming into online platforms, it is only sensible for insurance companies to adopt equivalent methods for themselves.

Even the Government is encouraging the embracing of technology. IRDA launched an insurance repository on 16th September 2013. It enables policyholders and insurance customers to obtain and retain dematerialized or electronic policies. Thus, their policies are kept in an electronic format in an account called eIA(electronic Insurance Account). IRDA prescribed four insurance repository entities:

- CDSL Insurance Repository

- Karvy Insurance Repository

- NSDL Database Management

- CAMS Repository Service

Unfortunately, the major players in the industry are still reluctant in adapting to the new ways. Despite, the government’s reforms, many insurance providers still use hard copies of documents and multiple in-person verifications for applications and claims processing.

What the US did with their insurance industry is similar to what they did with their banking industry. They eliminated the steps in processing that are unnecessary or over-resourced. They specifically found the areas that had repetitive work and transferred the responsibility of their execution to an automated source. This in essence saved time, resources, and money.

What the Indian insurers can do in the initial stages is to make use of APIs for online applications and transactions. With Robotic Process Automation(RPA) the processes can be made more efficient. RPA is used to evaluate applications and documents for forgery, credibility, and validity. It is also used to obtain and retain necessary data associated with respective scenarios.

With advancing technology, even AI can be used for insurance process automation. But there are considerable roadblocks for that. The regulatory norms by the government still demand a human evaluation during claims processing. In time, this might change and more advanced technology might find its inroads into the Indian market.

Conclusion

Tapping into the untapped Indian Insurance potential is lucrative. Many companies understand this, yet do not acknowledge it. Indian customers primarily look for inexpensive and comfortable services. With automation, both these demands can be met. Additionally, such a step will provide financial benefits in the long run.

Adapting to modern times is inevitable in the world of cut-throat competition. The Indian Insurance Sector is becoming a cut-throat battlefield for many smaller companies. To stay ahead of the curve, it is wise to adopt newer technology that requires lesser efforts and more benefits.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.