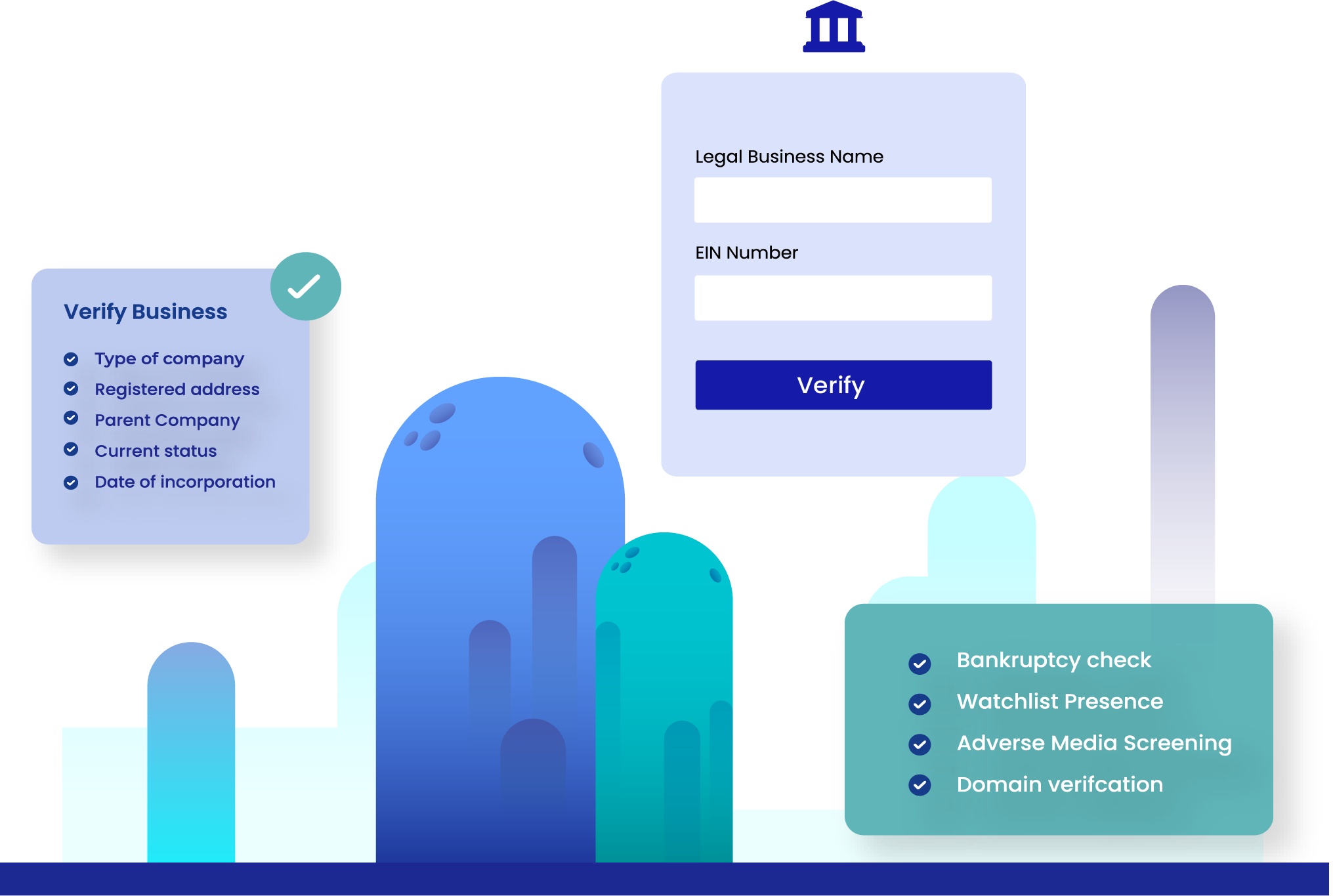

EIN Verification

Validate the EIN for business verification

Your success metric is our only performance metric.

4

Applicantgrowth

99

Reduced fraud80

Cost reduction60

Less customerdrop-offs

growth

drop-offs

Onboard users globally, stay compliant locally.

Seamless onboarding with essential business checks.

Protect your business from illegal practices.

Verify the 9-digits in EIN in 0.9 seconds.

Your complete KYB solution.

Go live in just 2-4 weeks!

something better for you.

Ready to look at the pricing?

the industry!

Signzy's KYC verification suite for you!

Need a custom solution? We’re ready to build your vision.

Our Success Stories

Seema Kumar

Country Leader, IBM India

It is answering the question, how do you build trust online.

It uses APIs on visual recognition to build digital trust.

Bala Srinivasa

Managing Director, Arkam Ventures

We were attracted to the founder’s clarity of thought

and their early proof points in building a proprietary platform that could become an industry.

Rajan Anandan

Managing Director, Sequoia Capital and Surge

Signzy is a standout example of tech-enabled disruption.

Ashith Kampani

Chairman, Cosmic Mandala15 Group

Signzy is redefining the limits of innovation in building trust online.

They are committed to delivering a secure and positive experience to their clients.

FAQ's for EIN Verification API

What is an Employer Identification Number (EIN)?

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses, non-profits, and other entities for tax identification purposes in the United States. It functions similarly to a social security number but is used for organizations and businesses.

Why is an EIN important?

An EIN is crucial for various activities, including:

- Opening a business bank account

- Hiring employees

- Filing tax returns

- Conducting certain financial transactions

It helps the IRS identify and track businesses and organizations for tax reporting and compliance.

How can I obtain an EIN?

You can apply for an EIN through the IRS using one of the following methods:

- Online: Instant issuance of the EIN.

- By Mail: Application forms can be mailed to the IRS.

- By Fax: Fax your application to the IRS.

The application process is free of charge.

What is the EIN Verification API?

The EIN Verification API is a tool designed to verify the validity and accuracy of Employer Identification Numbers (EINs). It checks EINs against official records to ensure that businesses and organizations are properly identified for tax-related purposes.

How can the EIN Verification API be useful?

The EIN Verification API enhances data accuracy and compliance across various applications:

- Tax Filing and Reporting: Validates EINs on tax documents to prevent errors.

- Business Verification: Helps banks and financial institutions verify the legitimacy of businesses.

- Vendor Onboarding: Ensures the authenticity of vendors before onboarding.

- Employee Background Checks: Confirms the accuracy of EINs provided by potential employees.

- Contract Management: Validates EINs in legal agreements to reduce disputes.

- E-commerce and Payment Processing: Verifies business legitimacy for online transactions.

- Government Services: Supports business registrations, permits, and grants.

- Insurance: Verifies policyholders and beneficiaries for coverage.

- Real Estate Transactions: Confirms ownership and legal status of commercial property owners.

- Compliance and Reporting: Ensures adherence to industry regulations.

- Data Enrichment: Enhances customer and vendor databases with accurate information.

- Fraud Prevention: Helps detect and prevent identity theft and fraud.

How does the EIN Verification API ensure accuracy and reliability?

The API verifies EINs against official records maintained by the IRS and other relevant databases, ensuring that the information is accurate and up-to-date.

Read More

Websites can't replace conversations.

Let's talk?

Error: Contact form not found.