- Inadequate KYC processes can erode customer trust, leading to lost business and partnerships.

- Without proper KYC procedures, companies become more vulnerable to fraud and financial crimes, resulting in significant financial losses and legal risks.

- Financial institutions face $4 in expenses for every $1 lost to fraud, highlighting the need for effective KYC procedures.

*KYC Verification Failed*

A blinking red notification. A frustrated customer. A pending transaction.

When KYC verification hits a wall, it typically stems from two distinct scenarios:

- System catching legitimate errors – like when a customer inadvertently uploads a blurred document or mismatches their data entries.

- System doing exactly what it was designed to do: identifying potentially risky profiles that warrant closer scrutiny.

This fork demands an immediate decision.

Solution of one path leads to simple technical corrections – a resubmitted document, a data update, a quick verification. The other demands a deeper dive into potential risks, triggering enhanced due diligence protocols.

You can’t take any shortcut and “make it work”. What if those automatic systems were right?

But you can skip the guesswork if you have the next 8 minutes free.

Below is your roadmap for both scenarios – you’ll know exactly how to handle both technical glitches and suspicious profiles.

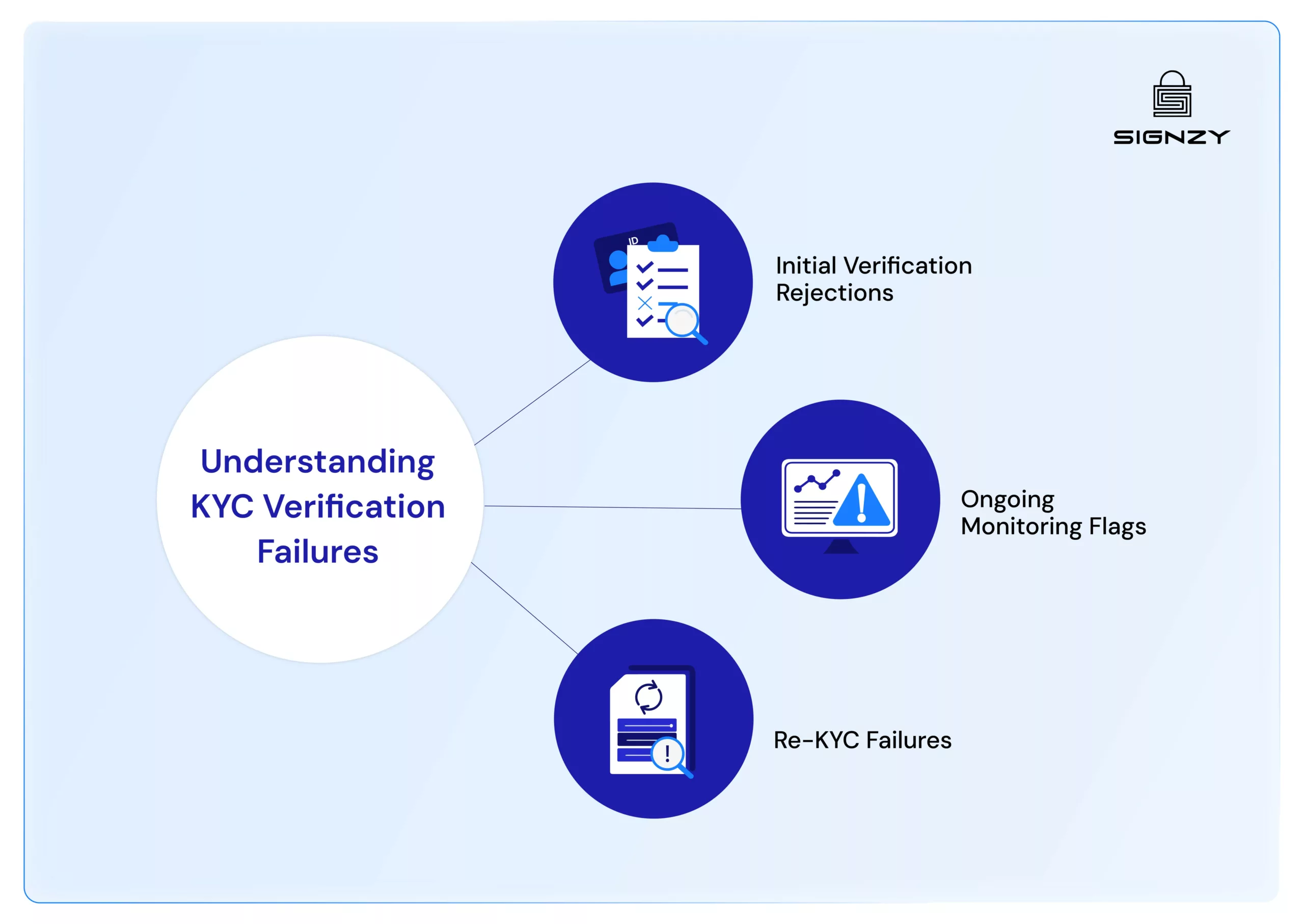

Understanding KYC Verification Failures

It’s easy to think of KYC checks as a minor step – something quick, maybe even automatic. Until, suddenly, it is not.

Failed customer KYC can have multiple reasons. However, all KYC failures generally fall into three categories. Each requires different handling:

- Initial Verification Rejections: These occur during customer onboarding when submitted information doesn’t meet verification requirements. Often, these are straightforward fixes – a clearer passport photo, correcting a mistyped date of birth, or providing current utility bills instead of expired ones.

- Ongoing Monitoring Flags: These emerge during regular account reviews or when transaction patterns trigger automated alerts. Unlike initial rejections, these require careful investigation as they could signal changes in customer behavior or potential risks that weren’t apparent during onboarding.

- Re-KYC Failures: These happen during periodic customer information updates, often revealing discrepancies between historical and current data. While some reflect natural changes (new addresses, name changes after marriage), others might indicate attempts to obscure activity patterns.

Regardless of the reason, nobody likes seeing verification failures pop up. They create stress, slow things down, and yes, they can feel like roadblocks.

For businesses, each failed verification demands time, effort, and resources for investigation and resolution.

Customer acquisition costs rise as potential clients abandon applications due to verification friction. More critically, missed risk signals can lead to regulatory penalties and reputational damage.

At the end of day, these alerts exist to protect both your business and your customers. And, yes, there are solutions.

Here’s how to address each type of failure.

Common Causes & Instant Solutions

Most verification issues stem from simple oversights, not suspicious intent. Refer to the table below for those oversights initially.

| Issue Type | Common Problems | Solutions |

| Invalid ID | – Name mismatch across documents

– Date of birth inconsistencies – Missing signatures – Passport without signature – Multiple submission variations |

– Request resubmission with exact legal name

– Standardize date formats – Clear signature requirements – Specify passport standards – Monitor submission frequency |

| Document Quality | – Blurred images

– Information hidden by glare – Partial document captures – Screenshots instead of originals – Black and white copies |

– Require clear, high-resolution photos

– Specify lighting conditions – Mandate full document visibility – Accept only original photos – Request color copies |

| Face Verification | – Poor lighting during capture

– Multiple faces detected – Glasses causing reflection – Movement during verification – Improper face angle |

– Guide proper lighting setup

– Ensure single-person verification – Remove glasses requirement – Stability instructions – Clear positioning guide |

| Address Proof | – Documents over 3 months old

– Address inconsistencies – Unacceptable document types – Third-party names on documents – Missing information |

– Set clear date requirements

– Establish format standards – List approved documents – Define name requirements – Specify needed details |

However, if a KYC failure moves beyond simple technical issues, it requires careful attention.

Enhanced Due Diligence (EDD) Triggers

Not every red flag means suspicious activity, but each deserves proper analysis.

Your ability to differentiate between genuine customer mistakes and actual risk signals makes all the difference in maintaining strong compliance without alienating valid customers.

Conduct Enhanced Due Diligence (EDD) and monitor any high-risk indicators you can see. Some common ones include:

|

Escalating Failed KYC Verifications

The moment your system flags potential high-risk behavior, you’re working against time.

Start by recording your initial findings within the first 24 hours. Yes, that sounds fast, but remember: regulatory bodies will scrutinize your response time if questions arise later.

Your preliminary risk assessment needs to follow within 48 hours.

Your team needs to:

- Alert relevant internal stakeholders

- Document customer interactions

- Record all verification attempts

- Update case management systems

- Prepare regulatory filing drafts

- Maintain investigation timelines

Think of this KYC documentation as your shield. Months or even years later, you might need to explain exactly why and how you handled a specific case. Clear, chronological records of your decision-making process and actions protect both you and your institution.

Down the line, in cases where suspicious activity reports become necessary, your earlier documentation will prove invaluable.

Reporting Failed KYC Verifications

A KYC failure that suggests potential money laundering or terrorist financing requires SAR (Suspicious Activity Report) filing within 30 calendar days of detection.

Complex cases might warrant a 60-day extension, but you’ll need solid justification for the delay. Critical cases involving terrorism require immediate notification to law enforcement and same-day SAR filing.

Your SAR filing must include:

- Complete subject information – names, addresses, SSNs/EINs, account numbers

- Clear chronological narrative of events

- Specific reason codes for the suspicious activity

- Total dollar amounts involved

- Connected accounts or entities

- Your institution’s initial findings and actions taken

Apart from SARs, certain KYC failures trigger other Bank Secrecy Act (BSA) reporting requirements.

A Currency Transaction Report (CTR) is required for cash transactions exceeding $10,000. Multiple related transactions totaling over $10,000 in a single business day also need reporting.

Turn Verification Challenges into Compliance Strengths

Every failed verification represents a moment of truth for your compliance system. These moments test not just your processes, but your ability to maintain security while treating customers with respect.

The difference between good and exceptional compliance often comes down to the quality of your verification services. This is where Signzy’s verification suite makes a measurable impact.

Our ID Verification API, Liveness Check API, and OCR API work in concert to catch document issues early, validate identities accurately, and automate data extraction.

When verification fails, these systems provide precise feedback for swift resolution, helping you maintain both compliance standards and customer confidence.

Want a closer look at automated KYC verification? Schedule your free 15 demo minute call today.

FAQs

How long should I retain KYC verification failure records, even if the customer was eventually approved?

Keep all verification attempt records, including failed ones, for at least 5 years from the date of verification. This includes system logs, submitted documents, and resolution notes.

If a customer's verification fails due to technical issues, can I request them to try again immediately?

Yes, but track the number of attempts. Allow 2-3 immediate retries for technical issues. After that, implement a 24-hour cooling period to prevent potential system gaming.

What's the difference between a CTR and SAR filing requirement for failed KYC?

CTRs are automatic for cash transactions over $10,000. SARs are required when you spot suspicious patterns or potential deliberate deception in KYC submissions, regardless of amount.

Should I inform customers when their verification failure triggers an SAR filing?

No. It’s illegal to disclose SAR filings to customers. Simply inform them that additional verification is needed without mentioning regulatory reports.

How quickly must I report suspicious patterns in multiple KYC attempts?

File a SAR within 30 calendar days of detecting suspicious patterns. For immediate security concerns, contact law enforcement first, then file the SAR the same day.