FinCEN bringing stricter AML / CFT to avoid another TD Bank Fiasco

December 2, 2024

7 minutes read

- The TD Bank case, wherein a hefty penalty of $1.8 billion is levied, becomes an example of what happens when you have weak AML processes.

- 70.9% of the money laundering frauds are committed by the citizens of the USA

- FinCEN is all set to revamp the AML / CFT rules

TD Bank: Anti-money Laundering Charges

This October 2024, a news headline flashed on all news applications: “TD Bank N.A. (“TD Bank”), charged with a penalty of $1.8 billion.” This was the largest penalty ever imposed under the Bank Secrecy Act (“BSA”). What did this news really mean for the public and regulators? It was a horror unfolding, to put it mildly.

In summary, the Justice Department determined that TD Bank N.A., the 10th largest bank in the United States of America, and its parent firm, TD Bank US Holding firm, had violated the BSA following a comprehensive investigation that lasted several months. Due to the money laundering conspiracy, the two organizations were required to pay a $1.8 billion hefty penalty.

In the banking history of the United States of America, TD Bank became the first and largest bank to (1) conspire to commit money laundering and (2) enter a guilty plea to BSA program failures.

Hold back, as we have just begun.

The failure on the part of TD Bank made way for three money laundering networks to transfer $670 million between 2019 and 2023. Through significant cash deposits into nominee accounts, one money laundering network routed about $470 million through the bank between January 2018 and February 2021. To guarantee that workers would continue to handle their transactions, the scheme’s organizers gave them gift cards totalling over $57,000.

Yes! All these facts are put out by the Office of Public Affairs, U.S. Department of Justice.

Imagine the wide range of criminal activities these networks would have funded over these years from right under the noses of all. Before we get to why are we harping so much on this case, let us understand one more time what is money laundering.

In layman’s terms, financial transactions in which criminals, especially terrorist groups, try to conceal the proceeds, sources, or character of their illegal activity are typically referred to as money laundering.

One more shocker: Of all money laundering charges brought to justices, about 70.9% are committed by the citizens of the United States.

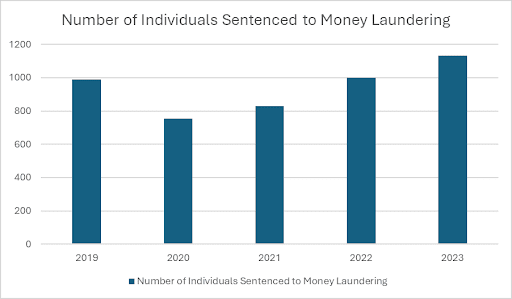

A few statistical data of individuals who were sentenced to money laundering between 2019 and 2023:

Does anti-money laundering and countering terrorist financing need a revamp?

No law in history has ever been 100% bulletproof, and we all must comprehend that. There will always be people who find their crooked way through a legal framework to meet their end game.

But it is also because of such individuals only that stronger and more powerful processes are put into reality.

The anti-money laundering and countering the financing of terrorism were under review and due for amendments. In June 2024, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (“FinCEN”) announced that it would bring in force rules to enhance and modernize financial institutions’ anti-money laundering and combating the financing of terrorism (AML / CFT) programs.

In a statement by FinCEN, it mentioned that the proposed rules would aim to achieve the following:

- Change the current program regulations to clearly mandate that financial institutions create, carry out, and maintain efficient, risk-based, and logically constructed AML/CFT programs with a few essential elements, such as a required risk assessment procedure;

- Mandate that financial institutions examine AML/CFT priorities throughout the government and, if applicable, integrate them into risk-based programs; and allow for specific technological modifications to program requirements; and

- Encourage uniformity and clarity in FinCEN’s program regulations for various financial institution types.

A link to the proposed rules is here for you to go through.

Impact of money laundering:

Brand image is everything in today’s digital world. One bad review going viral can tank your operations for the foreseeable future.

This is even more severe when we are talking about banks and financial institutions, as they are the ones trusted by people to keep their hard-earned money safe.

Here are a few common roadblocks a business may suffer in case any money laundering charge is brought against:

- Devaluation of brands and harm to company reputations

- lowering staff morale

- Possible boycotts by customers

- Unfavorable opinions of investors

- Potential legal action

- Directors may face fines and even jail time

Checkpoints to keep money laundering at bay:

Here are some basic checkpoints for you to keep the money laundering activities at bay while safeguarding your business and your customers:

- Look out for transactions that are especially huge and/or complex: Automated systems that identify these kinds of transactions for examination in order to ascertain their authenticity and intent are needed.

- Strange transaction trends: Install software that can identify such patterns of potential abuse for assessment when smaller transactions occasionally show a trend of illicit activity linked to money laundering or terrorism funding.

- No anonymity in financial transactions: Since most suspicious actors use anonymity as a cloak to conceal their financial operations, this commonsense practice can aid in discouraging and preventing money laundering activities.

- Clients’ due diligence: The organization should conduct due diligence on a large number of clients to confirm their identities, business objectives, and business relationships, all while staying within the bounds of a jurisdiction’s privacy regulations.

- Record Keeping: Clients, transactions, and the results of due diligence should all be retained on file for a minimum of five years or more.

Over and above these, we have curated a list of red flags you need to keep a tab on.

Signzy Products at your disposal:

We are all growing at lightning speed and aspire to go even faster. If one takes a look at the growth trajectory of the United States of America over the past few decades, it is really impressive beyond doubt! But there is always a but.

The extent of all-source money laundering has grown in tandem with the global GDP during the past 20 years. According to IMF and World Bank estimates, money laundering accounts for 3% to 5% of the world’s GDP, or roughly $2.17 to $3.61 trillion yearly. And this money has gone to fund kleptocrats, multinational organized criminals, and narcotraffickers of others.

Your business needs a system that can protect itself and all your stakeholders from any possible money laundering activity. Do not worry; at Signzy, we have your back. Here is a list of our products that come to your aid when we talk money laundering:

and more!

We have also curated an AML Watchlist Screening Guide.

Digital databases known as watchlists hold data about people and organizations connected to a range of financial crimes, such as money laundering, terrorist financing, fraud, and corruption, amongst others.

We also have a well-curated and reliable five-pillar AML program that will be life-changing for your business, which includes:

- Appoint a Compliance Officer

- Complete Risk Assessment

- Prepare AML Policies

- Monitor AML Program

- Customer Due Diligence Rule

The failure of a single bank provides criminals with a fresh avenue to launder money. The sector as a whole might be impacted by that one bank’s weakness, which would increase regulatory scrutiny of all financial institutions. All major regulatory changes have come as a result of a catastrophe. As Cummans observes, TCF’s Executive Vice President, Director of BSA, Compliance & Fraud, says “Fraudsters target weakness in banks.”

Let us help you to ensure that your organisation is not the next target of such fraudsters.

For more information, kindly reach out to us here 🙂