What Exactly is OCR Technology? End-to-End Guide for KYC Use Case

December 17, 2024

7 minutes read

- According to Next Matter research, OCR technology enables financial institutions to accelerate customer onboarding 5-6 times faster while maintaining compliance requirements.

- The integration of OCR with Intelligent Document Processing enhances data analysis capabilities, enabling detection of patterns, anomalies, and potential risks.

- OCR technology demonstrates accuracy rates between 95% and 99.99%, exceeding typical human data entry accuracy rates of 96% to 99%.

If you’ve ever watched your KYC team manually type information from thousands of documents, you know there’s a gap between what your business needs and what your current process delivers.

Your challenge isn’t unique.

But what if every document that landed in your inbox was instantly ready for verification? When your analysts open a customer file, what if all the information is already there, extracted and organized, and waiting for their expert review?

This is where OCR technology enters your story. Not as another complex system to learn, but as a practical solution to a daily challenge you’re facing right now.

And before you think OCR requires a massive technological overhaul, the reality is simpler than you might expect.

The below guide breaks down all the important aspects you need to know about OCR technology – and how you can make it work for your business.

What is OCR?

OCR (Optical Character Recognition) is the process of digitizing documents. When you take a photo of a document, your computer sees it just like a picture hanging on your wall – it can display it, but can’t understand what’s written on it. OCR acts like a bridge, helping your computer actually ‘read’ and understand the text in that image, just like you would.

But what makes OCR particularly powerful is its intelligence in handling different types of documents. It doesn’t just capture random text – it understands context.

When scanning a passport, it knows exactly where to look for the date of birth versus the document number. When processing a utility bill, it can identify and extract the address fields automatically.

Why OCR Matters in KYC Processes

Think about your KYC team’s daily routine. Paper documents keep coming in – passports, IDs, utility bills. Each document needs careful attention, and your team spends hours typing information into systems. The work is essential but time-consuming.

And fortunately, OCR technology can solve this mess.

OCR’s main use case of digitizing perfect documents for ID verification is just one feature. It can clean up images, adjust document alignment, and maintain accuracy even when working with less-than-perfect submissions which are super common.

Here’s how it can handle various real-world challenges that KYC teams face daily:

- Batch split on blank: Uses blank pages as natural dividers to separate multiple documents scanned together.

- Batch split on N: Automatically creates new files after every N page, perfect for processing documents of consistent length.

- Blank page removal: Identifies and removes empty pages from scanned documents, saving storage space and processing time.

- Despeckle: Cleans up tiny dots and marks that appear on scanned documents, like removing dust from a photograph.

- Deskew: Automatically straightens documents that were scanned at a slight angle, ensuring text lines up correctly.

That was the discussion about the business side.

What about the customer side? Yes, they’ll also get the benefits of fast and accurate processing.

Think about this: When a customer sends in their verification documents, they’re often waiting to access your service. Every minute spent on manual data entry is a minute they’re kept waiting. With OCR, along with saving your team’s time – your business can deliver a better experience to your customers.

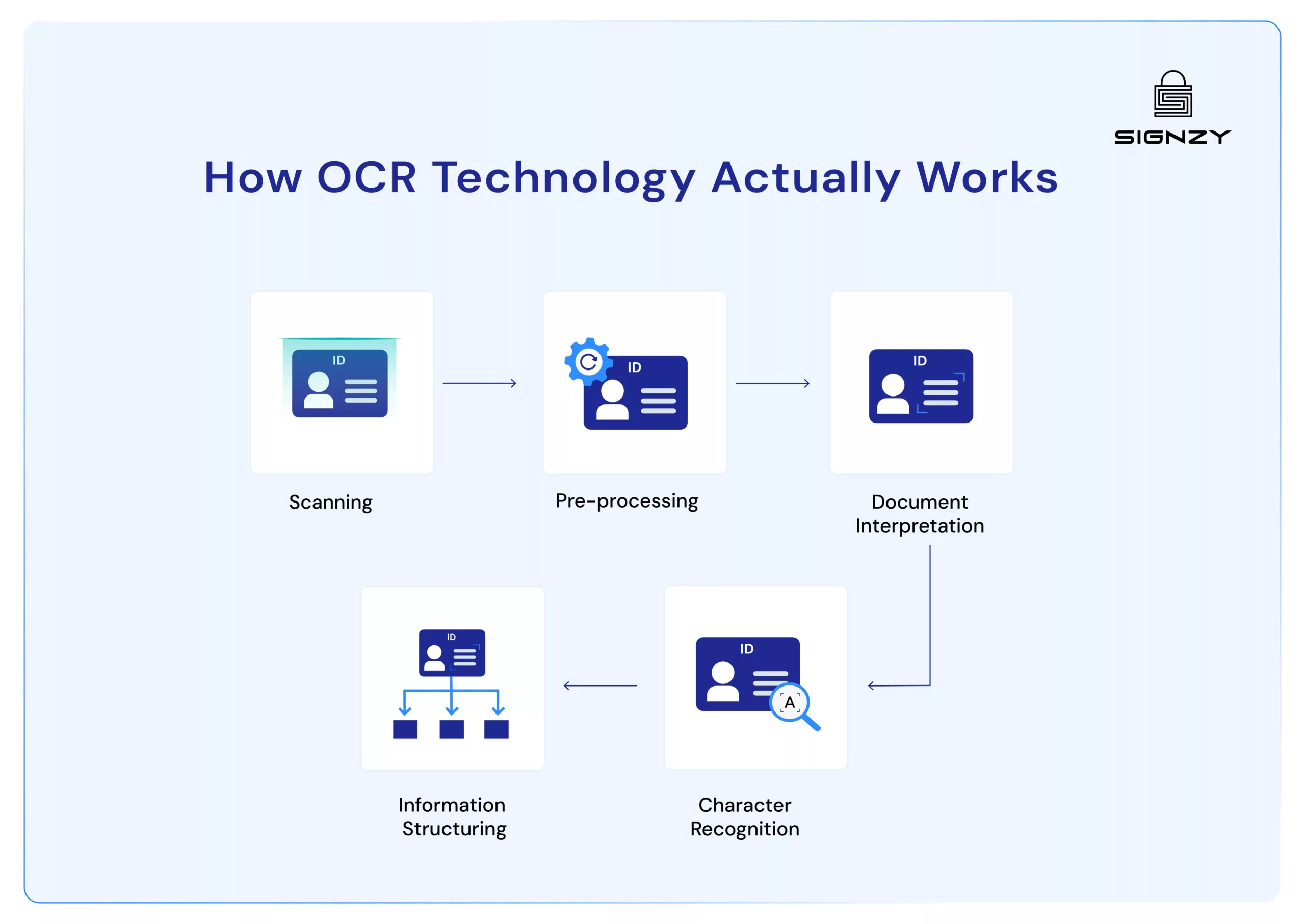

How OCR Technology Actually Works

OCR technology might sound sophisticated, but its core process is similar to how humans learn to read. When a customer submits their ID card or passport for verification, OCR follows a five-step process.

-

Scanning

Just as your eyes need good lighting to read clearly, OCR needs a quality image to work with. Whether through a mobile camera or a scanner, the technology captures the document image. This is why you’ll often see apps asking customers to “ensure good lighting” or “avoid shadows” when uploading their documents.

-

Pre-processing

But really, it’s just OCR cleaning up the image.

Remember trying to read a crooked page? It’s harder, right? OCR feels the same way. It straightens out tilted images, adjusts brightness, and removes any digital noise (those tiny spots and specks that sometimes appear in scanned images). This step is crucial because cleaner images lead to more accurate results.

-

Document Interpretation

This is where real intelligence shows up. OCR breaks down the cleaned image into smaller chunks – first into blocks of text, then into lines, words, and finally, individual characters.

-

Character recognition

Using a combination of pattern matching and artificial intelligence, OCR identifies each character in the document. It’s similar to how you might recognize your friend’s handwriting – you know it’s them even if some letters look slightly different. OCR systems can handle various fonts, styles, and even some handwritten text.

-

Information structuring

OCR structures all this information. Instead of creating a simple text file, it understands that a passport number should be labeled as a passport number, an address as an address, and so on. This organized data then flows smoothly into your KYC systems, ready for verification.

Using machine learning, these systems get better over time at handling different document types, languages, and formats.

Compliance and Security in OCR-Driven KYC

OCR technology, when properly implemented, actually makes compliance easier by creating consistent, traceable processes for document verification.

Let’s look at a practical example: When verifying a customer’s identity, you need to ensure you’re meeting Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. OCR helps by automatically extracting standardized data from identity documents, creating a clear audit trail of what information was collected and when.

If a regulator asks how you verified a specific customer’s identity six months ago, you can show them exactly what data was extracted, who reviewed it, and what decisions were made.

There’s more.

As regulations change – and they often do – OCR systems can be updated to capture new required information or follow modified verification processes. This means your team spends less time worrying about keeping up with changing regulations and more time focusing on actual risk assessment and customer service.

Whether it’s GDPR’s strict data protection requirements, BSA’s record-keeping rules, or local regulatory frameworks, OCR helps maintain a single, secure, and compliant workflow for your document processing needs.

How to Include OCR in Your KYC Workflow

Integrating OCR into your KYC workflow doesn’t require a complete system overhaul.

Modern OCR solutions work through APIs – think of them as digital connectors that plug right into your existing systems. Your team can keep using the same familiar tools, but now with the added power of automated document processing.

When a customer submits their ID or proof of address, the OCR API immediately extracts the relevant information, formats it correctly, and passes it to your system.

Signzy understands challenges firsthand. That’s why we’ve developed OCR APIs that integrate smoothly with existing KYC workflows. Our solutions handle everything from basic document processing to complete identity verification suites. Whether you’re looking to speed up a specific part of your process or change your entire KYC workflow, we have tools that can help.

Want to see how much faster your team could work with automated document processing? Let’s talk about your specific needs.

FAQs

Does OCR work with handwritten documents?

Modern OCR can process handwritten text, though accuracy varies depending on handwriting clarity. For KYC purposes, it works best with printed documents and standardized handwriting formats like block letters.

How long does OCR take to process a typical identity document?

OCR processes most identity documents in seconds. However, the total processing time might take 15-30 seconds including image capture, verification, and data organization – still much faster than manual entry.

Can OCR handle documents in different languages?

Yes, modern OCR systems support multiple languages and alphabets. You’ll need to ensure your chosen solution specifically includes support for the languages your business commonly encounters.

Will OCR work with poor-quality document scans?

OCR includes pre-processing features that enhance image quality before extraction. While it works best with clear scans, it can handle somewhat blurry or poorly lit documents – though there’s a minimum quality threshold.