AML Requirements for Payment Processors: Does Your Business Meet the AML Standards?

September 17, 2024

5 minutes read

Online transactions have been growing in recent years. According to a Forbes article, 53% of Americans prefer using digital wallets over their traditional counterparts.

With this growing trend, payment processors have also grown in importance and popularity.

While not subject to any regulatory requirements, payment processors prefer to and should have certain internal AML measures in place.

What are Payment Processors?

Payment processors are companies or services that act as intermediaries to facilitate digital payments. Whenever you use your debit or credit card, payment processors receive the card’s data from the merchant you’re transacting with. The processor then verifies this data against records with the bank or card network associated with your debit or credit card. Upon authorization, the money is transferred from the customer’s bank account to the merchant’s.

This is just a basic gist of the operations of payment processors, let’s take a deeper dive into the various functions performed by payment processors.

What are the Functions of Payment Processors?

As intermediaries in the digital payments ecosystem, payment processors perform a wide variety of tasks like:

- Facilitation of Transaction: As mentioned before, payment processors send and receive customer information to banks and card networks once they receive it from the merchant’s payment platform. Once authorized, payment processors signal the customer’s bank to send the money to the merchant’s bank.

- Security and Encryption: Since payment processors deal with sensitive information like the customer and merchant’s bank details, the many card details from various customers, and more, payment processors also tokenize and encrypt this data to ensure its safety.

- Authentication and Authorization: Payment processors also send authorization requests to banks and other financial institutions to allow payments. They also perform authentication checks to ensure that the customer has sufficient funds and access to their account.

- Generating Data: Payment processors have access to the many payments that pass through their platform. Processors use this data to create reports and analytics on spending habits, customer preferences, trend analysis, and more.

- Chargeback Management and Fraud Detection: In case a customer makes an incorrect payment, or needs to cancel payment due to unauthorized use of their card or credentials, payment processors handle the settlement of such chargeback transactions and other disputes. Payment processors may also monitor transactions and flag irregular payments or deposits to prevent fraud.

As you can see, processors are a sensitive junction in the online payments journey.

What are the AML regulations that apply to payment processors, though? Let’s find out.

What are the AML Requirements for Payment Processors?

Speaking from a regulatory perspective, the Bank Secrecy Act (BSA) which regulates most participants of the payment pipeline, has no specific regulations for payment processors. However, it is advisable for payment processors to maintain internal standards for risk mitigation and help law enforcement track and catch bad actors.

Payment processors can follow a basic AML checklist to reinforce the security of their platform. Here are some of the items that they can add to their checklist:

- Installing KYC verification processes for both customers and merchants to ensure that none of the participants in the payment process are potentially risky.

- Checking if anyone from their clientele is a Politically Exposed Person (PEP), or has a criminal record. This can help identify entities that need additional surveillance.

- Requesting account verification data from banks and financial institutions when onboarding new clients.

- Verifying the businesses that payment processors onboard to stay vigilant about shell companies and other potentially risky entities.

These security measures can be cost and time-intensive to develop in-house. Thankfully, these are not problems that you need to worry about, thanks to Signzy.

How Signzy Helps Payment Processors in AML

As mentioned above, adding just a few security measures to your payment processing business can help you mitigate any liabilities that might arise due to bad actors. Not only do these measures help in security enforcement, but they can also help build better client and stakeholder relationships, as these measures make your business more secure than peers.

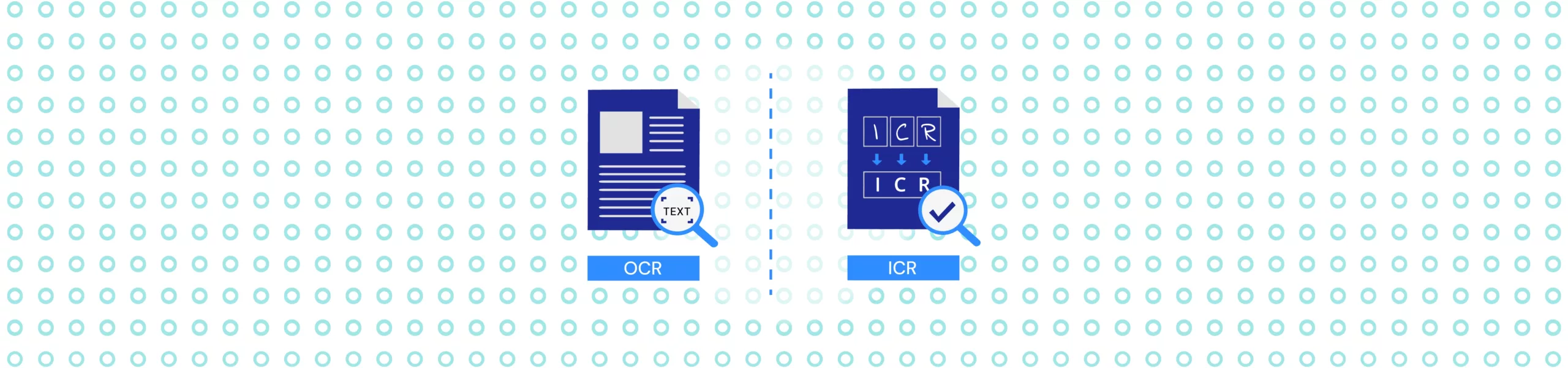

Signzy’s API marketplace has easy-to-integrate measures that not only help you achieve greater security but also ensure that these measures are easy to use, to avoid client drop-off.

If you’re still wondering how we can work together, book a demo with us, we’d be happy to help you out.

- Payment processors are businesses that act as an intermediary between buyers and merchants. They transfer important data between these parties to authorize payments.

- So far, regulations do not require payment processors to install any specific processes for AML requirements. However, maintaining some form of internal control helps these businesses maintain positive business associations and consumer relations.

- Failing to maintain AML records and reports may lead to a loss of clientele.

FAQs

Who needs AML compliance?

Currently, the AML/CFT Act applies to any and all businesses that operate in the following segments:

- Financial Institutions

- Gambling

- Digital Currency Exchanges

- Remittance

- Bullion Sectors

- Any other such service that the AML/CFT Act deems necessary to cover.

What AML checks are required?

Any business that falls under the AML/CFT Act, needs to perform the following checks:

- Personal details of the client like name, address, photograph, date of birth, and more.

- Purpose and nature of the relationship between the business and its client

- Details of the individual/organisational client

- Source of the funds in question

- Relationship between the parties in the transaction

- Existing value and frequency of transactions

What are the requirements for money laundering reporting?

According to the Bank Secrecy Act (BSA), all financial institutions need to keep track of cash purchases of negotiable instruments, total cash transactions for a day exceeding a total of $10,000, and any such transactions that might be linked to tax fraud, money laundering, terror financing, or any other illegal activity.