Guide on Merchant Category Code (MCC)

- Credit card companies rely heavily on MCCs to flag suspicious transactions. If you’re buying something odd, like a $5,000 gift card from a convenience store, the MCC helps the bank decide if they should call you to confirm the purchase.

- MCC codes also influence other systems, like payment wallets (Apple Pay, Google Pay) and mobile banking apps. The wrong code can impact transaction success rates.

- MCCs are one of the ways advertisers and data aggregators analyze your spending habits. They might not know exactly what you bought, but they know where you bought it.

Picture running a legit crypto exchange but being flagged as a gambling site. Or better yet, imagine your fintech platform being categorized as a high-risk money transmitter. Sounds absurd, right?

Yet that’s exactly what happens when businesses operate with incorrect Merchant Category Codes. In simplest terms, these codes tell financial institutions exactly who you are and how to treat your transactions.

Why do they matter at all? Because getting them wrong can affect your business DIRECTLY.

Do you know just switching from code 7999 to 7311 could slash processing fees by 3%? Or that certain MCCs automatically flag for enhanced due diligence, even if you’re squeaky clean?

If you are trying to figure out these codes, perfect timing – this guide has your back. Let’s crack the code.

What is a Merchant Category Code?

A Merchant Category Code (MCC) is a four-digit number that tells banks, credit card companies, and payment processors exactly what type of business they’re dealing with. These codes serve as a universal classification system that helps financial institutions process and track transactions appropriately.

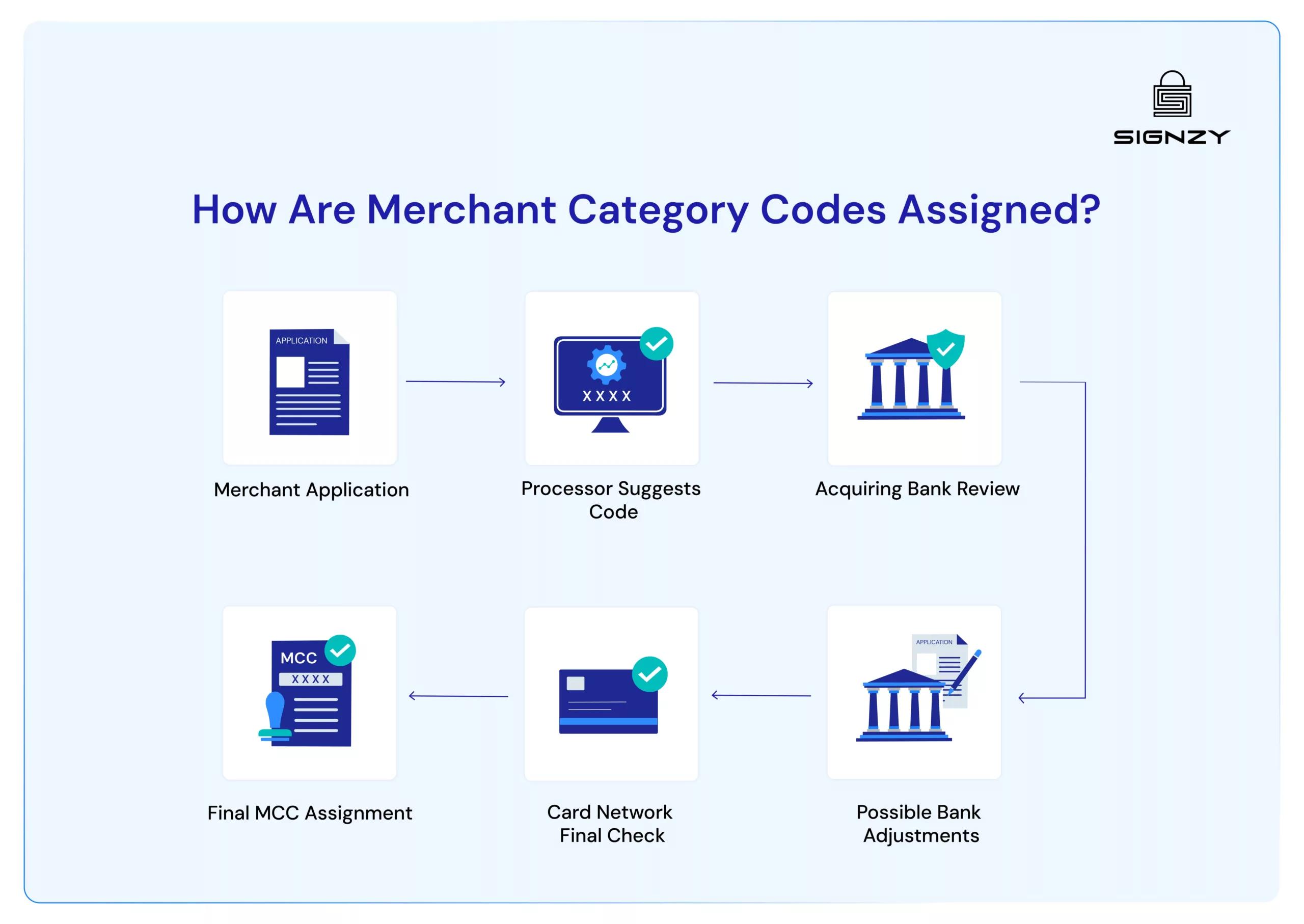

MCC codes get assigned through a chain of decisions that starts when a business applies for payment processing. The acquiring bank bears primary responsibility, working with payment processors like Stripe or Square who handle the initial classifications.

Think of it as a series of handoffs – the processor suggests a code based on the merchant’s application, then the acquiring bank reviews and potentially adjusts it, and finally card networks might step in with their own assessment.

💡 Related Blog:

How Does MCC Codes Affect The Transactions?

Every swipe, tap, or click that processes through your payment system carries an MCC code.

These codes determine not just how transactions are processed, but also what fees apply and what rules need to be followed. For example, look at this transaction scenario to understand what happens when MCCs are wrong.

Scenario: A new crypto platform mistakenly coded as a gambling site (MCC 7995 instead of 6051)

What happens next?

- Instant decline in countries where gambling is restricted

- Fees jump from 2.6% to 3.8% ($26 vs $38 on a $1,000 transaction)

- Customer credit card rewards don’t process correctly

- Transaction gets flagged for enhanced due diligence

- Risk of account suspension due to mismatched business model

- Potential regulatory reporting issues with incorrect transaction classification

In short – the impact goes beyond just higher fees. Wrong MCCs can trigger unnecessary declines, cause customer service headaches, create compliance issues, and even lead to account freezes or terminations.

The system dates back to 2004 when the Internal Revenue Service mandated their use for tax reporting purposes. Since then, MCCs have evolved into essential tools for managing everything from interchange rates to risk assessment.

MCC Categories For Financial Institutions

Processing financial transactions isn’t as simple as money moving from point A to point B. Each type needs its own handling – from basic bank transfers to crypto trades, from investment purchases to insurance payments. To handle, all are assigned different MCC codes.

For financial institutions, crypto platforms, and similar businesses, the 6000-series MCC codes create this structure. Some important codes are

| MCC | Description |

|---|---|

| 6010 | Financial Institutions – Manual Cash Disbursements |

| 6011 | Financial Institutions – Automated Cash Disbursements |

| 6012 | Financial Institutions – Merchandise And Services |

| 6050 | Quasi Cash–Member Financial Institution |

| 6051 | Non-Financial Institutions – Foreign Currency, Money Orders (Not Wire Transfer), Cryptocurrency And Travelers Cheques |

| 6211 | Security Brokers/Dealers |

| 6300 | Insurance Sales, Underwriting, And Premiums |

| 6513 | Real Estate Agents And Managers |

| 6535 | Value Purchase – Member Financial Institution |

Also, you don’t necessarily need to use only one MCC code. Financial businesses often need multiple MCCs to operate effectively.

Take a digital payment platform – it might handle basic banking through 6012, offer crypto services under 6051, and process international transfers using 4829.

Each code serves a specific purpose, carrying its own regulations, fee structures, and processing rules. This separation helps maintain clear records and ensures appropriate fee structures for each service type.

Why MCC Codes Matter?

MCCs play several critical roles in financial operations:

- Interchange Rates and Processing Fees

Different MCCs come with different interchange rates – the fees merchants pay for accepting card payments. For financial services, choosing the right MCC can mean significant savings. A mere 3% difference in processing fees could save thousands of dollars monthly for high-volume operations.

- Risk Management

Payment processors use MCCs to assess transaction risk levels. These codes are used as a traffic light system. Green means go, yellow means caution, and red… well, let’s just say it’s best to avoid red.

Recent updates to Visa’s Integrity Risk Program (VIRP) have introduced a three-tier system for risk assessment, making proper MCC classification even more important for financial businesses (more on this in a minute).

- Tax Reporting

MCCs help determine which transactions need reporting on Form 1099-K and other tax documents. For example, a payment processor handling transactions for a crypto exchange (MCC 6051) must report all transactions above $600 to the IRS, while a retail store (MCC 5411) only reports when exceeding $20,000 and 200 transactions.

Financial institutions must track and report certain types of payments based on their MCCs, making accurate classification essential for compliance.

- Authorization and Processing

The code attached to a transaction influences how it’s routed through payment networks. Wrong MCCs can lead to unnecessary declines or processing delays, especially in cross-border transactions.

Consider a fintech platform incorrectly coded as a high-risk merchant (MCC 7995) instead of a financial institution (MCC 6012) – their standard $5,000 transfer might get declined due to gambling limits, despite being a legitimate financial transaction.

Finding MCC Code of Business (And Making Changes)

While the process might seem hard at first, clear methods exist for both verification and adjustments when needed.

Direct Verification Methods

The foundation starts with processor documentation – no guesswork needed. Major card networks maintain comprehensive MCC listings through their official guides. Visa’s Merchant Data Standards Manual and Mastercard’s Quick Reference Booklet serve as essential reference points, offering precise classifications for every business type.

For active merchants, the monthly processor statement holds valuable information. The assigned MCC typically appears near the business details or within the fee structure breakdown – making regular verification straightforward.

Card Statement Verification

Transaction appearances on credit card statements offer another practical verification method. MCCs show up either as four-digit codes or category descriptions, providing clear insight into how charges appear to customers and confirming proper classification status.

Making Changes When Needed

Miscoding often happens when businesses don’t fit neatly into traditional categories.

Take a fintech lending app marked as a cash advance business because of similar transaction patterns or because the processor’s classification system hasn’t caught up with newer business models. Sometimes it’s as simple as the business description being too vague, or staff not being familiar with emerging industries like cryptocurrency trading.

When MCCs need adjustment:

- Document misalignment between current classification and primary business activity

- Compile evidence of core business operations and revenue sources

- Submit formal requests through payment processors

- Maintain consistent follow-up until resolution

If you still don’t find a resolution, gather documents and visit or contact your payment processor or bank directly to get more clear steps to resolution.

Speaking of documentation for fixing MCC codes – automated verification systems can speed things up considerably.

When merchants need to prove their business model and activities to get their MCC corrected, digital KYC and business verification APIs can gather all that evidence in minutes instead of days of back-and-forth with processors. Check Signzy for more.

FAQ

How do I know if my business has the right MCC?

What happens if my business is operating under the wrong MCC?

Can I request a change to my MCC?

Can a business have multiple MCCs?

Do MCCs affect my customers' credit card rewards?

Agrima Dwivedi

Agrima is an Associate Product Marketer at Signzy, currently working in the B2B fintech space. She brings over two years of experience in copywriting and content writing, which laid the foundation for product marketing. Today, she leverages both creative and strategic skills to drive go-to-market efforts and build user-focused marketing strategies.