- Digital driver’s licenses are gaining momentum across America, with fourteen states from Maryland to Utah actively testing or implementing these systems.

- Market analysis by Gartner points to massive adoption potential, with digital ID wallets expected to serve 500 million users globally by 2026.

- Unlike physical cards, mDLs offer instant verification through direct checks against government databases, significantly reducing the risk of fraudulent use.

Staring at license uploads. Squinting at screens. Matching pixelated photos. Checking details repeatedly. Hoping the system accepts it.

That’s today’s driving license verification process.

Compare this 21st-century ID verification process with that of the 20th-century: we’ve simply traded paper documents for PDFs, calling it progress.

But now there’s a new challenge on the horizon: the United States is adapting mobile driver’s licenses. Major states like California, Georgia, and Alabama are already paving the way for mDLs, with others rapidly following suit.

Customers already expect seamless digital experiences. Not being able to verify mDLs will soon be a deal-breaker.

For most businesses, this creates two challenges: understanding how mDLs work and updating systems to handle mDLs verification.

The good news? Both are simpler than you might think.

Let’s start by understanding the nuts and bolts of mDLs.

💡 Related Blog: What is Government ID Verification?

What are mDLs and Why Do You Need to Verify Them?

A mobile driver’s license is a government-issued digital identity credential stored securely on your smartphone. More than just a digital photo, it’s an interactive credential that lets you control how much personal information you share.

As per America’s Department of Homeland Security documentation, mDLs consist of three key elements:

- An issuing authority (like your state motor vehicle departments aka DMVs) that creates the digital credential

- A holder system (your smartphone) that stores it securely

- Verifying entities that can check the credential’s authenticity

However, in terms of information, it’s no different from a physical Driving License – it contains the same information:

- Name

- Date of birth

- Address

- Driving class

- License number

- Issue date

- Expiration date

- Issuing jurisdiction

- Restrictions

States like Maryland and Georgia now allow residents to add their licenses to digital wallets, while others like Louisiana and Arizona offer standalone apps. According to recent data, 13 states currently accept mDLs, with more joining the movement.

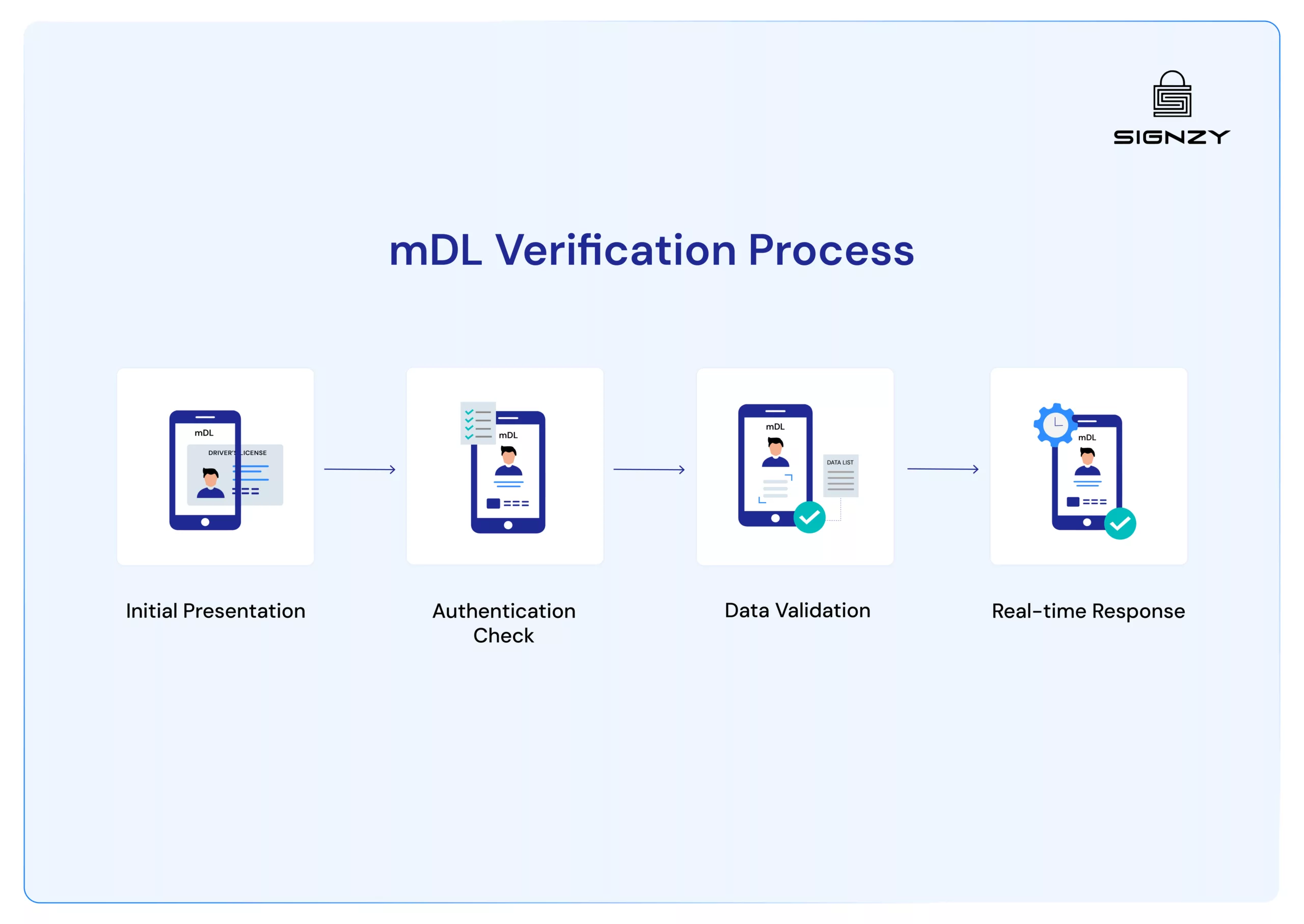

mDL Verification Process – Step by Step

Here’s exactly how the mDL verification process progresses when businesses need to confirm someone’s identity, step by step:

Initial Presentation

The process starts with a simple tap or scan. The person presenting their ID opens their mDL app or digital wallet. The verifying business generates a unique request code. One quick connection through a QR code or NFC, and the verification begins.

Authentication Check

During this phase, the system automatically validates several security elements:

- Confirms the issuing authority’s digital signature

- Ensures the credential hasn’t been altered

- Verifies that it remains active and valid (not revoked or expired)

This all happens within seconds, providing much stronger security than visual inspection of physical IDs.

Data Validation

This stage showcases perhaps the most significant improvement over traditional IDs. The person presenting their mDL sees exactly what information the business wants to verify. They maintain complete control by approving or denying specific data sharing.

A store checking age doesn’t need to see an address, and now they won’t.

Real-time Response

The verification concludes with quick, definitive results. The business gets a clear yes/no on the credential’s authenticity while the system maintains appropriate logs for compliance purposes. The entire process typically takes just seconds to complete, significantly faster than manual verification methods.

Why is mDL Verification Needed?

Financial regulations, including the Bank Secrecy Act and KYC requirements, mandate businesses to verify customer identities, ages, and addresses before providing services.

While traditional driver’s licenses have long served as primary verification documents, they present significant risks – they can be forged, stolen, or altered.

Digital alternatives like photocopies and scanned PDFs create additional security concerns and compliance risks. However, they can be forged as well. But doing the same for mDL is nearly impossible, thanks to its cryptographic nature.

So, verifying mDL instead of traditional DL (physical card) or its PDF version is the safest way.

Some common scenarios where mDL verification can help your business are:

-

Account Openings

Finance businesses know the drill – every new account needs thorough KYC verification. Traditional methods involve manual document checks, often taking days and creating a backlog. mDL verification changes this into an instant, automated process that’s actually more secure than physical document inspection.

-

High-Value Transactions

When large sums are involved, identity certainty becomes non-negotiable. mDL verification shines here – its cryptographic checks provide stronger assurance than any visual inspection could offer.

-

Age-Restricted Services

Getting age verification wrong carries serious consequences for businesses. mDL verification removes the guesswork by providing mathematically certain age checks without exposing sensitive data.

No more squinting at birth dates or calculating ages manually – the system handles it all while protecting customer privacy.

-

Customer Onboarding

Speed matters in business, but not at the expense of security. mDL verification strikes that perfect balance: lightning-fast verification that’s actually more reliable than traditional methods.

Digital banks, lending platforms, and financial apps can now welcome new customers without friction or compromise.

How mDL Verification Differs from Traditional DL Verification

| Aspect | Traditional DL Checks | mDL Verification |

| Verification Speed | Manual inspection taking minutes | Instant cryptographic validation |

| Data Accuracy | Manual data entry prone to errors | Automated data extraction |

| Privacy Control | All data visible on card | Selective data disclosure |

| Security Level | Visual security features | Cryptographic signatures |

| Fraud Prevention | Relies on physical inspection | Real-time validation checks |

| Audit Trail | Manual record keeping | Automated verification logs |

| Integration | Standalone process | API-ready for systems |

| Operational Cost | Staff training and time | Automated processing |

Beyond these technical differences, mDL verification aligns better with modern business needs. Organizations can process more verifications faster, maintain stronger security, and create better customer experiences – all while meeting compliance requirements.

Modern Verification Solutions

Implementing mDL verification doesn’t mean rebuilding entire systems from scratch – that would be impractical for most businesses.

Instead, modern solutions offer flexible integration paths that fit different operational needs and technical capabilities.

For those wanting faster deployment with less technical overhead, third-party verification platforms offer ready-to-use solutions. These platforms handle all the complex parts – maintaining connections with multiple state systems, updating verification protocols, and ensuring compliance with changing standards. They typically provide both SDK options for mobile apps and web-based solutions for online services.

For businesses ready to handle verification directly, API-based systems offer the most control and customization. These solutions connect straight to state verification systems and digital wallet providers through secure APIs, enabling real-time checks within existing applications.

Whether it’s a banking platform, investment service, or digital onboarding system, APIs make integration straightforward. Many providers even offer pre-built components for common verification scenarios, significantly reducing development time.

If you are ready to step into modern identity verification, Signzy’s DL Verification and KYC APIs offer a practical starting point. The platform handles the complex parts of license validation while fitting smoothly into existing workflows. By combining license verification with comprehensive KYC capabilities, businesses can build secure, compliant verification processes without extensive technical overhead.

Learn more about integrating these solutions.

FAQs

How long does it typically take to implement mDL verification into existing business systems?

With modern APIs and SDKs, integration can be completed in days to weeks, depending on your system complexity and chosen solution. Third-party platforms often offer quick-start options for even faster deployment.

What happens if a customer's phone dies during mDL verification?

Most states issuing mDLs still require carrying physical licenses as a backup. Modern verification systems can smoothly switch between digital and physical verification methods when needed.

Do businesses need special hardware to verify mDLs?

Most mDL verification works through standard smartphones or computers with no special hardware required. The verification happens through secure software systems using existing devices.

What’s the cost difference between traditional ID verification and mDL systems?

While initial setup costs exist, mDL verification typically reduces long-term operational expenses through automation, faster processing, and reduced manual errors. Many providers offer flexible pricing based on verification volume.