These two terms KYC and CDD are used as synonyms many times. Though they are very similar, there are still some differences between the two.

Let’s understand the differences in detail.

KYC and CDD policies are the foundation of every AML (Anti Money Laundering) policy created in an organization.

But, what are these policies based on?

These two policies depend significantly on the requirement to confirm the identity of the clients who do business with organizations subject to AML legislation.

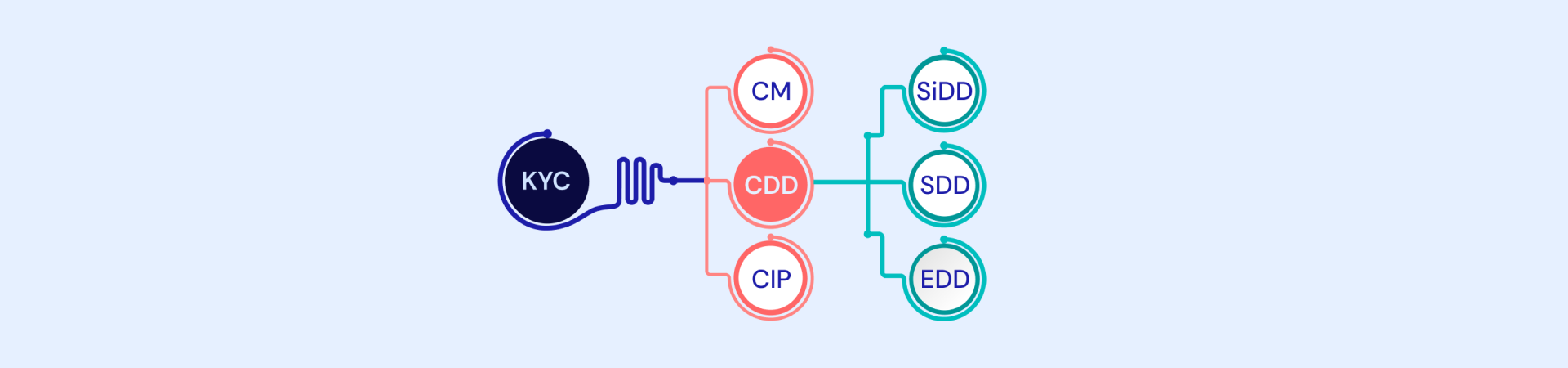

In short, KYC- Know-Your-Customer – refers to the process of carrying out Customer Due Diligence (also known as identification verification, or CDD).

Because CDD is an essential component of KYC, it is challenging to distinguish between the two.

Therefore, they are viewed as being the same in that sense, but are they really the same thing?

KYC Processes: What Does KYC Include?

A KYC process must include three main aspects-

First- Customer Identification Program (CIP)

Potential customers of financial services companies must provide the following four pieces of identification: full name, date of birth, residential address, and valid identity number.

Second- Customer Due Diligence (CDD)

To confirm the customer’s identity and assess the possibility of questionable behavior, the credentials are assessed.

Then, there is more scrutiny directed towards high-risk clients. (This stage is also occasionally referred to as KYC Due Diligence.)

As an obliged entity, you must use CDD when –

Establishing a new commercial alliance- To determine the customer’s risk profile and confirm their identification.

During specific transactions- To detect and mitigate risky transactions.

For example, when a consumer comes from a high-risk area where money laundering is common, or when a transaction entails a substantial sum of money.

In the event that something seems odd- To take corrective actions.

For example, if a client shows warning signs or acts in a way that suggests they may be funding terrorists or laundering money.

If the data from the consumer is inconsistent- To bring the same into light.

Additional CDD checks assist verify the customer’s identity when the information they submit doesn’t match legal criteria or raises red flags.Third and last one – Continuous Monitoring

Financial services providers must keep an eye on accounts with a higher risk level. These consumers’ transactions need to be closely examined by your organization, frequently in real time.

As time goes on, you may need to ask them to provide your financial institution with additional information for risk management considerations.

KYB (Know your business) is essentially KYC with a few tweaks.

Knowing Your Business necessitates figuring out who the company’s ultimate beneficial owners are—those who stand to gain the most from it.

To identify these individuals, you will need to look closely at the client’s business relationships as they may not be those mentioned on the company masthead.

💡 Related Blog: What is the end to end KYC process

In addition to continuous monitoring, an efficient KYC program should have well-defined anti-fraud rules, such as explicit restrictions for various account types, in order to more effectively identify any anomalous activity. The degree and frequency of the continuous observation procedure are contingent upon the risk attached to the client and the organisation’s overarching plan.

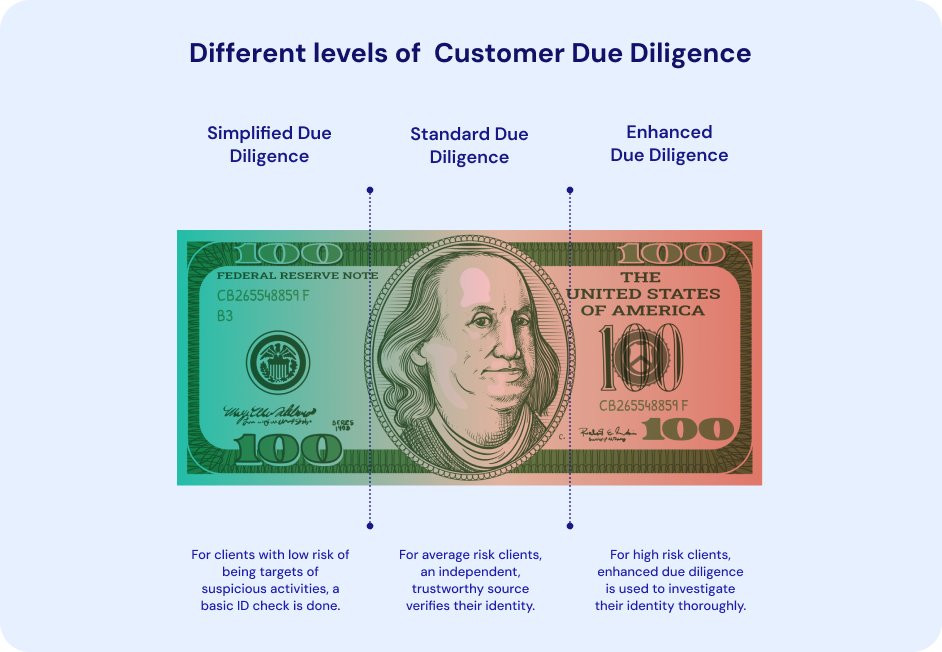

What Are the Different Levels of Customer Due Diligence?

Customer Due Diligence needs to be customized based on the risk profile of the client.

You develop client risk profiles during this procedure, which establishes the amount of CDD that each customer is eligible for.

Each customer will be allocated one of the following levels of customer due diligence based on the results of this risk assessment.

Let’s have a look at different levels of CDD.

You can achieve this by requesting further identification from them, as well as details regarding the origin of their money, the types of business partnerships they have, and the purposes behind their activities.

These clients are continuously under observation till the time commercial partnership exists.

These higher-risk clients include those with political exposure, those on financial watchlists, those on official sanctions lists, etc.

Along with looking for negative media about the client, you will also need to consider other possible hazards associated with this client relationship.

How to Improve KYC and CDD Procedures

These procedures entail the tedious process of collecting and assessing information. Potential clients are lost as a result of delays, particularly in the KYC procedure.

Businesses should therefore implement procedures that guarantee a quick but legal process. Quality of checks is emphasized in good KYC and CDD procedures, and manual and digital assessments should be carried out.

To do this, complex imaging software will be used to collect data during KYC.

Furthermore, monitoring software simplifies and improves the accuracy of the CDD process. But it wouldn’t be a good idea to totally abandon customer engagement with people.

This is a result of how risky the finance industry is.

Customer convenience should also be a priority for KYC and CDD procedures.

Why?

This guarantees a positive client relationship right away. Companies must devise strategies for automating laborious KYC processes.

Reusability of data is another benefit of sound CDD and KYC protocols.

Why?

This will save you from having to repeatedly and annoyingly ask customers for information. Companies ought to use software that just needs a single document upload.

Fraud prevention is the primary goal of KYC and CDD procedures. Therefore, these processes ought to be protected from access by unauthorized people.

How can Signzy help?

We – Signzy- are a seasoned identity verification provider with a solution that assists in adhering to new laws, particularly those concerning KYC and CDD requirements.Signzy assists financial organisations, such as banks, credit unions, intermediaries etc. in providing a straightforward, KYC-compliant onboarding process that lowers the risk of fraud.Our solution to KYC and CDD processes quickly and automatically makes possible-

- – the taking of the identity document and its verification

- – the use of facial biometrics for identity verification along with liveness detection (evidence of life).