Complete Guide to Proof of Address Verification: What It Is, Steps & Methods

- Under the Bank Secrecy Act (BSA), businesses must maintain address verification records for a minimum of 5 years, though some industries require longer retention periods.

- A single comprehensive business address verification process simultaneously satisfies multiple regulatory requirements: AML compliance, USA PATRIOT Act Section 326, FinCEN’s CDD Rule, FFIEC guidelines, and various state-level regulations.

- Organizations can face civil and criminal penalties under the USA PATRIOT Act for failing to maintain adequate address verification systems as part of their Customer Due Diligence (CDD) program.

“Proof of business address required.”

Whether you’re onboarding a new business partner, vetting vendors, or conducting due diligence – this verification requirement sits at the heart of your compliance process.

The irony? In an age where satellite imagery can show any storefront in seconds, businesses still need concrete proof that their partners operate where they claim.

Not just any address – a provable, documentable, verifiable address.

We are cutting straight to the core of address verification: regulatory requirements, steps to verify, best practices and everything in between.

Below is your complete roadmap of how to do address verification. Everything you need, nothing you don’t.

What is Proof of Address Verification?

A proof of address (POA) is a document that confirms a business operates at its stated location. Think about this: your business partners and customers exist in countless digital spaces today – websites, social media, online marketplaces. Yet, without verified physical address documentation, they can’t be properly validated for regulatory compliance, risk assessment, or service provision.

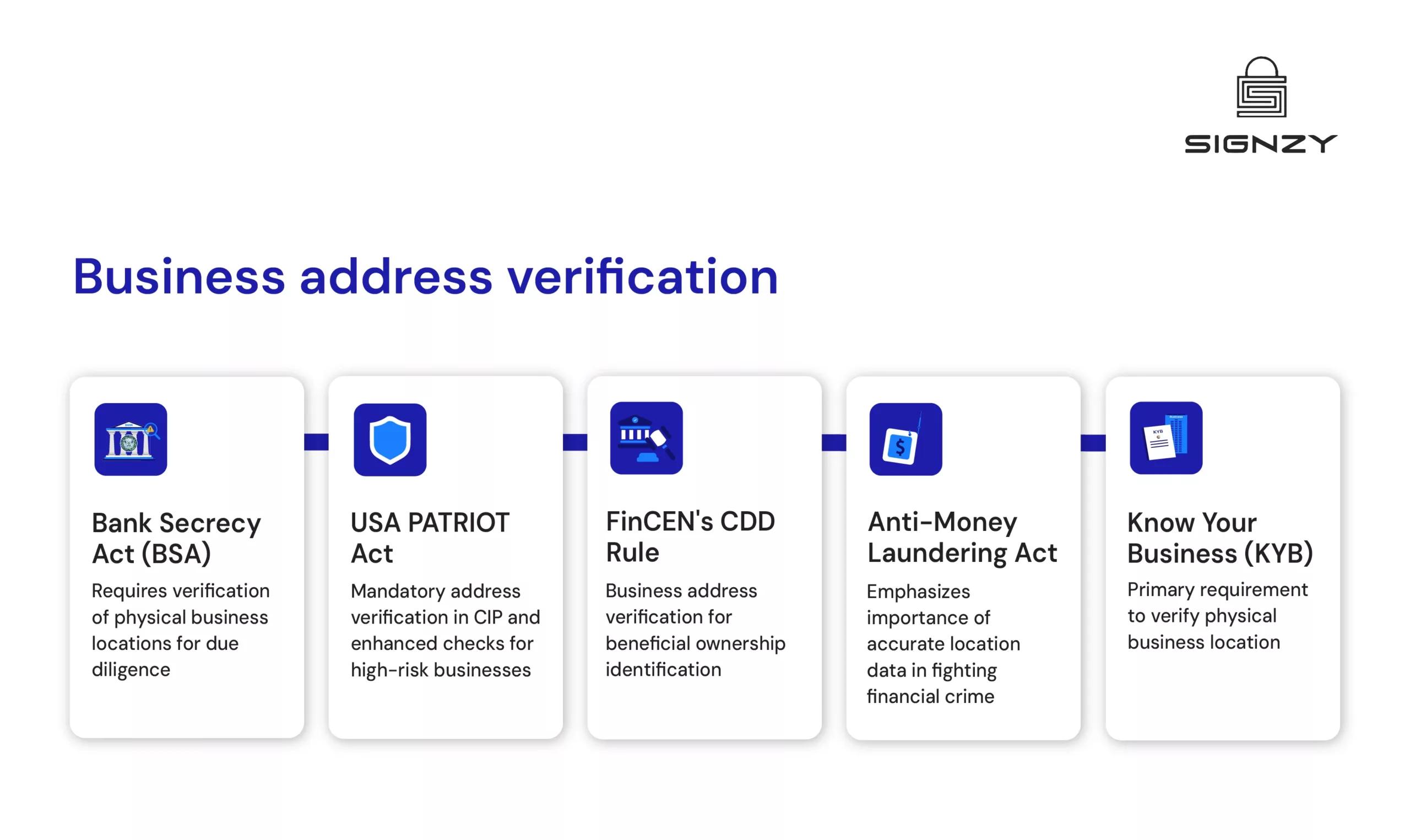

Business address verification serves as a vital component of various compliance frameworks in the US.

| Regulation | Address Verification Requirement |

|---|---|

| Bank Secrecy Act (BSA) | Requires verification of physical business locations for due diligence |

| USA PATRIOT Act | Mandatory address verification in CIP and enhanced checks for high-risk businesses |

| FinCEN’s CDD Rule | Business address verification for beneficial ownership identification |

| Anti-Money Laundering Act | Emphasizes importance of accurate location data in fighting financial crime |

| Know Your Business (KYB) | Primary requirement to verify physical business location |

💡 Related Blog:

When verifying a business partner or customer’s address, organizations protect themselves and their stakeholders while meeting essential regulatory requirements.

Acceptable Primary Documents:

- Utility bills (electric, water, gas) dated within 90 days

- Bank statements with transaction history

- Current lease agreements or property deeds

- Property tax statements

Supporting verification can include state-issued business licenses, IRS correspondence, local permits, and insurance policies. Each document must show the physical business location and match across all submissions.

Step-by-Step POA Verification Process

Building a robust address verification system requires careful attention to detail and consistent protocols.

Process contains three main and two optional steps. Main ones are:

- Data Collection

- Document Verification

- Validation

Below is a breakdown (with optional steps included).

Step 1 -Setting Document Standards

Organizations need clear, systematic standards for document collection. Start by creating a detailed requirements document for business partners and clients. This should outline exactly what documents are acceptable, their required format, and any specific criteria they must meet.

Setting these expectations upfront significantly reduces back-and-forth communications and speeds up the verification process.

The documentation requirements should specify:

- Minimum resolution (300 DPI for digital submissions)

- Acceptable file formats (typically PDF, PNG, or JPEG)

- Maximum file sizes (usually 5-10MB per document).

For physical submissions, detail paper quality requirements and whether original documents or certified copies are needed.

Step 2 – Initial Document Check

This stage of verification focuses on document authenticity and completeness. This includes:

- Examining security features (watermarks, holograms, official seals)

- Validating document sources and issuing authorities

- Confirming all required fields are present and legible

- Cross-referencing addresses across multiple documents

Modern verification systems often employ OCR (Optical Character Recognition) technology to extract and compare address data automatically. However, human oversight remains crucial for catching subtle discrepancies or potential red flags.

Step 3 – Conducting Enhanced Verification

When initial verification raises concerns or for high-risk relationships, additional verification steps become necessary. This includes comparing addresses against multiple authoritative databases such as:

- State business registries

- USPS address verification systems

- Property ownership records

- Utility service databases

Each check should be documented with timestamp, source, and findings. Any discrepancies require clear documentation and appropriate escalation based on risk levels.

Step 4 – Setting Up Decision Framework

Establishing clear decision criteria helps maintain consistency across verifications.

Create a structured framework for approval and rejection. The below table might help you formulate the framework.

| Approval Requirements | Complete documentation matching across all sources Clear alignment with USPS standardization No unexplained discrepancies Valid document dates within required timeframes |

|---|---|

| Rejection Triggers | Mismatched addresses across documents Suspicious alterations or inconsistencies Invalid or expired documentation Known high-risk address associations |

Note: You can add more approval requirements or rejection triggers based on the nature of your business.

Step 5 – Automating with Technology Integration

While maintaining the human element in verification, appropriate technology integration can significantly enhance accuracy and efficiency. Modern verification platforms can:

- Automatically extract and validate address components

- Cross-reference multiple databases simultaneously

- Flag potential issues for human review

- Generate comprehensive audit trails

- Maintain ongoing monitoring protocols

Remember: Every step in the verification process must align with regulatory requirements while remaining practical and efficient. Regular review and updating of verification procedures ensures they stay current with changing compliance needs and emerging risks.

Throughout the process, you might stumble upon some hurdles. Below are some quick solutions for some of the most common hurdles.

| Issue | Solution |

|---|---|

| Outdated Documents | Request new documents dated within last 90 days; provide clear date requirements |

| Address Mismatch | Cross-reference with USPS database; request clarification on discrepancies |

| Missing Suite Numbers | Require updated documentation with complete address details |

| Poor Document Quality | Specify minimum resolution requirements (300 DPI); request new copies |

| Foreign Language Documents | Request certified English translations; specify accepted translators |

| Digital Format Issues | Provide clear file format guidelines (PDF preferred); specify size limits |

| Incomplete Documentation | Send comprehensive checklist; highlight missing items |

| P.O. Box Only | Request physical location documentation; explain regulatory requirements |

| Multiple Addresses | Request clarification on primary business location; document relationship between locations |

| Name Variations | Require explanation of name differences; request supporting legal documentation |

Handling Failed Verifications

Address verification failures don’t always signal fraudulent activity – but they do require systematic response.

For straightforward technical issues, like blurry documents or outdated statements, reach out to the business partner with specific requirements, set clear deadlines for new documentation, and provide detailed submission guidelines. Keep communication channels open and documented.

More complex verification failures require deeper investigation. When addresses don’t match across documents, or when documentation shows inconsistencies, implement enhanced due diligence. This might mean requesting additional verification methods or involving third-party verification services. The focus should be on understanding the root cause of the discrepancy while maintaining regulatory compliance.

Critical verification failures – those suggesting potential suspicious activity – demand immediate action:

- Suspend account activity or service provision

- Document all findings comprehensively

- File necessary regulatory reports

- Consider relationship termination if warranted

- File Suspicious Activity Report (SAR) if needed

The most effective approach is creating standardized response protocols based on failure type. For instance, technical issues might trigger an automated document request, while suspicious patterns initiate a full review. This ensures consistent handling while maintaining regulatory compliance.

Modern Solutions vs Traditional Methods

The field of address verification has transformed to meet current business demands. Traditional methods, while still used in some contexts, often create unnecessary friction and delays. Manual document reviews require extensive staff time and training, while in-person site visits add significant operational costs. Paper-based processes are prone to human error and can take weeks to complete.

Modern solutions offer enhanced efficiency without compromising security. Smart OCR technology can extract and verify information from documents in seconds, while real-time database validation provides instant confirmation of address accuracy.

Signzy streamlines this entire process through its OCR API for automated document processing, Business Verification suite for comprehensive company validation, and Domain Verification API for digital presence confirmation. Together, these solutions create an efficient, integrated address verification system that meets both regulatory requirements and modern business needs.

FAQ

What happens if a business has multiple operating addresses? Which one should be verified?

Are digital utility bills acceptable for address verification?

What if a business operates from a co-working space or virtual office?

Can address verification be completed entirely online, or are physical checks necessary?

Tanya Narayan

Tanya is a Product Marketing Manager at Signzy and a GrowthX Fellow, with a strong focus on SaaS and fintech. She specializes in go-to-market strategy, customer research, and positioning to help teams bring products to market effectively. She has also cleared the Company Secretary foundation level, reflecting her grounding in corporate and compliance fundamentals.