Top 3 Payment Frauds of 2024 and What Businesses Can Learn From Them?

December 27, 2024

6 minutes read

- Businesses that experience high levels of payment fraud may face increased scrutiny from banks and payment processors, potentially leading to higher processing fees or account termination.

- The reputational damage caused by payment fraud can be severe, leading to negative publicity, loss of customer confidence, and difficulty acquiring new customers.

- Offering secure payment options, such as reliable tokenization and encryption, can help businesses protect sensitive customer data and reduce the risk of payment fraud.

Money moves, business happens, life goes on.

At least, that’s how it’s supposed to work. But 2024 was different – payment frauds reached shocking levels – even basic bank account verification failures spiraled into big fat payment frauds.

Case in point: Zelle, a money transfer app, is under investigation by the Consumer Financial Protection Bureau for potential losses of over $870 million.

So, what went wrong?

The simple answer: there were gaps in how financial companies verify who’s really sending and receiving money. Think of it like leaving your front door unlocked – sooner or later, someone notices.

If you have next 7 minutes – here’s a closer look at what went wrong in 2024’s 3 biggest payment frauds, why they matter, and what you can do as a business moving forward.

Major Payment Security Frauds in 2024

2024 saw three significant attacks on payment systems where attackers successfully circumvented transaction verification protocols.

1. Zelle Fraud Investigation

On December 20, 2024, the Consumer Financial Protection Bureau filed a lawsuit against EWS (Zelle’s operator) and three major banks – Bank of America, JPMorgan Chase, and Wells Fargo. As we stated earlier, the investigation accused customer losses totaling over $870 million across Zelle’s network during its seven-year operation.

The CFPB’s investigation report highlighted how Zelle’s emphasis on frictionless signup became a security liability. Fraudsters could easily register for Zelle accounts by simply having a deposit account and basic contact information, exploiting the streamlined onboarding process designed for user convenience.

As a result, money intended for legitimate customers ended up in the wrong hands. Making matters worse, when customers sought help after discovering unauthorized transactions, they were told to contact the fraudsters themselves to recover their funds.

2. Change Healthcare Attack

In February 2024, Change Healthcare, a critical component of America’s healthcare payment infrastructure, suffered a major attack.

The incident began through inadequately secured remote access points, revealing how even payment systems processing millions of transactions remain vulnerable to access-based attacks. The scale was massive – over 100 million records exposed, including critical payment verification data.

During Senate testimony, CEO Andrew Witty revealed that Change Healthcare faces attempted intrusions approximately every 70 seconds, highlighting the constant threats to payment systems.

3. Fidelity Investments

Between August 17-19, 2024, Fidelity Investments faced an attack that demonstrated how sophisticated threat actors could bypass traditional financial security measures.

According to Fidelity’s filing with Maine’s attorney general, the attackers cleverly used two newly created legitimate accounts to penetrate broader customer databases. The attack compromised sensitive verification data of 77,000 customers, including critical identifiers used in payment authentication

All in all, these incidents reveal precisely where payment security needs reinforcement. At the heart of it all is verification – the process of ensuring every transaction is legitimate.

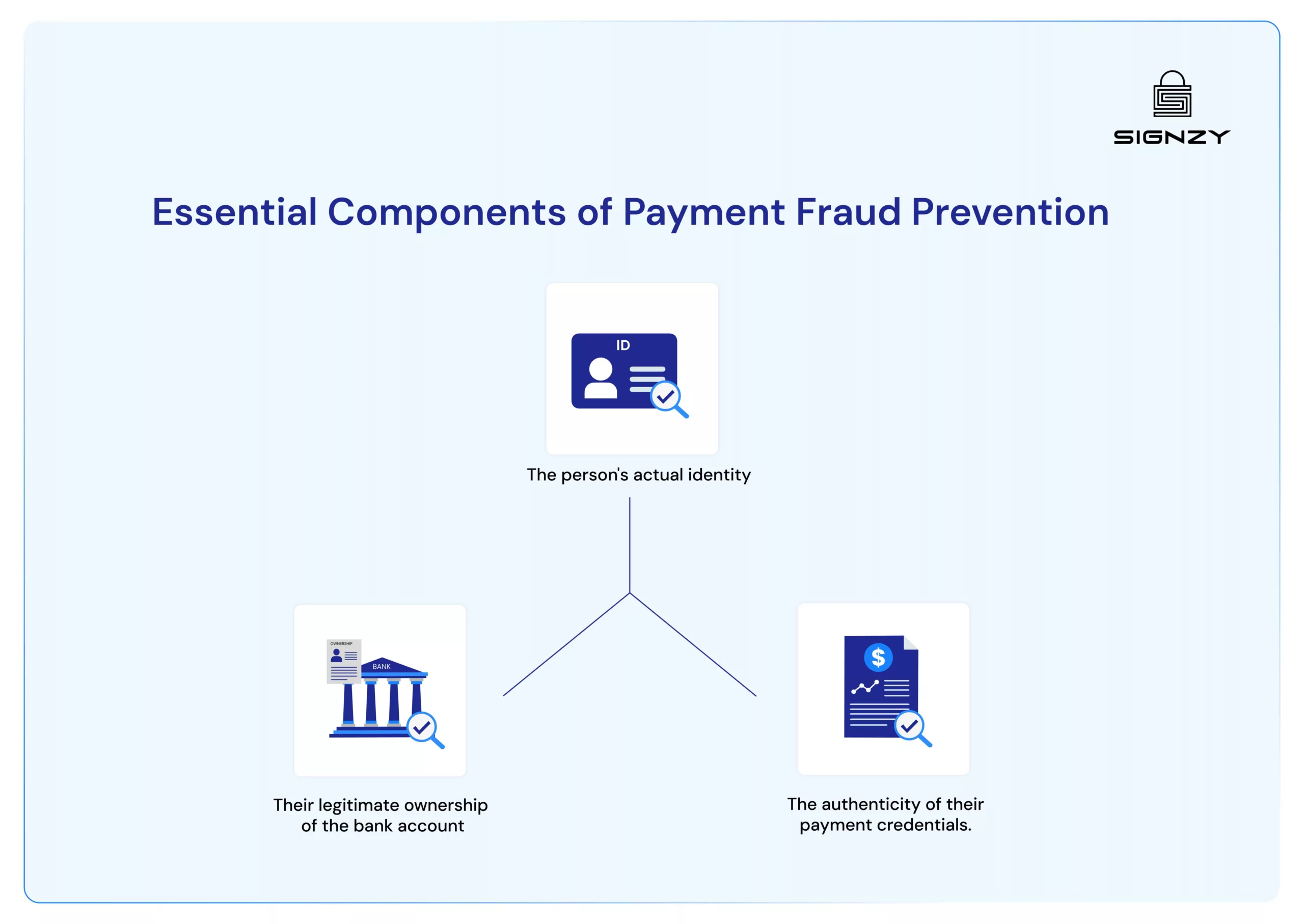

Essential Components of Payment Fraud Prevention

After examining the major payment frauds of 2024, one point is clear: strong account verification could have prevented some of these incidents.

Bank account verification creates essential safeguards by establishing three main validation points before any transaction can occur.

When these three components align through proper verification, it becomes significantly harder for fraudsters to divert payments or create fraudulent accounts.

Each component addresses specific vulnerabilities that fraudsters try to exploit.

Here’s exactly how these pieces work together to protect transactions.

1. Identity Confirmation

Everything starts with knowing who you’re dealing with. You need to match names against official records and government IDs. Why? Because when someone tries to create a fake identity, this first line of defense stops them cold.

2. Ownership Verification

Getting ownership validation right protects everyone in the transaction chain. When someone says “this is my account,” verification systems spring into action. They’re checking active status with the bank, confirming the account holder’s details match perfectly, and making sure there aren’t any red flags on file.

Take a typical business payment – before any money moves, the system confirms the receiving account belongs to the intended business, not someone who’s trying to intercept the payment.

3. Payment Credential Authentication

When payment details like email addresses and phone numbers aren’t properly verified, fraudsters find ways to exploit these gaps.

The ongoing Zelle investigation case shows exactly what can happen – criminals linking legitimate customer credentials to their own accounts. But when systems thoroughly verify these credentials against account holder information, these schemes fall apart before any money moves.

This three-layered approach helps prevent the exact types of fraud we saw in the cases above.

Payment Security Solutions

When it comes to protecting payments, businesses have more options than ever. But that also means more decisions to make. Here are the solutions you have on the table.

1. Bank Account Verification APIs

Bank Account Verification APIs handle verification in real time, with remarkable simplicity. When someone enters their bank details, APIs instantly check if that account exists, is active, and belongs to them. The entire verification happens through encrypted connections, keeping sensitive data secure.

What sets APIs apart is their continuous monitoring capability. Account status changes, ownership updates, or concerning patterns trigger immediate alerts. This means businesses can stop problems before processing payments, rather than dealing with failed transactions later.

2. Banking Data Aggregators

Data aggregation brings depth to verification by examining complete banking histories. These systems check account age, analyze transaction patterns, and verify ownership details across multiple data points. For high-volume businesses, this automated analysis catches potential issues that basic verification might miss.

When verifying numerous accounts daily, aggregators save significant time while strengthening security. They process thousands of data points quickly, flagging accounts that need closer review without slowing down legitimate transactions.

3. ACH Verification Tools

ACH tools protect payment processing through thorough account validation. Beyond standard micro-deposits, they verify routing numbers, confirm account status, and review transaction histories. This helps businesses prevent return fees and failed payments – especially important for subscription services and recurring transactions.

These systems also maintain detailed verification records, helping businesses meet compliance requirements without extra work. Each verification step gets documented automatically, creating clear audit trails.

4. Identity Verification Systems

Identity verification strengthens account validation by confirming who controls the account.

The process checks official documents and databases without creating friction for legitimate users. When combined with account verification, these systems help prevent unauthorized access while keeping transactions flowing smoothly.

For businesses handling sensitive financial data, this extra support of verification proves essential. It stops account takeover attempts early, protecting both the business and its customers from potential fraud.

Signzy offers secure identity and bank account verification APIs that help businesses validate account details, confirm ownership, and prevent fraud – all through a single integration. Learn more about our verification solutions

FAQ

Do businesses need different verification methods for domestic and international accounts?

Yes. International accounts often require additional verification steps due to varying banking systems and regulatory requirements across countries.

What should businesses do if verification fails?

Common steps include requesting alternative payment methods, asking for additional documentation, or suggesting customers contact their bank to resolve any account issues.

Are bank account verification requirements different for high-risk transactions?

Yes. High-value transactions or those in high-risk industries often require enhanced verification steps, including additional identity checks and fraud screening.

How does bank account verification help with regulatory compliance?

Proper verification helps meet KYC (Know Your Customer) requirements, anti-fraud regulations, and helps demonstrate due diligence in preventing financial crimes.