Crypto’s grand comeback in the U.S: Here’s how the currency is affecting elections, policies, and everything in between

October 25, 2024

8 minutes read

Cryptocurrency and its influence in general

Did we ever think that the most valuable and haughty physical form of paper, money, would ever become outdated? The answer is a resounding no! But our world is evolving constantly and the advent of digital currency may make this a reality. Indeed, we are discussing cryptocurrencies. Let us explore how this digital asset has significantly altered the United States of America’s (USA) ecology.

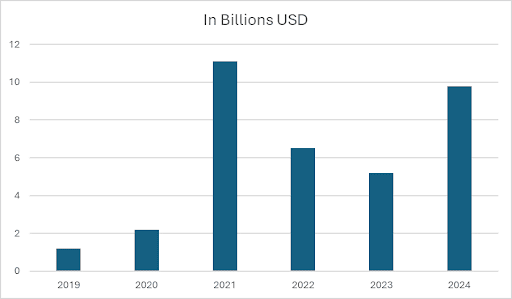

According to the Statistics, the USA will be recording its highest earnings from the cryptocurrency market globally by the end of 2024, estimated at around USD 9.8 billion. The big players, the Institutional Giants, and their games are creating a profound influence on the crypto market. The demand and prices of cryptocurrencies have hiked as a result of their increasing interest and subsequent investment in this sector.

If numbers are to be believed, then the user base of people using any form of crypto in the USA will be around 96.67 million by the end of 2025. That’s huge! All this is helping create a narrative around how cryptocurrencies will develop and flourish in the USA.

Although these figures are unquestionably impressive, the money produced by the cryptocurrency sector has been steadily declining since 2021.

Source: https://www.statista.com/outlook/fmo/digital-assets/cryptocurrencies/united-states

What, then, occurred between 2021 and 2023 that altered the crypto world’s dynamics?

To put it modestly, a lot happened, from investors losing billions of their hard-earned money to the United States Attorney’s Office in Massachusetts filing the first-ever criminal charges against financial firms, to say the least.

The Federal Bureau of Investigation (FBI) reported that the Americans lost over $5.6 billion in 2023 alone. “Over the years, the widespread promotion of cryptocurrencies as an investment vehicle, coupled with a mindset associated with the ‘fear of missing out,’ has led to opportunities for criminals to target consumers and retail investors,” the agency boldly stated.

Though evident setbacks in this crypto world are being witnessed, over time, the general perception of cryptocurrencies has changed. Crypto was once thought to be an extremely dangerous and unstable asset that only tech fanatics understood. Nowadays, this opinion has changed to one that views it as an investment vehicle with great potential for profitable returns.

Cryptocurrencies and their charm over businesses in the USA

Businesses have started using cryptocurrency and other digital assets for receiving payments against the purchase of their goods and services, making long-term investments, and for other operational transactions. By the end of 2022, approximately 2,352 businesses in the USA were accepting bitcoins and there has been an uptick in these numbers ever since. World-renowned brands like Tesla, Victoria’s Secret, etc. have announced that they will accept cryptocurrencies as a mode of payment for buying their products. Soon, we will hear from more and more businesses going in this direction.

Among many, the idea of making more money due to the constant fluctuation in the value of this currency is an alluring factor for the merchants.

Here are some of the reasons why you should start using cryptocurrency for your business, if not already:

Investing in cryptos or alike:

Usually, the Treasury Department is made responsible for looking after the preservation of capital while managing risks. According to Fortune Business, the cryptocurrency market globally in 2028 may reach up to USD 1902.5 million with a CAGR of 11.1% between 2021 and 2028. Numerous treasurers have begun investing a sizable portion of their excess cash in Bitcoin due to the return on investment.

Naturally, the foundation for making any such investment should be a carefully thought-out risk management policy with defined boundaries. A policy like this aids companies in reducing their overall exposure.

Access to newer demographics made easy:

Numerous agencies and variables that operate in a given region control and regulate currency. If you begin dealing in cryptocurrencies, you don’t have to worry about the exchange rate, fees associated with it, or the method of payment.

These days, someone sitting in India can place an order for products that are available in the USA, pay for them from their digital wallet, and complete the transaction in a matter of seconds. The demographic limitations that any firm faces are softened, which opens new demographics for businesses.

Now the whole world can become your marketplace. In a recent survey, it came out that about 85% of the sample merchants are using cryptocurrency to expand their clientele and tap newer demographics.

Staying up to date with the emerging technology:

It is always a good idea to be up-to-date. The adoption of new technologies has a greater impact on the clientele of any business in today’s age.

Introducing crypto may spur awareness internally about this technology. It will also aid in placing your businesses in a much stronger position a few years down the line when digital assets will gain more importance and power in the economy.

However, one cannot deny the fact that whenever a new frontier appears, it comes with its own set of incentives and unknown dangers and this new-age currency is no exception.

Regulations around the Digital Assets in the USA

Currently, there is no one federal regulation governing the operations of this digital currency market. In actuality, the two regulators are at odds over the issue. There has been a huge buzz as to which regulatory body should govern digital assets.

Since the Securities and Exchange Commission (SEC) views digital assets as “securities,” it argues that oversight of these assets should fall under its jurisdiction and direction. The Commodities and Futures Trading Commission (CFTC), however, has asserted power over these assets as well.

The Financial Innovation and Technology for the 21st Century Act seeks to establish a regulatory framework that will govern all digital assets in the United States. The House of Representatives passed the bill in May 2024, and it will now proceed to the Senate for approval.

This bill has resolved any doubt over their respective jurisdictions by acknowledging the independent functions of the SEC and CFTC.

According to the Bill:

- The CFTC must regulate a digital asset as a commodity if the blockchain, or digital ledger, on which it runs is functional and decentralized.

- The SEC must regulate a digital asset as a security if its associated blockchain is functional but not decentralized.

Both SEC and CFTC are ordered to draft independent rules around the digital assets based on the roles carved out for them individually and avoid duplicity.

Crypto for USA in 2025

Source: ft.com

The economies of today are less independent and more intertwined. An occurrence in one region of the world affects practically every economy it is associated with, either directly or indirectly. The election is the mother of all events. It is a decisive aspect since it will influence every decision that the nation makes in the upcoming years, both at the macro and micro levels. The US elections are scheduled for November 2024, so exciting times are ahead.

Before the election, Bitcoin reached a three-month high of about USD 70,000. The optimism around the elections is the cause of this price spike.

This time, Donald Trump is definitely different, especially in light of his stance on cryptocurrencies. Back in 2019, he tweeted that “Unregulated crypto assets can facilitate unlawful behaviour, including drug trade and other illegal activity.”

Now, in September 2024, Trump launched a new cryptocurrency venture, which goes by the name World Liberty Financial, while live streaming on the platform X.

“We would make the US the crypto capital of the planet and create a strategic national bitcoin stockpile similar to the US government’s gold reserves” – Such bold statements have the attention of crypto enthusiasts.

On the other side, Kamala Harris has not made any direct statement in support of the crypto world. Despite this, she has pledged to develop a solid framework that would encourage the usage of digital assets while protecting investors.

Paul Grewal, Chief Legal Officer at Coinbase, a crypto firm, has mentioned that crypto is what the world wants. He even made a stark statement: “Every vote is going to count, and crypto votes are no exception.”

The advancement of the digital currencies in the USA shall depend a lot on the political party coming into power. One will have to wait and watch.

Signzy and its Products

At Signzy, we strive to meet our customers’ needs in this constantly changing, technologically driven world. We want you to be a part of this new world since the crypto era is a whole new game. To help you succeed, we have created several products that will allow you to explore and reap the rewards of the cryptocurrency world:

- National Criminal Screening

- Watchlists, Politically Exposed Persons, Adverse Media Screening

- SSN Trace

- Bank Account Verification

- US DL Verification

- Global ID Intelligence