You might lose your best pal, CFPB—before that, know what it really does!

March 3, 2025

7 minutes read

What was life before the invention of money? Pretty simple, to say the least. Thousands of years ago, humans had a barter system (a method to trade products and services without exchanging any currency), which was a way of survival. Quite cool, isn’t it?

Today, we have different forms of currencies or methods to buy what we want. From plastic money, like our debit and credit cards, to loans and mortgages, all come under that umbrella. Almost all of us have used these methods at some point. Their influence on our day-to-day lives is unfathomable.

It is safe to say that almost all of us either have a card or have used it by now.

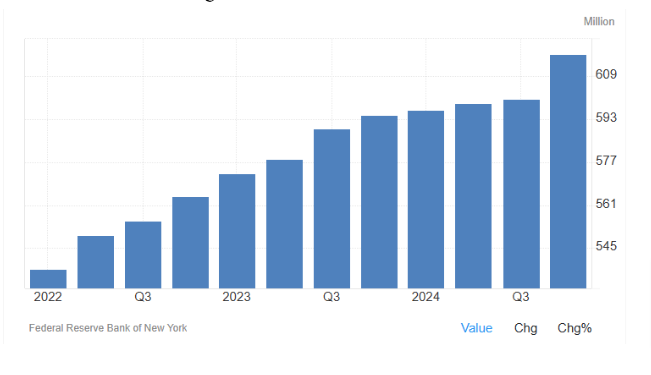

In the fourth quarter of 2024, there were 617.41 million credit card accounts in the United States of America, up from 600.53 million in the third quarter. This is its all-time high!

With such a mass using it, there have to be regulations around it and a body that governs such a regulatory framework. The Consumer Financial Protection Bureau (CFPB) is entrusted with this job.

What is CFPB?

The official website of CFPB states, “We are the Consumer Financial Protection Bureau, a U.S. government agency dedicated to making sure you are treated fairly by banks, lenders, and other financial institutions.”

They are basically the best pals of consumers in the United States of America.

Their core is to take action against businesses that violate the law and shield customers from unfair, dishonest, or abusive acts.

CFPB provides people with the knowledge, actions, and resources they need to make wise financial choices.

Imagine the significance of this body and how harsh the consequences of the actions taken by the current administration in the country will be.

As rightly pointed out by the New York Times – With the government seemingly stepping back from regulatory duties, consumers may have to act as their own financial watchdogs.

Before we dive deep into the consequences of shutting down the CFPB, let us have a look at what all it is, or perhaps was, looking after.

CFPB’s arms and legs:

The jurisdiction of the CFPB is way beyond your imagination. The following are under the CFPB’s purview:

- Banks (goes without saying)

- Credit unions (this also could be an easy guess but not what follows)

- Securities firms

- Payday lenders

- Operations related to mortgage servicing

- Services for foreclosure relief

- Debt collectors

- Colleges that are for-profit (this must be hard to guess, but yes, even colleges are answerable to CFPB).

Broad job profile of CFPB

Every regulatory organisation is responsible to keep a tab on the organisations under it and ensure that the compliance environment stays intact.

Here are a few ways in which the CFPB is protecting the compliance environment in which it operates:

1. Consumer protection: The banks and financial institutions are under the purview of the CFPB. All their actions are looked at under a microscope by this Bureau.

Owing to the diligent work of the CFPB this year, it has brought a case against Capitol One alleging that it was unlawfully defrauding clients of over $2 billion in interest payments. Subsequently, the current administration withdrew the case against the bank last week.

This is exactly what the CFPB does! Alarming the government of any wrongdoing of the most powerful organisations of the country while protecting the interests of the consumers, which are the common citizens.

In a nutshell, the CFPB defends customers against deceptive business practices by banks, credit unions, and other financial institutions.

2.Rules are enforced: The CFPB upholds laws and guidelines that safeguard customers.

There is a Compliance Resource tab on the website of CFPB, which has videos, manuals, and other materials to assist organizations in comprehending, applying, and adhering to the regulations and laws crafted by CFPB.

The following tabs are available on its website. Any business house currently in the game or planning to get into one can visit these and have an idea about the broad compliances that shall be applicable to it.

- Mortgages

- Consumer cards

- Consumer lending

- Deposit accounts and services

- Other applicable requirements

3. Financial education: To assist consumers in learning more about financial services and products, the CFPB provides resources.

4. Assists customers in submitting complaints: The CFPB offers a mechanism for customers to submit complaints concerning banks and financial services firms.

A consumer can submit the complaint either through an email or via a phone call as well. The services of CFPB are available in over 180 languages.

Click here to learn more about how you can submit a complaint and what follows pre- and post- https://www.consumerfinance.gov/complaint/.

5. Complaint sharing: In order to assist with enforcement and oversight, the CFPB shares complaints with other federal and state entities.

6. Market observation:The CFPB keeps an eye on the consumer financial services and product markets.

This is just the tip of the iceberg. The roles and responsibilities of the CFPB go much beyond this.

What has the agency done for the consumers?

CFPB has done a noble work of targeting organizations for subjecting customers to severe terms, exorbitant costs, and useless items.

When we talk about mortgages, the CFPB ensures that mortgage lenders don’t offer loans with deceptive practices that cause individuals to lose their homes. Further, it has drafted regulations to establish new safeguards.

In 2023, Lauren Saunders, associate director of the National Consumer Law Center, applauded CFPB: “It has completely changed the consumer financial marketplace. Overall, it has had a tremendous impact on making it more fair and transparent.”

Other protections have also been established, including guidelines for service providers to follow when interacting with borrowers seeking alternatives to foreclosure.

Last year, the CFPB also took action to cap credit card late fees at $8. According to Wallet Hub, the typical late fee is about $30, but it can reach $41. Due to lawsuits by corporate and banking organizations, such a rule is currently on hold.

A few Fast Facts :

- $21 billion+: Total amount of refunds, principal reductions, debt cancellations, and other consumer assistance brought about by CFPB enforcement ($19 billion) and oversight ($1.7 billion).

- The estimated number of consumers or consumer accounts that can benefit from the CFPB’s enforcement and oversight efforts is 205 million+.

- 4.6 million+ consumer complaints regarding credit reporting, 83,000+ complaints about medical debt collection, and 96,000+ complaints about student loans are among the 6.8 million+ consumer complaints that are forwarded to businesses for resolution.

There is a lot more that the CFPB has done, and without its existence, the financial economy in the country might take a hit.

This has created additional pressure on all the organisations that so far have operated under the CFPB’s. They will now be required to be extra cautious. Banks and other institutions are in a dilemma as to whether they need to follow the compliances implemented by CFPB or not. Banks and financial institutions, lending houses, etc., are all the backbone of any economy; the latest actions of the government have put their compliances under question. So bizarre and worrisome!

Also, the consumers are left high and dry. “Everything is on pause right now,” said Delicia Hand, senior director of digital marketplace with Consumer Reports. “So it’s back on consumers to be extra diligent.”

What is currently happening in the country is astounding! Mass layoffs and terminations of this Agency are very much on the cards.

CNBC reported that the Consumer Financial Protection Bureau’s Trump-appointed leadership plans to fire nearly all its 1,700 employees while “winding down” the agency, according to testimony from employees.

A current CFPB employee stated that during meetings held between February 18 and February 25, “Senior Executives informed staff that the CFPB would be abolished except for the five statutorily mandated positions.”