What is Government ID Verification? Step-by-Step Guide for businesses

April 15, 2024

6 minutes read

More and more businesses are operating online as the digital transformation of industries accelerates.

Many issues have arisen as a result of this transformation, the most urgent of which is the requirement to precisely verify the identities of clients.

Companies leave themselves vulnerable to identity theft and fraud when they don’t have a strong system in place for verifying identification.

What does government ID verification entail?

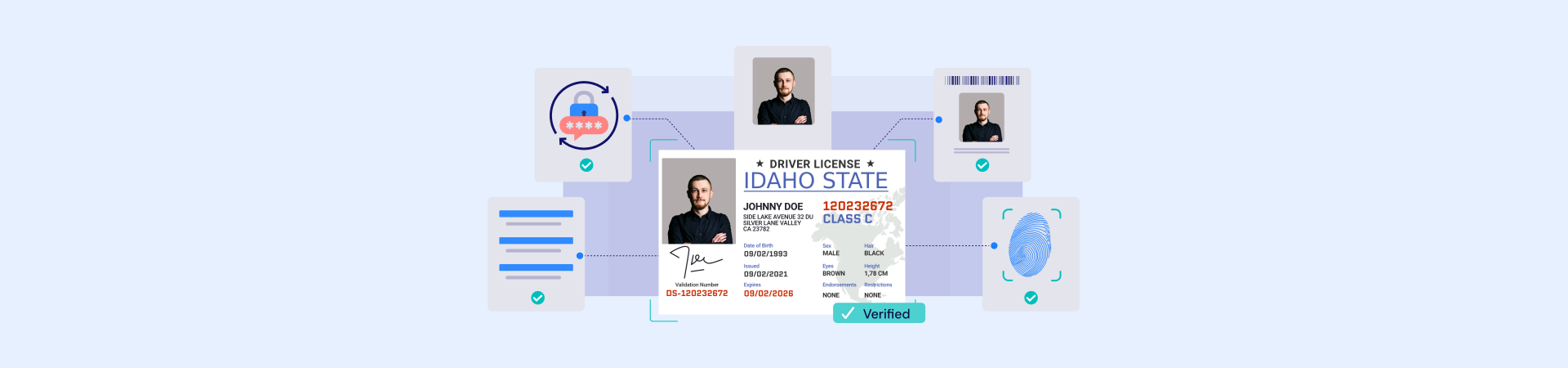

The process of verifying the authenticity of a government-issued ID and bolstering an individual’s assertion that they are who they say they are is known as government ID verification.

These identity checks can take place in person, like when the TSA examines your driver’s license when you walk through airport security.

They may also be a component of a digital identity verification procedure, which frequently calls for the user to send in a picture of their official identification as well as complete a liveness check and selfie verification.

Methods of ID verification

Digital identity verification and identity verification solutions come in a variety of forms.

Methods for verifying someone’s digital identification involve comparing the information they present, such as an ID document or face biometric, with a confirmed data set, like government-held information like passport data or biometrics saved on a user’s registered mobile phone.

To determine whether someone is who they claim to be, digital identity verification compares the data that is being presented with the data that has been validated.

Digital identity verification can be accomplished using a variety of techniques as mentioned below-

- ID Document Verification: Verifies the legitimacy of an ID document, such as a driver’s license, passport, or official government ID

- Biometric Verification: Uses selfies to verify that the individual presenting the ID is the same person whose photo is on it

- Liveness Detection: Recognizes spoofing techniques like the use of face masks or altered photographs to determine if a selfie is legitimate

- Knowledge-based Authentication (KBA): Uses information from the applicant’s credit record to generate “out of wallet” requests.

- Verification by One-time Passcode (OTP): During the verification process, the applicant receives an email or text message containing a one-time passcode.

- Trusted Identity Network: Using the applicant’s current login credentials, the trusted identification network verifies their identity and speeds up the onboarding and account opening processes.

- Database techniques: Verifies the information provided by the applicant by utilizing data from social media, offline databases, and other sources.

What is the process for verifying a government ID?

The procedure of verifying a government ID online typically consists of three steps:

Step 1: Collect and examine ID

A user snaps or uploads a picture of a valid ID from the government, such as a passport, driver’s license, identification card, or permanent residence card.

To ensure that the picture satisfies the standards for verification, it must be pre-processed and examined.

Step 2: Extract and compare data

Next, the algorithm can take information out of the picture, including the person’s name and address, and compare it with the details they provided in their application.

It is also possible to gather further details about the document, like its identifying number and expiration date.

Step 3: Validate the ID

Lastly, the system carries out validation procedures to confirm that the picture was not altered and that the document is genuine.

These could involve confirming the government ID’s security elements, like watermarks, holograms, and stamps.

This method is frequently used by automated identity verification systems to swiftly verify and validate users’ and government IDs; Signzy’s government-issued ID verification can be completed in a matter of seconds.

In addition to lowering the chance of fraud and assisting companies in meeting Know Your Customer (KYC) and anti-money laundering (AML) regulations, these quick verifications can provide excellent customer service.

They might also be the only financially viable solution for expanding and sizeable businesses to handle a high or irregular volume of requests for identity verification; rather than requiring team members to examine each application, they could automate the process and only forward those that require additional examination to a human reviewer.

Progress in online government ID verification

A typical online government ID verification procedure is described in the stages above.

However, if electronic government identification gains traction, the norm might shift.

For instance, in many jurisdictions, obtaining a mobile driver’s license (mDL) requires residents to go through a government ID verification process. The information on an actual driver’s license is included in the mobile driver’s licenses (mDLs) – encrypted and stored in mobile wallets. Then, to confirm someone’s identification, your company can request their mDL.

Similar to this, passports with an NFC (near-field communication) chip, (often known as e-passports), enable secure and immediate download of the passport’s data to NFC-capable devices.

Consequently, companies are now able to obtain a passport photo and swiftly validate the data via an NFC link.

Using mDL or e-passport verifications, businesses looking to confirm an individual’s identity with a government ID may be able to decrease false negatives, boost security, and decrease friction.

How can ID verification impact your business?

Keeping banks and other institutions free from fraud and criminal actors depends critically on ID verification.

It makes it possible to identify and stop criminals from utilising the organisation to launder money or hide the real purpose of their operations in the early stages.

ID verification serves as a gatekeeper to guarantee that only authorised people and businesses can use the bank, which is in line with larger Anti-Money Laundering activities.

Furthermore, identity verification guarantees that organisations uphold the public’s trust while adhering to strict regulatory requirements. Even if banks were not aware, they could suffer serious financial, legal, and reputational consequences if they serve as havens for illegal enterprises.

Because of this, precise ID verification is quite important.

An antiquated or cumbersome ID verification procedure can negatively affect an institution’s productivity and financial results, which is just as crucial as maintaining compliance.

Fortunately, in the digital age, it is no longer essential or ideal to need customers to physically visit a site with a photo ID and conduct manual checks. It is less precise, takes longer, and detracts from the agent and client experience.

However, organisations using cutting-edge AI-based ID verification technology can process more “good guys” in less time while immediately identifying possible “bad guys.”

These days, we don’t have to pick between efficiency and compliance because electronic ID verification takes care of both.