What is Liveness Check?

- The losses in the US due to identity theft racked up to $43 billion in 2023.

- Digital liveness checks have allowed businesses to scale their operations beyond their geographical boundaries.

- There are three types of liveness checks – Active, Passive, and Hybrid.

Digitization has brought ease of business and operations for both businesses and customers. However, the reduced physicality due to this development has also compromised the security of identity verification.

Bad actors circumvent the identity verification processes to commit fraud and other illegal activities. This usually involves stealing the customer’s identity to misuse their personal information. According to an AARP report, adults in the US lost around $43 billion to identity theft in 2023.

Thankfully identity fraud is not a problem without a solution. The identity verification industry has kept up with this growing problem and created measures to resist it. Liveness checks are one of the many ways businesses can counter the identity theft issue.

Let’s find out how liveness checks can help improve your business.

Related Solutions

What is Liveness Check?

Liveness check is a biometric verification method. It uses facial recognition technology to verify that a customer is submitting legitimate identification documents. Liveness checks also help in ensuring that the person submitting the documents is the same person who is in those documents.

Liveness checks are also a strong counter against the growing deepfake problem. Deepfake fraud involves using fabricated videos to replicate a person’s identity to gain illegal access to their personal information or accounts.

Now that we know what liveness check is, let’s understand how it works.

How does Liveness Check Work?

Liveness checks help prevent identity fraud by comparing the customer’s face in the identity document shared by them with a live specimen of their facial features. The live specimen is usually collected in the form of a selfie photo or a video from the user.

Once the live picture or video is collected from the customer, liveness check is performed by a software. The checks involve analyzing the various aspects of the customer’s submission like:

- the spacing between their facial features,

- how natural their movements are,

- artifacts in the picture or video that could hint at the submission being fake,

- and more.

With the advent and growth of digitization, identity verification techniques like liveness detection have also gone digital. This has allowed businesses to scale their operations beyond normal geographical boundaries. Customers can also complete verifications from anywhere since they almost always have a camera on them.

The digital move has also led to a few problems. The apps or digital platforms of businesses often prove to negatively impact the user experience due to lag or unresponsiveness. So businesses need to make sure that their liveness checks create a positive user experience.

Now, while liveness detection might seem like a singular process, it actually has a few types. So let’s take a look at the types of liveness checks to help you understand which suits your business the best.

Types of Liveness Detection

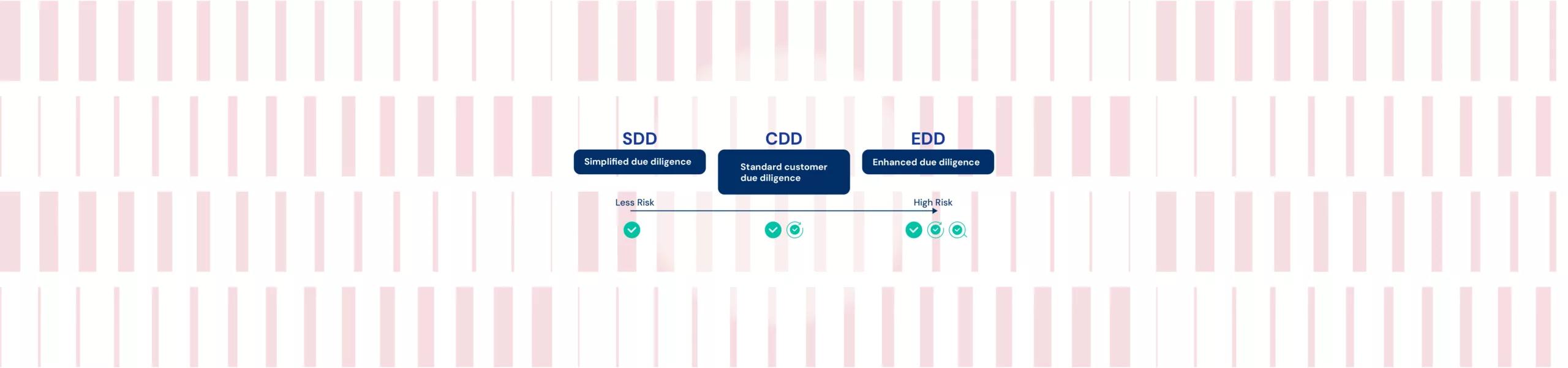

The type of liveness check depends on the amount of activity needed from the customer to verify their identity. Here are the three types of liveness detection methods:

Active Liveness Check

In this form of liveness check, the customer has to perform certain actions as directed by the business platform. These actions might be moderated and directed by a human or software. The actions can be along the lines of “turn your face to the left”, “raise your right hand”, “look up”, or others. These actions help ensure that there is a real person in front of the camera and not a pre-recorded video.

Passive Liveness Check

Passive liveness checks are a lot less involved than active liveness checks. They do not require the customer to perform any specific actions. Just taking a selfie usually suffices. This selfie is then compared with the identification document submitted by the customer to ensure that the customer is a real person and that the ID documents submitted by them are genuine.

Hybrid Liveness Check

Hybrid liveness checks are also called semi-passive liveness checks and is a combination of the two methods mentioned above. When conducting hybrid liveness checks, the customer may be asked to perform a single action to complete the process. This is the most commonly used type of liveness check and is often used by banks and other financial institutions when onboarding new customers.

Combating Deepfake Frauds with Signzy

As mentioned before, identity fraud is a growing problem for many businesses, and negative developments like deepfakes and AI-generated fake identities require businesses to keep their security standards updated. Improving security and stepping up verification processes should not come at the expense of loss in clientele, though. Businesses often struggle with overly complicated verification processes leading to clients abandoning their onboarding processes, which in turn hurt the businesses.

These businesses cannot get away with being relaxed about these standards either. Poor verification standards can attract legal troubles for businesses, hurt their image among customers and stakeholders, cause financial losses, and other problems.

Signzy’s API marketplace was developed with the intent of combating these very issues. With our Liveness Check API, businesses can digitally verify and authenticate the identity of their customers without any hitches. This means that your business can scale beyond your geographical locale, and your customers get to enjoy security and a great user experience.

Book a demo with us and find out how you can improve your business’ security.

Businesses need to constantly work on upping their standards on identity verification and ensuring that their customers have a secure platform to transact on. While businesses can develop their own methods and platforms to achieve these ever-improving standards, such an endeavor can be costly. Collaborating with specialists like Signzy helps businesses achieve the desired levels of safety and security, without breaking the bank, or losing too much time.

FAQ

What does liveness check mean?

How do you pass a liveness check?

How does a liveness check work?

Gaurav Gupta

Gaurav Gupta is the Global Product Head at Signzy, leading the strategy and development of the company’s KYC, KYB, AML, and digital onboarding products used by banks, fintechs, and financial institutions across global markets. He specializes in building scalable compliance and verification platforms, transforming complex regulatory and risk workflows into seamless, automated product experiences. Gaurav works at the intersection of product, engineering, and AI.

![Face Matching vs. Selfie Verification [Which is Right for You?]](https://cdn.sanity.io/images/blrzl70g/production/35569107cd3d0dc0e28b221813f008c8301a7f78-2560x600.webp)

![Video KYC: Pros, Cons and Key Differences [2025]](https://cdn.sanity.io/images/blrzl70g/production/7bbc8274feeb85b1d7452245a7fe034b8105e572-2560x600.webp)