Synthetic identity fraud is growing violently!

As per an article published by Thompson Reuters in 2023, synthetic identity theft has become the world’s fastest-growing financial fraud, outpacing even credit card fraud, resulting in losses of multi-billion dollars!

But a question arises.

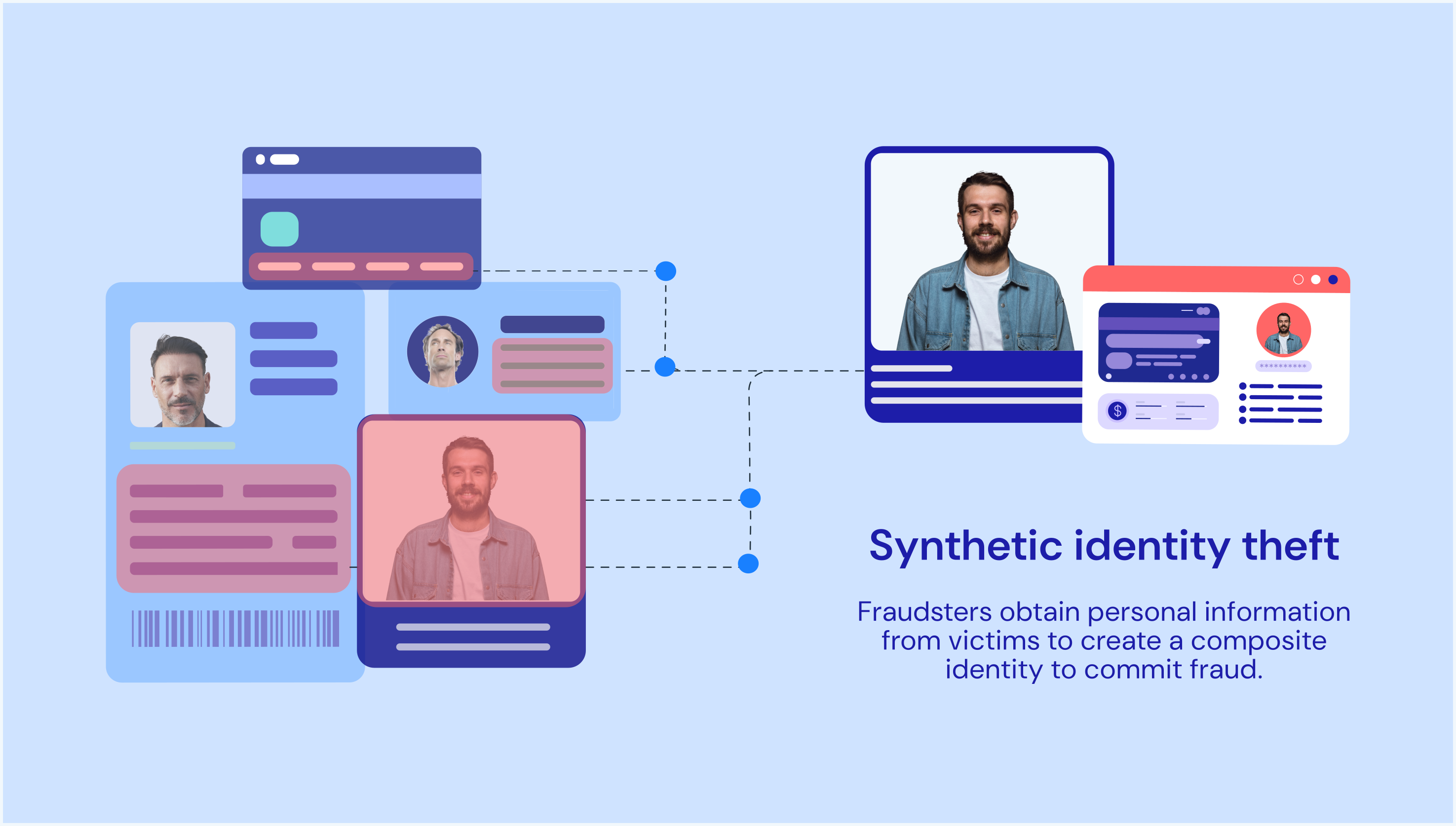

What is synthetic identity theft?

It’s become common nowadays to use fake identities to execute various criminal activities, including smuggling, money laundering, illegal arms sales, and terrorism.

What is a fake identity?

Synthetic identity fraudsters combine fake and real information to create a new fictitious identity.

Once this identity is created and put into action, the fraudster has successfully created a new appearance so that they can carry out several fraudulent operations continuously.

This can go on unnoticed for years.

The fraudster goes on building up a synthetic credit profile based on a fictitious identity. The fraudster will open and utilize numerous accounts, loans, credit cards, etc., only to cash out in one fell swoop and disappear for good without a trace!

Out of all new account fraud, 80% of cases are of synthetic identity fraud.

Synthetic identity theft cases

Synthetic identity theft has become a major concern for US businesses as well.

Identity theft resulted in losses of $1.8 billion to the lending industry in the calendar year 2023 till September. Around 0.8 million cases of identity theft has been reported during the aforesaid period!

Credit card fraud and bank fraud are growing like wildfire.

Credit card fraud?

Yes.

Building a good credit score using artificial identities.

A falsification of address proof is also a very popular approach seen among fraudsters while executing bank fraud.

But how is Synthetic identity theft different from traditional identity theft?

Synthetic vs traditional identity theft

Traditional identity theft typically involves stealing an individual’s existing personal information and exploiting it for fraudulent purposes. This could include stealing someone’s Social Security number (SSN), credit card details, or other sensitive data.

How? Through various means such as hacking, phishing, or physical theft.

Once this information is in the hands of a perpetrator, they can impersonate the victim to carry out fraudulent activities.

Fraudulent activities as in?

As in opening new credit card accounts, taking out loans, or making unauthorized purchases.

The victim may not even be aware of the theft until they notice suspicious activity on their accounts or receive bills for debts they didn’t incur.

Traditional identity theft cannot be easily resolved.

Resolving traditional identity theft can be time-consuming and may involve disputing fraudulent charges, updating account information, and repairing credit damage.

On the other hand, synthetic identity fraud involves the creation of a new identity using a combination of real and fake information. Instead of stealing an individual’s complete identity, fraudsters may use elements from multiple sources, such as a real Social Security number combined with a fake name and address.

What’s the use of such a fake identity?

This synthetic identity may then be used to open fraudulent accounts or obtain credit, often flying under the radar of traditional identity verification processes. These are difficult to detect.

How does synthetic identity theft work?

This identity theft involves stealing SSNs and then combining them with fabricated details such as names, addresses, and dates of birth. Such theft remains undetected most of the times.

Why? No clear victim can be identified in this type of fraud.

Synthetic identity fraudsters can simultaneously utilize various identities and may maintain active accounts for extended periods, even years before their fraudulent activities get detected.

They cleverly establish accounts and use them responsibly over a specific period to establish a positive credit score – providing the fraudster with the opportunity for substantial financial gain later.

There are instances where criminals accrue fraudulent charges, subsequently, exploit the genuine information used to create their false identity to pose as a victim of fraud, and then manipulate the situation to have their credit line reinstated – allowing them to continue perpetrating theft.

While still a form of fraud, these synthetic identity thieves aren’t looking to steal money from financial institutions, they just want access to bank accounts and credit cards that facilitate getting paid and making payments and purchases.

Impact of Synthetic Identity Fraud on Businesses

Who are the common victims of synthetic identity fraud?

Mainly financial institutions such as banks and NBFCs.

Banks and financial institutions themselves have to bear the majority of the consequences, experiencing various financial losses and criticism from clients – who question the reliability of their encryption systems and security-related measures.

In most cases, fraudulent individuals can accumulate major loans through additional lines of credit, further exacerbating the financial impact on the banks.

In addition to this, synthetic identity fraud can facilitate money laundering, as the use of synthetic identities makes it difficult to trace as well as detect illegal transactions.

Therefore, implementing anti-money laundering (AML) and know-your-customer (KYC) measures can help banks to avoid regulatory fines and penalties. It is important to note that customers strongly dislike incidents that involve data breaches and identity theft, and these incidents can significantly impact their trust and satisfaction levels.

How to detect synthetic identity fraud?

Multiple ways. One of the ways includes using machine learning and AI to understand customer behaviour patterns and spot anomalies.

Alternatively, businesses can analyse and connect a multitude of data including third-party data, looking at data across organizations and not only across accounts and portfolios. Establishment of the customer identities also helps to prevent fraud.

Businesses need to invest in more sophisticated methods for verification of identities, such as document verification and biometric verification powered by AI algorithms.

While a synthetic identity which combines a real SSN with fake data can bypass a credit bureau check, it is less likely to go through checking the documents.

Prevent synthetic identity theft with Signzy

Fraudsters can securely siphon funds through these banks and financial organizations by using synthetic identity fraud.

And hence, financial institutions are required to comply with the AML/KYC theft standards. AML/KYC due diligence on consumers should be carried out by banks and other financial organisations.

Signzy’s KYC Solution is excellent at improving the security of digital onboarding procedures. Signzy can considerably lower the risk of identity fraud and guarantee a safe onboarding process by combining biometric verification, real-time data analysis, and AI-powered document verification.

Visit our website for more information.