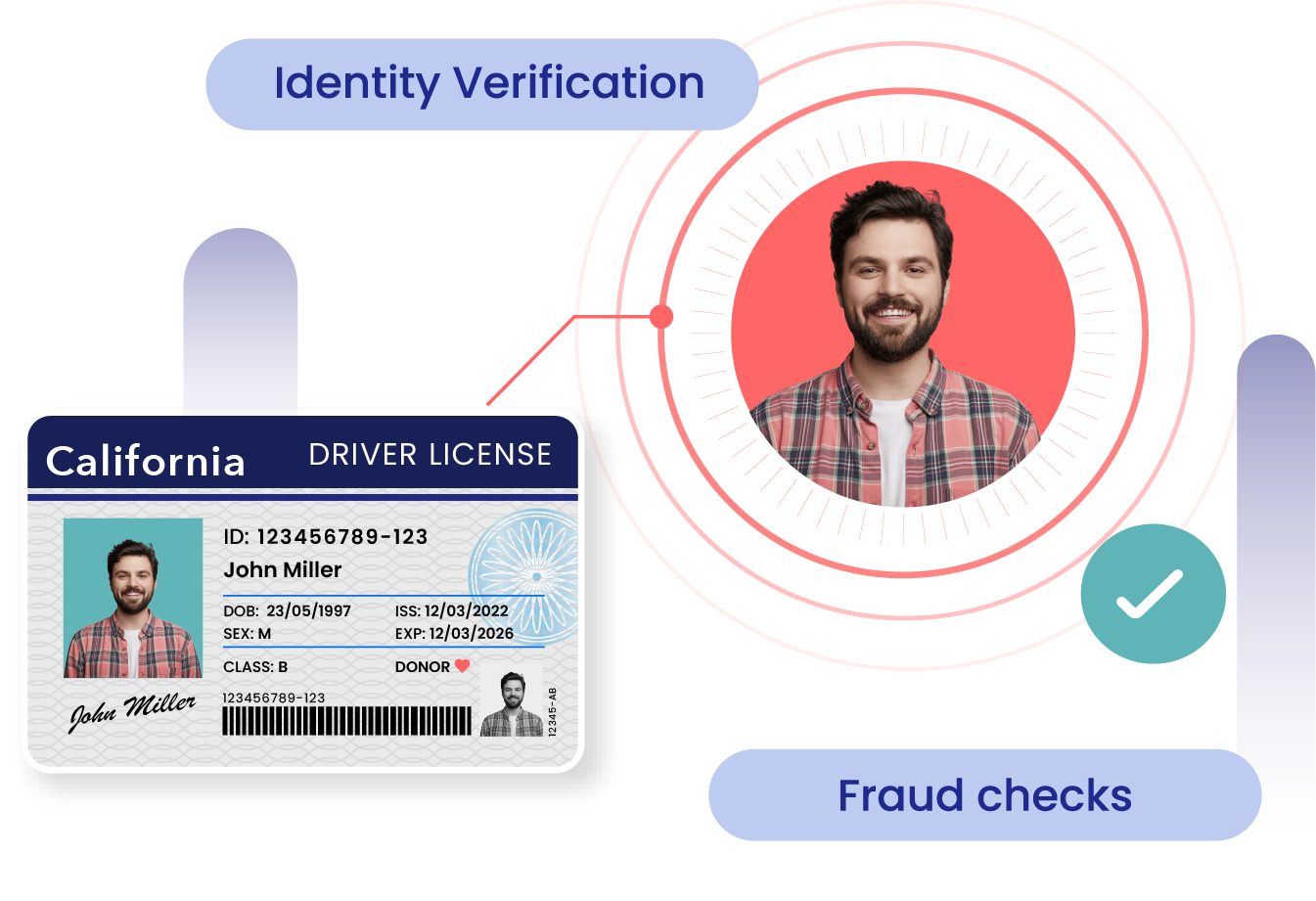

Identity

Verification

Securely onboard users from 240+ countries with our end-to-end identity verification API. Using our AI-powered real time analyzer, complete your entire process in less than 2 minutes while also ensuring compliance.

Your success metric is our only performance metric.

4

Applicant

growth

99

Reduced fraud

80

Cost reduction

60

Less customer

drop-offs

0

x

Applicant

growth

growth

0

%

Reduced fraud

0

%

Cost reduction

0

%

Less customer

drop-offs

drop-offs

Onboard users globally, stay compliant locally.

We are available across 180+ countries worldwide!

What we Solve

Verify identities in real-time

Humanize your user experience using our seamless identity verification suite that ditches the “one-size-fits-all” approach while maintaing compliance and reducing fraud.

Navigate global compliance

Onboard customers from around the globe without the burden of dealing with the regulations everywhere.

Eliminate fraudulent imposters

Verify customers against global databases right from the outset, ensuring only legitimate customers are onboarded.

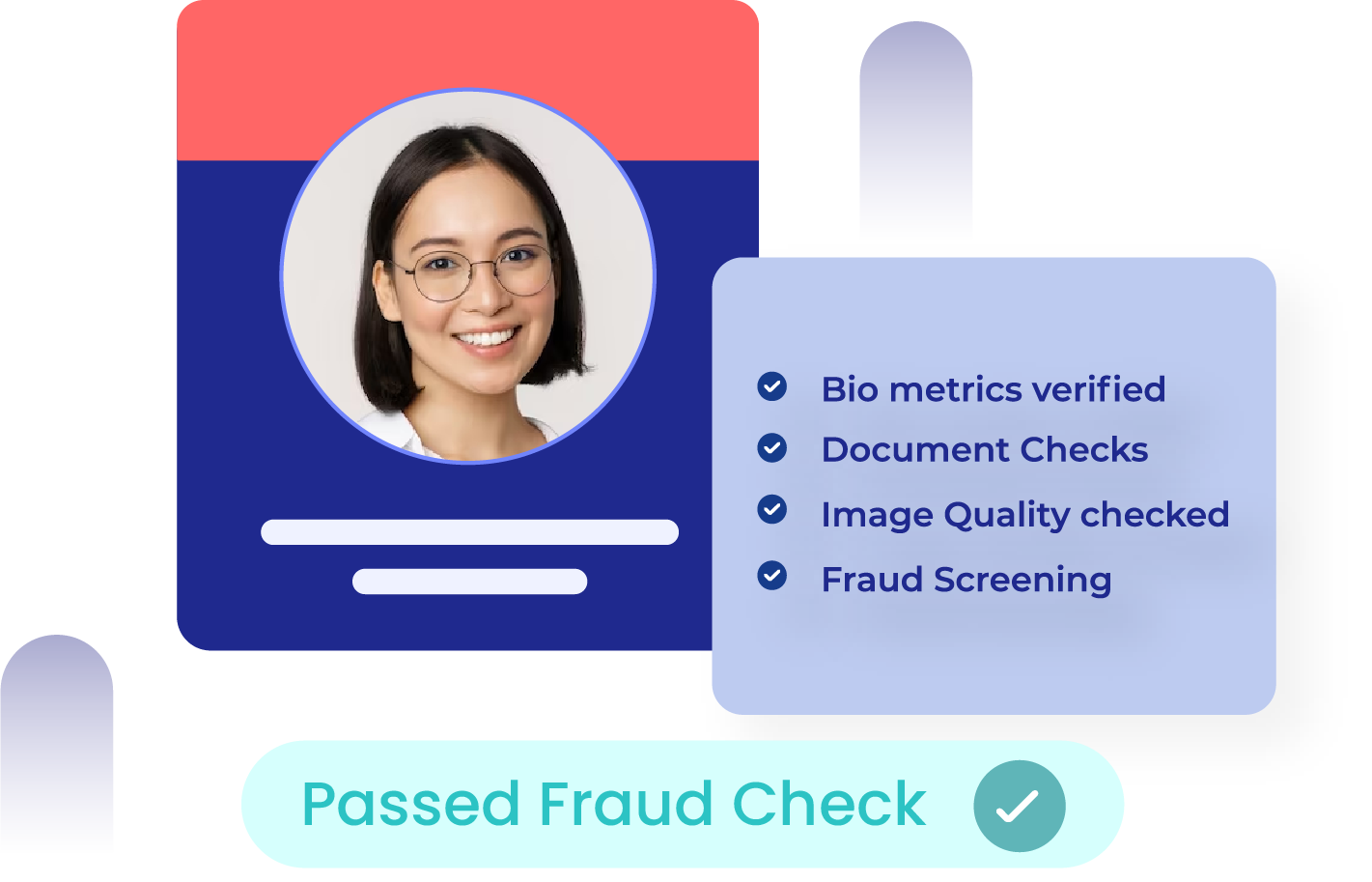

All IDV needs at one place

Choose from our wide range of solutions for identity and fraud checks which includes Fraud screening, Document forgery, Biometric verification and many more.

Go live in just 6-8 weeks!

Good things come to those who wait, but we have saved

something better for you.

something better for you.

Ready to look at the pricing?

Just between us.. but we are the most affordable solution in

the industry!

the industry!

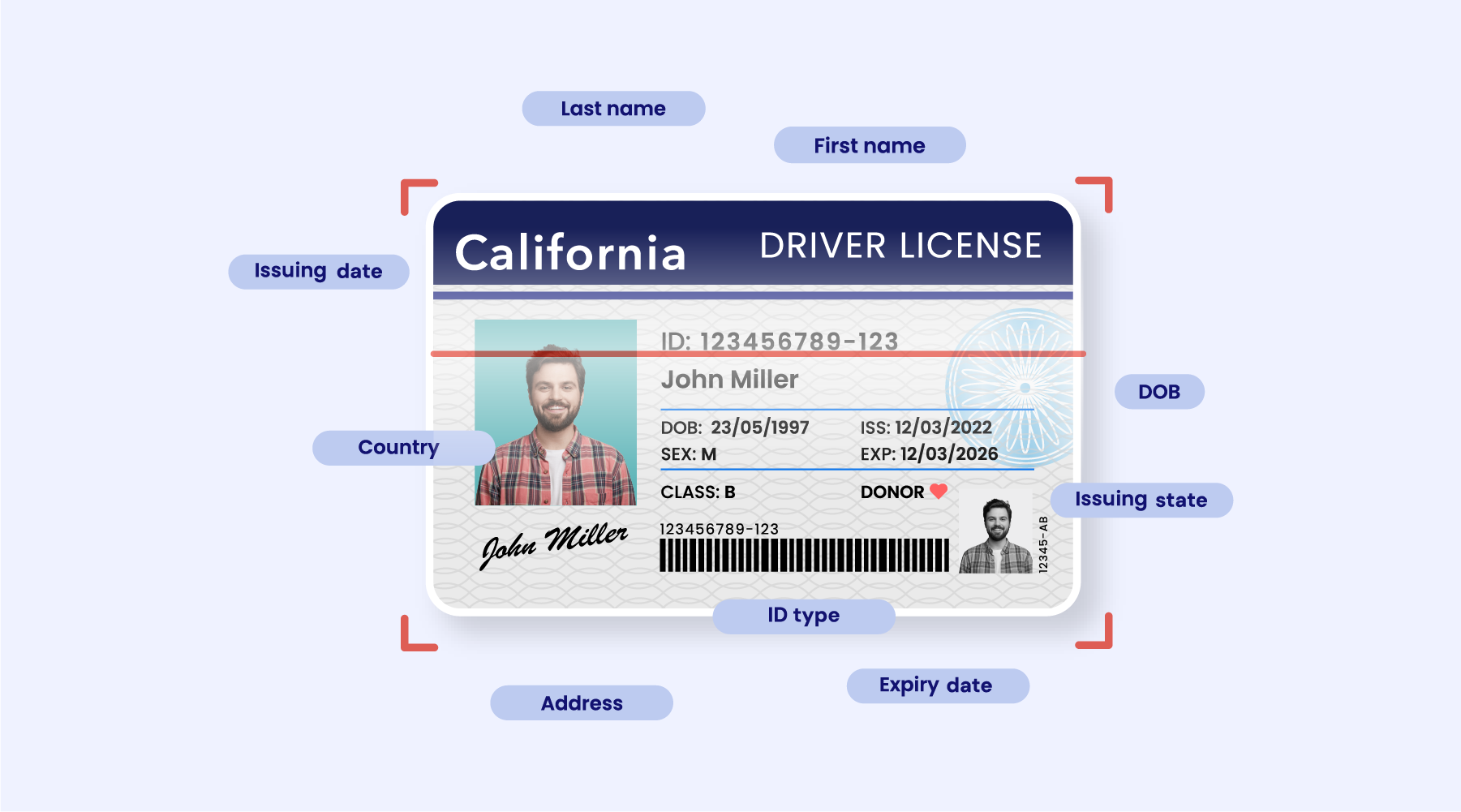

Signzy's KYC verification suite for you!

Seamlessly validate documents like passport, drivers licence and many more from more than 200 countries. Whether you require identity verification or fraud screening, our API ensures swift processing in less than 30 seconds, significantly expediting your onboarding procedures.

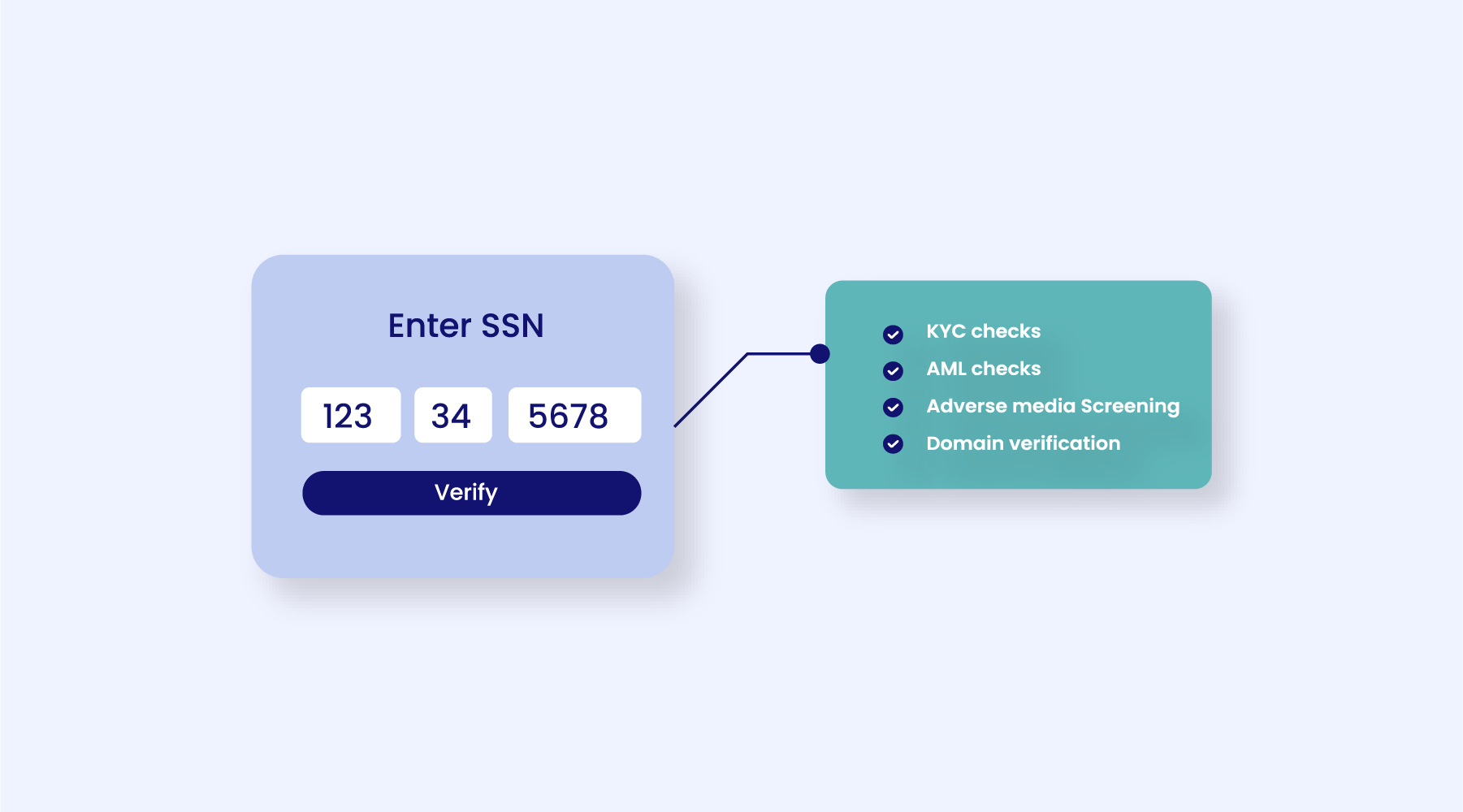

Ensure compliance with KYC, AML, and sanctions screening standards by cross-referencing user data against reputable databases. Benefit from our extensive library of 150+ data sources, providing thorough coverage and delivering precise results.

Need a custom solution? We’re ready to build your vision.

Our Success Stories

Seema Kumar

Country Leader, IBM India

It is answering the question, how do you build trust online.

It uses APIs on visual recognition to build digital trust.

Bala Srinivasa

Managing Director, Arkam Ventures

We were attracted to the founder’s clarity of thought

and their early proof points in building a proprietary platform that could become an industry.

Rajan Anandan

Managing Director, Sequoia Capital and Surge

Signzy is a standout example of tech-enabled disruption.

Ashith Kampani

Chairman, Cosmic Mandala15 Group

Signzy is redefining the limits of innovation in building trust online.

They are committed to delivering a secure and positive experience to their clients.

FAQ's

What is the primary purpose of KYC, and why is it important?

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

What are the types of KYC ?

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Is Video Verification mandatory in the KYC process?

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

How are AML/CFT checks are done? And what are steps taken if any fraud is detected?

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

What is the primary purpose of KYC, and why is it important?

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Book a meeting now?

Connect with our team of experts at your time of convenience by booking a slot below.