Revving Ahead With Digitization- How To Revolutionize Verification In The Vehicular Industry

June 15, 2021

4 minutes read

Introduction

Being the 6th biggest manufacturer of motor vehicles, the Indian Vehicular Industry is a behemoth with a $118 billion value estimation. The fact that this is expected to skyrocket to $300 billion by 2025 makes it an unleashed beast.

The current process of customer onboarding and underwriting involves multiple physical parameters with the in-person involvement of the client and the assigned agent. But with novel technologies and cutthroat competition on the rise, it is time insurers decide to upgrade their game. This article focuses on the current market of automobile verification, its challenges and the solution.

The Current Market for Vehicles in India

By 2021 India is expected to become the 3rd largest passenger vehicle market in the world. 2019 saw a 2.7% increase in production in the industry as compared to the previous financial year.

The industry is in a state of growth and it is the right time to take the initiative and utilise it. The current modes of processing can be upgraded with technology. This will help flourish in a cutthroat market like India.

The Primary Players In The Indian Vehicular Industry

There are numerous automobile companies competing in the Indian market. The top ones are:

- With revenue of near Rs.300,000 Crore, Tata Motors Ltd. takes the lion’s share of the market. Tata currently has a 6.3% and 45.1% market share in passenger and commercial vehicles sectors, respectively.

- Maruti Suzuki India Ltd dominates the passenger vehicles market with over 50% in market share. The Rs.83,281 crore revenue and a market cap of nearly Rs.200,000 crore is an impressive aspect.

- Mahindra & Mahindra Ltd also holds a big chunk of the market with revenue heading over Rs53,000 crore and a market cap reaching more than Rs. 70,000 crore.

- The two-wheeler giant Hero MotoCorp Ltd comes on top of its specific niche with 36% of the market share. The Rs 32,871 crore revenue and the 57,180 crore market cap is impressive for a primary two-wheeler manufacturer.

- Other honourable mentions include Bajaj Auto Ltd, Ashok Leyland Ltd, TVS Motor Company Ltd, etc

What Are The Challenges Of The Industry

As is with most industries, the challenges in the vehicular industry also play a lot in parallel with the adoption of technology. Gone are the old days of physical processing of documentation and verification. With the advancing technology, the terrain is entirely changing.

Insurers must ensure that they can survive the peer competition. Technological services are available for verification and other related processes. But the coding required coupled with the complexity and unavailability of resources from a single portal is frustrating.

Why Is Signzy The Solution?

The solution to technological hurdles is not simply newer technology. It is the right newer technology. Signzy can provide this. With a quiver of products and resources, we can provide you with the state of the art technology while properly understanding your requirements.

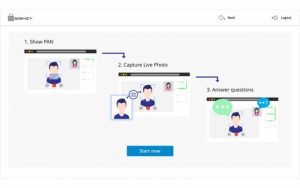

Beginning with customer verification using OVDs such as driving license to the verification of the vehicle registration, Signzy’s plethora of APIs will suit you. APIs like DL verification API and Vehicle Registration APIs use government and other databases to cross verify the user’s credibility while maintaining the process seamless.

Since the Signzy portal is extremely customizable you can choose from the arsenal of APIs and other resources. This will help you avoid unnecessary roadblocks. The No-Code AI rule engine that we deploy makes integration and access easy and efficient. Signzy can make your verification processes seamless while maintaining the best security you can obtain.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.