As society and businesses move online, an identity check has evolved to digitally verify a candidate’s name, date of birth, address, and Nationality. However, digital verification is a must if you want to run a profitable organization, reduce fraud, stay compliant with international regulations and reduce the manual effort involved in physical verification.

Digital verification supports multiple technologies like Image rectification, Blurriness detection, and Optical Character Recognition. These technologies will automate the identity verification process, making it reliable and time-efficient.

But with the changing business behavior and behavior, how do you know that you are ready for what the future holds? This guide will cover almost everything about digital identity and related topics. In addition, we will be examining the current and emerging technology for online identity verification.

What is Digital Identity Verification, and Why is It Necessary?

Digital identity verification is a process that validates a person’s details and identifies who they are by computer technology. Digital identity is an online identity claimed in cyberspace by an individual, organization, or electronic device.

In simple words, digital identity is the body of information about an individual that exists online.

Through unique patterns, each identifier makes it possible to identify individuals. Initially, a digital identity arises from personal information on the web, and it may be the Pseudonymous profile linked to the device’s IP address.

Why Has Digital Identity Verification Become Necessary?

As technology helps us perform various complex tasks, cybersecurity threats also can’t be overlooked. Unfortunately, however, many people have their identities compromised. And cybercriminals are always on the hunt for frail networks.

That means loopholes will be created in the complete identity management system that can be fatal for any organization. Organizations have to face millions of financial losses only because of the increase of identity thefts.

That’s why the more robust line of defense in the form of digital identity verification is becoming necessary.

Rise of Digital Identity Verification

In the mindset of the social alarm created by the Coronavirus, many efforts are focused on regaining stability. However, since March 2020, we all have been asked to change our habits in most circumstances like everything has to be done without leaving home.

From watching movies to banking, everything should be done remotely. With the rise of digital transactions, there is a positive impact in the world of banking. However, digital transactions open up various advantages and opportunities for users.

But it also has some risks that did not exist before. That’s why digital banking requires a lot of security and trust between banks and consumers. For example, while interacting with new customers, banks need to know whether the customer is who they say they are.

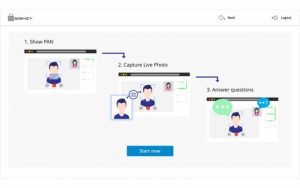

In that case, Banks conduct a Know your customer process to ensure that the individual is not a fraudster. Therefore, during the customer onboarding process, the online real-time identification of an individual’s identity through digital identity verification is also a must.

Recently, the Fintech company allowed their customers to transfer money through an online app; as a result, their shares rise to 13% on the first day, and its market value reached up to $7.8 billion.

Below, we will show you some points that will clarify the concept of digital identity verification evolution.

- Rising Trend in the use of Digital Identity

Identity verification is a critical issue in many companies that need to comply with KYC regulations during the personal onboarding process. Many financial institutions are turning to digital identity verification to safely and securely onboard remote customers.

About 85% of BFSI companies have already started the digitization process and provided digital account opening. However, the budget allocated to the digital account opening has almost doubled the size before the current pandemic.

After the COVID-19, many Financial institutions partially started digitizing the customer verification process. For example, an individual has to initiate a loan application online and then finalize it with an in-person visit to show their online identity.

- Strong Security, Privacy and Compliance Requirements

The customers want to open a bank account with minimal friction. In addition, they want to feel secure that the right level of security is in place to protect their identity.

Therefore, digital verification must consider anti-fraud, all security, and data privacy with the security of customers’ data. Anyone aiming to digitize an account opening process will be well aware of many requirements that need to be met.

- Some Financial Institutions have a Solid Competitive Advantage in Enabling Digital Identity Verification by Adapting to New Customer needs

The digitally-enabled financial institutions whose employees work from home best fit social distancing and online financial services. The banks with a mature digitalization channel are on the success line, while others have to kick start their digitization program from starting.

- Digital Transaction Volume Increases, But so do Fraudsters and Cyber-Attacks

Fraudsters are also taking advantage of the insecure online transactions during COVID-19. When the WHO declared the pandemic, there was an apparent rise in the loan fraud attacks and took the form of first-application fraud, third-party application, and synthetic identity fraud.

That’s why financial institutions are incredibly vigilant in their onboarding and digital identification process to detect and prevent application fraud.

How Does OCR Work for Identity Verification?

The manual job of feeding the data needs to be automated to improve the process of identity verification. In that case, OCR (Optical Character Recognition) converts all the information on an ID into text for input and information validation.

First, the digital identity will be scanned, then analyzed, and finally translated into the character codes. Further, you can use this machine-encoded text to validate the information against a genuine verification source.

It will help you verify National IDs containing numbers, addresses, names, and various other parameters.

Benefits of Using OCR Technology for Identity Verification

Here, we will walk through some of the benefits of using OCR technology for digital identity verification.

- Time-efficient: OCR will eliminate the need to enter details on every form or HR portal manually.

- Cost-efficient: It will reduce manual labor for document sorting and filing, thus saving delivery and raw material used for physical verification.

- High accuracy and improved service: OCR ensures that the employees only access accurate and reliable information whenever needed.

- Storage space and data security: You can store the data inputted through OCR on servers that reduce the cost of maintaining the physical files.

How Does Signzy Add Value to Your Digital Identity Verification Process?

The benefit of partnering with Signzy for Banks and other financial institutions is that our combination of Artificial intelligence and blockchain will ensure that digital compliance is convenient but secure.

Our solution is trained for document reading and facial recognition accurately representing an individual’s personal details. Our scalable backend operations help businesses to scale faster, cut turnaround time and reduce cost.

Our data protection infrastructure can identify different types of IDs to input correct details and generate accurate and reliable results.

Wrapping Up

The organizations that haven’t yet indulged in the digital identity verification process gradually lose their customers. However, the evolution of OCR technology for digital identity verification benefited many financial institutions in time and cost efficiency, providing high accuracy and improved service.

About Signzy

Signzy is a market-leading platform that is redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering totally customizable workflows. It gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling 10 million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a strong global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and it has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.