Future Of Corporate Banking Automation- How Traditional Titans Can Take On Digital Startups

Introduction

There was a time when Digital Startups in the US struggled to keep up with the highly resourceful Titans in Banking. But times have changed and the Davids in the industry now pose an imminent challenge to the Goliaths. One might ask how the underfunded neo-banks and startups are able to do this. The answer lies in the core essence of any business, they understand what the customer needs and aren’t opposed to banking transformation advancing technology.

Of course, there is no doubt that these little innovators are definitely not in the leagues of big banks like JPMorgan Chase & Co. or Bank of America Corp. But their maximal utilization of minimal resources makes them highly efficient. Thus their growth through the decade is evident.

As of February 2020, a total of 8775 Fintech Startups are functioning in the US. The calculated CAGR of 8.6% will continue to remain the same or close until 2024. A study reported an estimated US $880 Billion total transaction value in the digital payment space alone.

The smaller players are using their instruments to increase their value in the market. They very well know how banking transformation will help them achieve their ambitions. But we need to take a closer look at how they are using the low hanging fruits of retail banking to make their marks in the corporate banking industry.

Process Automation in US Corporate Banking

Corporate banking or business banking serves a spectrum of clientele, ranging from small and mid-sized businesses to giant conglomerates with billions in turnover. The difference between Corporate Banking and Investment Banking lies in the fact that the former is associated with financial operations and business goals while the latter is associated with raising capital for investments. It was differentiated from investment banking after the Glass-Steagall Act of 1933 but was repealed in the 1990s. Now both services are provided by multiple banks.

Corporate Banking brings in huge numbers as it is one of the key profit centers in the industry. This does come at a cost as the largest originator of loans renders it as a source of numerous write-downs for soured loans. They provide multiple services to financial institutions and corporations. Some of them include:

- Credit products including loans

- Cash management and treasury services

- Equipment utilization and lending

- Commercial real estate

- Financial services for trades

- Employer-Employee services

With specialized branches for investment banking, they provide services to corporate clients for securities underwriting and asset management.

Traditionally the corporate banking industry had been dominated by the old and major banks in the US. This includes banks like JPMorgan Chase & Co., Wells Fargo & Co., Goldman Sachs Group Inc., etc. But in recent times niche-specific fintech startups are on the rise and soon enough will constitute a major portion of the market. This is because of their tactical use of technology. With banking transformation, They are automating all the unnecessary manual interventions.

Automation in Banking is the system of utilizing technology to operate banking processes through highly automatic means rendering human intervention to a minimum. To have a thorough idea of the fundamentals of the topic, check out our blog post on Automation in banking.

Most titan banks have advanced from traditional automation processes to RPA methods. But even the age of RPA is over and it is time to adapt to the new norm- Artificial Intelligence(AI). With Machine Learning(ML) and additional advancements in the field, the banks have a long way to look forward to.

How Are The Traditional Banks Using Automation?

Most banks in this segment have been in the industry for decades or even centuries. Some of them like JPMorgan Chase & Co. and Capital One Financial Corp. adapt well to banking transformation. But most of them are too late to the game. Till the 21st century, their established presence in the country alone would have substantiated their dominance. Now, the playing field is changing with the incursion of the internet and digitizations they need to up their game.

It is also noteworthy that most top tier banks won’t be affected to a destructive level due to their enormous presence in the industry. But the ones just below them, who still stick to the traditional methods will be stricken.

The generic provisions of online banking, credit cards, and others. are no longer a luxury for the customer, but a necessity. Now the banks must provide more options to the customer. These include e-wallet payments, digital availing of loans, etc. In 2018 Statista.com reported 61% of Americans use digital banking. They expected it to rise above 65% by 2022. They also reported that 66.7% of all bank executives expected Fintechs to impact e-wallets and mobile payment methods, globally. Where the giant banks stand in this advancing fintech market is yet not definite.

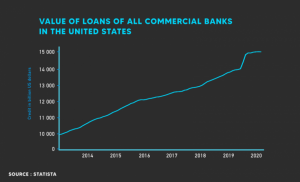

People look for ease of access in areas like lending and loan applications. Even without advanced automation, the numbers are high.

Some important facts about the adoption of automation for the traditional banks include:

- With a massive presence in almost all states, the giant banks have too much manpower and machinery. Most of them have over 100,000 employees to handle day to day transactions. Some Automation with a central database and RPA help lighten the load a little, but this certainly is an area of improvement.

- Millennial customers are not keen on doing business with giant banks as the experience is not always smooth and easy. Unfortunately, most banks ignore the millennials due to their current low market involvement. But in 30–40 years time, they will be the inheritors of trillions of dollars. For that future securement, smart bankers must think now.

- Individuals and businesses now prefer mobile-only banking over standing in a queue. This is an area where digitization is the only solution.

- The fact that most banks are well established comes with an additional issue of maintenance. BAI(Bank Administration Institute) reported banks overpay 15–20% for real estate on an average compared to other retailers. Over a long period of time that amounts to a huge amount. This could be reduced if banks were to go remote.

- Apart from the conventional facilities offered these banks do not have many attractive features for the customer. Even the rewards provided through credit cards are minimal.

- The boon for giant banks is their all-encompassing nature. They are present in all spheres of financial transactions. Unfortunately, this leaves them little room to focus on specific areas. Most of the time this renders them to be all over the place.

What Gives The Fintech Startups An Edge In Corporate Banking Automation?

Previously the startup industry was mostly located in Silicon Valley. Lately, this has changed and fintech startups are booming all across the country. These startups adapt to technology through automation and digitization. Some of the way they use it to provide services to their customers include:

- Unlike major banks, the fintech startups are primarily focused on a specific area of banking or finance. For example, Blend focuses on lending and loan sanctions for small business owners. This gives them breathing space to improve their service in that sector.

- Since they have limited manpower, they use automation for repetitive tasks and processes. This makes the transactions swift and free of human error.

- Since they have mostly remote accessibility and faster response they provide a better customer experience. Much time, effort, and funding is spent on making the user experience good.

- They focus on millennial customers and entrepreneurs. The services are calibrated to entertain millennials as in the long run they know a loyal customer base from that generation will pay off.

- The millennial population in the US will have more than 78% digital banking users by 2022. Fintech startups acknowledge this, embracing mobile-only banking, and are constantly trying to up their ease of access. Chime and Varo are good examples of successful startups in this sector.

- Most of these startups reduce human interaction and use ML and AI technologies for processing and improvement. To avoid a detachment from comfort for the customers, Some of them go to the extent of making their offices feel like cafes instead of formal buildings. The approach encourages a more casual experience in banking than a formal one. This psychological move has a positive impact on people’s emotions since it removes general stigmas.

- Easy access to loans as much of the bureaucracy involved is cut down with automation.

- Startups like Brex that offer credit cards are on the rise as their rewards systems favor the users much more than other banks’. Even with high debt regret, most users avail credit cards from these providers for their attractive rewards.

- Innovative ideas are encouraged as startups are not impeded by bureaucracy. Forwards Financing’s practice of lending money to startups and using their own technology to give access on the same day to the funds is a brilliant move. It attracts most startup owners for quick fund access.

- Some of the startups are venturing into uncharted territories like the equity markets and even major Wall Street scenarios. Robinhood and Acorn are good examples.

How Can The Giant Banks ace the game with banking transformation?

The competition has moved beyond basic automation and RPA. Now the banks should focus on newer technology like AI and ML. Better procedures for onboarding and corporate transactions can be done efficiently with automation.

Specifically, the banks should expand their target audience to include the newer generations. Millennials along with Generation Zs will form the majority of the customer base within the next few decades. Learn from the startups on how to provide them with a better experience. Additional services and features will help. The startup Varo provides no-fee transactions and spending habit trackers to their customers along with other bank services. Banks should take note and bring to life such innovative ideas.

As mentioned in the beginning, top tier giants are less likely to be affected, but the banks that fall after the top ten should tread with caution. This is evident as many giants do take some sort of technology adoption to further their market. For example, the top 7 banks in the USA (JPMorgan Chase, PNC Bank, U.S. Bank, Bank of America, BB&T, Capital One, and Wells Fargo) came up with the app, ‘Zelle’. It’s an exclusive digital payments network for these banks.

Capital One also took a step to remove the formal feeling of visiting a bank with a more laid-back type of ambiance by setting up their offices like cafes.

But these initiatives are exclusive to the elite titans. The lesser giants will have to fend for themselves. As most startups pose a competition for them, it is only sensible to collaborate with international companies for digitization and automation. The expenses will be reduced while getting dependable manpower for set up.

Conclusion

In essence, the financial market is more competitive than a couple of decades ago. With emerging technology and even more innovative ideas, traditional methods must be upgraded. With AI expected to power 95% of customer interactions in the coming decade, the banks need to act fast.

Even in the Stock Market Robo- Advisors intend on managing more than $2 trillion in assets in the coming year. Thus all-encompassing banks require to adopt the new methods. If they don’t, in the coming 30–40 years will be the diminishing of their lights. But this is the time to act. Including new partners from overseas and implementing new ideas will help the giant banks to fly high. While the concept of banking transformation has, both, pros and cons, moving forward automation is the way forward for US corporate banks in the years to come.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.