Blooming Blockchain- How It Can Help You KYC Faster, Safer, And Better

Does $10 billion seem like a boatload of money to you? According to Compliance Week, financial institutions across the globe were charged $10.4 billion as KYC and AML fines in 2020. Adjusted to inflation, that’s nearly half the revenue of the entire Hollywood in 2020. That’s wasted money that could have been saved.

Know Your Customer(KYC) processes form the spine of financial institutions’ safety. It primarily encompasses their Anti-Money Laundering (AML) efforts. Traditionally they have always been tiresome and time-consuming. Even after, they were not issues-free, and they were not unhackable. The processes are inefficient and labor-intensive. The risk of error is also pretty high. 80% of efforts go for information collation and processing, whereas the rest 20% is only spent on assessing and monitoring.

Let’s have a look at how we can change this.

How Traditional KYC IS Falling Short

Customers dread KYC. For them, it serves no purpose other than to increase the activation energy required for CTA. Traditional KYC is out of the question as it:

- Is manual and prone to human errors

- Tiresome and time-consuming

- Heavily dependent on physical attributes like space, storage, etc.

Digital KYC was the solution some years ago. They had:

- AI-based processing that reduced errors

- Quick TAT

- Server storage

- Better user experience

Many institutions shifted to Digital KYC with advanced Video KYC as an option. But before that metamorphosis could complete, we got newer and better modes. The digitized is getting digitized. This was primarily due to the shortcomings in safety, security, and universal ease of accessibility for the data and the users. An incompetent digital KYC process also Misidentifies fraudulent data and cannot track the customers for verification.

The era for change is here, and it begins with understanding blockchain technology. Blockchain is versatile and resilient. But above these, it records information as electronic databases in the form of blocks.

Blockchain KYC- The Next generation of KYC Processing

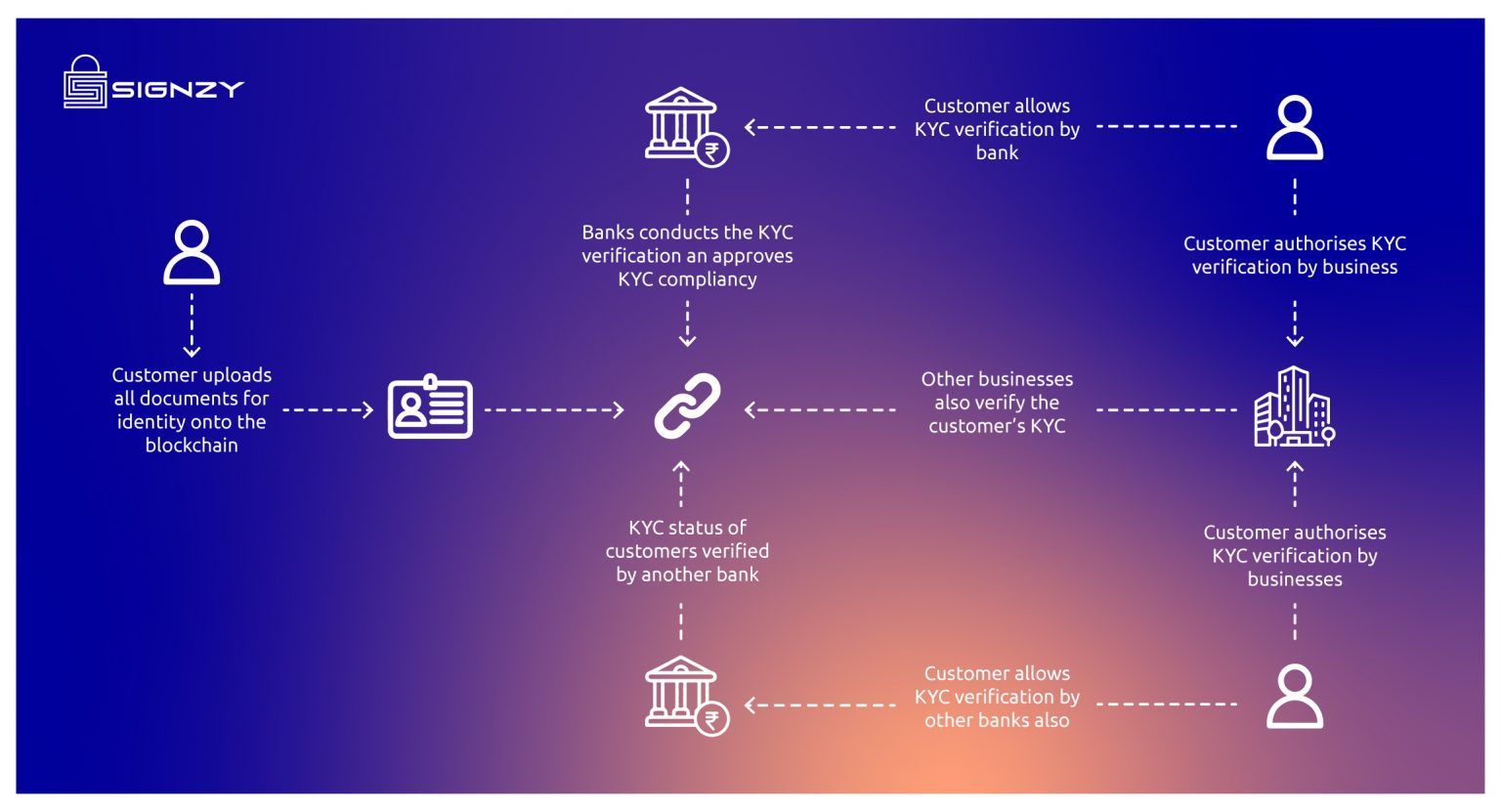

A blockchain is a specifically distributed database shared among the nodes of a digital network. It stores information electronically as a database. Blockchain KYC occurs in multiple stages in a specific Distributed Ledger Technology (DLT).

Stage 1- KYC DLT System

IFI or Initial Financial Institutions ensure users set up their digital identity using valid documents on a Blockchain KYC platform. The data becomes available with consent to institutions for verification. Some of the available options for storage are:

- DLT platform

- FI’s server

- Centralized server

Stage 2- User can transact with FI

The user provides consent. The FI can verify and save the data on the DLT platform using the ‘Hash Function.’ FI delivers digital copies of KYC to the users marked with a Hash Function which matches the DLT platform’s one. This ensures that if the KYC data is changed, it will not correspond with the one on the DLT platform. In addition, it will alert the FIs about the change.

Stage 3- User transacts with Final Financial Institution(FFI)

Users consent to share data with FFI, and the KYC is performed. Then, FFI reviews the data and the respective hash function with the ones IFI uploaded. If both match, FFI finalizes the data as valid.

The Benefits of Blockchain KYC

- Quality data with real-time monitoring and tracking.

- Lower TAT- FIs have direct access to data without collation.

- It eliminates paperwork

- Decentralized, distributed data collection

- Mandatory consent ensures safety for the user’s data.

- Reduced expenses due to unhackable security and fortified operational efficiency.

- Accurate information validation with DLT

- Real-time user data appraisal- blockchain technology updates the FI of any new addition of user data.

The Culmination of Blockchain Technology and KYC

Collating user data and processing is expensive and time-consuming. But it has always been a mandatory part of any KYC process. But now, this has changed.

Blockchain not only provides an alternative for this but also helps enterprises monitor and assess user behavior. It saves time from tedious, laborious tasks of data accumulation and processing. It uses this time for the companies to focus on finding solutions for more creative KYC challenges.

It is important to note that Blockchain Technology is not magic and hence not the answer to all problems in KYC. It mainly helps in data collation. The validation process still is an unavoidable task.

Blockchain coupled with AI and cognitive processing technologies helps resolve this. They will create a synergistic and efficient system. However, it is hard to find the right solutions for your enterprise in such a saturated market. Signzy offers state-of-the-art resources and solutions for all your fintech needs. Ranging from onboarding to KYC, we have customizable solutions powered by AI decision engines to get you the best in the industry.

About Signzy

Signzy is a market-leading platform that is redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering totally customizable workflows. It gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling 10 million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a strong global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and it has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.

References

- https://www.ibm.com/topics/what-is-blockchain

- https://www.tcs.com/reimagining-kyc-using-blockchain-technology

- https://www.devteam.space/blog/why-is-blockchain-a-good-solution-for-kyc-verification/

- https://www.google.com/url?q=https://www.nasdaq.com/articles/how-blockchain-can-help-upgrade-kyc-processes-2021-05-05&sa=D&source=editors&ust=1647470656416508&usg=AOvVaw3pvoMfosOaumL2BRbjlDq-

- https://appinventiv.com/blog/use-blockchain-technology-for-kyc/

- https://www.investopedia.com/terms/b/blockchain.asp