Cars, Loans, and Technology- How APIs Help In Vehicle Financing

August 17, 2021

5 minutes read

In 2018 India had a sale of more than 3.3 million passenger cars making it the 5th biggest car market in the world. Lion’s share of this was financed or bought on loans(Vehicle Financing) which amounted to more than 2.6 million vehicles. Since then the annual car loan market has stayed north of Rs.1.25 trillion in value in the country.

It is time the Financing industry took up the mantle and utilized this ecosystem. It will be a win-win situation for the lenders and the lendee. Unfortunately, it’s far easier on paper than in practicality. With the tremendous demand scalability of loaning is constrained while the threat of fraudsters is also on the high. Thus an easy solution for verifying and onboarding customers is essential for financing entities.

What Are The Challenges In The Vehicle Financing Industry?

With the increasing demand, the industry faces many challenges to resolve. With the plethora of incoming applications, it is cumbersome and time-consuming to process all documents manually. It is not efficient and even borderline whimsical. The TAT for the whole process is a major roadblocker for onboarding. The fact that manual intervention results in numerous human errors also adds to this argument.

As most financing institutions are indulging in scaling their processes, traditional modes of financing and onboarding the customers are not pragmatic. Scalability brings a form of synergic profitability as replicable system is more preferable. Traditional methods lack this.

Additionally, fraudsters, scammers, and illegitimate customers may cook up ways to avail of loans that they otherwise wouldn’t. The advancing technology they are using aids them in this deceit. The only way to halt fraud using technology is to use better technology. In India, many financial institutions are yet to create an environment with technological competence.

In summarizing, the major challenges in the auto-finance industry are:

- The high TAT required

- The inefficiency of in-person verification

- The undeniable human error factor

- The impracticality in Scaling

- Advanced Financial Fraud

How Can We Tackle The Challenges With Technology?

The unprecedented pandemic and the advancements in technology boosted automation in ways we had not experienced before. Even before the pandemic the government and the regulatory authorities saw the trajectory of technology. They have instated regulatory and compliance guidelines for digitizing financing and onboarding processes.

Digitization is the key to smoothening vehicle financing. It helps us get rid of human errors while drastically reducing the TAT for processing. Long queues and waiting lists can be eliminated. Instantaneous processing replaces it with technology.

The Indian car loan market is expected to grow by a dashing 8% by the fiscal year 2026. But this is possible only with all the major players digitizing their processes. A completely digitized system makes massive scalability practical and easy. When each competitor is scaled to a good extent, the industry proliferates.

With adopting digitization, it is easier to store, retain and retrieve data. Almost all information is in the soft copy format. This reduces the capital resources required and storing documents is no longer a headache. If the system is secure, then the data is safer than it is in hard format. This leads to safer transactions as fraud is detected swiftly and necessary measures are taken to stop it. With a good security system, all-digital processing is fortified.

In essence, digitization makes vehicle financing:

- Faster with reduced TAT

- Profitable with easy scalability

- Not prone to human-errors

- Store data as soft copies

- Secure against fraudsters

Why Signzy Is The Right Choice

With the strict competition, almost all financial institutions are making their loaning process easier. This makes it all the more needed to identify and verify the customers availing loans while ensuring all the needed regulatory and safety measures. But the catch is that, how do you fulfill all the criteria of regulations and safety while maintaining an easy journey for each customer? This is what we excel at.

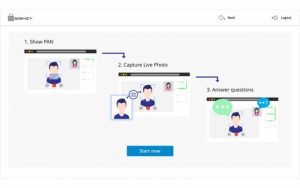

We at Signzy give you customizable APIs and other resources that help you conduct safe and compliant customer onboarding, KYC, and all other requirements you have. Our RC API verifies all vehicular registrations in the country with valid government databases. We will help you onboard customers availing auto-loans with ease and safety while the seamless UI will make the journey all the more engaging. With numerous products, services, and resources in our arsenal, we can make your enterprise better.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.