In a digitally advancing world, the need for automation is more than ever. This is mainly due to tech-savvy fintech and a surge in the demand for personalized user experience. Today, Intelligent Automation holds the power to accelerate growth. This can be done by integrating robots to digitize processes and systems.

What do we mean by Robots?

Robotic Process Automation (RPA) has been widely used by institutions. However, Intelligent Automation (IA) has been gaining the likes of organizations recently. Intelligent automation combines Artificial Intelligence(AI) and Process Automation to create smart workflows and business processes that think, learn and even adapt on their own. It and its modified forms are called Intelligent Process Automation(IPA).

Across financial institutions, IA has already helped companies drive productivity. This has been achieved by processing a range of structured and unstructured data.

However, the thought of shifting the burden of responsibilities to a robot might be an uneasy one. So without any further ado, let us burst the huge bubbles around Intelligent Automation in the financial sector.

Identifying Roadblocks And The Need Of IPA In Finance

Financial institutions deal with a lot of unstructured data from various sources. Manually processing this could be time taking. This also adds to the chances of error accounting to loss of the institution’s time and resources.

- Gartner’s research report on RPA shows that organizations had 80% of their data unstructured. It states how processes that are most suited to RPA have a high transaction throughput of structured digitized data. This comes with relatively fixed processing paths and/or user interfaces. They do not change frequently and are rule-based activities.

- Moreover, the banking experience must be customer-friendly. Providing a hassle-free and quick solution is a must. Leveraging IPA improves the institutions’ productivity. It also makes it customer-centric. This helps banks drive massive success.

- IPA can process even unstructured data. It improves the accuracy & eliminates chances of manual error. It can also help to validate customer requests by accessing emails and other relevant data.

- At the same time, it can process digital signatures and open bank accounts within minutes. It can execute transactions and account transfers and update the customer data into the CRM system.

Revolutionizing Banking and Financial Institutions Using IPA

Let us now see the applications of IPA and how it is transforming the banking and financial institutions.

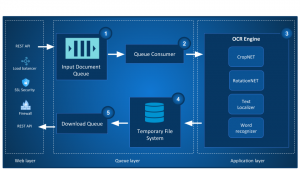

Commercial lending operations: This life cycle starts with onboarding a corporate client. NLP, ML, OCR, and RPA can be leveraged to extract data from structured and unstructured loan documents and automate the entry of client data. This helps in the calculation of risk and loan eligibility. IA in commercial lending operations is a powerful and effective way to reduce costs. Along with this will help in improving controls, quality, and scalability.

Trade operations: Trade operations require multiple systems and high levels of documentation. IA can be used in several stages to extract data from different sources and formats. It also helps in identifying patterns and classifying the extracted data to get optimal results. IA can also be used in monitoring trade activities. Optical Character Recognition (OCR) technologies, as well as Artificial Intelligence (AI) algorithms, provide end-to-end automation of Trade Finance processes. Systems can improve their accuracy and spot red flags optimizing the use of capital. This can be done through supervised and unsupervised learnings,

Regulatory and compliance operations: There are several regulatory and compliance requirements in banking. This leads to high operational efforts, time and cost. Automation tools can be embedded in several processes. For example, data mapping and other labor-intensive processes. IA can be used to pick up KYC customers and automate the data into AML screening solutions. This can significantly reduce the cost and efforts of compliance operations. This will also help institutions overcome the challenges of inconsistency in data. This inconsistency is due to the long process and the chances of human errors. Several documents available in different formats can be collected. These can be further processed using NLP and OCR technologies.

Transaction screening: An ML engine can identify suspicious patterns and automatically remove them. It can also leave an audit trail of every bot decision for compliance reviews. This significantly reduces operational effort. IPA reduces variation in recording data improving consistency and accuracy. At the same time, it can continuously learn and improve quality over time.

Payment operations: Intelligent automation reduces the manual effort to investigate payment issues. ML can be used to identify a pattern in the payment processes of the customers. Issues related to payment processing can be fixed and suspicious transactions can be identified.

Manual labor is required to process and reconcile invoices. It is also needed to purchase orders in multiple formats. These can be simplified.

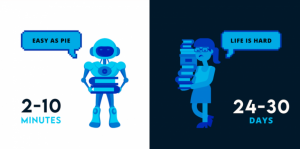

Customer Onboarding: The process of KYC collection and verification can take up to 24–30 days. Embedding IA in workflows speeds up the onboarding process. It brings the turnaround time to 2–10 minutes. Relevant data is extracted from the customer’s documents. Then an extensive background check is done by the system. Advanced analytics also help in assessing the potential risks. This also helps in providing a smooth, hassle-free customer experience.

Extending Support To A Wider Spectrum

IA helps banks and FIs stay competitive. It also helps evolve in terms of customer relationships. The capability of IPA solutions to self-learn based on a given set of rules is what makes it unique. Let us look through some other aspects where IA can extend its support.

Predictive analysis- Technology and several statistical techniques can help institutions. These can collectively make a better prediction about the forthcoming future events. Data mining, machine learning, and predictive modeling can help in analyzing the data. It can also gather facts from the present and the past to make better predictions. Incorporating IA with predictive analysis would ease the processing of the data collected. This will collectively improve automated end-to-end decision-making.

Fraud Detection- IA can prove to be critical for anomaly or fraud detection. IPA is capable of processing even unstructured data. Due to this, gathering transactional or other relevant information related to the identity verification of the user will become much simpler.

This collected data then can do an extensive background check of the said user. Any suspicious or fraudulent activity will be notified to the institution. Automating this process reduces the manual labor and time taken. It also increases the accuracy. It can also be used in online, credit/debit card transactions.

CRM systems- Customer relationship management (CRM) systems are useful tools. They help sales employees stay updated with their customers. Automating the update of the system will save the precious time of employees. It also increases accuracy. Employees working in the sales function can focus on maintaining customer relationships. Unstructured data saved in various formats can be processed using IPA.

Tech support- In a digitally advanced world, simpler customer interaction is a must. IA can help solve simple issues. Ex: password resets. It can also diagnose issues by asking a series of questions. This saves the institution’s time and also improves the overall customer experience. Incorporating such technologies will help address the grievances faster saving manual labor.

Financial reports- Aggregating data for financial reports can be a tedious task. Ex: Data on quarter-end. Gathering, processing data from different sources and formats can be made simple and faster with IA.

Benefits of Applying Intelligent Automation In Finance

IA tools can perform a series of tasks ranging from basic data entry to complex risk analysis. IA tools can also be leveraged for dynamic feedback learning. It is also useful for identifying patterns and detecting anomalies. Institutions can benefit from the application of Intelligent Automation in the following ways-

- Reduction in manual efforts- Incorporation of IA can reduce the manual grunt work. Automation of structured and unstructured data processing reduces the burden on employees. It also eliminates the scope of manual error.

- Increases productivity- Employees can then focus on higher priority tasks. This is because time taking tasks are automated. This will improve both the quality of work as well as the work-life balance of the employees

- Better Customer Experience- IA allows institutions to track the progress of work at every step. This end-to-end audit trail is beneficial in optimizing results, thereby making the customer experience far better.

- Reduced operational costs- Digitization ensures better risk assessment and assists in faster decision-making. The processes are executed efficiently at a higher speed. This creates a great value for resources.

Conclusion

Intelligent Automation can be incorporated into many such labor-intensive processes across various sectors. It can help in identifying the sources of inefficiencies. It also ramps up productivity effectively. Fintech providers are emerging with simpler solutions with applications that improve customer relationships. Implementing IPA will allow institutions to significantly reduce risks and improve decision-making. Manual resources can then be used to work on high-quality optimal tasks.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.