The Life Insurance sector, historically reliant on paper-based processes and face-to-face interactions, is undergoing a transformative shift with the adoption of digital onboarding. This digital evolution not only streamlines the cumbersome enrollment procedures but also caters to the modern customer’s demand for quick, hassle-free experiences.

Life insurance policies play a crucial role in the insurance industry. The Insurance Regulatory & Development Authority Of India (IRDAI) is the regulatory body for all insurance companies in India. IRDAI has now allowed the use of paperless KYC collection or e-KYC. To enable this, the government has allowed insurers to avail the Aadhaar-based authentication services of the Unique Identification Authority of India (UIDAI)

Life Insurance Companies can use KYC For Fraud Prevention

Insurance fraud is a reality in this day and era. Many people who commit such frauds do so without realizing that their actions result in higher premium rates that have to be paid by other people. On average, insurance companies lose around $30 billion every year on account of fraud. The costs of these frauds are levied upon innocent, hard-working people. The necessity for fraud prevention systems in the industry is the need of the hour.

Moreover, the smaller cases are most harmful as they get ignored. After a while, they add up to become a cumbersome amount. Background checks are conducted in the insurance industry as they can single out money launderers, if not the fraudsters. Most people who engage in insurance fraud use fake or stolen identities to execute their schemes. As we proceed with the article, we will point out how KYC services providers can assist the insurance industry.

Frauds Mitigation Through KYC For Insurance

There are many types of frauds that happen with life insurance companies. However, some can be easily avoided by applying secure processes.

Fronting: The insurance policy is taken out using the details of another person to get favorable terms such as lower rates on premiums. Criminals or fraudsters usually use this process to carry out their scams. They use fake or stolen identities to identify themselves as someone else. Then they proceed to create fake documents to support their taken identity. KYC service providers can isolate such attempts and prevent them from happening.

Money Laundering: This is a global problem. Insurance companies too are a common target to launder money. The products offered by insurance companies are easy to target for fraudsters. This is because the processes that are associated with them make it easy for money laundering. Life insurance policies are extremely tempting to money launderers. This is because they allow for heavier premium deposits. Money Launderers take out such policies and deposit large amounts of money while canceling the policies after a while. KYC service providers conduct conclusive background checks. This helps prevent these types of frauds.

The KYC Screening Process

For a productive business, corporates require to deal with the right people with beneficial and favorable intent. Sectors that are particularly in the profession of handling money need to be careful. They must be sure that they are dealing with genuine entities. This is why the life insurance sector has to adhere to KYC norms mandated by their respective regulatory bodies.

As part of the Anti Money Laundering Act, KYC norms help in ensuring that the entity in question has an authentic identity. It is made sure that the source of money is not a shady one. The money would not be used for fostering any criminal activity either.

If we take the life insurance industry as an example, insurance companies deal with three entities-

- the insured party

- policy taker

- agent.

All these entities need to be KYC screened.

Insured party — this is the entity on which the insurance policy is being taken making it imperative to be checked for authenticity. There have been instances when insurance policies have been taken on non-existent or fake identities or on persons who no longer exist. There also have been times when the policy is taken by tweaking a few pertinent details of an individual. The goal of KYC screening is to avoid such a situation.

Policy taker- the entity who is taking a policy should be eligible for taking such insurance. This is the rationale behind screening policy takers.

The insured party and the policy taker are screened with the same method. Their identity proofs are examined for authenticity and the specified address is examined by paying a site visit.

Agent- Insurance companies depend on agents to generate business. An agent is the one who markets the insurance products to individual customers. Agents also educate customers about various products and help them choose the most suitable one. Subsequently, they are also expected to provide all sorts of assistance in taking the policy, paying the premium, and receiving the insured amount when required. Given this significant role, insurance companies are extra cautious about their appointment of agents.

Drawback Of The Current KYC Process

Multiple insurance companies struggle to deliver digital experiences. This is because legacy applications are the most common obstacle for digital transformation. Onboarding a customer in lesser time with due diligence is a challenge.

The existing onboarding process for most insurance companies is similar to the following:

- Customer lands on company website

- Selects insurance type and plan

- Fills-in Occupation, income details, and PAN details as (ID proof).

- Life-cover details: pre-filled form

- Basic Info: partially filled form

- Customer Identity undergoes verification

- Customer must enter Lifestyle-associated details

- The customer fills the Nominee details

With digital KYC, the following areas can be addressed for a smoother customer experience::

- Form filling is smooth

- Liveliness check ensures more sanity

- Telemedical video conference eliminates back and forth.

Digital Onboarding — Need For Digitization In Life Insurance

- Industry analysts and large consulting firms claim onboarding is a top priority for digital transformation efforts across the insurance industry. After all, bad onboarding can increase customer attrition rates by between 25 and 40 percent, according to The Financial Brand.

- Industry analyst firm Celent emphasized the need to focus transformation efforts on onboarding. In its November 2018 report, it also talks about industry trends for wealth management firms.

- In a study by Bain & Company, customers who use digital channels tend to be loyal to their banks. Digital banking customers tend to own more products, and they transact and engage more with their banks. Mobile-first customers contribute to higher loyalty scores to their primary bank. This in comparison to the clients with low digital behavior. Globally, it is 50% higher approximately.

- As noted by Argo executives at the InsureTech Connect conference in October 2018: “Customer acquisition is just the beginning. How you deliver value to customers — that’s the real benefit to them in this ecosystem. We’re trying to create a better experience for everyone we engage.” That means a better onboarding experience.

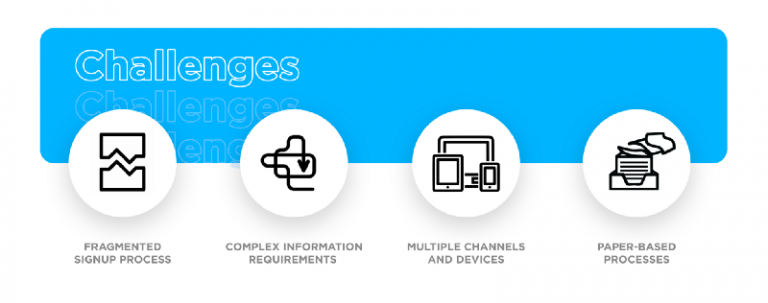

Major Challenges in The Life Insurance Onboarding Process

Fragmented signup process — There may be some customers who are unable to complete the signup process in just one session. Ideally, the onboarding process should track progress and let them stop. The process can later restart onboarding effortlessly, from where they left off.

Complex information requirements — Several industries have complicated data requirements and strict compliance regulations. Instances can be financial services, healthcare, and government. State or regional rules frequently oversee the information that needs to be gathered as well as the format. In general, customers have to sift through forms with irrelevant questions. This leads to a struggle to comprehend the exact requirement from them. This often results in high NIGO (not in good order) scores.

Multiple channels and devices — It is possible for customers to choose to onboard across multiple devices, or even via a call center. However, the experience is often inconsistent. Enterprises must provide clients with an integrated and seamless experience on each channel.

Paper-based processes — Many business processes require customers to complete and sign paper forms. They can either scan and fax or even worse, mail them back. No one enjoys this tedious and time-consuming effort, either externally or internally.

IRDAI Existing Guidelines For Life Insurance

- Every insurer in the life insurance business must provide customized benefit illustrations to proposers or policyholders at the point of sale for all products. The exception can be to those issued under IRDAI (Micro Insurance) Regulations, 2015, Guidelines on Point of Sales (POS) — Life Insurance Products, 2016, and IRDAI (Insurance services by Common Service Centres) Regulations, 2019 as amended over time.

- Such benefit illustration shall have to be signed by the prospective policyholder as well as the insurance agent. The signatories may also include the authorized person of an intermediary. Another alternative can be to include the insurer involved in the sales process, as the case may be, This should form part of the policy document.

- Further, the benefit illustrations should be constructed as per the specific format prescribed by the IRDAI. The circular contains annexures specifying formats for these illustrations. These apply to different types of policies.

Need For Digital KYC — New Guidelines By IRDAI

Life insurance policy buyers will soon be able to complete KYC through a paperless process or e-KYC. This requires providing Aadhaar number as proof of identity to insurers, as per an IRDAI press release. This would make the Know Your Customer (KYC) process much easier for policy buyers.

This e-KYC will also be very useful in the current lockdown in the country. The government has allowed insurers to avail the Aadhaar-based authentication services of UIDAI. This can fulfill the KYC norms of policyholders.

The IRDAI press release, issued on April 24, 2020, mentions new KYC norms while availing insurance services. These norms will facilitate the general public to easily fulfill.

The release further states that the interested customers/policyholders/claimants may avail paperless KYC services in the coming days from the following insurance companies:

List Of Insurance Companies

- Bajaj Allianz Life Insurance Company Limited

- Bharti AXA Life Insurance Company Limited

- Exide Life Insurance Company Limited

- HDFC Life Insurance Company Limited

- ICICI Prudential Life InsuranceCompany Limited

- India First Life InsuranceCompany Limited

- Max Life Insurance Company Limited

- PNB Metlife India Insurance Company Limited

- SBI Life Insurance Company Limited

- Future Generali India Life Insurance Company Limited

- Reliance Nippon Life Insurance Company Limited

- Aegon Life Insurance Company Limited

- Shriram Life InsuranceCompany Limited

- Aditya Birla Sun Life Insurance Company Limited

- Pramerica Life Insurance Company Limited

- Kotak Mahindra Life Insurance Company Limited

- Star Union Dai-ichi Life Insurance Company Limited

- IDBI Federal Life Insurance Company Limited

- Edelweiss Tokio Life Insurance Company Limited

- Canara HSBC Oriental Bank of Commerce Life Insurance Company Limited

- Kotak Mahindra General Insurance Company Limited

- Future Generali India Insurance Company Limited

- Manipal Cigna Health Insurance Company Limited

- ACKO General Insurance Limited

- Religare Health InsuranceCompany Limited

- Royal Sundaram General InsuranceCompany Limited

- SBI General InsuranceCompany Limited

- HDFC Ergo General Insurance Company Limited

- HDFC ERGO Health Insurance Limited (Formerly Apollo Munich Health Insurance Company Limited

KYC For Agent Assistance — How Digital KYC Helps

Agents are the fundamental constituents and the first step of the customer towards the onboarding journey. Insurance agents introduce customers to the various products on offer by a life insurance company. They also clear doubts and confusions of the customer and in many cases, collect the KYC for a new customer.

Given below are some highlights on why digital KYC can help insurance agents:

Client identification

The first step which involves identifying the correct name of the entity is a bigger challenge than most people would expect. A significant amount of time is wasted when front office staff or partners provide compliance with details, but of the wrong legal entity.

A common example is a deficiency of understanding in the front end around corporate structures. When a sales rep embarks on a new relationship with an entity, it’s easy for them to use the wrong name. It is very frequent for the holding company to not have the same name as the brand or branch with whom you are engaged in communication.

Initial risk assessment

This is a preliminary setup using customer-provided demographics to assign an initial risk rating, such as high, medium, or low. Such information can contain :

– director and shareholder details

– company incorporation documents

– a basic risk screen to identify major red flags, like sanctions.

Based on the top-level information provided on the client, it is easy to assess the level of risk they can inflict on your organization. However, not all customers will be high risk. With digital KYC, there is no need to dedicate time and resources to performing unnecessary due diligence steps which makes for an inefficient process.

Manual verification

Manual verification is a part of most traditional KYC processing workflows. They are multiple scenarios in which these aren’t the most efficient. Several agents have to go through several documents, make sure the information is correct and check for fraud. Humans aren’t anywhere close to being as fast as computers. Automating this process can mean a lot of time and money saved for the company, a higher rate of onboarding, and better employee satisfaction. Digital KYC can thus help remove the cost and time involved without any additional requirements from the agent side.

Authenticity of Agent

The primary channel through which insurance is sold in India is with the insurance agents. To increase the numbers for sales, agents may end up selling the wrong products to the clients. In such cases, agents do not provide complete information to the customers. This ultimately leads to customers who don’t get the best product. The consequence is a poor customer experience which is a loss for the industry. With Digital KYC, the insurance information can be identified. These cases can then be isolated to prevent further misuse by agents in the future.

Innovating Life Insurance with Digital Onboarding

For easier onboarding, Signzy has developed 2 unique Digital KYC solutions — RealKYC & VideoKYC.

With RealKYC, remote onboarding of new insurers is no longer a hassle. There are many benefits to RealKYC in the life insurance sector as follows:

- Zero Paperwork: With RealKYC, customers can easily upload their KYC documents and IDs to the system. No need for making physical copies for manual submission.

- Policy In Minutes: With RealKYC, customers no longer need to wait endlessly for the verification process to be completed. Get your life insurance policy active within minutes.

- Easy Form Filling: Real-time data pre-population to eliminate manual form filling for submission of new claims.

VideoKYC has gained a lot of attention recently and has been the winner of multiple awards and accolades. With VideoKYC, you can get the following advantages:

- Proof Of Life: With real-time in-person verification, insurance companies can easily establish ‘proof of life’ of the insurer from time to time.

- Lesser chances of claims fraud: VideoKYC uses a host of Signzy’s proprietary APIs to verify all official documents and financial statements to mitigate potential claim frauds.

Conclusion

The fact that Digital KYC can be used for fraud prevention and to build trust is evident. Along with this, proper implementation will create a reliable and better onboarding process for the customers and the companies. This can be a boon for the Insurance Sector in India.

The operative word here is ‘proper’. Such an innovative idea demands excellent execution. That can be achieved by collaborating with credible associate companies and startups. If the insurance companies acknowledge this and process it, they will thrive in the booming Indian insurance sector.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Reach us at www.signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.