Fintech APIs

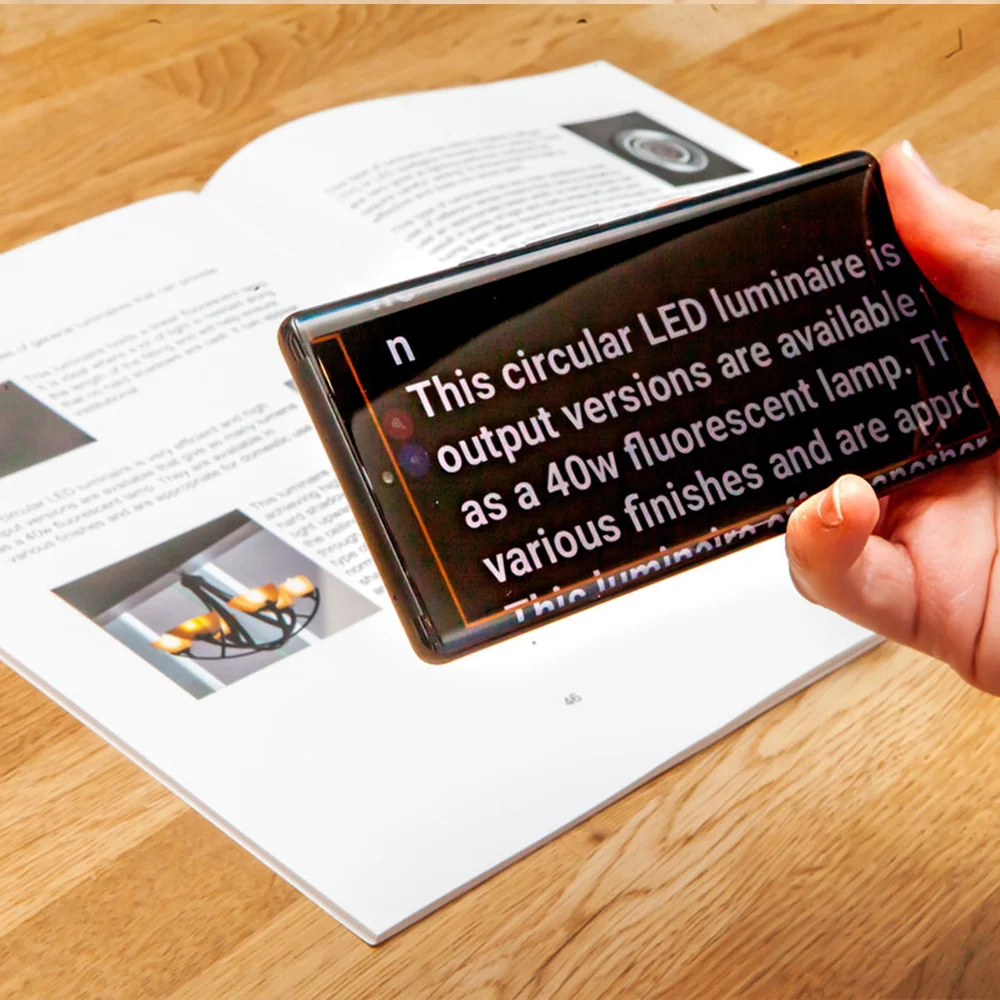

Optical Character Recognition API

Signzy’s Optical Character Recognition API helps you scan and extract data from OVDs and other documents with reliability and ease. The retrieved data can be cross-checked and will help you determine the legitimacy of the customer while preventing any fraudulent activities.

Most advisory institutions advise using online OCR API systems to verify their customers’ credibility. All we require for this process are the documents to be scanned.

Use Cases of the API

USPs of the API

Error-free data extraction and form filling

Swift processing with reduced TAT

Seamless Usage Dependable Process

Benefits

Easy to Use

Signzy's OCR API is optimised for the best user experience. It is simple and effortless.

Stop Fraudsters

With prime precision, our API will detect fraudsters who try to use fake OVDs or other documents. We will ensure your safety.

Reliable Verification

The system extracts the data using our state of the art AI-decision engine which verifies all the information provided are legit and accurate.

Real-time Verification

The data is retrieved (and verified) within a matter of seconds saving you time and effort.

How to Verify?

Extracting and Verifying OVD and other Documents’ Details have never been easier. Following are the steps:

Once you receive the link to the inquiry form, access it and fill in your details.

After this, the OCR API is to be integrated.

Provide the scanned copy or photo of the document to be verified.

The API uses an AI-based decision engine to extract the relevant data from the image. You can retrieve this data.

FAQ