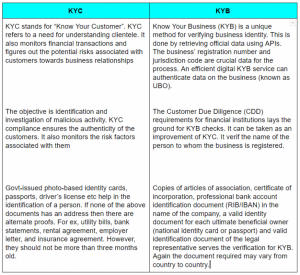

Know Your Business (KYB) process is not so different from the most widely known and standardized Know Your Customer (KYC) process. The difference lies in the purpose and intentionality of the process. The focus is on identifying companies and suppliers in the first case. It changes to consumers or customers in the second one.

KYB (Know Your Business) process shares all the features we have seen in defining KYC processes. The difference lies in the user to identify. In the standard process, potential clients or users are identified to register them in a company. KYB process involves identifying the person responsible or legal representative of a business.

Most B2B (Business-to-Business) companies need to carry out due diligence to identify the businesses they work with. This is to fight money laundering and other tax crimes. It also ensures that they work with organizations with security and guarantees. Even so, in the great majority of occasions, as in the financial sector, it is a mandatory requirement of legal compliance.

For example, companies that offer professional services to other companies must establish KYB. This is to identify the legal representatives of these businesses. It also verifies their connection with the client company.

As with the KYC process, digital solutions in KYB help

– reduce costs

– eliminate bureaucracy

– develop control methods that are safer and more reliable than traditional methods.

KYC To KYB — How One Led To The Other

The US Banking Act of 1970, laid the foundation for the Anti Money laundering (AML) regulations. Customer Due Diligence (CDD) was deemed essential to the financial sector. The term assigned to CDD at the earlier stages was Know Your Customer or KYC.

However, in June 2016, a loophole was found in KYC compliance regulations in the US. These regulations ensured the identity of the customers while assesing the risk factors associated with them. The loophole is that financial institutes weren’t required to identify or verify the stakeholders and beneficiaries of the businesses and entities they are serving. This meant that legitimate firms could unknowingly shelter bad entities or shell companies. These entities could perform illegal and high-value transactions on their behalf. To verify the identity of businesses, the need for KYB was born.

Talking About KYB Terminology

Ultimate Beneficial Owner | UBO

A UBO or Ultimate Beneficial Owner denotes the person or entity that is the ultimate beneficiary of an organization that initiates a transaction. A UBO of a legal entity is a person who possesses:

An interest of at least 25% capital of the business.

At least 25% voting rights at the common meeting of shareholders

A minimum receipt of 25% of said organization’s capital as a beneficiary

Customer Due Diligence | CDD

Customer Due Diligence is a KYC process. It involves conducting background checks on clients. This helps in risk mitigation before further dealings. Business relationship risks may root from many factors in the finance factor. These may have financial crime, creditworthiness and inefficient AML/CFT policies.

Enhanced Due Diligence | EDD

Enhanced Due Diligence is a KYB process having a greater level of scrutiny of potential business partnerships. It also highlights risks that evade Customer Due Diligence.

Simplified Due Diligence | SDD

This is the simplest level of due diligence that can be carried out on a customer. This is appropriate where there is nil to moderate risk of money laundering or terrorist financing. Under such criteria, products and services fall into simplified due diligence criteria. The only requirement is to identify your customer.

AMLD5 Guidelines — Role In KYB Compliance

Recently, two major regulatory global directives were updated. These are the 2nd Payment Services Directive (PSD2) and the Fifth Anti-Money Laundering Directive (AMLD5). The PSD2 requires financial institutions to share data with other institutions. This can be done through the use of APIs (Application Programming Interfaces). On the other hand, AMLD5 compels financial businesses to keep checks on personal information online.

Some key takeaways of AMLD5 –

Obliged entities should assess the information available in KYB records. Then they can proceed with the data process to mitigate any gaps in the Ultimate Beneficial Ownership (UBO) data. There may be gaps or new requirements to obtain information. KYB periodic reviews can be used to obtain or confirm existing beneficial ownership information. This way, the necessary information is available for updating relevant beneficial ownership registers.

The following are the requirements for a robust KYB process:

1. Collect information on the customer, UBOs and intended nature of the business relationship.

2. Gather data on the source of funds and wealth of the customer and UBOs. The reasons for the intended or performed transactions can also be procured.

3. Gain consent of senior management for establishing or continuing the business relationship.

Need For KYB In Businesses

KYB checks are most relevant in the context of AML compliance currently. In India, the major reason for introducing KYB is fraud. Despite advancements in KYC, frauds at the organizational level continue to occur in India. Here are some examples:

Money Laundering Through Shell Companies

A common method of money laundering is through the establishment of fake companies. These are also called shell companies. Most of these appear compliant with the Government of India. However, these companies do not really exist. Shell companies sell no goods or services. They exist only on paper, not in reality.

In a recent crackdown on Chinese companies in India, the Income Tax Department conducted a series of search operations. A scant number of Chinese individuals and their Indian counterparts were found. They were engaged in money laundering and hawala transactions through shell entities. Above 40 bank accounts were created in various dummy entities. These were used in the transactions of over Rs 1,000 crore. With KYB, these shell companies could have been easily investigated and identified faster.

Chit Fund Scams

In India, chit fund scams go back to several decades. In such cases, a registered organization looks authentic. But it mainly just cheats people with lucrative offers. The customers end up providing money. Then the company disappears without a trace.

In Himachal Pradesh, a recent scam was run under the name of Sarv Manglam Cooperative Society Non-Trading Company. This organization was registered in Dharamshala. The members were been accused and arrested for cheating people of Rs 2.75 Cr. With KYB, this could easily have been prevented as the UBO information would have appeared as bogus or fraud.

Bank Loan Frauds

These kinds of fraud involve a bogus organization. It registers as a genuine service company. The objective is to scheme people into providing payments by cash or through fraud accounts. Recently this has become a pain point in multiple states.

The Anti-Bank Fraud Wing of the Central Crime Branch on 6th Feb 2020 arrested six persons. The accused were running a call center in Pazhavanthangal (Chennai). They cheated several persons who sought loans online. In a similar incident this year, 4 fraudsters were arrested in connection to fraud of Rs 2 crore from more than five banks. This was done by pledging forged land documents. With KYB, the business information could have been traced early on.

Challenges associated with manual business verification

Businesses are required to verify customers, corporate clients, and other critical information under the KYB guidelines. Some of the major challenges for this process are are:

Time taking manual onboarding process

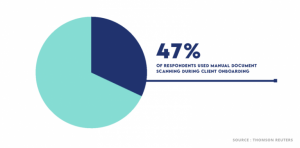

Normally, KYB verification for customer onboarding can be a hectic manual process. This is because it requires extensive efforts. In a 2019 Survey Report by Thomson Reuters on AML Insights, 47% of respondents used manual document scanning during client onboarding. This ensured a robust digital identity verification at the expense of laborious effort. The report further states that 4/10 companies employ no digital verification at account opening.

The conventional method leads to a frustrating customer experience. Customers are probable to abandon the account creation process. Moreover, the chances of errors and mistakes when done manually are higher.

High compliance cost

In the Thomson Reuters report, 95 % of respondents reported that data accuracy was very important. 93% cited both well-structured data and company reputation/credibility were also crucial. High costs are required for manually retrieving UBO information. These other factors also drive up the cost for manual KYB verification.

Complex ownership structure

KYC/KYB regulatory directives such as AMLD5 and PSD2 CDD rules make it necessary to verify and identify the business entities. This becomes a mandatory regulatory requirement. Financial institutions rely on gathering business details from clients. This is done with a manual process of filling in forms and verifying the information manually. There exists a high probability of data discrepancies to occur in this process.

Data inconsistencies

Companies can afford manual data retrieval. But the problem of data verification remains. There are multiple sources for collecting companies’ data. Sometimes the information can be defunct or invalid.

Technology To The Rescue — Areas To Address For Automating KYB

With an increase in regulatory requirements, the above points clearly state the need to automate the current process. Here are some solutions that could help businesses:

Automated KYB onboarding

AI-powered verification opens an opportunity to increase the efficiency of the onboarding process. It also reduces the cost and speeds up the process.

The manual method for retrieving UBO information can be achieved in a fashion similar to KYC process. What used to take 24–30 days for manual KYC has been reduced to 2–3 minutes by Signzy’s VideoKYC solution.

Access to authentic business registries

Companies must have access to the properly updated business registries. This is valuable and will make business compliance an easy task. Signzy’s proprietary APIs that can easily retrieve company information. This can be done from reliable sources like from the Registrar Of Companies (ROC) database

API integrated KYB solutions

Advanced API integrated solutions can be designed to aggregate data from various sources. Businesses only need to enter the required details to retrieve data. For ex, business registration number and the jurisdiction code where the business is operating.

Signzy provides a host of microservices involve unique APIs that can extract and verify the UBO data in a matter of hours as opposed to days. Our APIs are also capable of cross referencing data across multiple govt. Databases and sanction lists.

Virtual Identification Using VideoKYC

Businesses are now turning towards automated software. This is due to increasing compliance costs. Software helps conduct checks for everything. This includes from basic forgery attempts to advanced negative checks. The data is cross-referenced against sanction lists across the world.

With Signzy’s VideoKYC, the entire process can be completed in a matter of 2–3 minutes. Our unique video conferencing tool can also allow officials to interact and verify the credibility of the data. This is done while maintaining KYB compliance as well as data accuracy.

Scope Of The KYB Market

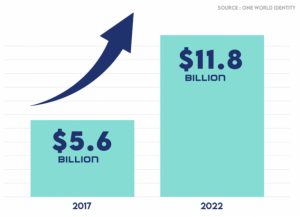

The market for KYB includes multiple services. Ex: business verification, beneficial ownership identification, and risk assessment and so on. This market is projected to grow to $11.8 billion by 2022. This projection comes from OWI Labs in their recent report

The total global KYB addressable market, as of 2017, the value of the market is estimated at

$5.6 billion with an annual growth rate estimated at 16 percent, adding up to a market size of $11.8 billion in 2022

KYB in Europe

In Europe, the AMLD5 has already been implemented. It facilitates the businesses to know about the UBOs. This is to enable trust between foundations. It also ensures legality of the entities to comprehend the structure of the business and customers.

Devoid of commitment to KYB and other related AML activities can have extreme consequences. For example, Deutsche Bank was fined $16.6 million last year by Frankfurt prosecutors. This was due to failure to observe suspicious transactions. This came as a direct result from their poor management of their AML processes. Previously, a £163 million fine from the UK’s Financial Conduct Authority. This was again due to effective AML oversight. Criminal activity associated with a business can also harm credibility and reputation. It can also cause other business disruptions.

Therefore, KYB is an essential element of anti-fraud frameworks and requirements. This includes Anti-Money Laundering regulations. An extension of KYC and regular due diligence is having a proper KYB process within your organisation. This protects against potential clients and vendors who intend to commit money laundering activities or other financial crimes. By establishing and understanding risk levels during onboarding, organisations can manage potential vulnerabilities. They can also respond effectively to indications of fraud or crime.

KYB in the US

The Customer Due Diligence (CDD) Final Rule is active from May 2018 in the US. This rule states as:

“Beginning on the Applicability Date, covered financial institutions must identify and verify the identity of the beneficial proprietors of all legal entity customers (other than those that are excluded) at the time of opening a new account (other than exempted accounts)”

The financial institutions constitute banks, dealers and brokers, mutual funds and futures commission merchants. However, different jurisdictions constitute different requirements. For example, the US financial institutes, in addition to the Bank Secrecy Act (BSA), are also liable to OFAC (Office of Foreign Assets Control), FACTA (Foreign Account Tax Compliance Act) and SEC disclosure rules.

KYB In India

The newly developed concept of KYB is still in its infancy and yet to be fully applicable across all business sectors. While the regulatory authorities have to take the developments of KYB under consideration, the need for KYB is clear in certain business sectors, particularly in financial space as listed below:

Banking

With money coming in from all corners of the globe, banks must be able to perform Know Your Business (KYB) checks on a client base that may be moving money all around the world. In addition, a “beneficiary owner”, which is a derivative of KYC, must be a present as a priority before financial transactions take place.

A recent article by Times Of India has brought to light how certain “fake” branches have been operating in major Indian states. These are Tamil Nadu’s Cuddalore district as an SBI branch, as well as a false branch of Karnataka Bank which was discovered in Phephna in Ballia district. The culprits behind the 2nd incident swindled almost Rs. 17 lakh in terms of new accounts and fixed deposits. With such fraudulent methods in full sway, KYB in banking is now necessary more than ever.

Lending

India’s lending market is one of the largest in the world, particularly with the advent of digital platforms. Digital lending to micro, small and medium enterprises (MSME) in India can grow upto 7 lakh crore by 2023, a 15x increase in annual disbursements. This is based on a joint report by Omidyar Network and Boston Consulting Group (BCG).

Assessing the integrity and ability of a borrower can be difficult — despite assets backing the loan, making it rock-solid. Unfortunately, there is no stereotypical “fraudster”. There is no scam artist who can be profiled or categorized. A polished CEO with an impressive background can look the same as every other swindler. Lenders need to be particularly mindful of who the borrower is and this means conducting proper due diligence. KYB in lending can help assess:

- The background of the directors and the organization

- Past offences/lawsuits/ criminal cases registered

- Any other controversial data which may harm future business

SMEs/Merchant Onboarding

KYB (know your business) checks are crucial to help businesses verify customer identification by gathering and verifying important documents. It should be mandatory for most financial companies to conduct KYB on their customers/businesses to protect against money laundering, identity theft and fraud. KYB can be incorporated at the time of onboarding to minimize risks as well as mitigate potential frauds.

A lot of companies adhere the use of time-consuming manual KYB processes due to:

- Need for complete checks and collect signatures from multiple directors

- The applicant is not always the director

- The application can quickly become a complex journey if there is overseas ownership or beneficial ownership

Insurance

India does not have an effective insurance fraud law against insurance frauds. According to an article in Business Today, frauds burnt a Rs 45,000-crore hole in the Indian insurance industry’s pocket in 2019. Most of these are due to bogus or fraud claims passed. In many cases, insurance companies, their intermediaries or those pretending to be either of them may also perpetrate frauds.

As India’s insurance industry continues to grow, fraud management is now a major concern for insurers and business leaders. Fraud risk in the insurance value chain can originate from internal as well as external factors. There is also the risk of employees misusing confidential information. Colluding with fraudsters is on the rise. Insurers must install internal checks and balances to rectify such issues.

KYB can also contribute by providing the list of people who have access to sensitive client information as well as conduct checks against the background and history of the organization as well as the people involved.

Conclusion

The global business markets are growing at a rapid pace. Companies must tighten customer due diligence for clients. The KYB processes and checks defined above can take hours to days without a platform with automation capabilities. However, cutting corners to achieve faster onboarding without proper controls increases the risk. It exposes the business to fraudulent actors and their illicit activities. Therefore while complete automation remains a challenge, care must be taken to improve KYB to match the levels of KYC automation that has already been achieved.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.