- The UAE’s ambition to become a global fintech hub is shaping innovative approaches to KYC.

- The UAE has established a specialized court dedicated to handling money laundering cases, emphasizing the country’s commitment to AML/CFT efforts.

- In the first half of 2022 alone, the UAE imposed fines totaling over AED 41 million (approximately $11.2 million) for AML/CFT violations.

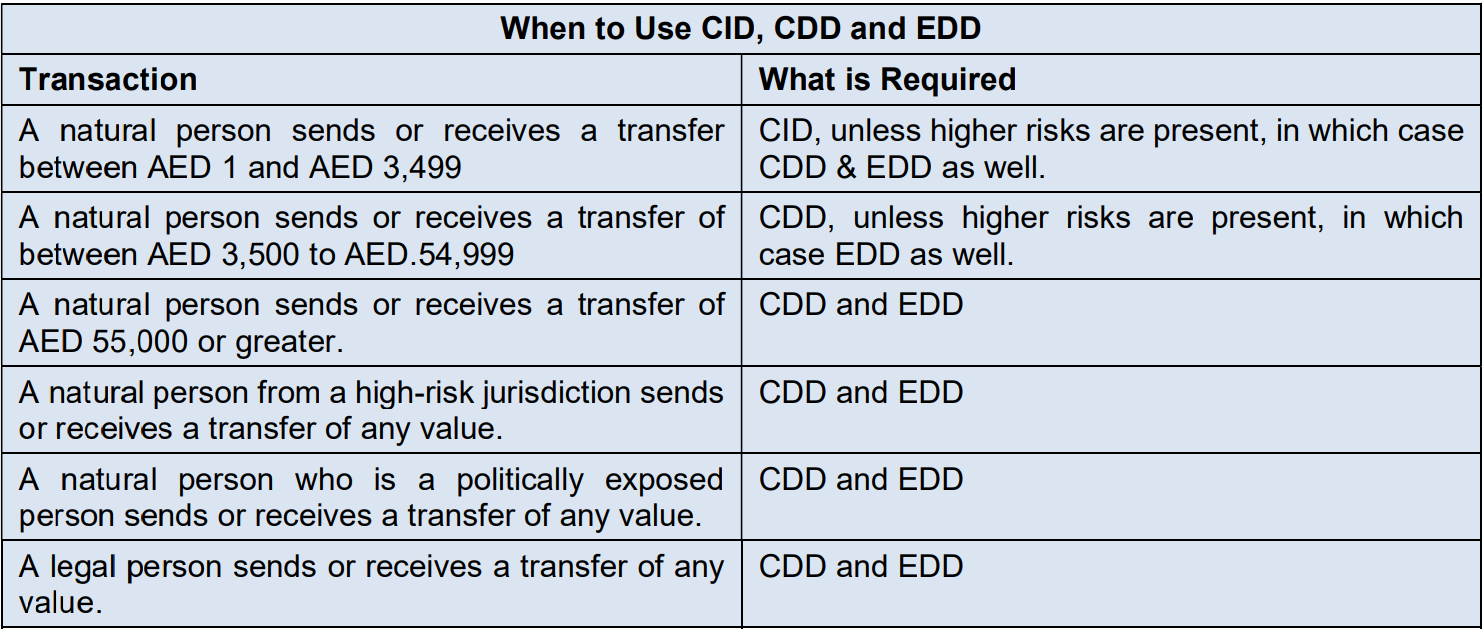

- The UAE employs a multi-tiered KYC system, with escalating levels of due diligence based on risk profiles.

Your company in the UAE just shook hands on a deal with a hot new client.

You’re pumped to get started, so you skip some of those pesky Know Your Customer (KYC) checks.

Months into the project, it comes to light that your client’s paperwork isn’t as watertight as it should be – some details don’t fully align with official records. Oops.

Your oversight in KYC procedures now exposes your business to potential fines exceeding AED 100,000 (~ USD 27,225), license revocation, or even a legal imprisonment.

Sure, this story’s made up, but it’s not exactly science fiction. Stuff like this happens more often than you’d think.

Want to dodge these bullets and the penalties that come with them? (We’re talking million-dirham fines, maybe losing your license, or even legal trouble.) Then you’ve got to get to know about KYC verification guidelines of UAE.

Keep reading to learn how to keep your business safe while still killing it in the UAE market.

KYC requirements for different entity types in UAE: Who needs what?

The UAE’s diverse business ecosystem demands entity-specific KYC protocols. Failure to implement the correct procedures for your entity type not only risks non-compliance but also exposes your business to financial and reputational damage. Here’s what you must know.

Corporate clients

Local companies and financial institutions need to provide several documents, including trade licenses, certificates of incorporation, and shareholder information. The verification process for corporate clients typically involves cross-checking with government databases to confirm the authenticity of provided information.

International entities face the added challenge of cross-border verification, which may require extra steps to meet UAE KYC verification standards. It’s a bit more work, but it’s necessary to ensure compliance.

List of documents required for UAE KYC verification of corporate clients

- Valid trade license

- Certificate of Incorporation

- Memorandum and Articles of Association

- Shareholder register

- Board resolution appointing authorized signatories

- Passport copies and Emirates IDs of shareholders, directors, and authorized signatories

- Proof of business address (tenancy contract or utility bill)

Financial Institutions

Financial institutions, including insurance companies, investment firms, and banks face more rigorous KYC requirements. In addition to the documents required for corporate clients, they must also provide:

- Regulatory licenses and approvals

- Detailed ownership structure, including ultimate beneficial owners

- Corporate governance documents

- AML/CFT policies and procedures

- Evidence of regulatory compliance in home jurisdiction (for foreign institutions)

[Source]

Financial institutions undergo Enhanced Due Diligence (EDD), which may include on-site visits, interviews with key personnel, and more frequent reviews of their KYC information.

Designated Non-Financial Businesses and Professions (DNFBPs)

DNFBPs, such as real estate agents and precious metal dealers, have specific KYC obligations designed for their industries. These businesses often find it difficult to balance customer convenience with thorough document verification UAE requirements.

Implementing strong KYC processes while keeping business running smoothly is a common challenge in this sector, but with the right approach, it’s certainly achievable.

List of documents required for UAE KYC verification of DNFBPs

- All documents required for corporate clients

- Industry-specific licenses or certifications

- Proof of membership in relevant professional bodies (if applicable)

- Enhanced due diligence documents for high-risk businesses

Non-Profit Organizations (NPOs)

Given the potential misuse of NPOs for illegal activities, these organizations undergo more detailed examinations. KYC procedures for NPOs in the UAE often involve thorough checks on funding sources and beneficiaries.

This requires a careful balance between supporting legitimate charitable activities and reducing financial crime risks. It’s a delicate process, but one that’s essential for maintaining trust in the non-profit sector.

List of documents required for UAE KYC verification of NPOs

- Registration certificate from the relevant UAE authority

- Founding document or charter

- List of board members and key executives with identification documents

- Financial statements or audit reports

- Donor information and fund source documentation

Individual customers

For UAE nationals, the Emirates ID verification process is the foundation of KYC procedures. This national ID card verification is usually complemented with passport information and proof of address.

Foreign residents face additional checks, often needing to provide authenticated copies of their home country identification alongside their UAE residency documents. We understand this can be challenging, but it’s an important step in maintaining financial integrity.

List of documents required for UAE KYC verification of individual customers

- Emirates ID (for UAE residents)

- Valid passport

- UAE residency visa (for expatriates)

- Proof of address (recent utility bill, rental agreement, or bank statement)

- Recent photograph

For UAE nationals, the Emirates ID verification process is often sufficient, but additional documents may be required depending on the service or institution.

Meeting UAE KYC verification requirements

If the onus of KYC compliance falls squarely on your shoulders, this roadmap outlines the non-negotiable steps you must take to meet all necessary requirements.

| Step | Description | Key Actions |

| 1. Customer Identification | Collect required KYC documents | Refer to the above section to know which documents you are supposed to collect depending on the type of entity. |

| 2. Verification of Identity | Authenticate provided documents |

|

| 3. Due Diligence | Assess customer risk and apply appropriate measures |

|

| 4. Compliance Check | Ensure adherence to UAE AML laws |

|

| 5. Ongoing Monitoring | Continuous review of customer relationship |

|

Common UAE KYC challenges and solutions

The unique characteristics of the UAE market present distinct KYC challenges that generic solutions fail to address. Below are some UAE-specific solutions to overcome common challenges.

1. Verifying identities of a diverse international population

- Implement a multi-lingual KYC platform that supports Arabic, English, and other common languages in the UAE.

- Create a comprehensive guide for your staff on different types of international ID documents.

- Partner with international verification services to authenticate foreign documents quickly.

- Use AI-powered document verification tools that can recognize and verify a wide range of international IDs.

2. Identifying Ultimate Beneficial Owners (UBOs) in complex corporate structures

- Develop a clear, step-by-step process for mapping corporate structures.

- Use visualization tools to create ownership diagrams for complex entities.

- Establish direct communication channels with UAE free zone authorities for verification.

- Implement a risk-based approach, applying enhanced due diligence for more complex structures.

- Refresh your UBO information database frequently, and do cross-references with international company registries.

3. Balancing thorough KYC processes with customer experience

- Implement a digital onboarding process that allows customers to submit KYC documents securely online.

- Use OCR (Optical Character Recognition) technology to auto-fill forms from scanned documents, reducing customer effort.

- Offer video KYC options for remote verification, particularly useful for international clients.

- Clearly communicate the KYC process and its importance to customers, setting correct expectations.

- Provide a dedicated support line or chat service to assist customers with KYC-related queries.

4. Managing ongoing monitoring and regular KYC updates

- Implement an automated alert system for when customer documents are nearing expiration.

- Use transaction monitoring software tailored to UAE-specific red flags and typologies.

- Develop a risk-based schedule for periodic KYC reviews (e.g., annually for high-risk, every 2 years for medium-risk).

- Integrate your KYC system with customer relationship management (CRM) tools to streamline the update process.

- Offer incentives (e.g., preferential rates, reduced fees) for customers who proactively update their KYC information.

Streamlining UAE Identity Verification and KYC compliance with digital solutions

The challenges of KYC compliance in the UAE demand robust, efficient solutions. Manual processes are inadequate for meeting the emirate’s strict regulatory standards while maintaining operational efficiency.

Advanced technologies can help you directly address the issues of verifying diverse international identities, managing complex corporate structures, and keeping pace with regulatory changes.

For example:

- AI and ML can spot patterns in complex data, making it easier to flag unusual activities or identify high-risk customers.

- OCR technology quickly reads and processes documents, saving time and reducing manual errors in KYC checks.

- Blockchain creates a secure, unchangeable record of all KYC data, ensuring transparency and trust in the process.

- Biometric verification, like facial recognition or fingerprints, adds an extra layer of security to confirm someone’s identity.

Signzy equips you with all these technologies in one powerful platform. Your document verification needs are covered across 200+ countries, tackling the challenge of diverse identity validation head-on. You’ll identify Ultimate Beneficial Owners in complex structures efficiently, thanks to data validation powered by 150+ sources. Plus, configurable criteria and automated actions adapt swiftly to regulatory changes, keeping your business consistently compliant.

Bottomline

These tech tools can seriously speed up your customer onboarding, cut down on fraud, and keep you on the right side of the law by meeting UAE identity verification requirements. Play it safe while making life easier for your customers too. Win-win.