KYC in the USA- The Origin, Evolution, and Future of America’s Frontier Against Financial Fraud

Introduction

In 2017 a survey from FDCI revealed that 25% of all US households were unbanked or underbanked. This meant that more than 30 million households did not have a bank or credit card account. In 2019 the numbers fell to less than 5.4% of the households being unbanked. That was an estimated 7 million households. This indicates the untapped potential in the banking industry.

More customers than ever will start a bank account in the coming years. This pace at which citizens are starting a relationship with a bank is impressive. But how much can we ensure that all the applicants are legit? How can we make sure that no fraudsters are aided? To put things into perspective 2019 alone saw 650,572 cases of identity theft and 271,823 cases of credit card fraud in the US. To prevent this, KYC comes into play.

KYC process in banks is used to obtain information about the customer with their consent. The obtained information includes their identity details and addresses. It ensures that there is no misuse of the bank’s services. This stops fraudsters who try to imitate or forge identities for financial crimes.

We must also notice that fraudsters have found newer ways to evade KYC through the ages. These include digital synthetic ID frauds and scraping for ATOs(Account Takeovers). In 2021, we have enough resources and methods to maneuver the issues with traditional KYC processes. An upgrade is inevitable. The introduction of Digital KYC is set to change the whole process of onboarding. Let’s have a detailed look at the KYC process in banks in the US and what its future holds.

Does KYC Require The Attention It Demands?

Before the introduction of the KYC process in banks, fraudsters conducted crimes without much resistance. The lack of regulation coupled with unverified customer identifications caused easy manipulation of the financial system. Combatting this was inevitable. With the introduction of KYC financial crime has reduced, but new challenges await the sector.

According to a report from Atlas VPN, Q1 2020 saw a 116% increase in loan/lease fraud, alone. Credit Card frauds were at an all-time high of 435.8% during the same quarter. To add flame to the fire, overall fraud reports compared to Q1 2015 were over 435%. We can not attribute this to solely human errors or insufficient data collected.

The real culprit( other than the fraudsters, of course) is the inefficient handling of KYC. It might come as a shock that all this fraud occurred even after concerned institutions implemented the KYC process in banks. One can only imagine the outrageous leaps these numbers might have taken if such a regulatory process didn’t even exist.

KYC acts as the firewall against these fraudsters, but with advancing technology and global connectivity the fraudsters have an edge. The era of traditional KYC is nearing dusk. It is only a matter of time before the government brings regulations and advises for digitized KYC process in banks.

The primary objective of KYC is not fraud prevention, even though it does filter out the fraudsters for the better. The Patriot Act intended CIP or KYC to prevent Terrorist Funding and Money Laundering. To an extent, it has been effective. But as all things go, it can be better. This is where banks should upgrade their processes..’ A system devoid of human errors and manual processing will be the next step for this.

How KYC process in banks Came Into Being In The US

The need for KYC came with an increase in financial crimes in the Country. Every decade fraudsters find ways to commit crimes avoiding the regulatory oversight. To eliminate the problem at the source, the government and experts came up with KYC. Proper verification of the customer helps identify fake and fraudulent activities if any.

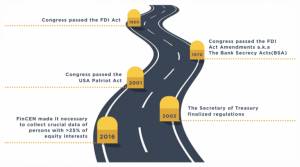

Though KYC was introduced under The USA Patriot Act, its history spans several decades before. Here is an overview:

- In 1950, Congress passed the Federal Deposit Insurance Act to govern FDIC( Federal Deposit Insurance Corporation). It had regulations for banks to comply with to be insured by the FDIC. This was the first primitive step towards modern KYC.

- In 1970, Congress passed the FDI Act Amendments also known as the Bank Secrecy Acts(BSA). It was a modified take on the FDI Act adding five types of reports for banks to file with the Treasury Department and FinCEN.

- On October 26, 2001, Congress passed the USA Patriot Act. This act contained all the ingredients for modern manual KYC.

- On October 26, 2002, The Secretary of Treasury finalized regulations defining KYC mandatory for all financial institutions. All associated processes conformed to CIP(Customer Identification Program) under this act.

- In 2016, FinCEN made it necessary for banks to collect the name, address, social security number, and date of birth of persons owning more than 25% of an equity interest in any legal entity.

KYC was met with mixed reception during the two decades that have passed since it became mandatory in the US. Nonetheless, none of its criticism countered that KYC helps ensure safety and prevent fraudulent activities. Rather most of it was associated with the difficulty in implementing such a procedure and the privacy concerns.

What Does KYC Mean In The US?

KYC refers to the process implemented by a financial institution or business to:

- Establish verified customer identity.

- Understand the exact nature of the customer’s activities. This is to confirm that the source of associated funds is legitimate.

- Assess money laundering risks.

It has 3 aspects:

1. CIP- Customer Identification Program

Any individual associated with a financial transaction requires identity verification in the US. CIP ensures this. This is under the recommendation of the FATF( Financial Action Task Force). FATF is a pan-government anti-money laundering organization.

A pivotal element to proper CIP is risk assessment. This has to be at the institutional level as well as at the level of procedures for individual accounts. Most of the exact implementation decisions are left to the institution, but CIP provides a guideline to follow.

The minimum requirements for opening a financial account in the US are:

- Name of the customer

- Address of the customer

- Date of birth

- Identification Number/ Social Security Number(SSN)

The documents verified for KYC include social security card, passport, driving license, and credit/debit cards. It is up to the institutions to install the necessary protocols for the specific documents.

The institution is to verify this information within a reasonable time. This includes comparing provided information with information from public databases, consumer reporting agencies, among other diligence measures.

2. CDD- Customer Due Diligence

CDD ensures if you can trust a particular client. It assesses the risks and protects the institution against criminals, PEP(Politically Exposed Persons) presenting a high risk or even terrorists.

It has 3 levels:

- SDD(Simplified Due Diligence)- it is a simplified procedure. The risk of money laundering is low.

- CDD(Basic or Standard CDD)- standard procedure for average or moderate levels of risk. Performed for most clients.

- EDD(Enhanced Due Diligence)- Additional information is obtained. It has a clearer understanding to mitigate associated risks. Mostly done in high-risk circumstances.

Some of the important measures taken during CDD are:

- Confirm the identity and location of the client including a proper understanding of their business venture. This might be a simple act of verifying the name and address of the potential customer.

- Categorize clients based on their risk profiling. This must be done prior to any digital storing of information and documentation

- In areas that require EDD, ensure that the entire process is performed. This is an ongoing process as any low-risk client can become high-risk. Thus, periodic CDD is necessary.

- The necessity of EDD depends on certain factors. These include the location of the person, occupation of the person, types of transactions, and pattern of activity.

3. Ongoing Monitoring

It refers to the program monitoring the customers on an ongoing basis. This includes oversight over accounts and financial transactions. This includes accounts with spikes of activity, adverse media mentions, or any other concerning occurrences. Periodical reviews of accounts and risk factors are done.

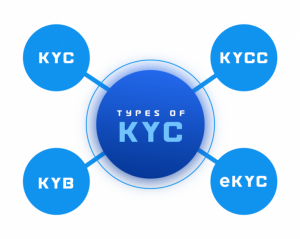

What Are The Types Of KYC?

Standard KYC

Includes the KYC performed for individual customers and clients. It is most widely done. The process has slight variations depending on the jurisdiction the banks fall under.

KYB- Know Your Business

It is an extension of KYC for anti-money laundering. It verifies a business including the registration credentials, UBO(Ultimate Beneficial Owners), location, and other factors. The institution screens the business against the grey and blacklists that include entities involved in fraudulent activities. It identifies fake businesses and shell companies.

It is also known as Corporate KYC.

KYCC- Know Your Customer’s Customer

It identifies the activities and nature of the customer’s customer of a financial institution. It includes identifying the people involved, assessing the risk levels and major activities of all entities.

eKYC- Electronic KYC

eKYC, also known as Digital KYC is the remote and digital transposition of the KYC process. Authentication is done through electronic and digital methods with verification performed digitally without the requirement of physical documents. It uses the aid of technology like OCR and live-video access.

The Not-Too-Distant Future Of KYC

KYC is criticized for the increase in dropout rates during onboarding as it makes the process more complex. This overwhelms the customers trying to onboard who become reluctant to do business with the banks.

This is worth notice as newer fintech startups are increasing their customer onboarding every year. Since 2018, Venmo has performed KYC on more than 30 million customers before onboarding them. They do this through technology and digitization. eKYC or digital KYC was the key factor that gave such impressive results.

Another concern regarding KYC is the amount of machinery and expenditure associated with the traditional modes. In 2016, regulatory compliance cost banks over $100 billion. This cost was expected to rise by 4% to 10% by the end of 2021 by Forbes. The expenses banks have to bear for KYC compliance is high.

This can be reduced to fascinating degrees with proper digitization of the entire KYC process. The perks of adopting such revolutionary technology will drive companies to success. It is time we understand this and proceed further into the future. For the future is not too distant!

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.