KYC’s Impact On Investment Scams, Bank Fraud, And Other Financial Crimes In The US

Introduction

With a projected GDP of USD 24.9 trillion by 2023, The United States of America will remain to hold the title of the World’s Largest Economy. This position has always provided lucrative opportunities not just for genuine investors but also for fraudsters and scammers. This is evident from the fact that the majority of all scams in the US revolves around the investment sector.

An Investment Scam is an initiative where fraudsters and scammers convince investors to expend their money in fraudulent opportunities offering high returns and unrealistically low risks.

With the advent of technology, along with the benefits it brings to investing and banking some concerns need to be addressed too. It is far easier for fraudsters to scam individuals and organizations as almost everything is going digital in the sector. Without proper precautionary measures, the boon of technology might turn against the very people whose lives it is trying to make better.

All this renders institutions to hesitate before adopting new technology and its applications. This should change and the careful adoption of technology with secure and safe measures is the right solution. One major measure for this is to obtain and verify crucial data of the entity without letting any red flags go unnoticed. This will help the financial institutions to assess and evaluate if the situation involves any potentially fraudulent activities. Properly implemented KYC achieves this.

Investment Scams and Financial Fraud From The Past Century In The US

No discussion about investment fraud can avoid the name Charles Ponzi, the first man to have nationwide infamy for creating one of the earliest pyramid schemes in the world. The term ‘Ponzi Scheme’ originated from his name.

In the late 1910s, Ponzi promised a 50% return in a mere 45 days time span. The scheme failed causing 5 banks and all investors to lose money and earning Ponzi more than $20 million ( Adjusted to inflation- $220 million). But this was just the dawn of the next generation of financial fraudsters in the country.

Musch closer to the 21st century, Kenneth Lay, the founder of corporate mogul Enron. His ‘strategic’ moves resulted in Enron’s stock price plummeting from $90 to just $1 between 1999 and 2001. The once $68 billion company filed for bankruptcy in the fall of 2001. Neither the banks who had loaned the company money nor the general investors who had invested had any idea of how much they had been hoodwinked until they lost all of it.

Almost every citizen in the US is aware of investment scams in the country. But the problem is that they have neither the required knowledge nor the clarity to protect themselves from the fraudsters. A simple solution is to have strict identification procedures and security measures from banks while onboarding a customer and carrying out transactions.

Apart from these big ones, numerous ‘nuclear’ scammers operate in the country.

Such fraudsters focus on stealing social security numbers by presenting themselves as phony tax officers or stealing the identity of the consumer and misusing it with the bank. Some of them even misuse benefits by forging fake documents to fool the financial institutions. With the advent of the internet by the end of the century, the scams began to go global attracting remote scammers from all over the planet.

How is Financial Fraud Faring In The Age Of Information?

In 2014 a Brazilian National under the name Rojo Filho opened more than 17 bank accounts under his real name in the US and used them for illegal money transfer and laundering. The banks included JP Morgan Chase, Citigroup Inc., and Wells Fargo. This was a true mockery of these bank’ policies to know their customers. These policies and systems were supposedly strict after the 2008 financial crash. ‘Supposedly’ being the operative word here. It did not add to the banks’ safety credibility that Mr. Filho had committed multiple financial frauds and investment scams before this.

Mr.Filho was a mere individual who was unsuccessful in the long term. Imagine how many successful scammers are slipping through the cracks.

The fraudsters who target banks and financial institutions are the primary targets for bank security. They impart a direct threat. But what most banks neglect is that even the scammer ripping off of an old man’s IRA or another’s 401(k) can be stopped by proper verification of bank accounts and customer information. The indirect effect this has is immeasurable.

The ease of access to the internet in the 21st century has given tremendous access to scammers. Governments and financial institutions are not blind to this and are taking the necessary precautions to avoid any large scale scamming. This has helped them to subdue singular massive fraud occurrences. But the small scale or as some may call, ‘nuclear’ incidents still take place.

With banks adopting automation more, ACH(Automated Clearing House) scams are also increasing. ACH is a network that functions as a central clearing facility for EFTs( electronic funds transfer) forming an integral part of the national banking system. In the ACH system, payments linger awaiting clearance and to complete the transactions. Using commercial customers’ credentials or even employees’ credentials the scammers manipulate the clearing process and transfer the funds to their desired accounts. If the customer data is well fortified this can be avoided.

A practical way to reduce this is to implement proper verification of customers and businesses. An initial evaluation is necessary, but even annual follow-ups strengthen safety.

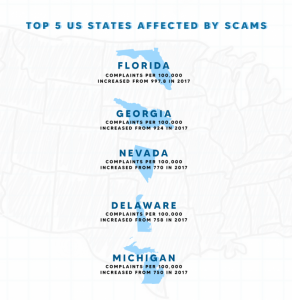

Top 5 US States Affected By Financial Fraud and Scams

Though almost all types of investment scams occur in almost every state, we have focused on the state-wise relevant ones here:

- Florida

Social Security numbers are the primary targets for scammers here. They pretend to be phony tax collectors representing IRS or other agencies and contact individuals to obtain their financial information. The state also has one of the highest numbers of identity theft cases. The majority of the 40,000 complaints received in 2019 were associated with government benefits and documents.

- Complaints per 100,000 increased to 997.8 in 2017

- Total complaints were 208,443 in number

2. Georgia

More than 13,000 cases of identity theft were reported in Georgia in 2019. More than half of this includes government documents and financial benefits frauds. This occurs in a state with a financially dependent youth population with an average student loan debt of $32,283.

- Complaints per 100,000 increased to 924 in 2017

- Total complaints were 96,316 in number

3. Nevada

Nevada mostly had a mix of general financial fraud and identity theft cases in 2017 and 2018. A state that was hit hard by the housing crisis, citizens of Nevada are still struggling after a decade of recovery. The near 8% unemployment rate in the state also contributes to an increase in fraud as people are financially pressured.

- Complaints per 100,000 increased to 770 in 2017

- Total complaints were 23,071 in number

4. Delaware

New accounts are opened in other people’s names for phone and utilities frauds. This is more than in any other state in the US. Even the surging number of imposter scams contributed to the state becoming the 4th(2017) most affected from 5th most (2015).

- Complaints per 100,000 increased to 758 in 2017

- Total complaints were 7,290 in number

5. Michigan

Michigan stands out as of all the major states affected, its citizens had far fewer debts than most of the others. Nonetheless, it was severely affected by the cases of INvestment scams and other financial frauds.

- Complaints per 100,000 increased to 750 in 2017

- Total complaints were 74,689 in number

What Is KYC And How Does It Help?

In 2003 the Congress implemented the Customer Identification Program (CIP) as a provision of the USA Patriot Act. It prescribes institutions to verify the identities of individuals who conduct financial transactions with them. It is more commonly known as KYC

Know Your Customer (KYC- for individuals) or Know Your Business (KYB- for organizations and institutions) are processes where a firm identifies and verifies the data provided by its clients.

Clients or potential client data is obtained. This includes names, dates of birth, addresses, etc. From individuals and checking Companies House registration, ultimate business owners, annual returns, etc. for companies and businesses. KYC identifies PSCs(Persons of Significant Control), Ultimate Beneficial Owners, and exposed individuals.

Most businesses and financial institutions perform KYC manually using physical ID documents such as the original copy of the passport or driving license. As technology has advanced not only is it more convenient for digital processing but also safer as the options offered by novel fintech security players are well fortified. A Digital KYC process would cross-check all details with multiple data sources from government entities and other bodies to ensure accurate safety.

KYC prevents fraud in multiple ways. Some of them are listed below:

Tracking Tax Evaders

Undoubtedly, track evasion is a type of fraud. The perpetrators defraud the government and thereby the general public of the country. There have been cases in the judiciary where major tax evaders have been tried for grand larceny from the public. To perform this, individuals with high-income use banks to conceal their financial assets. This permits them to evade the high taxes levied on them by the government.

AML(Anti-Money Laundering) and KYC processes prevent such activities. They verify and confirm the identity of the customers as well as the data they provide. Referential data is stored after compulsory document and compliance checks. This will assist authorities in future investigations if there ever arises a need.

Continuous Transactions Monitoring

Regular Transaction Monitoring with compliance checks forms an essential part of KYC processing. Potentially suspicious customers are tracked and reported accordingly. This includes money being transferred for terrorist financing and money laundering. It prevents the flow of black-market funds into the economy preventing any funding for terrorist entities.

Such measures reassure the customers and stabilize trust in the financial system. This will encourage the public to act with integrity and report relevant instances.

Background Checks

Background checks help institutions to evaluate potential customer’s risk classification and status on government watchlists. This provides safety to the organization to be not involved in financial crime, even unintentionally.

Overall Benefits

As an overview, we can say that KYC helps understand the customer’s legitimacy better. All kinds of scams extract customer data and misuse it in another portal. KYC allows prevention at both levels. It makes it hard for scammers to produce legitimacy and double checks the use of data by verifying it with existent credible databases.

For scams ranging from basic identity theft to massive money laundering and terrorist funding, KYC will be a wall hard to pull down. Every single data provided by the customer will be used to verify at each access point. Not only does it fight the problem upfront, it roots it out by making it near impenetrable for scammers to even register as processors or other false pretexts. This renders the investment scammers to oust from their existing methods.

Ultimately KYC reduces investment scams and more significantly develops trust. Adopting strict KYC procedures ensures the customer that the institution is concerned with lawful business practices. This translates into credibility and a good reputation improving the trust in the company.

Conclusion

KYC is no longer an additional measure for banks to take. It is mandatory for safety. But methods of KYC implementation have altered in the US over the decades. The pen and paper approach is no longer viable and what we see are the prerequisites of a coming digitization. As Cyber Crime and Investment Scams evolve to adapt, we must take it with absolute certainty that we stay ahead of the fraudsters.

KYC will prevent scams, especially investment scams as the scammers in this particular arena are not as sophisticated as more developed fields like advanced cybercrime. But we must consider the fact that the scammers will evolve according to the cages they are put in. They are already evolved over our current traditional methods. KYC alone may not safeguard in certain occasions, but without KYC the sector doesn’t stand a chance. It has come to that, digital KYC is the next step in financial security for all institutions, including the traditional ones.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.