In the rapidly evolving landscape of digital finance, staying ahead of the curve is imperative for lenders. One development that has been gaining momentum and warrants close attention is the Open Network for Digital Commerce (ONDC). This ambitious initiative, launched by the Indian government, has the potential to reshape the lending landscape not just in India but potentially across the world.

Understanding ONDC

The ONDC is an ambitious project introduced by the Government of India to create an open, decentralised digital commerce platform. Its primary objective is to provide a level playing field for all participants in the digital commerce ecosystem, fostering healthy competition and innovation. This initiative aims to bring transparency, convenience, and accessibility to digital commerce, and its implications for lenders are profound.

The Importance of ONDC for Lenders

- ONDC’s integration enables lenders to offer their financial products and services directly to customers on the ONDC platform, extending their reach without the need for extensive infrastructure.

- Lenders can leverage ONDC’s robust security measures to protect customer data and ensure compliance with data protection regulations, fostering trust among customers.

- ONDC’s streamlined KYC process reduces paperwork and enhances the customer experience. Lenders can onboard customers swiftly while meeting regulatory requirements.

- By leveraging ONDC’s data-driven credit scoring models, lenders can mitigate risks effectively. This reduces the likelihood of non-performing loans and enhances their portfolio quality.

How can Lenders get Onboard ONDC?

Getting onboard ONDC involves a strategic approach:

# Embrace Digital Transformation

To align with ONDC’s objectives, lenders must embrace digital transformation. This entails a shift towards digital lending processes and the integration of these processes with the ONDC platform.

One notable example is the transformation of traditional banks into digital banks. For instance, DBS Bank in Singapore underwent a digital transformation, reimagining itself as a “Digital Bank” that seamlessly integrates banking services into customers’ digital lifestyles. DBS’s digital initiatives have led to increased customer engagement and market share.

# Collaborate with ONDC Ecosystem Partners

Collaboration with ONDC ecosystem partners can provide lenders with a head start in gaining access to the platform’s extensive customer base.

In the context of ONDC, a lender could collaborate with an e-commerce platform that is part of the ONDC ecosystem. For instance, Amazon India, a prominent e-commerce player, is part of the ONDC initiative. A lender could partner with Amazon to offer financing options to customers directly through the ONDC platform.

# Invest in Technology Infrastructure

Lenders should invest in technology infrastructure to ensure seamless integration with ONDC and to efficiently manage the increased transaction volume that comes with participation in a digital commerce platform.

Many fintech companies have excelled in this area. For instance, PayPal, a global digital payments platform, continually invests in its technology infrastructure to handle large volumes of online transactions securely. This investment has allowed PayPal to become a trusted partner for both consumers and businesses in the digital payments space.

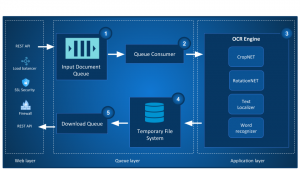

# Leverage APIs and Integration

To effectively integrate with ONDC, lenders should leverage Application Programming Interfaces (APIs) and integration solutions. APIs facilitate the exchange of data and functionalities between different software systems, enabling seamless interactions.

Stripe, a global online payment processing platform, offers APIs that allow businesses to integrate payment processing into their websites and apps easily. This integration simplifies the payment process for both businesses and customers.

Navigating Regulatory Compliance with ONDC

- Firstly, lenders must stay informed about regulatory changes through industry events and updates from government bodies like the RBI.

- Additionally, they should implement robust compliance processes, including dedicated teams, training, and regular audits. Balance compliance with business needs to avoid inefficiencies.

- Lastly, lenders should be agile in adapting to regulatory changes, and revising processes or business models as needed.

Conclusion

The Open Network for Digital Commerce (ONDC) is a transformative force in digital finance, and lenders should take heed. By embracing the digital revolution and aligning their strategies with the platform’s objectives, lenders can not only stay competitive but also contribute to broader financial inclusion goals, creating a win-win scenario for all stakeholders. The path forward for lenders in the ONDC ecosystem is paved with opportunities for growth, innovation, and a deeper connection with customers in the digital age.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs, easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

Contact us directly!