The Fincen Papers Incident & How KYB Could Change The Financial World

On September 20th, the International Consortium of Investigative Journalists (ICIJ) released the “FinCEN Files” to the world in collaboration with Buzzfeed News. These were the same reporters who brought us the “Panama Papers” and the “Paradise Papers”. This latest data leak of the FinCEN Files delivered a stunning blow to law enforcement and regulators across the globe. As we have seen from similar past incidents, releasing such highly confidential data into the public domain has serious consequences for the businesses and authorities involved.

2 Important Terms In Connection To Fincen

FinCEN stands for the US Financial Crimes Enforcement Network. It constitutes the people at the US Treasury who counter financial crime. Any concern about transactions made in US dollars is sent to FinCEN, even if they occur outside the US.

Suspicious activity reports (SARs) are the documents where the above-mentioned concerns are recorded. A bank must fill up one of these reports if it has a suspicion against one of its clients. The report is forwarded to the relevant authorities.

The Suspicious Activity Reports (SARs) have established that most banks often moved funds for companies registered in offshore tax havens. Ex: the Cayman Islands and the British Virgin Islands, where the owner information was unavailable.

Banks could have denied proceeding with these transactions. But in most instances, the transactions were carried out and a SAR report was later filed to fulfill their reporting obligations.

The Fincen Files — What Are They

The so-called FinCEN Files constitute 2,657 documents leaked from the Financial Crimes Enforcement Network (FinCEN). The FinCEN files were leaked to Buzzfeed News in 2019 who promptly shared them with the ICIJ. For the last 16 months, 400 journalists across 88 countries have sifted through the leaked records. They conducted a number of their own investigations to verify the data.

The documents contain 2,121 SARs sent to the US authorities. These are regarding transactions that took place between 1999–2017. The leaked SARs allegedly provide “some of the international banking system’s most closely guarded secrets”. They cover 200,000 suspicious transactions Which are at over USD 2 trillion that occurred over two decades.

Key Revelations Of The FinCen Files

- HSBC enabled fraudsters to move millions of dollars of stolen money around the world,. This was done even after it learned from US investigators the scheme was a scam.

- JP Morgan assisted a fraud company to move more than $1bn through a London account. They did not even know without knowing who owned it. The bank later discovered the company owner to be a mobster on the FBI’s Top 10 Most Wanted list.

- Recovered evidence from the files hint that one of Russian President Vladimir Putin’s closest associates used Barclays bank in London to avoid sanctions that were meant to stop him using financial services in the West. Some of the cash was used to buy works of art.

- The husband of a woman donated £1.7m to the UK’s governing Conservative Party’s. According to the files, he was secretly funded by a Russian oligarch with close ties to the Russian President.

- The UK is called a “higher risk jurisdiction” and compared to Cyprus. This is according to the intelligence division of FinCEN. The number of UK registered companies that appear in the SARs has over 3,000 UK companies. These are named in the FinCEN files — more than any other country.

- Chelsea owner Roman Abramovich once held discreet investments in footballers not owned by his club. These investments were made through an offshore company.

- The UAEs’ central bank did not respond to warnings against a local firm which was helping Iran evade sanctions.

- Deutsche Bank was involved in money laundering for organized crime, terrorists and drug traffickers.

- Standard Chartered Bank mobilised funds for Arab Bank for more than a decade. This was even after their clients’ accounts at the Jordanian bank had been funding terrorism.

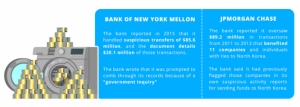

- In North Korea, a host of shell companies were used to mobilise millions of dollars through U.S. banks in New York. The funds were routed through China, Singapore, Cambodia, the U.S. and elsewhere. This is based on the suspicious activity report filed by the Bank of New York Mellon and JP Morgan Chase.

In another instance, JPMorgan Chase, alerted the Treasury Department in January 2015. This was about suspicious financial transactions linked to North Korea. In its report, JPMorgan Chase said that it oversaw $89.2 million in transactions from 2011 to 2013. These transactions benefited 11 companies and individuals with ties to North Korea. The bank said it had previously flagged those companies in its own suspicious activity reports for sending funds to North Korea.

The Indian Involvement

The Indian Express joined 109 media organizations in 88 countries at the International Consortium of Investigative Journalists (ICIJ) as the Indian representative. They coordinated tracking of the Indian entities and the banks mentioned in these SARs filed with FinCEN from 1999 and 2017.

Suspicious bank transactions of Indians are red-flagged by FinCEN. They are suspected for money laundering, terrorism, drug dealing or financial fraud.

The investigation also revealed transactions of a range of individuals and companies. The list includes a jailed art and antique smuggler, a global diamond firm owned by Indian-born citizens named in several offshore leaks, a premier healthcare and hospitality group, a bankrupt steel firm, a luxury car dealer who allegedly duped several high net worth individuals, a multinational Indian conglomerate, a sponsor of the Indian Premier League (IPL) team, an alleged hawala dealer who became the reason for a massive fight within the Enforcement Directorate (ED) and a key financier of an Indian underworld crime boss, among others.

Not The First Incident, But How Is It Different?

There have been a significant number of big leaks in the financial world in recent years:

- 2017 Paradise Papers — This event marks a bunch of leaked documents from an offshore legal service provider Appleby and corporate services provider Estera. The two were partners in operation together under the Appleby name. This was until Estera became independent in 2016. The documents divulged the offshore financial dealings of politicians, celebrities and business leaders

- 2016 Panama Papers — The infamous incident marking the leak of documents from the law firm Mossack Fonseca. These documents showed in detail how wealthy people were using offshore tax regimes.

- 2015 Swiss Leaks — The documents from HSBC’s Swiss private bank were revealed in 2015. They displayed how it was using the country’s banking secrecy laws to help tax evasion.

- 2014 LuxLeaks contained documents from the accountancy firm PricewaterhouseCoopers. These documents exposed big companies who were using tax deals in Luxembourg. The deals helped to reduce the tax amount they were having to pay

The FinCEN papers are different because they are not just documents exposing a bunch of fake/offshore companies. They are actual reports which come from a number of well-established banks.

These papers bring to light a plethora of potentially suspicious activity involving companies and individuals. The reports also put up questions about why the banks which had noticed this activity did not address their concerns.

Once a bank has delivered a report to the higher authorities, it is very difficult to prosecute it or its executives. This is despite the fact that it carries on helping with the activities and collecting the fees.

FinCEN stated that the leak could

– have repercussions on US national security

– jeopardize investigations

– place the safety of institutions and individuals who file the reports under risk.

Role of Shell Companies In Money Laundering And Fraud Businesses

A shell company is an on-paper business that is established to hold funds and manage another entity’s financial transactions. Shell corporations don’t have any employees. Their shares/stocks aren’t traded on exchanges. Shell companies neither generate any revenue nor provide customers with any products/services. The only normal business practice that shell companies take part in is managing the assets they hold. This usually doesn’t amount to much money.

- Tax Evasion: Many times corporations set up shell companies at offshore venues. These locations usually have a very lenient tax rate. These places are known as ‘Tax Havens’. Examples of these places are Panama and Switzerland. These corporations dump their assets in the shell companies. This way, they can escape from paying high taxes on their assets. Foreign companies can create shell company law. This is because some tax havens don’t have to report any tax information. This makes it a cakewalk to defer taxes and hide offshore accounts from other tax havens. Ex: include places such as Switzerland, Hong Kong and Belize which have gained public attention.

- Money laundering — The Black & White Game; In India, a lot of shell companies were discovered in 2016 when demonetization happened. This was because they were engaged in making use of black money. Many people and corporations make use of shell companies to store their surplus cash. This is preferable instead of making deposits.

- Ponzi Schemes: People or corporations may create shell companies to defraud people. They do so by offering fraudulent schemes and earning money out of it. By making use of these companies, they save themselves. When the fraud is discovered, it is very difficult to find the actual people behind the scheme. The only thing upon which the blame can be put on is the company (which is not of any use).

- Masked Vigilantes — Hiding The Identities: Finding the real owner of a shell company can be a problematic task. The owners of these companies successfully hide their identities. They cannot be located as usually the registered office of the company or directors is at a completely different place. In most cases, it does not match the address submitted to the registrar.

Can There Be Any Legal Reasons For Setting Up Shell Companies?

There are some legal reasons for which a shell company can be created. These are as follows:

- Hold or store money temporarily. This is mainly when the main company/ owner of the shell company is planning to start a new company.

- If a company wants to conceal its business with another company, which has a bad reputation, a shell company can come into play. This can be solely to deal with the other company.

- A shell company may be created in order to stage a hostile takeover of another company. This happens when a company buys another company. This is usually done without the approval of the management of the target company.

- To protect assets from lawsuits.

- In case a company is working in a dangerous country with rampant terrorist activities. The people may formulate shell companies to hide money. This helps avoid being a target of criminals and thieves.

- Shell companies are often used to receive access to foreign markets.

Why Shell Companies Prefer Offshore banking

Essentially, an offshore bank is just a bank located outside the account holder’s country of residence. Offshore banking services are typically offered by banks with a presence in a low tax jurisdiction. These banks tend to offer financial and legal advantages over domestic banking arrangements.

There are plenty of legitimate reasons for having an offshore account:

When living or working abroad, holding an international bank account can make it easier to manage finances. Also, offshore accounts are often available in multiple currencies. This can be more convenient for someone making or receiving payments across different countries.

Clients like the ones mentioned above may find it more convenient and more economical to direct all of their business through one bank. This makes sense to centralize this in a jurisdiction that is the most tax-efficient. There are several companies that do this without actually having a physical presence in the country where they are tax domiciled. This is not illegal, but it can be stated as highly unethical.

International banking facilities usually offer more flexibility. This helps those who need immediate access to their money or to international financing. They can do so more cheaply, quickly and easily than would be possible with domestic arrangements.

There are of course demerits here as well.

– Such accounts usually require a minimum balance

– These accounts are not protected in the same way as account balances are protected (up to £85,000 in the UK) via schemes such as the UK’s Financial Services Compensation Scheme.

KYC and AML — Need For A New Approach

KYC (Know Your Customer) and AML (Anti Money Laundering) are very popular terms today. They’re basically catch-all procedures designed to prevent all kinds of horrors in the financial world.

The same processes are used for sanctions.

KYC and AML procedures have modernized over the years as international payment volumes boomed through the ages. After 9/11, the prevention of terrorist financing made these processes more refined.

The newly introduced concept KYB is an additional security layer to the above. It requires each bank to formally identify who their customer is. So if the client is a company, the bank needs to know who each Ultimate Beneficial Owner (UBO) is.

This can be a bit tricky. Criminals often build shell companies in offshore jurisdictions. These are usually owned by companies in another country. These shell companies are handy for hiding who the real owners are.

The bank must then engage in a series of Customer Due Diligence (CDD) — and sometimes Enhanced Due Diligence — checks. The bank must also check that the person isn’t on a sanctions list (e.g. they’re not considered a danger by the USA or EU).

Need For KYB — Good For Business

In recent years, combatting money laundering and terrorist financing has ramped up. There are stricter regulations in place to ensure financial transparency around business ownership.

Over the last few decades, the introduction of new regulatory updates like AMLD5, PSD2 and many more have changed the game. Companies and financial institutions are expected to know who they are doing their business with. This requires the detection of the ownership structure and their business relationships.

Use of offshore tax havens, shell firms, investments in cash-intensive sectors like bullion and real estate, Trusts with no specific purpose, layers of shareholding (for instance, through subsidiaries or intermediaries), are some ways fraud and crime are concealed.

Fraudsters utilize fictitious addresses and fake identities to :

– avoid the deposit of annual financial statements

– conceal their identities and get away in the case of investigations.

UBO — The New Weapon

UBO is an acronym for ‘Ultimate Beneficial Owner’, i.e. the person or entity who is the ultimate beneficiary of the company. The Financial Action Task Force (FATF) is the global money laundering and terrorist financing watchdog.

Their definition of UBO is as follows:

“the natural person(s) who ultimately owns or controls a customer and/or the natural person on whose behalf a transaction is being conducted.”

The FATF focuses on two types of UBO, based on “ultimate ownership” and “ultimate effective control”. The beneficial owner is thus;

– the person you are doing business with, who may be the legal owner of the entity, or

– the person, or group of persons, who own/s or controls that business.

A company may have more than one beneficial owner or group of owners, to conceal the identity of absolute controlling person or interests.

The UBO compliance law applies to;

– Financial transactions, financial institutions (commercial banks, investment banks, insurance companies, brokerages and investment companies), and companies that deal with money (credit unions, money transfer businesses, payment services, online marketplaces, gambling and gaming companies).

– Other companies, like real estate and bullion trading, where transaction above threshold limits, may trigger the requirement of UBO reporting.

– Jurisdictions where regulators have explicit AML/CTF laws, and KYC rules.

Regulated entities are required to retrieve, maintain and disclose such UBO information. Non-compliance can lead to heavy fines and severe reputational damage.

Significance of KYB screening.

KYB screening guarantees fraud prevention and gainful regulatory consistency. It assists organizations with accomplishing believability and generosity in the business network. The better the rating an organization has from the specialists, the more business it draws in.

It helps businesses achieve their share of the worldwide market. Enterprises are developing online connections with others from every corner of the planet. With the limited experience of the prospects, the chances of loss are high due to ambiguity.

This ambiguity leaves a loophole in the B2B relationship. This loophole is then exploited by the criminal entities. It is used to prepare attacks on companies with various types of fraud.

There certainly are a few common scams or fraud which are committed through B2B relations like:

Money laundering.

–black money is channeled through a business with weak security protocols. It is used to launder money and to aid terrorist activities.

Shell businesses fraud.

Fake businesses are set up to wash black money. Black money is incorporated available proceeds and declared as legit revenue. In case a shell company is found by the authorities, the credibility of the businesses conducting business with it is also tarnished.

KYB is significant for global companies to achieve retainable growth in today’s scenario of fraud and increasing regulatory scrutiny.

Conclusion

There are no winners in scandals such as the FinCEN Files — except, perhaps, for the media who can profit from sensationalist headlines. Neither the banks nor the regulators come off well.

This case can, however, be used as a call to arms for positive change. With KYB, bogus corporations and shell companies can be weeded out to prevent further misuse of funds. While SARs are easy to be ignored, mandating KYB as part of the initialization process can easily prevent such fiascos from happening in the future.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.