Updates from Signzy and a few useful reads!

Keep up-to-date with Signzy’s newest events, blog posts, and industry initiatives. Plus, enrich your fintech understanding with our curated selection of must-read articles and reports from experts worldwide. Your comprehensive guide to staying ahead in the fintech landscape.

Updates from Signzy: Signzy’s Netra Team became runner-up at the IDRBT IBTIC

Signzy’s Netra Team became runner-up at the IDRBT Banking Application Contest, 2018. We competed with the worlds largest IT organisations and banks for technology implementations and were judged by CIOs of Indias largest banks. We’re so glad to have received this recognition. We’ll continue to work even harder towards our vision of transforming traditional banking processes into a fully digital experience. Read here.

Signzy listed amongst the 10 RegTech Companies Making Waves in the Industry

We’ve been included in the list of the 10 RegTech Companies Making Waves in the Industry by Disruptor Daily — a publication that reports on groundbreaking and innovative technologies, trends and companies. It feels great to be listed along with companies like AYASDI, Feedzai, Forcepoint, Provenir and others. We’ll strive to build innovative solutions using AI to transform current semi-manual processes in financial institutions into real-time digital systems. Thereby making regulatory processes simple, secure yet compliant for these institutions. Read here.

Events we attended

Innovation And Startup Connect Event For Global Capability Centers (GCCs): We attended the NASSCOM’s Product Conclave’s — Innovation and Startup Connect Event for Global Capability Centers at Bengaluru. The event brought together the best in the product ecosystem connecting GCCs and startups to accelerate innovation and digital transformation. Signzy’s Ankit explained top institutions like Sony India, Target, and Samsung about how Signzy is using the power of AI to transform traditional banking into a fully digital experience. (16th March)

Tech in Asia Blockchain meetup: We were at the Tech in Asia Blockchain meetup at Bengaluru. Tech enthusiasts, experts, and founders explored the key verticals of blockchain technology at the meetup. Signzy’s Ashish was a part of the panel and discussed about the potential, use cases and controversies surrounding blockchain. (28th March)

Oracle Industry Connect: We attended the Oracle Industry Connect at New York, Midtown Hilton. The event brought together thought leaders and top execs and offered thought-provoking ideas and insights to address industry-specific challenges. Signzy’s Ankit discussed the implications of user privacy and data ownership — the key themes that will drive digital customer onboarding journeys at the event. (10th-11th April)

Asian Development Bank Event: We presented at the Asian Development Bank’s Event in Vietnam. Honoured to be helping in bringing about the digital revolution in Vietnam. Signzy’s Arpit talked about digitising customer onboarding, doing e-kyc, and making banking more efficient at this event. (11th-12th April)

IDRBT Hyderabad Meeting: We were at the IDRBT meet at Hyderabad. RBI’s IDRBT initiative was about fast tracking the development of innovative fintech solutions solving complex regulatory, compliance, and other industry challenges. Signzy was among the few select fintech companies RBI/IDRBT sought inputs from. Arpit from Signzy shared his insights towards building a fast-moving fintech ecosystem (16th April)

Future of Business Conclave: We were a part of the panel at the Future of Business Conclave by Cisco and YourStory on innovation-driven digitisation at Mumbai. Signzy’s Arpit explained-although digitisation is the new norm, it can’t encompass everything — operations like customer support must remain humanised at the event. (28th April)

Tech Updates from Signzy: How we replaced legacy banking processes with AI-driven technology

From our blog:

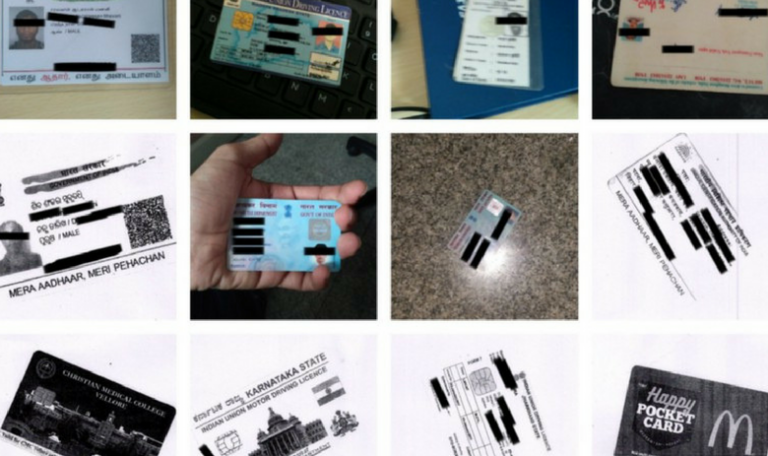

How we replaced legacy banking processes with AI-driven technology — A detailed article on power of deep learning explaining how AI transforms banking operations. Read here.

An approach to data privacy for Indian banks and financial institutions

An approach to data privacy for Indian banks and financial institutions — A must read explaining how Indian banks and financial institutions can approach data privacy despite the lack of regulations. Read here.

Industry News Updates from Signzy: Store data locally, RBI directs payment facilitators

The RBI released a notification asking financial technology companies to store all the data related to payments and transactions within India alone. Read on to know the impact the current directive has on the fintech companies storing/processing data. Check out the full story here.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com