How to Find the UBO of a Company? (Examples inside)

- UBO identification is mandatory for compliance. Identifying beneficial owners protects against money laundering, fraud, and sanctions violations. Failure to verify UBOs results in heavy fines and legal consequences across major jurisdictions.

- Direct and indirect ownership require different verification approaches. Direct ownership is straightforward. Indirect ownership demands tracing through corporate layers, calculating percentages, and spotting red flags like circular structures or threshold manipulation.

- Signzy's APIs map ownership across 180+ countries, calculate indirect stakes, screen against sanctions lists, and integrate KYC within KYB workflows for complete verification.

Ask yourself: who actually owns the business you're about to partner with? Not the name on the letterhead or the CEO shaking your hand, but who really controls it? If you can't answer that question with certainty, you're not alone. Most people can't.

The statistics reveal why this matters.

- The Stolen Asset Recovery Initiative found that anonymous companies were used to hide corruption proceeds in 85% of grand corruption cases they reviewed.

- The Panama Papers leak exposed over 214,000 offshore companies created for one specific purpose: concealing who the beneficial owners really are.

These aren't isolated incidents.

They represent a systematic problem in global business: ownership is deliberately obscured, often legally, making it nearly impossible to know who you're actually dealing with.

The good news is: everything is easily manageable if you know the fundamentals.

This guide walks you through the complete process of identifying ultimate beneficial owners. You'll learn where to look, what documents to verify, how to trace indirect ownership through corporate layers, and which red flags signal intentional concealment.

Related Solutions

What is an Ultimate Beneficial Owner (UBO)?

An Ultimate Beneficial Owner (UBO) is the natural person who ultimately owns or controls a company, regardless of the legal structure in place. This isn't necessarily the person whose name appears on official documents or company registries. Instead, it's the individual who holds the actual power, either through direct ownership, indirect control via intermediary entities, or by receiving the economic benefits.

Most jurisdictions define a UBO as someone holding 25% or more ownership or control rights, though this threshold can vary.

Is beneficial ownership the same as legal ownership?

No, legal ownership refers to the names on official paperwork, the registered shareholders or directors. Beneficial ownership, however, identifies who actually profits from and controls the entity.

| Aspect | Legal Ownership | Beneficial Ownership |

|---|---|---|

| Definition | Person/entity listed on official company documents | Natural person who ultimately owns or controls the company |

| Visibility | Public or easily accessible through registries | Often hidden behind corporate structures |

| Purpose | Administrative and legal compliance | Identifies who truly benefits and exercises control |

| Example | Nominee director listed as shareholder | An individual who owns the nominee's company |

| Control | Appears to have control of the paper | Actually makes decisions and receives profits |

| Regulatory Focus | Basic company registration requirement | Required for AML/KYC compliance and risk assessment |

Financial institutions, regulators, and law enforcement need to look beyond legal ownership to identify the real individuals behind business transactions.

A shell company might have a nominee director as its legal owner, but the beneficial owner, perhaps located in another jurisdiction entirely, is the one actually directing operations and receiving profits.

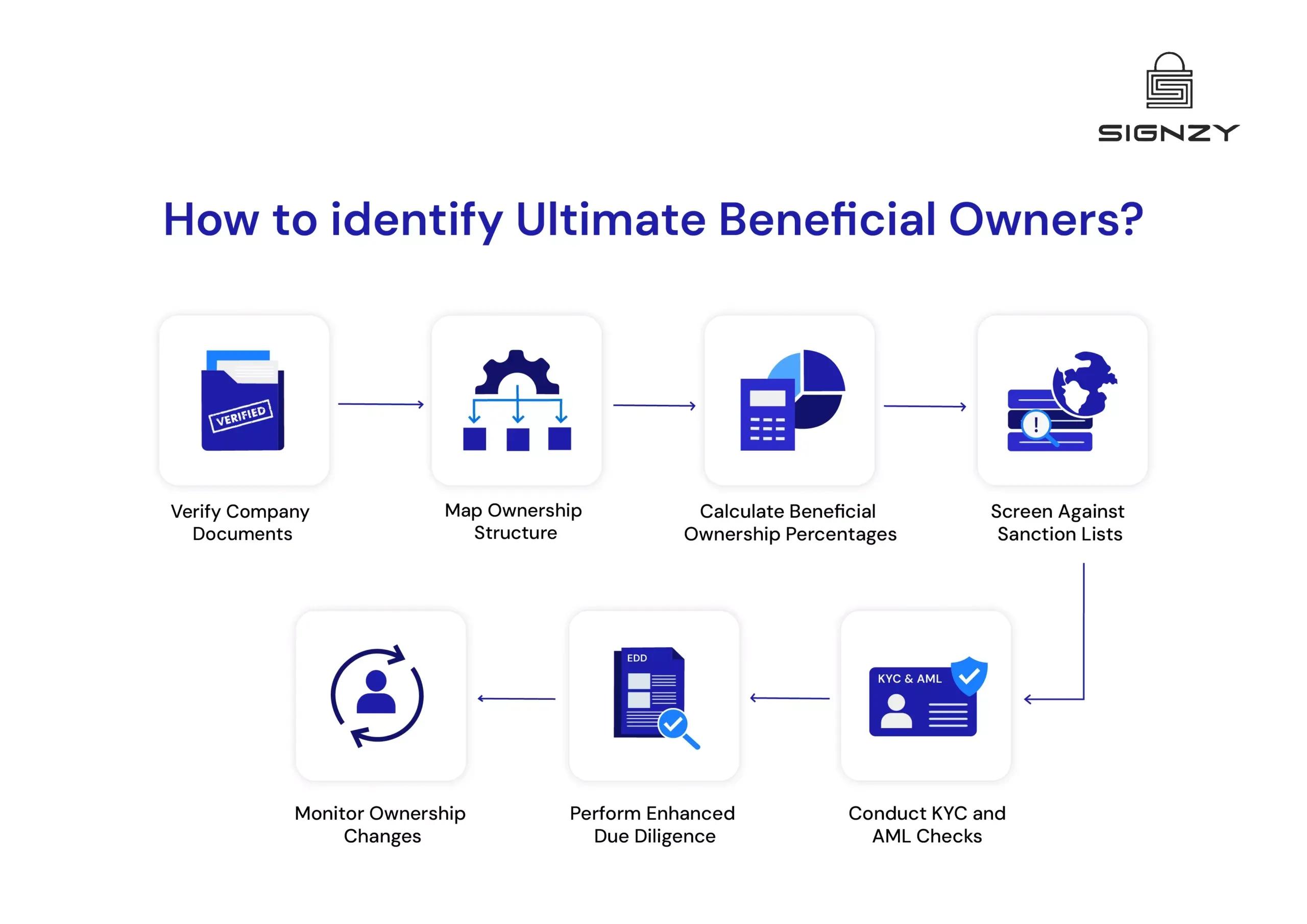

How to identify the UBO of a company?

UBO identification comes down to two core approaches: finding who owns shares directly and tracing ownership through other companies.

Direct ownership is simple to spot. Indirect ownership requires following the trail through multiple business layers. Both methods are necessary because complex structures often use a mix of both to hide who's really in control.

The next sections discuss the exact steps you can take to find both types of ownership.

How to find direct UBOs of a company?

Direct ownership means a person holds shares in the company in their own name. No other companies in between. This is the clearest type of ownership and the easiest to verify.

Here’s how to find direct UBOs:

- Ask for the company's official shareholder register.

- Go through the list and mark all individual people (not companies). Any corporate name on the list needs further investigation.

- For each person, see what percentage of the company they own. Look at the share percentage and the voting power percentage.

- Anyone with 25% or more ownership or voting rights is a UBO. Flag these individuals.

How to find indirect UBOs of a company?

Indirect ownership means a person controls the company through other companies they own. Think of it as ownership through a chain: Person A owns Company X, and Company X owns Company Y.

- Make a simple diagram showing who owns what. Start with your target company and trace back through every company shareholder until you find real people.

- Multiply the ownership percentages through each level to find the real ownership stake. Use this formula: Indirect Ownership = (% at Level 1) × (% at Level 2) × (% at Level 3)... and so on

- If someone owns the target company through different routes, add all their ownership percentages together.

- If the total comes to 25% or more, that person is a UBO.

- Document the entire ownership chain, showing how you calculated everything.

- Get registration documents for every company in the chain to confirm the ownership structure is real.

How to calculate company ownership?

Understanding ownership means following the money and control.

Simple ownership is straightforward – but business structures rarely are. Here’s what it looks like in practice:

Calculating direct beneficial ownership

Let’s say company ABC's shareholders are as follows:

- John Smith: 40% (person)

- Sarah Johnson: 20% (person)

- XYZ Holdings: 30% (company)

- Michael Brown: 10% (person)

Result: John Smith is a UBO because he owns 40% directly. XYZ Holdings needs more investigation because it's a company, not a person.

Calculating indirection or complex beneficial ownership

To calculate indirect beneficial ownership, we will use this formula: Indirect Ownership = (% at Level 1) × (% at Level 2) × (% at Level 3)... and so on

EXAMPLE 1: Single path

Person A owns 60% of Company X

Company X owns 50% of Company Y.

Using the formula of Indirect Ownership, the math will be: 60% × 50% = 30%

Result: Person A is a UBO of Company Y with 30% indirect ownership.

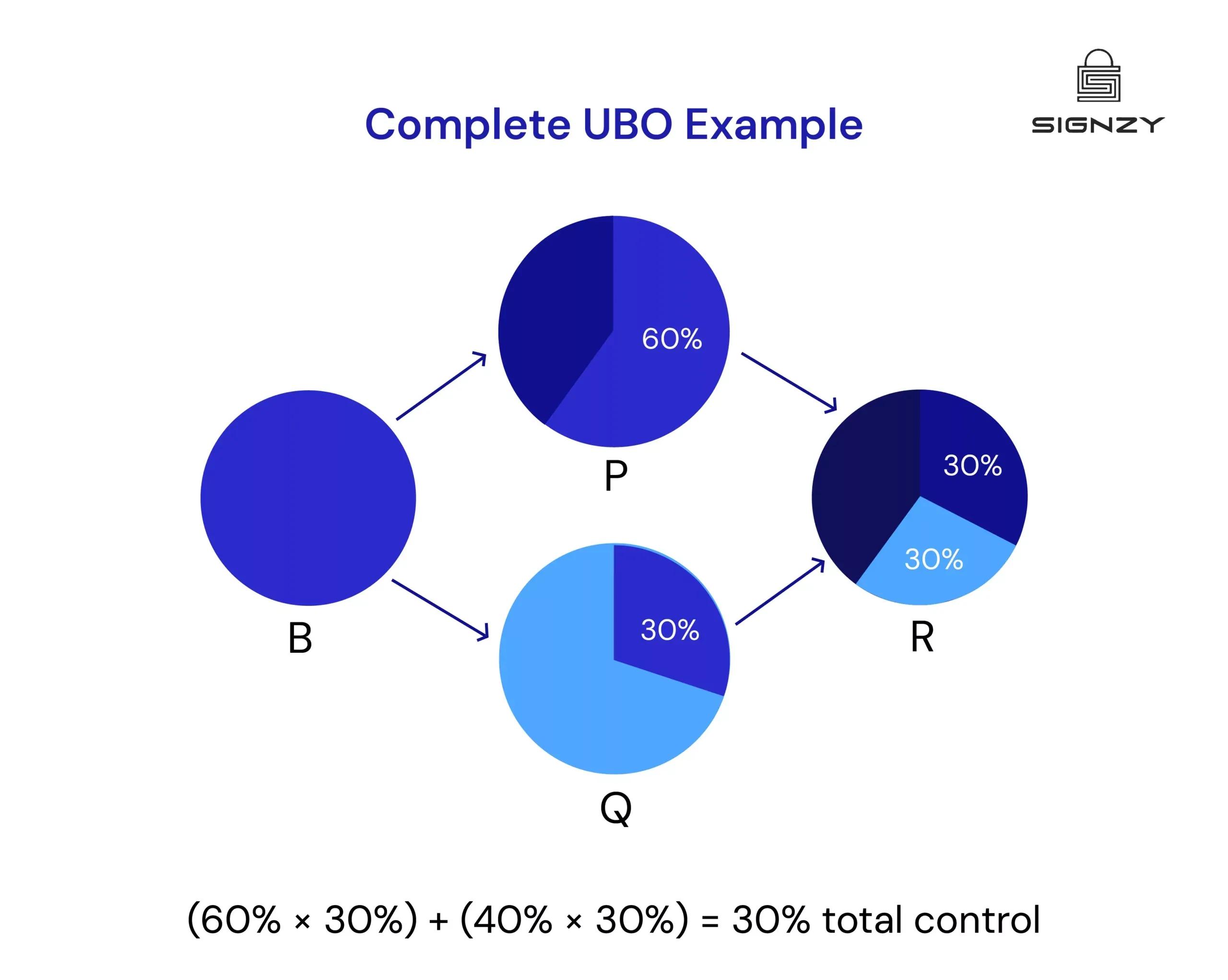

EXAMPLE 2: Two paths

Entity B owns:

- 60% of Company P

- 40% of Company Q

Both Company P and Company Q own shares in Company R:

- Company P owns 30%

- Company Q owns 30%

To find Entity B's beneficial ownership, the math will look like:

- First path (Company P → Company R) : 60% × 30% = 18%

- Second path (Company Q → Company R): 40% × 30% = 12%

- Total: 18% + 12% = 30%

Result: Entity B is a UBO of Company R with 30% total control through two different routes.

Entity B has split its ownership across two companies to own the same target (Company R).

While the math shows 30% total control, this split structure could be designed to appear below regulatory thresholds at each individual company level, potentially avoiding scrutiny.

💡 Ownership chains can go through three, four, five, or even more layers of companies. The more complex the structure, the more likely it's designed to hide something.

Clients with genuinely complicated ownership structures might resist deep investigation. They built those layers for a reason, right? They want to stay hidden. If a business becomes defensive or uncooperative when you start tracing ownership, that's often the biggest red flag of all.

Legitimate businesses with complex structures can explain them. Those with something to hide won't.

Which documents are needed for UBO verification?

Once you identify the UBO, it’s now time to verify the entity (natural person). While requirements vary across regions and entity types, certain basics remain constant. Every UBO verification needs:

- Current government ID (like Emirates ID in the UAE, Green card in the US).

- Proof of address (like utility bills and driver's license)

- Tax registration details

Why is Ultimate Beneficial Ownership identification important?

UBO identification is important because it reveals who actually controls a business. When you know who truly owns and controls a company, you can assess the real risk of doing business with them. Without this knowledge, you cannot verify if you are dealing with sanctioned individuals, politically exposed persons, or entities involved in criminal activity.

The consequences of getting this wrong are severe. Companies that fail to verify UBOs face four major risks:

- Money Laundering Schemes: Companies with unclear ownership structures become channels for cleaning illicit funds. A complex web of corporate entities, especially across multiple jurisdictions, makes tracking the true source of funds nearly impossible without proper UBO verification.

- Terrorist Financing: When beneficial ownership remains hidden, legitimate businesses can unknowingly become conduits for funding terrorist activities. This violation carries severe criminal penalties.

- Tax Evasion: UBOs use sophisticated offshore structures to conceal wealth and evade tax obligations. This creates unfair competition for compliant businesses and distorts market dynamics.

- Sanctions Evasion: Sanctioned individuals routinely use nominee directors or layered ownership structures to continue operations despite international restrictions. Doing business with them, even unknowingly, triggers immediate legal consequences.

The scale of this problem is substantial. The Pandora Papers investigation revealed more than 810,000 shell companies used to conceal UBO identities. These structures held at least 8% of global wealth, over $11.3 trillion in funds potentially tied to illicit activities.

Regulatory authorities hold organizations accountable regardless of intent. This makes UBO verification almost a mandatory business protection measure. This brings us to another important discussion.

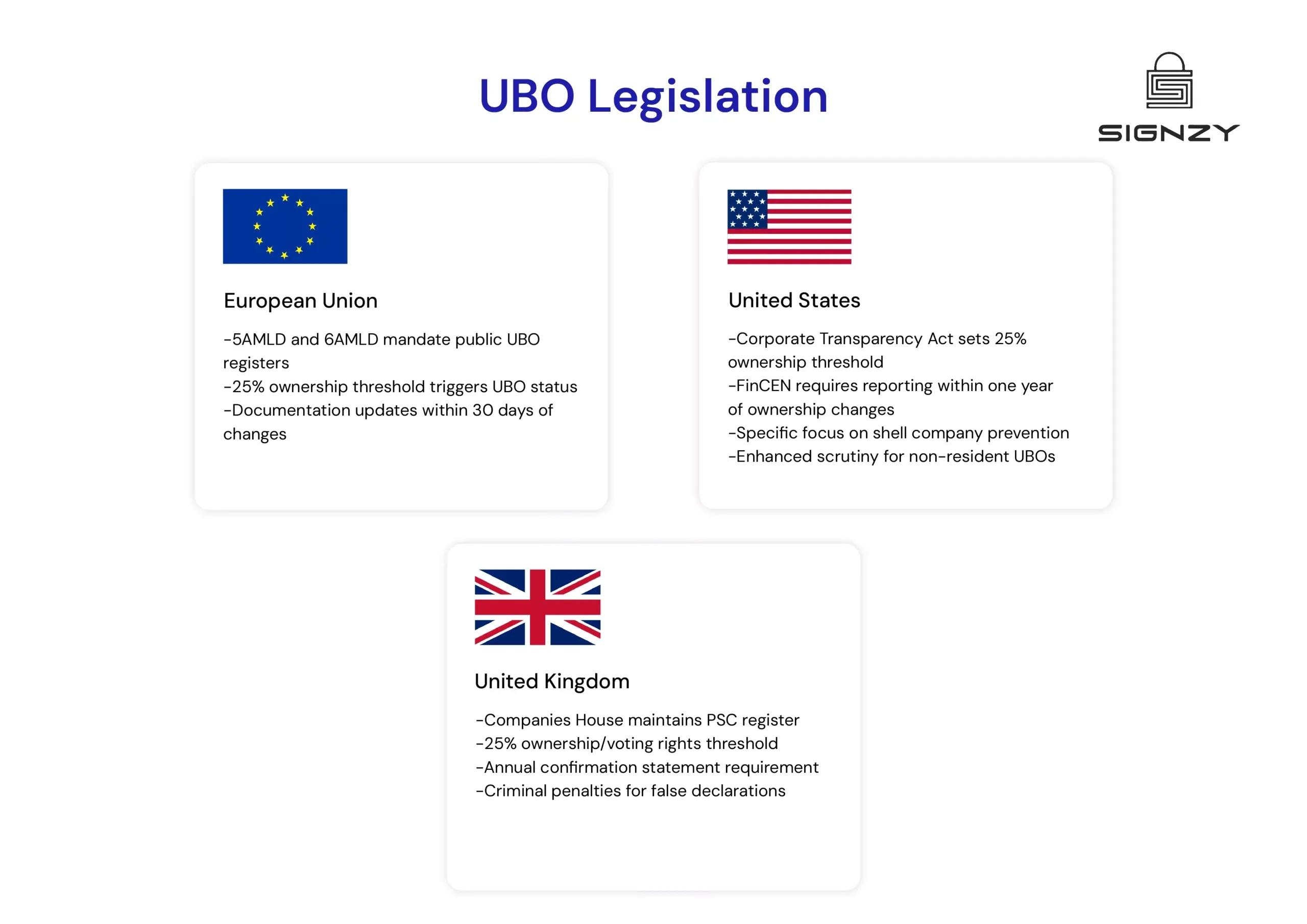

UBO legislation: What are the legal requirements for UBO verification?

The regulations for UBO verification vary significantly across regions, with each jurisdiction setting its own standards. However, recent years have seen a global shift toward stricter transparency requirements.

Financial Action Task Force (FATF) provides the international framework, but implementation differs:

- United States: Corporate Transparency Act (2024) requires most companies to report beneficial owners to FinCEN. Financial institutions must verify UBOs under the Bank Secrecy Act and the FinCEN Customer Due Diligence Rule.

- European Union: 5th and 6th Anti-Money Laundering Directives mandate UBO registries in all member states. Companies must identify and register beneficial owners holding 25%+ ownership or control.

- United Kingdom: The Persons with Significant Control (PSC) register is publicly accessible. All UK companies must identify and report individuals with 25%+ ownership or control.

- United Arab Emirates: Economic Substance Regulations and AML laws require companies to maintain beneficial ownership records and report to authorities.

- Singapore: Accounting and Corporate Regulatory Authority (ACRA) requires companies to maintain a register of registrable controllers with 25%+ ownership.

- Canada: Proceeds of Crime (Money Laundering) and Terrorist Financing Act requires financial institutions to identify beneficial owners as part of customer due diligence.

- Australia: Anti-Money Laundering and Counter-Terrorism Financing Act mandates beneficial ownership identification for reporting entities.

Even jurisdictions traditionally known for financial privacy, such as Switzerland and certain offshore centers, have implemented UBO disclosure requirements under international pressure.

Even recent enforcement actions show regulators actively pursuing violations.

In 2024, DBS Bank Limited in Singapore faced a $1.93 million fine for inadequate anti-money laundering checks. The bank failed to properly identify and verify ultimate beneficial owners in its transactions between 2014 and 2020.

How to spot suspicious company structures? Red flags explored

These red flags don't automatically prove wrongdoing, but they signal the need for enhanced due diligence and deeper investigation. Here are the six red flags that should trigger more scrutiny when spotted:

Circular ownership structures

Circular ownership occurs when companies own each other in a closed loop. In the simplest form, Company A owns Company B, Company B owns Company C, and Company C owns Company A.

This creates an ownership chain with no clear beginning or end, making it impossible to identify a natural person as the ultimate owner.

"We found Signzy through a compliance conference, and the difference was immediate. The platform maps ownership across multiple jurisdictions automatically, calculates indirect stakes, and flags circular structures we would have missed. Our verification time dropped from weeks to hours." — Compliance Manager, International Private Bank

🚨 Why it's suspicious: This structure serves no legitimate business purpose beyond obscuring who actually controls the entities. It prevents regulators and financial institutions from tracing accountability, fund flows, and decision-making authority.

💡 What to do: Circular ownership is an automatic red flag. Request a complete explanation of the business rationale. If the explanation is unclear or unconvincing, consider declining the relationship or escalating to enhanced due diligence teams.

Ownership just below reporting thresholds

Companies with multiple shareholders each holding exactly 24% or 24.9% ownership, just below the standard 25% UBO reporting threshold, raise immediate concerns.

🚨 Why it's suspicious: This pattern suggests deliberate structuring to avoid triggering beneficial ownership disclosure requirements. Legitimate businesses rarely have such precise ownership distributions that conveniently fall just under regulatory limits.

💡 What to do: Investigate relationships between these shareholders. Look for common addresses, family connections, or evidence that they may be acting in concert. Calculate aggregate ownership if shareholders appear to be related parties.

Nominee directors and shareholders

Nominee arrangements involve individuals who appear as directors or shareholders on official documents but have no actual involvement in the business. They're essentially placeholders for the real controllers.

🚨 Why it's suspicious: Nominees are commonly used to hide the identity of true beneficial owners, particularly when those owners are sanctioned individuals, politically exposed persons, or seeking to evade taxes.

💡 What to do: Interview the listed directors to assess their actual involvement and knowledge of the business. Request signed declarations confirming they are not acting as nominees. Cross-reference their names against other corporate records to identify if they serve as directors in dozens of unrelated companies. You can also integrate Signzy's out-of-the-box PEP screening API within your existing workflows to automatically flag politically exposed persons and check directors against global sanction lists.

Ownership through high-risk jurisdictions

Companies owned through entities registered in jurisdictions known for weak transparency requirements, minimal regulatory oversight, or favorable secrecy laws warrant additional scrutiny.

🚨 Why it's suspicious: While legitimate reasons exist for offshore structures, these jurisdictions are disproportionately used in money laundering schemes, tax evasion, and beneficial ownership concealment.

💡 What to do: Request enhanced documentation explaining the business rationale for using these jurisdictions. Verify the substance of offshore entities by requesting proof of employees, office space, and actual business operations beyond mail forwarding services. Signzy provides verification coverage across 180+ countries, making cross-border due diligence manageable even for complex offshore structures.

Reluctance to disclose ownership information

Businesses that avoid direct answers, provide incomplete documentation, miss deadlines repeatedly, or become defensive when asked about beneficial ownership often have something to hide.

🚨 Why it's suspicious: Legitimate businesses with nothing to conceal cooperate fully with UBO verification. Resistance, delays, or evasiveness typically indicate the entity is trying to avoid revealing problematic ownership connections.

💡 What to do: Set clear deadlines for documentation. If cooperation remains poor, escalate the case or terminate the business relationship. Reluctance to disclose is itself sufficient grounds for enhanced scrutiny.

Inconsistent or contradictory documentation

Ownership information that conflicts between different sources—company registries, financial statements, contracts, and declarations—signals potential fraud or deliberate obfuscation.

🚨 Why it's suspicious: Inconsistencies suggest someone is providing false information to different parties or attempting to maintain multiple versions of the ownership structure depending on the audience.

💡 What to do: Identify and document all discrepancies. Request certified copies of official registry documents. Building document collection timelines into your onboarding workflow using tools like Signzy can also help identify non-responsive cases early.

How to automate beneficial owner checks using Signzy?

Even with all documentation in place, tracing and verifying UBOs manually poses significant challenges. A single verification can take weeks, and still might miss critical connections.

"We onboard 40-50 corporate clients monthly, each requiring full beneficial ownership verification. Before automation, our team spent 60% of its time just chasing documents and building ownership charts manually. Signzy's API connected our system directly to company registries, and we were getting verified UBO data in minutes. Our processing capacity tripled without adding headcount." — Head of Client Onboarding, Asset Management Firm

This is where automation makes a real difference. Signzy's UBO verification API turns this complex process into something manageable and reliable. The platform works by:

- Connecting with global company registries in real-time across 180+ countries

- Automatically calculating direct and indirect ownership percentages through multiple corporate layers

- Mapping complex ownership structures and flagging circular patterns

- Screening identified UBOs against international sanctions lists and PEP databases

- Monitoring ownership changes as they happen

- Creating clear audit trails for compliance

What once took weeks now takes minutes. More importantly, the accuracy improves significantly.

One key advantage is how Signzy integrates KYC verification within KYB workflows. You can trace ownership through complex corporate structures down to natural persons, then immediately verify those individuals through standard KYC processes. This means you verify both the business entity and the beneficial owners behind it in one seamless workflow, giving you complete visibility from corporate structure to actual people.

For organizations handling high volumes of business onboarding, Signzy's API-based approach scales effortlessly while maintaining compliance with global AML and KYB regulations. To know more, book a demo here.

FAQ

What if a company does not have an UBO?

Is UBO identification mandatory?

How does UBO verification fit into KYB process?

What happens if UBO information cannot be verified?

Saurin Parikh

Saurin is a Sales & Growth Leader at Signzy with deep expertise in digital onboarding, KYC/KYB, crypto compliance, and RegTech. With over a decade of professional experience across sales, strategy, and operations, he’s known for driving global expansions, building strategic partnerships, and leading cross-functional teams to scale secure, AI-powered fintech infrastructure.

![Business Verification in Canada: Complete Guide [2026]](https://cdn.sanity.io/images/blrzl70g/production/72a7dd392f01378e66cfb0289fb556774b71174c-2560x600.webp)

![How to Verify Legitimacy of a Business: KYB Guide [2026]](https://cdn.sanity.io/images/blrzl70g/production/cd6d78e1cf2a2102945329f730ec063fe21cb5a9-2560x600.webp)

![UAE KYB Documents Requirements [Take-Home List Inside]](https://cdn.sanity.io/images/blrzl70g/production/544d434c34d12f9580fd9f8fbc736de22a07d613-2560x600.webp)