What is KYC? Here’s the end-to-end KYC process

As we move forward in this digital age, following compliances imposed on institutions, especially banks, have become inevitable. Governing bodies help businesses to stay afloat and well-oiled in this era of online fraud.

Through the process of KYC, financial institutions, like banks, can run a background check on their customer as a part of due diligence. It contains information about the customer such as their addresses, occupation, date of birth, identity details, etc. This way, institutions are protected from fraudsters who forge identities for financial crimes.

Among the many rules and regulations, KYC takes up the middle stage ensuring that banks and other businesses don’t fall under any scams.

KYC procedures are like superheroes combating villains (scammers and fraudsters) to keep our world safe and peaceful.

KYC is an important tool for accessing global and local threats imposed by criminals. No one can emphasize enough how important measure it is to comply with KYC regulations. Banks, especially, have to follow KYC standards.

But why?

Think of it, any criminal will need money to conduct a crime. It can be anything, from human trafficking, kidnapping, and extortion to scamming people online or even being connected to the world of terrorism. They will need a bank account to store and move illicit funds. But, if a bank recognizes the pattern of such activities or even raises suspicion as to why such transactions are happening, they can stop the criminals.

Cool right? That’s the job of KYC!

Why do we need an efficient end-to-end KYC process?

The simple answer is to prevent criminals from getting away from crimes.

Nothing is static anymore, with criminals getting hi-tech, compliances are getting dynamic too. Regulations and acts are updated timely and that’s when new norms come into the picture. Every country, sector, industry, and jurisdiction has a different set of rules which makes streamlining the KYC standards to manage risks and protect banks.

Results? Better customer experiences, quick delivery of services, and reduction in delays.

If a bank doesn’t comply with KYC rules? Go complacent? Hefty fines.

USAA bank had to pay up to $140 million for not playing fair and using KYC guidelines.

The process of onboarding a customer, verifying documents, checking whether the customer has no past criminal records, customer due diligence, and transaction monitoring is the end-to-end process of KYC.

💡 Related Blog:

What does “end-to-end” mean? Let us dig a little deeper.

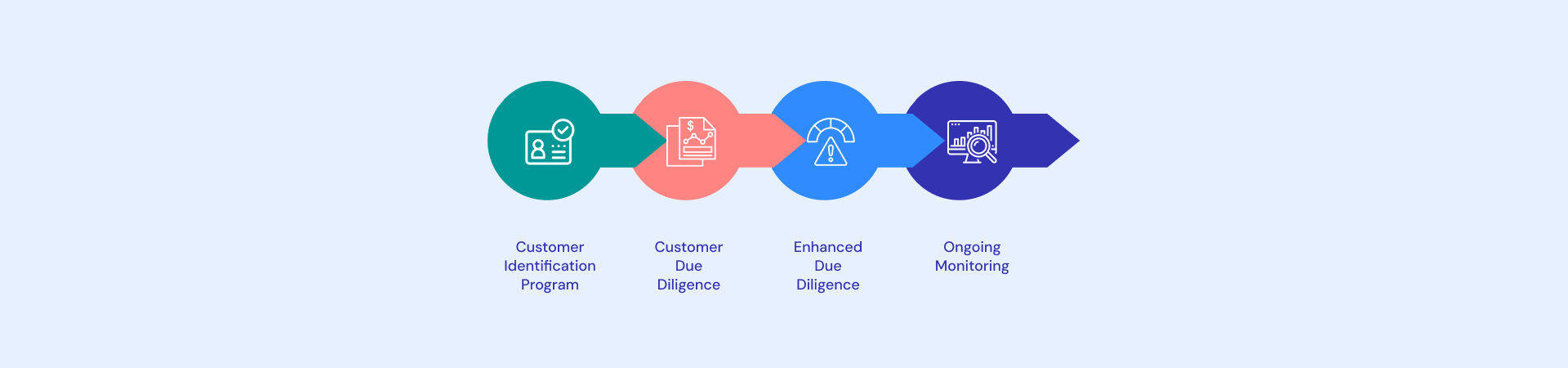

- Customer identification program (CIP): How do you know your customers are who they claim to be? We all related when Dwight Scrute said, ” Identity theft is not a joke Jim!” Not just Dwight Shrute but millions of people lose their money due to identity theft. Through CIP, businesses will make sure the user is not related to any government sanctions or they are known to have connections with terrorism. If they are, additional screening will be followed. For firms, it’s more than risk, it’s law!

- Customer Due Diligence (CDD): This is the next stage of the KYC verification process. Banks process the data collected in stage one. Usually, firms collect data regarding the occupation of customers, transaction patterns, frequency of payments, etc. Usually, the customer possesses little to no risk but if they do, enhanced due diligence is usually required. The banks keep monitoring to see if their customers have spikes in activities and transactions.

- Enhanced Due Diligence (EDD): If a customer is believed to have a high-risk profile, they have to go through this process. A person with a high-risk profile can have political exposure or connections with terrorism which makes it difficult for the bank to have a relationship with them. Banks want to make sure they are engaging with the right set of customers.

- Ongoing monitoring: Now that we have established the fact that fraudsters are always ahead of us, what if they clear all checkpoints? It’s not enough to have your customer checked only once. Any spikes in their activities must raise suspicion. Other such oversight must include checking if the customer has had their names included in the sanction list or negative media attention or even cross-border transactions. All such activities must be tracked and reported.

Related Solutions

What are the advantages of using KYC?

Will you believe if we said that many banks still use traditional manual processes? According to reports, customer due diligence is not adequately recorded by many banks. Heavy reliance on spreadsheets makes the data incorrect and not to mention time-consuming too.

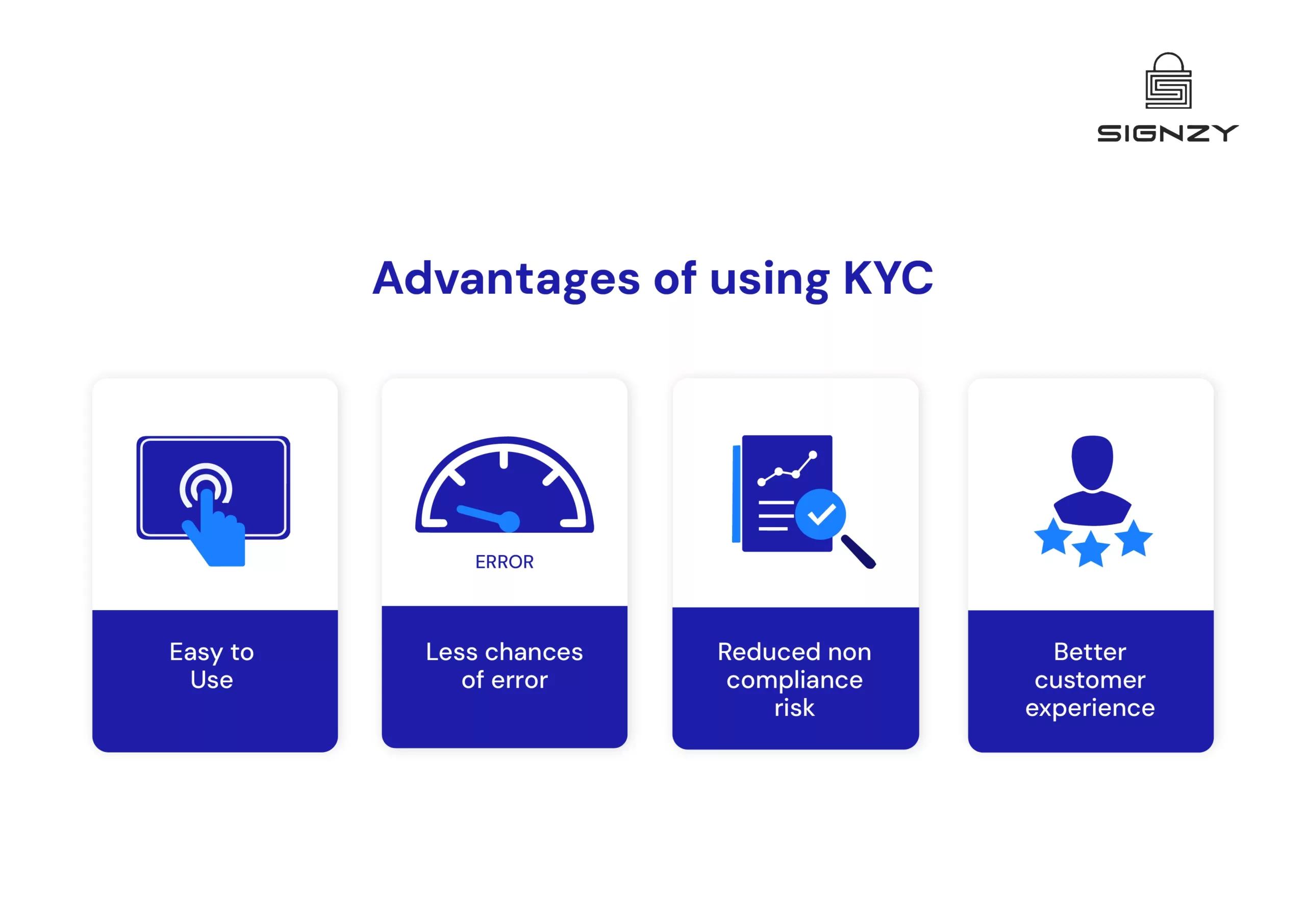

By using an End-to-end KYC process, we get the following advantages:

- Simple and easy to use: The whole process can be overwhelming if done manually. The whole process involves various parties and various complications. Using KYC, the same process is done in a fraction of the time.

- Less chances of error: While handling data, humans can enter the data wrong or mix up the numbers. Allowing computers to do the same, the chances of error becomes negligible.

- Non-compliance risk: With correct documentation and processing, banks and other firms can have periodic auditing to reduce the non-compliance risk.

- Better customer experience: Suppose you are told that you can open a bank account without having to come multiple times to the bank and your loan gets approved within days. Who would leave such an opportunity? With KYC handy, genuine customers feel relaxed with the whole process without having to pay homage to the banks every day! The whole process is quite seamless for both, financial institutions and the customer.

However, everything isn’t as rosy as it seems. Let’s also address the thorns in the room!

There were 1.036 million reports of identity theft in the USA in 2023 alone despite banks complying with KYC regulations. Why?

Even though we have advanced technology, we lack the resources to back KYC. Now that we live in a generation where you don’t need to rob a bank, you can sit in the comfort of your home and rob a bank with just a few clicks. It becomes very important to have security against such swindlers. A crisis in the US bank can cause a market crash in Japan. We cannot comprehend in a few words how interconnected our worlds have become!

Signzy’s KYC solution

Signzy can help you simplify your KYC compliance. With the help of Signzy’s robust KYC API, financial organisations can instantly get insights into data breaches, confirming the accuracy of consumer data and spotting any dangers.

You can also detect compromised credentials, stop fraudulent transactions, and improve compliance by incorporating the KYC API into your onboarding process. You will be able to fortify your security measures and recognize possible weaknesses as a result.

Click here to explore our KYC solutions 🙂

Shivam Agarwal

Shivam heads the go-to-market strategy at Signzy. He holds the CFA charter and a strong background in financial operations, PE analysis and strategy. His prior roles include business strategy and private-equity analysis in the financial services and fintech domain, giving him deep insight into client needs, risk-adjusted economics and monetisation models for compliance & identity verification platforms.