It isn’t just the finance and banking sector that is going digital. Every aspect of our lives, every industry we can fathom is undergoing a digital transformation. From the comfort of one’s home, a car can be rented, a fiancé found, a house booked, and a loan taken. The common prerequisite for each of these pursuits is verifying that the person is exactly who they say they are. (A little more than) a click of a button can authenticate the user with the help of a remote id verification service. Irrespective of workflow, the Know-Your-Customer (KYC) process is shifting to the digital for each step, end-to-end.

The Need for online ID verification & Video KYC

With the COVID-19 pandemic forcing everyone into their homes, there is a growing need for an efficient, cost-cutting paperless system. A system where the person seeking the service never has to come in contact with the organization providing it.

The problem NBFCs are facing

Due to the privacy judgment by the Supreme Court, Non-Banking Financial Companies (NBFCs) are not mandated to use Aadhaar eKYC as a means to simplify onboarding. This creates a gap for a simple, secure, and compliant solution.

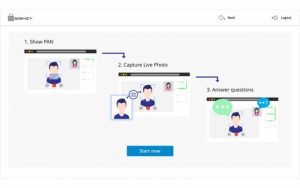

The Precedent: Video KYC in India

On 9 January 2020, the Reserve Bank of India (RBI) approved Aadhaar-based video authentication as an alternative to e-KYC. Now banks and other lending institutions regulated by the RBI can adopt a Video-based Customer Identification Process (V-CIP). It is a consent-based alternative method of id verification for customer onboarding.

The amendment to the KYC norms are a great way to push digital financial inclusion. The benefits of VideoKYC for banks are often discussed. But, what many fail to see is the future VideoKYC holds for non-bank institutions.

Non-banks, whether performing a financial function or not, can adopt VideoKYC as a solution to all their onboarding challenges. This blog will discuss the different industries that can adopt VideoKYC. It will also delve into the regulatory paths that exist, and those that can be potentially created to include NBFCs and non-financial institutions in the VideoKYC revolution.

The Potential Paths of KYC in India

Video KYC can fill in the gap of a simple, secure, and compliant solution for NBFCs. It is also useful to various non-financial institutions. It boils down providing a faster solution for all those sectors that erstwhile used electronic form filling.

RBI is the regulator of banking in India. Currently, different bodies regulate different finance related aspects carried out by non-banks. The future can only hold one of two options:

- The potential of non-bank financial institutions regulated by the RBI

- The current situation of non-banks not regulated by the RBI but other specific authorities

Either way, VideoKYC can be freely used by the following without any regulatory roadblocks:

Regulated non-bank institutions

The following 4 functions are financial in nature and the non-bank institutions performing them are currently regulated by different authorities.

- Asset Management Companies (Regulated by the Securities and Exchange Board of India): The VideoKYC onboarding customer journey allows full KYC, AML/CFT and authentication resulting in significant reduction of costs. Apart from individuals, it can also be beneficial to onboard non-individuals such as SMEs. The solution eliminates back and forth to reduce onboarding time.

- Insurance (Regulated by the Insurance Regulatory and Development Authority): Technologies such as a livliness check and digital fraud detection enable an enhanced user experience and reduces digital risk in the insurance arena.

- Lending: Using VideoKYC for the SME lending process can result in faster decision making and improved user experience. It can also be used for other forms of lending by NBFCs such as individual retail lending.

- Payments: KYC had been a primary barrier for mobile wallet companies who were relying on Aadhaar to onboard customers. They had to resort to cumbersome traditional processes. Video KYC can streamline the clunkiness of this experience.

Non Financial institutions

- Telecom industry: Authentication of a user is imperative to be issued a SIM card. Till now a physical visit to the service provider was mandatory to activate the SIM card. With the safe, contactless option of VideoKYC now in existence, the telecom industry should switch to this method of id verification.

- Rental/shared vehicle economy: Players like Ola Money which had a firm base of users using their wallet to pay for cab rides, had to perform the full KYC ritual to keep their accounts operational when eKYC was banned. With RBI accepting Video KYC as a potential alternative for digital KYC in 2020, Signzy’s Video KYC technology has the potential to provide the solution.

- Co-working spaces: Co-working spaces have been cropping up in the past few years. For the safety of all those working under one roof, KYC is done. Like any other long-drawn out process, VideoKYC can help reduce the time it takes to begin working from one’s new work place.

- Co-living and accomodation rentals: Driven mainly by urbanisation, the lack of affordable housing and technological innovation, co-living is gaining popularity. Documents may take time to be verified due to obstacles like blurred images or the possibility of forgery. A trustable solution must be used for the peace of mind of all tenants and VideoKYC is the best solution in the foreseeable future.

- Consumer goods rentals: Rental companies also follow the same approach where the owner never meets the buyer. In order to authenticate users, KYC collection and id verification is a must. But traditional forms of KYC collection can be cumbersome and require a lot of manpower, time and infrastructure. Just like every other paragraph in this blog, we cannot stress enough how much easier VideoKYC can make this.

- Educational platforms & exams: Although not used as widely as other sectors yet, with homeschooling now a forced practical reality for many students worldwide, VideoKYC can be used to onboard students to a new platform for learning. It can prevent cheating in competitive exams ensuring the person taking the exam isn’t someone else.

- Gaming: Cybersecurity and fraud are a huge concern for the gaming world. With money at stake, KYC is important to detect and shut down fake accounts and fraudsters.

- Dating and matrimonial sites: Trust is the foundation of any relationship or marriage. To get to that stage the user must trust the platform they are using to find their significant other. VideoKYC can ensure all suitors are exactly who they claim to be online.

But, why exactly are we calling Video KYC the future? You can find out through this blog.

Whether you are a bank or a non-bank, VideoKYC provides id verification solutions for any industry. Signzy’s VideoKYC solution has matured over dialects, browsers and low-internet scenarios. Use our new-age trust protocol to improve customer experience, cut down costs, and simplify onboarding. It will soon become a multi-industry standard. Adopt it to stay ahead of the curve.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.