What is a Politically Exposed Person (PEP)?

- Politically Exposed Persons (PEPs): PEPs are individuals holding prominent public positions or influence in governmental activities, making them higher risk for corruption, bribery, and money laundering.

- Importance of PEP Verification: Verifying PEPs is crucial for mitigating risks related to corruption and money laundering, while ensuring compliance with global anti-money laundering (AML) regulations.

- PEP Lists and Verification: PEP Lists provide essential information on individuals classified as PEPs, and verification involves screening against these lists, conducting Enhanced Due Diligence (EDD), and continuous monitoring.

- Challenges in PEP Verification: False positives, data accuracy, and global variations in PEP definitions pose challenges to effective PEP verification.

In the realm of financial services, compliance with anti-money laundering (AML) regulations is a top priority. One crucial aspect of AML compliance is the verification of Politically Exposed Persons (PEPs). Identifying and monitoring PEPs is essential to mitigate risks associated with corruption, bribery, and money laundering.

But what exactly is a Politically Exposed Person, and why is their verification so important?

Let’s understand.

Related Solutions

What is a Politically Exposed Person (PEP)?

A Politically Exposed Person (PEP) is an individual who holds a prominent public position or has significant influence over governmental activities. Due to their positions of power and influence, PEPs are considered to be at a higher risk of being involved in corruption or other illegal activities, such as money laundering.

PEPs can include heads of state, government officials, military leaders, senior executives of state-owned enterprises, and their close family members or associates. The risk associated with PEPs extends not only to their direct activities but also to the actions of those connected to them, as they may leverage their influence for personal gain or to facilitate illicit transactions.

Why is Verifying PEPs Important?

Verifying PEPs is important for AML compliance. Here’s why:

- Mitigating Corruption Risks

PEPs are more likely to be exposed to opportunities for corruption due to their positions. By verifying PEPs, financial institutions and businesses can identify individuals who may be using their political influence for corrupt purposes. This helps in preventing corrupt funds from entering the financial system and ensures that businesses are not inadvertently facilitating illegal activities.

- Compliance with Regulations

AML regulations, including those set by the Financial Action Task Force (FATF), require financial institutions to identify and monitor PEPs as part of their customer due diligence (CDD) processes. Failure to comply with these regulations can result in severe penalties, including fines and reputational damage. Verifying PEPs ensures that businesses are meeting their regulatory obligations and maintaining the integrity of their operations.

- Preventing Money Laundering

PEPs are often targeted by criminals seeking to launder money due to their ability to move large sums of money across borders with relative ease. Verifying PEPs allows businesses to detect and prevent potential money laundering activities, protecting the financial system from abuse and ensuring that illicit funds are not being laundered through legitimate channels.

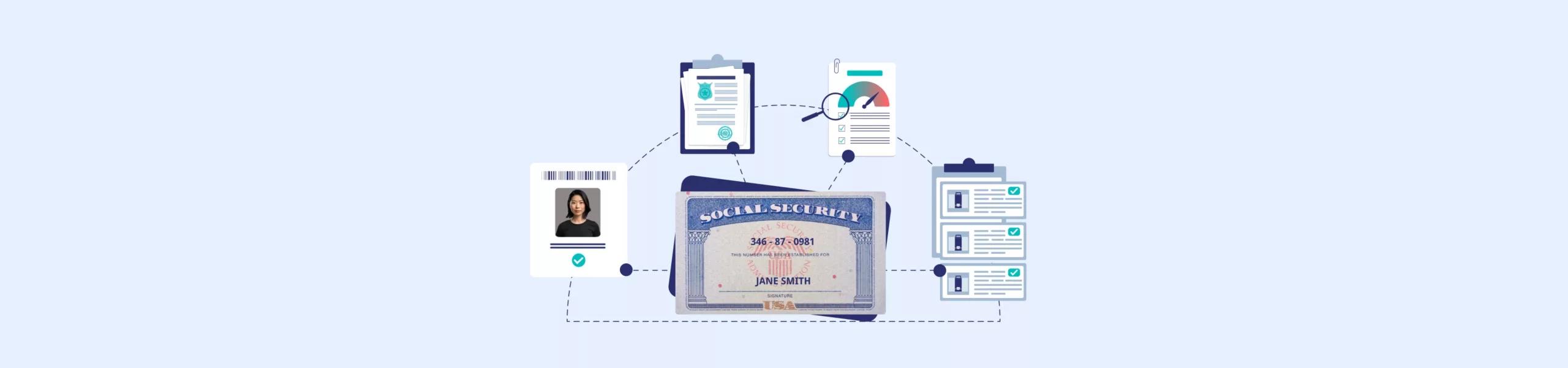

Understanding Politically Exposed Person (PEP) Lists

Politically Exposed Person (PEP) Lists are comprehensive databases that contain information on individuals who are classified as PEPs. These lists are compiled from various sources, including government records, public databases, and international organisations, and are used by financial institutions, businesses, and compliance professionals to identify and monitor PEPs.

PEP Lists typically include information such as the individual’s name, position, country of residence, and the nature of their political exposure. Some lists may also include information on close family members and associates, as these individuals are also considered to be at risk of involvement in corrupt activities.

💡 Related Blog:

How to Verify a Politically Exposed Person (PEP)

Verifying a PEP involves several key steps:

- Screening Against PEP Lists

The first step in verifying a PEP is to screen the individual against a Politically Exposed Person (PEP) List. This can be done manually or through automated screening tools that cross-reference the individual’s information with PEP databases. Automated tools are often preferred as they provide faster and more accurate results, reducing the risk of human error.

- Enhanced Due Diligence (EDD)

Once a PEP has been identified, Enhanced Due Diligence (EDD) should be conducted. EDD involves gathering additional information on the PEP, including their source of wealth, financial history, and any potential risks associated with their political exposure. This step is crucial for assessing the level of risk the PEP poses and determining the appropriate course of action.

- Ongoing Monitoring

Verifying a PEP is not a one-time process. Ongoing monitoring is essential to ensure that any changes in the PEP’s status or activities are detected promptly. This includes regularly updating the PEP List and conducting periodic reviews of the PEP’s transactions and activities. Continuous monitoring helps businesses stay compliant with regulations and manage risks effectively.

- Risk-Based Approach

Not all PEPs pose the same level of risk. A risk-based approach should be applied, where the level of scrutiny and monitoring is proportionate to the level of risk the PEP presents. For example, a head of state may require more stringent monitoring compared to a lower-level government official. This approach allows businesses to allocate resources efficiently and focus on high-risk individuals.

The Role of Technology in PEP Verification

Technology plays a vital role in the verification of PEPs. Automated screening tools and AI-driven solutions have revolutionized the way businesses manage PEP risks. These tools can quickly and accurately screen individuals against vast PEP Lists, conduct EDD, and provide real-time monitoring and alerts for any suspicious activities.

Plus, technology can help businesses comply with global AML regulations by ensuring that PEP verification processes are consistent, transparent, and auditable. By leveraging advanced technologies, businesses can enhance their PEP verification capabilities, reduce the risk of non-compliance, and protect themselves from potential financial and reputational harm.

Challenges in Verifying Politically Exposed Persons (PEPs)

Verifying PEPs is crucial. But there are also some challenges:

- False Positives

One of the most common challenges in PEP verification is the occurrence of false positives. This happens when an individual is incorrectly identified as a PEP due to a name match or other similarities. False positives can lead to unnecessary investigations and delays in customer onboarding, affecting the overall efficiency of the process.

- Data Accuracy and Completeness

The accuracy and completeness of PEP Lists are critical for effective verification. However, maintaining up-to-date and accurate PEP Lists can be challenging due to the dynamic nature of political positions and the varying quality of data sources. Inaccurate or outdated information can lead to incorrect assessments and increase the risk of non-compliance.

- Global Variations in PEP Definitions

Different countries and jurisdictions have varying definitions of who qualifies as a PEP. This lack of uniformity can complicate the verification process, especially for businesses operating in multiple countries. Understanding and adapting to these variations is essential for accurate PEP verification and compliance with local regulations.

Best Practices for PEP Verification

To effectively verify PEPs and manage associated risks, businesses should adopt the following best practices:

- Use Reputable PEP Lists

Choose PEP Lists from reputable sources that provide comprehensive and regularly updated information. This ensures that the data used for verification is accurate and reliable.

- Implement Automated Screening Tools

Automated screening tools can significantly enhance the efficiency and accuracy of PEP verification. These tools can process large volumes of data quickly, reducing the risk of false positives and ensuring that no PEPs are missed.

- Conduct Regular Training

Ensure that compliance teams are regularly trained on the latest PEP verification procedures and AML regulations. This helps in maintaining a high level of awareness and preparedness in managing PEP risks.

- Adopt a Risk-Based Approach

Apply a risk-based approach to PEP verification, focusing resources on high-risk individuals while maintaining adequate monitoring for lower-risk PEPs. This approach allows for more efficient risk management and compliance.

Conclusion

Verifying Politically Exposed Persons (PEPs) is important for AML compliance and risk management. By understanding the importance of PEP verification, using comprehensive PEP Lists, and leveraging technology, businesses can effectively manage the risks associated with PEPs and ensure compliance with global AML regulations. Implementing best practices and overcoming challenges in PEP verification will not only protect businesses from financial and reputational harm but also contribute to the integrity and security of the global financial system.

FAQ

What is a Politically Exposed Person (PEP) in AML compliance?

Why are PEPs considered high risk by financial institutions?

Are PEPs the same as individuals on sanctions lists?

Do family members of PEPs also need to be screened?

How long does someone remain classified as a PEP?

Roshan Kumar

Roshan leads product strategy for Identity and Fraud Verification at Signzy Technologies, where he oversees the development of secure, scalable ID Verification, Automated CKYC, and AI-powered Video KYC solutions for regulated banks and fintechs. With over five years of hands-on experience in KYC and API banking and a strong engineering background, he focuses on building platforms that ensure seamless and compliant onboarding across the BFSI sector. His expertise spans designing and implementing solutions that address evolving regulatory requirements and industry challenges.