Reserve Bank of India (RBI), on 15th April 2024, announced the new guidelines for Key facts statement (KFS) for retail and MSME terms loans and advances, containing essential information such as the all-inclusive APR and recovery and grievance redress mechanisms.

These guidelines are mandatory to ensure enhanced transparency in lending and enable customers to make informed decisions, thereby empowering borrowers to make informed financial decisions.

To whom are these changes intended?

-

- All Commercial Banks

- Local Area Banks,

- Small Finance Banks,

- Regional Rural Banks,

- excluding Payments Banks

- All Co-operative Banks

- All NBFCs

- Housing Finance Companies (HFC)

- Microfinance institutions (MFI)

- All Commercial Banks

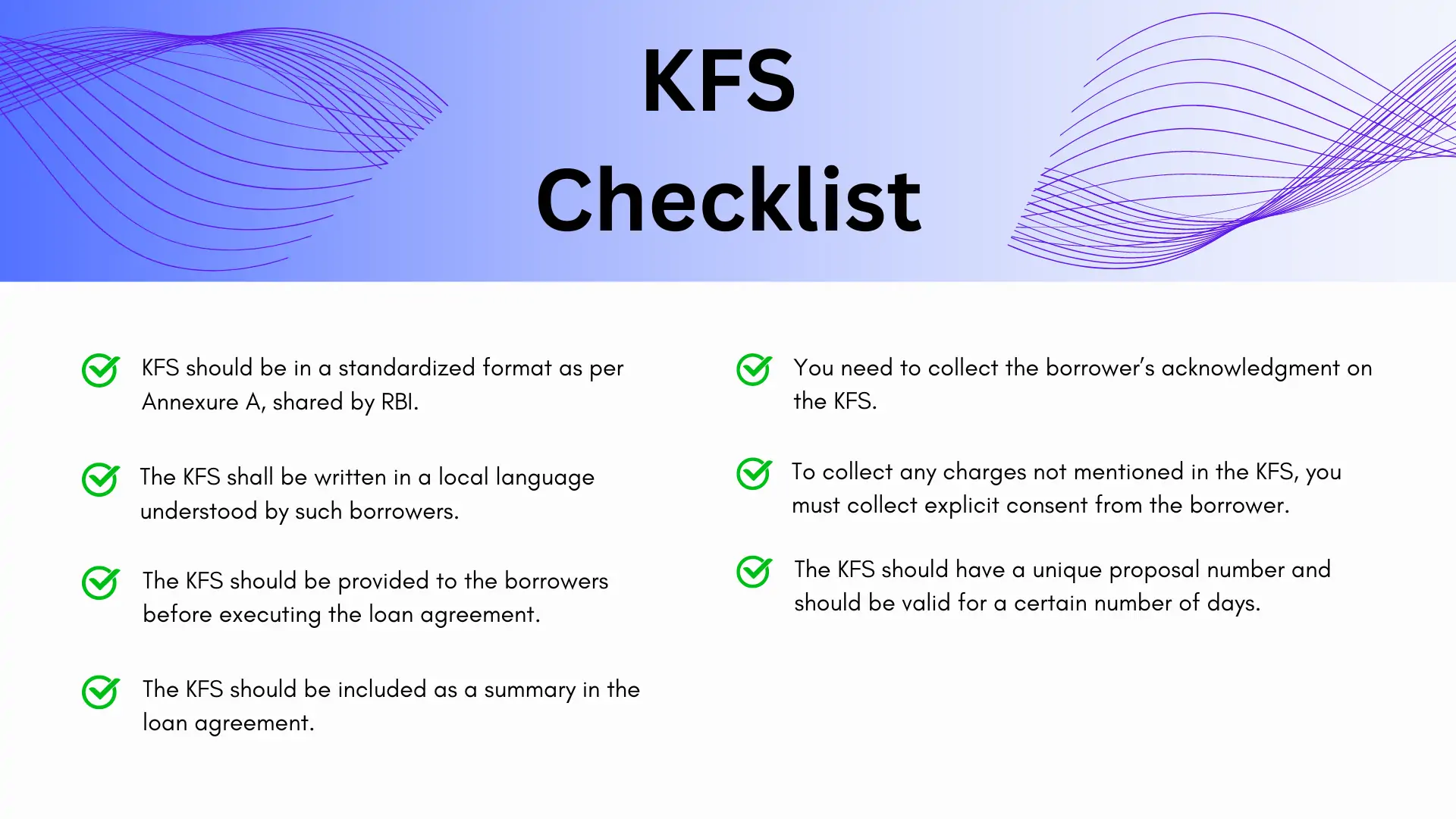

Here’s a quick checklist for your perusal

I am a bank and we use KFS for credit cards as well. Do these guidelines apply to credit card products as well?

No – these changes are only for “Retail and MSME term loans.” However, with implied regulations and the changing lending landscape, we prefer to look for new guidelines from the RBI.

“Credit card products and corporate loans” are not included in the recent KFS guidelines shared by RBI.

What are the changes mandated by RBI?

1. “The new KFS statement should be in a standardized format with an added APR and Amortization sheet.”

As per Annex A, provided by RBI

The KFS annex A has ensured transparency by providing the exact format in 2 parts:

Part 1: Interest rate and fees/charges

- Loan proposal/account No.

- Type of Loan

- Sanctioned Loan amount (in Rupees)

- Disbursal schedule (including stages and related clauses if not disbursed 100% upfront)

- Loan term (specified in years, months, or days)

- Installment details (type, number, amount of EPIs, and commencement of repayment)

- Interest rate (percentage and type: fixed, floating, or hybrid)some text

- Additional floating rate information: Reference Benchmark, Benchmark rate, Spread, Final rate, Reset periodicity, Impact of benchmark change on EPI, and number of EPIs

- Fees/Charges (payable to the RE, payable to a third party through RE, including specifics like processing fees, and insurance charges)

- Annual Percentage Rate (APR) (expressed as a percentage)

- Details of Contingent Charges (penal, foreclosure, switching charges, etc.)

Part 2: Other qualitative information

- Clause of Loan agreement relating to engagement of recovery agents

- Clause detailing grievance redressal mechanism

- Contact details of the nodal grievance redressal officer (phone number and email)

- Information on potential transfer of the loan to other REs or its securitization

- Details related to collaborative lending arrangements: Names and proportions of funding by the originating and partner REs, blended interest rate

- Specific disclosures for digital loans: some text

- Cooling off/look-up period

- Details of the LSP acting as a recovery agent

KFS annex B has illustrated the computation of ARP for retail and MSME term loans:

KSF annex C has illustrated the repayment schedule under equated periodic installment (EPI) for the hypothetical loan.

2. “The KFS should be written in standard language for borrowers to understand.

It has been mandated by RBI that the content of KFS should be explained to the borrower and the KFS shared with the borrower should be in the language understood by the borrower.

Since most of the borrowers don’t speak only English or Hindi, as a best practice, the KFS and loan agreement should be in a language understood by the borrower and the loan execution journey for eSign should also be in the same language.

3. Lenders should help borrowers understand KFS before loan execution.

It has been mandated by RBI to allow borrowers to review the entire KFS before signing.

In physical flow, the KFS should be shown and reviewed by the borrower.

In digital flow, during the loan execution journey, the KFS shall be reviewed by the borrower who could accept or reject it.

4. Loans with tenure >7 days -> The KFS validity will be 3 working days.

Loans with tenure <7 days -> The KFS validity will be 1 working day.

Further, the KFS shall be provided with a unique proposal number and shall have a validity period of at least three working days for loans having tenor of seven days or more, and a validity period of one working day for loans having tenor of less than seven days.1

Explanation

Validity period refers to the period available to the borrower, after being provided the KFS by the RE, to agree to the terms of the loan. The RE shall be bound by the terms of the loan indicated in the KFS, if agreed to by the borrower during the validity period.

Simply put,

For loan tenure => 7 days or more, the lender has to provide at least 3 or more working days for the borrower to review and sign the KFS

For loan tenure <= 7 days, the lender has to provide at least 1 working day for the borrower to review and sign the KFS

Note: The validity period will start from the day KFS is provided to the borrower. It is a minimum timeframe in which the borrower is entitled to either accept or reject the KFS.

There are two approaches by which lenders can share the KFS document with the borrower:

- Approach 1: It suggests that the KFS shall be sent to the borrower first – To review, acknowledge, and eSigned. Afterward, the loan agreement shall be sent to the borrower – To review, acknowledge, and eSigned.The KFS and loan agreement will not be part of the same loan kit.Note: The validity period as stated above is only for KFS. The lenders can choose loan agreement expiry as per their internal regulations.

- Approach 2: It suggests that the KFS and loan agreement shall be sent to the borrower as part of the same loan kit – To review, acknowledge, and eSigned.

Note: The validity period as stated above is now for the entire contract.

Note: Lenders can also upload scanned copies of KFS and loan agreements and share them with borrowers for signing.

5. The borrower should consent and acknowledge the agreement before signing.

In the digital KFS flow, there are multiple ways you can get consent and acknowledgment:

In the digital KFS flow, there are multiple ways you can get consent and acknowledgment:

- Aadhaar eSign (OTP, FaceAuth, Fingerprint, Iris)

- Smart eSign (Draw signature, upload, select auto-generated signature)

- Clickwrap (Based on your legal/compliance need)

All these methods are valid by IT Act, 2000 for collecting eSigns from the borrower.

For high-stakes loans where legal enforceability is crucial, you can often prefer robust authentication methods such as Aadhaar eSign.

For lower-risk loans where regulatory compliance is the primary concern, simpler electronic verification methods such as Smart eSign or clickwrap can be opted for.

6. Without the borrower’s explicit consent, lenders cannot charge any fees not mentioned in KFS, ensuring fair practice.

7. Charges recovered from the borrowers by the REs on behalf of third-party service providers on actual basis, such as insurance charges, legal charges etc., shall also form part of the APR and shall be disclosed separately. In all cases wherever the RE is involved in recovering such charges, the receipts and related documents shall be provided to the borrower for each payment, within a reasonable time.

8. Any fees, charges, etc. which are not mentioned in the KFS, cannot be charged by the REs to the borrower at any stage during the term of the loan, without explicit consent of the borrower.

Simply put, if you wish to levy any additional charges that are not mentioned in the KFS document, you will need to have the explicit consent of the borrower.

In all cases wherever the RE is involved in recovering such charges, the receipts and related documents shall be provided to the borrower for each payment, within a reasonable time.

7. Updating loan terms requires consent from both the lender and the borrower.

When modifying loan agreements, it’s essential to follow proper contractual procedures, the process involves creating a new KFS and loan agreement that accurately reflects the proposed changes.

These documents should be presented to the borrower for review and approval.

The borrower’s explicit consent is crucial in this process. It’s important to note that lenders cannot force borrowers to accept new terms.

The borrower has the right to decline any proposed modifications to the original agreement.

In scenarios where a borrower refuses the new terms, lenders must respect this decision. It’s not permissible for the lending institution to unilaterally terminate the loan based solely on the borrower’s rejection of proposed changes.

The original terms of the loan agreement should remain in effect unless both parties agree to modifications.

How to comply with KFS’s new regulations using Contract360

- Template Engine: You can easily create pre-build templates where data can be pre-populated as per borrowers’ details and can be easily sent to borrowers for eSign.

- Setting up the KFS flow – You can easily set up both of the flows where KFS can be sent separately or together as a KFS loan kit, for borrower to eSign.

- Selecting borrower-preferred language – You can easily build a template and eSigning journey in borrower-preferred language from 13+ local language support for a personalized borrower experience.

- KFS Consent and acknowledgment – Borrower can easily review the KFS, simply accept the KFS by acknowledging via eSign, or reject if any discrepancies are found.

- Validity period – You can easily set custom expiry links for borrowers to eSign the agreement.

Using Contract360, you can easily comply with all new KFS regulations within a week.

Contact us to schedule an expert call on how Contract360 can help you comply!

FAQ

Q. What would happen if I’m unable to comply with new KFS regulations?

A. RBI rolled out strict guidelines with a deadline of 1st October 2024.

Incase of non-compliance, RBI can charge a hefty fine or penalty. The new guidelines are mandatory for Banks, Co-op banks, SFB, NBCF, HFC, and MFI.

Using the Contract360, you can seamlessly comply with new KFS rule and be complaint in 1 week.

Get on an expert call

Q. KFS needs to be in a language understood by the borrower. I don’t have the bandwidth to change the language fluency for the borrower.

A. Contract360 provides support to convert your existing KFS into 13+ local languages. With Contract360, you can select the borrower-preferred language to complete the loan execution journey.

With dedicated ESP like eMudhra, you can easily change the consent text in 10+ different vernacular languages as well, providing an end-to-end personalized experience.

Q. What loans are covered in new KFS regulations that I need to comply with?

A. New KFS regulations suggest all loans including:

- Retail Lending by all REs

- Term loans to MSMEs by all REs

- Loans by SCBs to individual borrowers

- Digital lending by any regulated entity

- Microfinance loans whether by MFIs or other REs

Loan excludes

- Credit card debt

- Corporate loans

Q. What exactly comprises of retail loan?

A. Retail loans may include all types of loans to individuals, including the following :

- Vehicles/Auto loans

- Educational loans

- Home Loans

- Loan against shares

- Loan against property

- Loan against fixed deposit, etc.

The retail loan does not include:

- Business loans

- Lines of credit – as the circular specifically refers to term loans

- Loans to corporates (other than MSMEs)

- Dealer financing (other than individuals)

- Builder Finance (other than individuals)

Q. Is it applicable to an LSP displaying loan information?

A. If LSP is acting on behalf of the lender, and the authority of the lender, what applies to the lender applies to the LSP as well.

If LSP only has a platform that aggregates lenders and borrowers and provides a digital interface, they are not obliged to adhere to these new guidelines. However, we recommend you know about new regulations if needed to comply in the future.

Q. What are the differences between MITC and KFS?

I’m an HFC, do I need to comply with both?

A. MITC is Most Important Terms and Conditions and KFS is Key Facts Statements. The format of KFS is more focused on interest rates and other charges as well as a few qualitative terms of the loan, whereas MITC provides several other relevant details.

However, there are no new rules for MITC but lenders should prepare MITC as well as KFS in case of home loans.

Q. I am an LSP or digital lending platform. Will I be issuing the new KFS?

A. KFS should be issued by the lender and not the LSP/DL platform.

KFS needs to be reviewed and acknowledged by the borrower by a link sent via verified email ID/SMS/ Whatsapp

In the case of co-lending KFS is issued on behalf of joint lenders